Featured

The commodities markets are a mixed bag for investors

Soybeans and products closed mixed last week with Soybeans a little higher and Soybean Meal a little lower. Soybeans and also Soybean Oil found support after some significant purchases from China, which used the break in prices to buy at least 300,000 tons of Soybeans. The news buoyed a market in search of demand. The demand has been slow otherwise with the significant competition from Brazil.

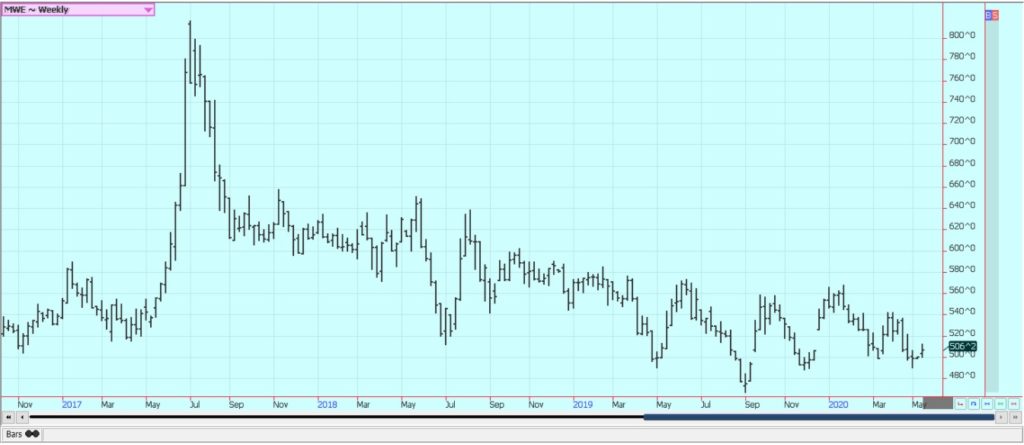

Wheat

Wheat markets were lower for the week and the Chicago Winter Wheat markets took out support levels to turn trends down. Improving weather around the world and here at home was the big reason to see some selling hit the markets, but reports that Russia and Europe are turning dry again could support the markets. The big negative for the market is still better weather for Europe and Russia. Europe got some rains after a prolonged dry spell and Russia also got a little rain in northern and central areas. The rains in Russia are leaving southern areas dry. The US Midwest has also seen a lot of rain and a bumper SRW crop is expected. It was very cold over the weekend in many SRW areas and a frost or freeze hit many Wheat areas and caused some losses. Reduced production ideas are floated for HRW areas. It has been hot and dry in central and southern areas after a freeze a few weeks ago. The crop suffered Winterkill first and now is suffering under the hot and dry weather. It has been mostly dry but cold in the northern Great Plains and into the Canadian Prairies but the market is less concerned about production potential for Spring Wheat crops.

Corn

Corn was about unchanged in quiet trading last week. It is possible that futures have seen at least a short term low. The main fundamental remains demand destruction caused by the lack of ethanol demand and the lack of feed demand. Both have been detrimentally affected by the Coronavirus. The virus has caused states to impose stay at home orders on its people, meaning no one is driving and consuming gas. Some states are starting to open now in the US but it is unclear if the people will move out and enjoy life as before. The experience in other countries suggests that the people will be very cautious in any activities and really not go out and spend money or hit the stores as before. Driving will be significantly less either way. Feed demand has been reduced as packers have been forced to shut plants down due to infected employees in the plants. The plants are opening now with some government mandated protections for workers, but not all workers are back to work and the social distancing requirements means that less meat can be processed in any case. Cattle and hog producers are seeing much less demand for their production and that has affected feed demand. The weather is improving after the recent cold spell. It is now warmer with some showers around.

Soybeans and Soybean Meal

Soybeans and products closed mixed last week wjth Soybeans a little higher and Soybean Meal a little lower. Soybeans and also Soybean Oil found support after some significant purchases from China. China used the break in prices to buy at least 300,000 tons of Soybeans and possibly more. The news buoyed a market in search of demand. The demand has been slow otherwise with the significant competition from Brazil. The Real has weakened a lot against the US Dollar and Brazil producers can sell at very high prices in the local currency. Weather became more important late in the week but it is improving with warmer temperatures. Some Soybeans might need to be replanted this week. Brazil production is almost sold out now. Production estimates are slightly less than before due to hot and dry weather in some areas.

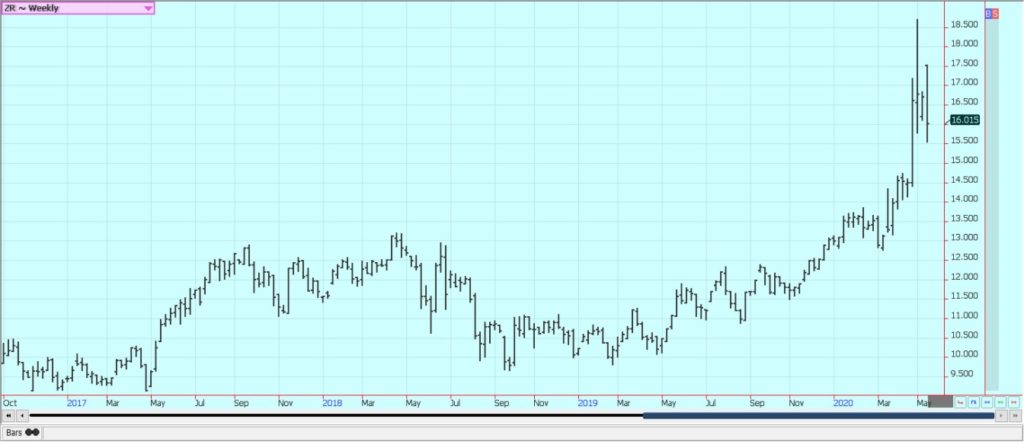

Rice

Rice was a little lower on the weekly charts as May expired and July became the front month. July was higher for the week but new crop months were a little lower. The domestic situation remains tight for the old crop months. New crop months have reflected ideas of greatly increased planted area from producers. Some producers are selling the next crop and some hedge selling has been seen in new crop months in futures but this has dried up as Arkansas has been cool and wet for planting. Planting should be active again this week in the state and northern sections of the state are reported to be planted already. Mississippi has also had problems planting the crop due to too much rain but the crop is being planted. Demand for US Rice remains generally positive and the export sales pace, in general, has been very good. However, they were a marketing-year low last week at about 28,000 tons. The weekly crop progress reports showed that southern Rice is emerging well. Some Rice in Texas and Louisiana is in flood.

Palm Oil and Vegetable Oils

World vegetable oils markets were all higher last week. Palm Oil closed higher after news of big stocks levels from MPOB. The rally on bad news was positive and indicates that the bad news for Palm Oil is already in the market. Palm Oil is hoping for better demand from importers as world economies slowly open after being closed by the Coronavirus epidemic. Soybean Oil was higher last week and Canola was also higher. Palm Oil and Soybean Oil were hurt by the lack of bio fuels demand, but the demand loss appears to be part of the market price now. The same factors affecting ethanol demand are affecting demand for other bio fuels. People are driving less due to the Coronavirus and even reduced Crude Oil production has not been enough to lift prices to profitable levels for bio fuels producers. Canola has found support from the recent recovery in Soybeans and Soybean Oil along with a weaker Canadian Dollar. Canola is more of a food oil than the others, although it also has bio fuels uses. China has recently allowed Canadian Canola imports to resume, so demand could soon improve. The weather has been cold in the Prairies and planting has been delayed. It will turn warmer this week.

Cotton

Cotton was higher last week and higher prices are possible this week. Support is coming from improved demand for US Cotton. The weekly export sales report showed another solid increase in sales with China as a buyer. Vietnam was also a good buyer. The world is starting to slowly recover from the Coronavirus scare and some stores are starting to open again after being closed for weeks. The hope that consumer demand for Cotton products will quickly return is not likely to be confirmed. Consumers have really been hurt economically due to stay at home orders imposed here and overseas and it will take some time for them to recover. As an example, Chinese stores have been open for several weeks but there has been no consumer rush to go to them and buy. The same is possible here and in Europe although the data so far is mixed in this regard. It is too dry in Brazil for good growth of the second crop of Cotton.

Frozen Concentrated Orange Juice and Citrus

FCOJ was higher for the week in July after making new highs for the move. The roll from May to July on the weekly charts made FCOJ close a little lower for the week. Trends are still up in the market. Support is coming from the continued effects from the Coronavirus that are keeping people at home and drinking Orange Juice in any form. Demand from grocery stores has remained strong in response to increased consumer demand. Oranges production was estimated as less in the latest USDA reports at below 70 million boxes, so supplies available to the market are somewhat reduced. Inventories in cold storage remain solid so there will be FCOJ to meet the demand. The weather in Florida has become a mixed bag over the last few weeks. It has been very hot and dry in south Florida but the north has gotten a lot of rain. Southern areas are cooler now and have seen a few showers. The midseason Oranges harvest is diminishing. Irrigation has been run several times per week in most areas. Color break is reported on late variety of Oranges. More signs of early bloom and new growth on trees are reported. Favorable weather is reported in Brazil but it has been dry and irrigation has been used.

Coffee

Futures were lower with most of the weakness in New York. New York was lower on depressed consumer and roaster demand in the US and Europe. The demand from coffee shops and other food service operations has dropped to almost nothing. Consumers are still drinking Coffee at home, but many smaller roasters are actively trying to unload green coffee already bought a there are only a few outlets for sales at this time. This might change a bit in the next few weeks as the US and EU economies slowly open up. The logistics of moving Coffee from Central and South America remain difficult. Producers have had trouble getting workers to pick the cherries and mills and processors have had trouble getting workers to staff the plants. Shipping logistics have improved somewhat, but many are still having trouble getting the Coffee to ports to move to consumer nations. Vietnamese producers are not selling due to the weaker prices paid currently and the effects of the Coronavirus. Indonesian producers are more active sellers.

Sugar

New York and London closed higher with London leading the way. Crude Oil and products prices were higher. The recently weaker petroleum futures had made higher priced ethanol that much more expensive to blend and cuts demand. Prices in petroleum futures remained generally firm last week but still have a long way to go before Ethanol processing becomes profitable again. That makes more Sugarcane available for processing into Sugar. The Brazil mills are trying to cover the lack of White Sugar in the market. Reports indicate that little is on offer from India in part due to logistical and harvest problems caused by the Coronavirus. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. There are reduced flows from rivers from China as well.

Cocoa

New York was slightly lower and London closed lower after a week of wide ranges. The virus has complicated farming and marketing efforts. Ideas are that deliveries can be slower on any contracted Cocoa and that the next crop could suffer as workers stay away. Analysts interview by Bloomberg News estimated the grind in Europe and North America moderately lower. The Coronavirus helps keep demand away and helps keep workers from grinding facilities and chocolate manufacturers. Harvest is now over for the main crop in West Africa and the results so far are very good. Ideas are that demand is less than before due to the Coronavirus problems in Europe. The reports from West Africa imply that a big harvest in the region.

—

(Featured image by bigfatcat via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Cannabis1 week ago

Cannabis1 week agoJuicyFields – the Largest Investment Fraud in the Cannabis Industry

-

Cannabis2 weeks ago

Cannabis2 weeks agoThe Legal Cannabis Industry in the U.S. Provides Over 440,000 Full-Time Jobs

-

Business3 days ago

Business3 days agoBananas Grow in Washington: Powell and FOMC Pinning for Rate Cuts

-

Cannabis1 week ago

Cannabis1 week agoCannabis Legalization Reduces the Likelihood of Youth Using It