Business

What’s new in the agriculture market this week

The world market has not worked lower with the US markets as reports indicated steady prices in Europe and Russia last week.

This week’s report includes a detailed analysis of changes and future predictions in the U.S. agriculture market.

Wheat

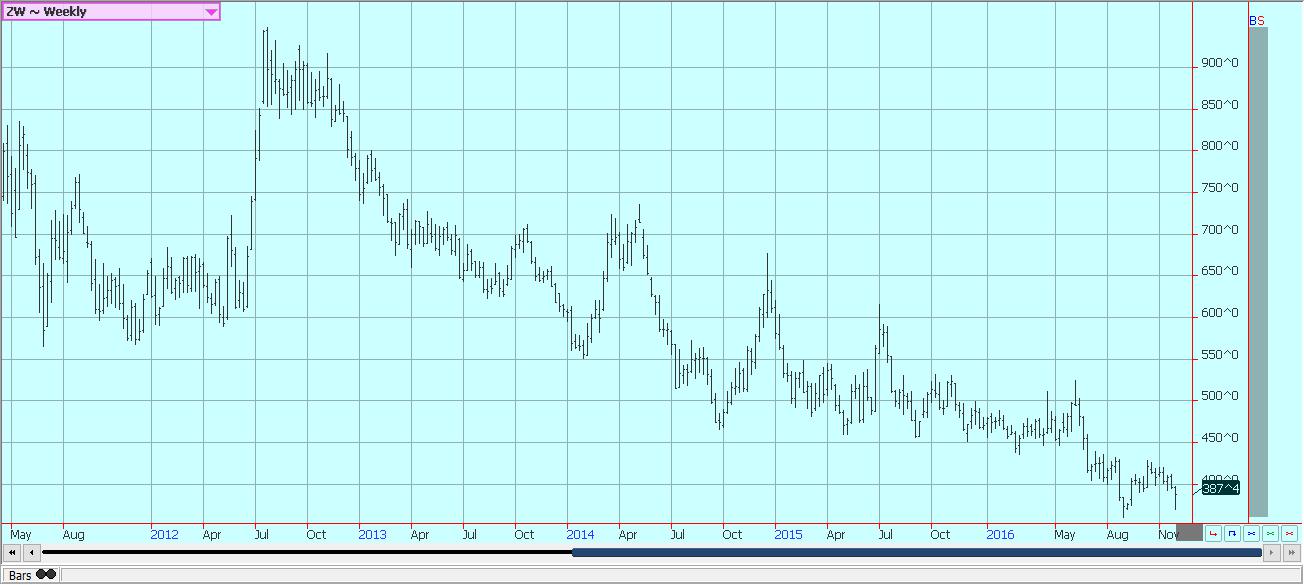

It was a lower week for Soft Red Winter and Hard Red Winter markets, gut Hard Red Spring markets enjoyed a positive week. Speculative selling was seen in the Winter Wheat futures on ideas that demand could be lost. Demand has held well for higher protein Wheat and this is the reason that the Minneapolis market has been able to hold firm. A strong US Dollar last week hurt the US competitive position in world Wheat markets, and demand was less in the weekly export sales report from USDA.

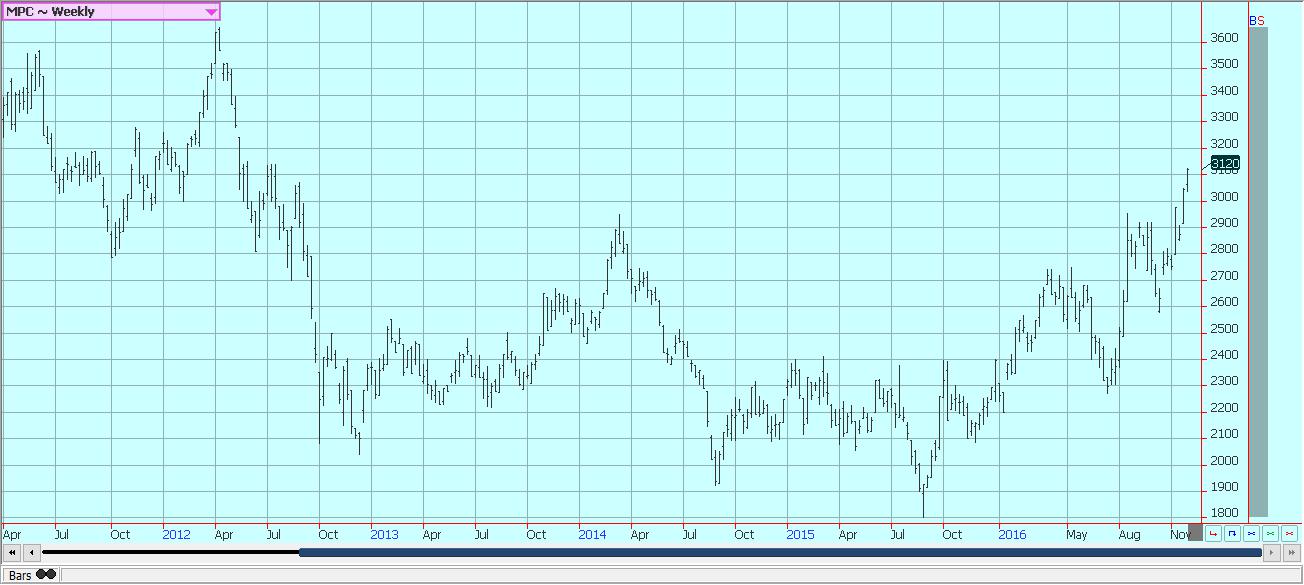

The sales were comprised of a lot of Hard Red Spring and other high protein Wheat and were a reason Minneapolis held firm at the end of last week. The charts show that trends are down, and many analysts are now looking for a rebound in prices. The targets on the weekly charts are 364 and 332 for Soft Red Winter and 377 and 346 for Hard Red Winter. Minneapolis is holding to up trends and has targets of 566 and 597 basis the nearby futures contract.

The world market has not worked lower with the US markets as reports indicated steady prices in Europe and Russia last week. Australia was selling Wheat at what were called aggressive prices into India last week and has sold between 500,000 and 600,000 tons to India in the last couple of weeks as India moves to shore up its domestic supplies. Lower quality Wheat will stay relatively cheap as supplies are plentiful and there is a lot of competition for feed sales. But, higher protein Wheat should stay high priced as supplies are reduced this year due to some extreme weather during the growing and harvesting periods that diminished quality in many areas.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Kansas City Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

Corn

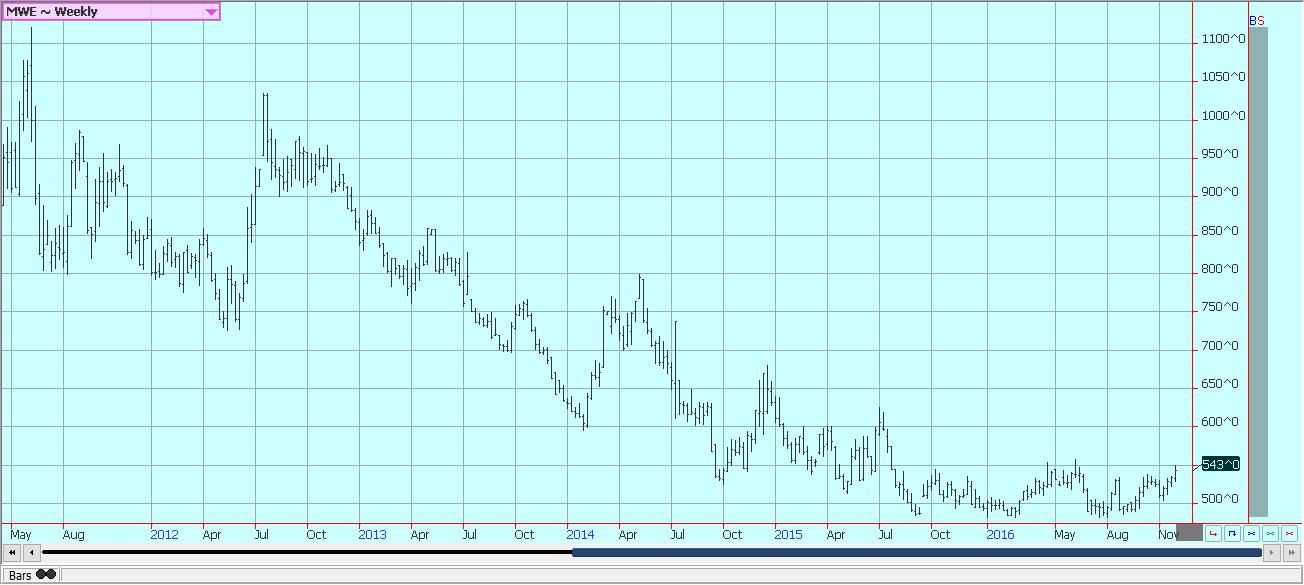

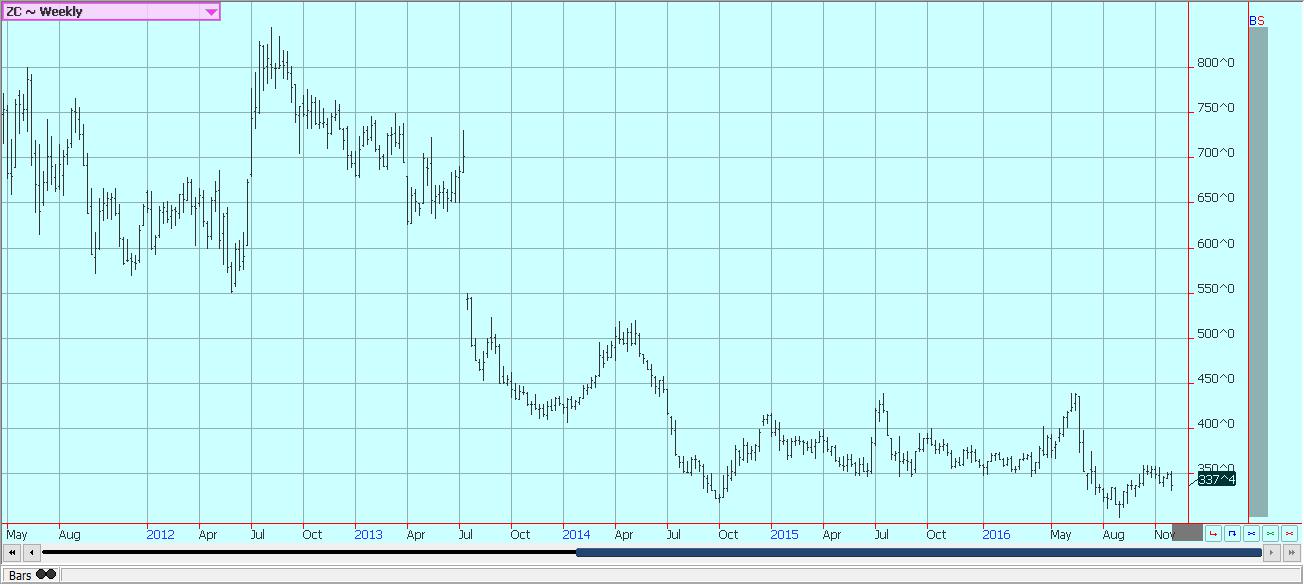

Corn closed higher on Friday, but still lower for the week. The weekly charts show a weak appearance, but there is no real down trend established yet. Daily charts show a short term down trend, but the swing targets for the move got filled at the end of last week. Overall, the market appears happy to trade in a sideways range going into the end of the year. The demand side of the market has been more quiet recently, although weekly export sales have generally held well. Basis levels at the Gulf of Mexico have been soft and there have been few announcements on the USDA daily reporting system.

However, interior basis levels have remained relatively firm as farmers have not been selling. Selling now implies accepting prices below the cost of production and taking a loss. Producers have been more willing to sell higher priced Soybeans and appear content to store Corn for now even though the inventories are very big. The standoff could continue for quite a while. Ethanol demand has been above year ago levels and should stay very strong. The OPEC news last week die bring some support to Corn futures due to implications that reduced Crude Oil production should mean higher petroleum prices and more potential demand for ethanol.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

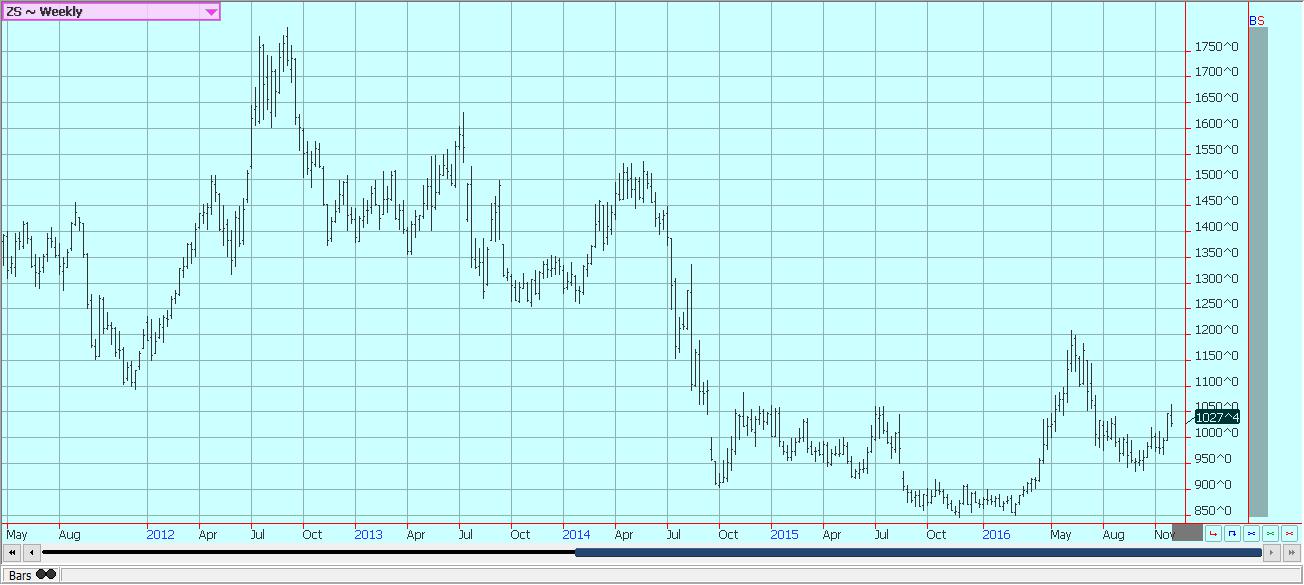

Soybeans and Soybean Meal were lower last week. Speculators were the best sellers amid talk that the market had found a high for the past week. The big rally in the US Dollar since the US presidential elections and improved planting and crop conditions in South America have created ideas that rallies should be sold. Ideas are that the primary Chinese buying interest could soon shift to South America as prices there have become increasingly competitive with those in the US. The US harvest is over now and yield reports from many producers have been outstanding.

US producers have been selling Soybeans this year as current prices are returning better than profits Corn. Planting is finishing up now in the northern half of Brazil. Strong planting progress is reported in southern Brazil and northern Argentina under drier conditions. The weekly charts show up trends continue despite the price action last week. The short term seasonal tendency is for prices to move lower in December, then to react to the weather developments in South America in the first part of the new year. It seems that the market is already paying a lot of attention to South America.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

World markets were mostly stable last week. Southeast Asian prices were sideways, and southern Asian markets were also mostly unchanged. Nearby US futures contracts closed unchanged for the week. It was a quiet week for the markets in these areas. The US cash market remains soft as demand from the mills has been steady at low levels. The mills have not been able to find any big export business and report that domestic demand is steady. The mills hope for export business from the Middle East, but this demand has been quiet.

The best export demand overall has been good from Latin America, but they buy Rough Rice and mill it at home. The price action and the volumes traded have not been real strong in the futures market. US producers are not really selling as the harvest is about over and prices are well below the cost of production for many. The Rice is locked in bins until most likely the first of the coming year. Asian markets have also been quiet, but there is talk of increasing interest. There is buying to be done as the crop in Philippines appears short. Private importers are getting more interested in buying. Indonesia suggests it has enough Rice in storage, but it could be a buyer too. Internal Indian prices appear firm.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

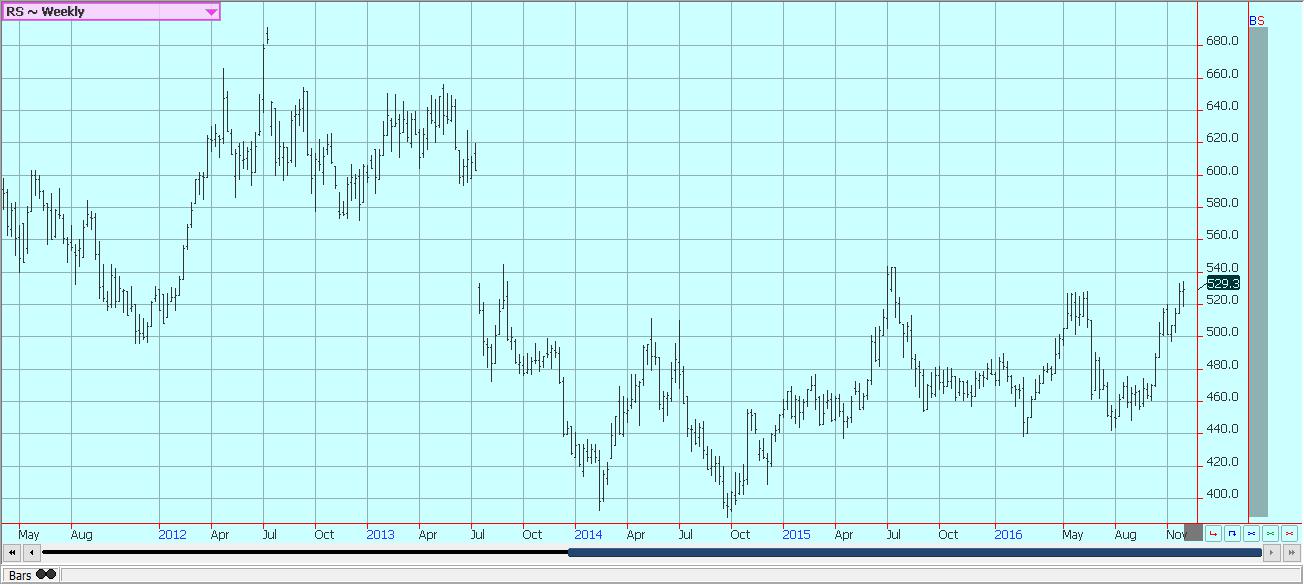

Palm Oil and other vegetable oil markets rallied to new highs for the move last week, with only Canola maintaining a range. The lack of Palm Oil production in both Malaysia and Indonesia remains a key reason for the higher prices. Production in both countries has been and remains below expectations as the trees have been showing a slower than expected recovery from the El Nino related drought earlier in the year. The markets got a big demand boost in the middle of last week when OPEC made its announcement of production cuts.

The move by OPEC was designed to increase prices for crude oil and its products, and could serve to increase demand for bio fuels. It will at least make it easier for bio fuels manufacturers to make money. But, other demand has been falling in recent reports. The traditional demand from places like India and China has been less as both countries work through internal supplies and make some changes in agricultural policies and buying.

And, Palm Oil remains high priced against competing vegetable oils. Palm Oil remains the leader in the push to higher prices and should remain the leader as that market has the shortest overall supplies. Soybean Oil has been strong, but has better supply right now given the strong US harvest. Soybean Oil has been a follower to the upside, but is getting pushed by Palm Oil and good demand. The charts show that the markets can continue to work higher over time.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures in the US closed with some losses, but held well above support on the weekly charts. That support for now is strongest near 7000 basis the nearest futures contract on the weekly charts. The overall weekly chart pattern shows that futures have been trending higher since early in the year and are now decisively above resistance and the sideways trend that lasted about two years. The price strength was based once again on world market conditions. China has seen excessive rains in Cotton areas and the harvest has been delayed.

There are questions on the quality of the remaining harvest and some expectations that yields will be reduced. Ideas are that the country might have to import more than had been anticipated. India has made some currency changes as it has outlawed large bills and the market has become frozen. Everyone is waiting to see how the economy handles the changes, and it looks like adjustments in operations and payment schemes are being made. Producers remain partially withdrawn from the market and prices have held strong. However, cash market activity is increasing. Pakistan said it would halt imports on Indian goods and that will affect Cotton demand.

Pakistan will likely have to increase imports from the US as a result. The total amount of the potential new demand has not yet been estimated. The US harvest is continuing throughout the southern parts of the US, and reports have been good. Current weather forecasts call should be good for crop maturation and harvest activities. The classing data provided by USDA shows that the quality of the crop harvested so far is mostly good. The quality should continue to improve as the harvest expands as conditions in most areas have been very good. Demand for US Cotton should remain relatively strong as the US has Cotton available.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

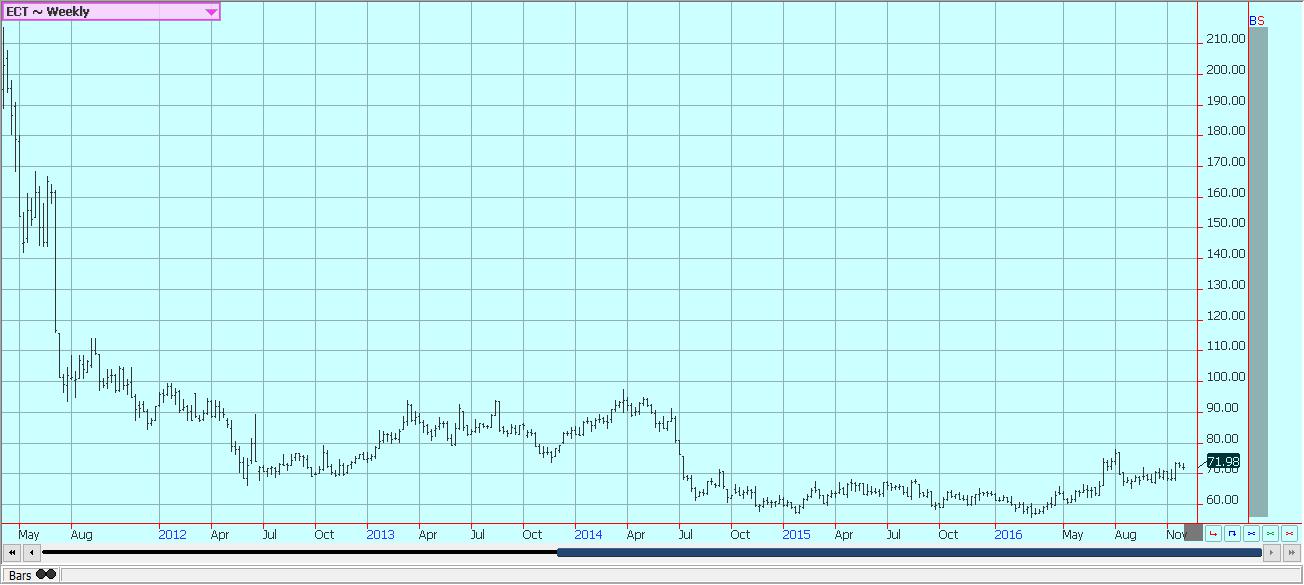

FCOJ closed lower on Friday, but posted a positive week in prices. It has turned colder, and the colder weather has created some speculative buying interests as some buy ahead of the freeze season. There are no frosts or freezes in the forecast for the state, but it is the time of the year when speculators start to buy just in case a freeze comes. The market does not appear worried about the current dry conditions in

Florida. USDA will issue a production update this week. It is an extremely small crop and would be a reason to keep futures prices high for FCOJ. Less Florida production and also less production in Brazil are the main market support factors. Brazil also suffers from the greening disease. The Florida harvest is moving forward, but harvest progress has been slow and progress is called behind normal. Irrigation has been used in Florida and is being used frequently at this time due to dry conditions. Fruit is moving to packing houses for the fresh trade, with only small amounts moving to processors. In Brazil, Sao Paulo state is getting showers and flowering is called good. Brazil exported 50,125 tons of FCOJ in November, from 46,032 tons last year.

Weekly FCOJ Futures © Jack Scoville

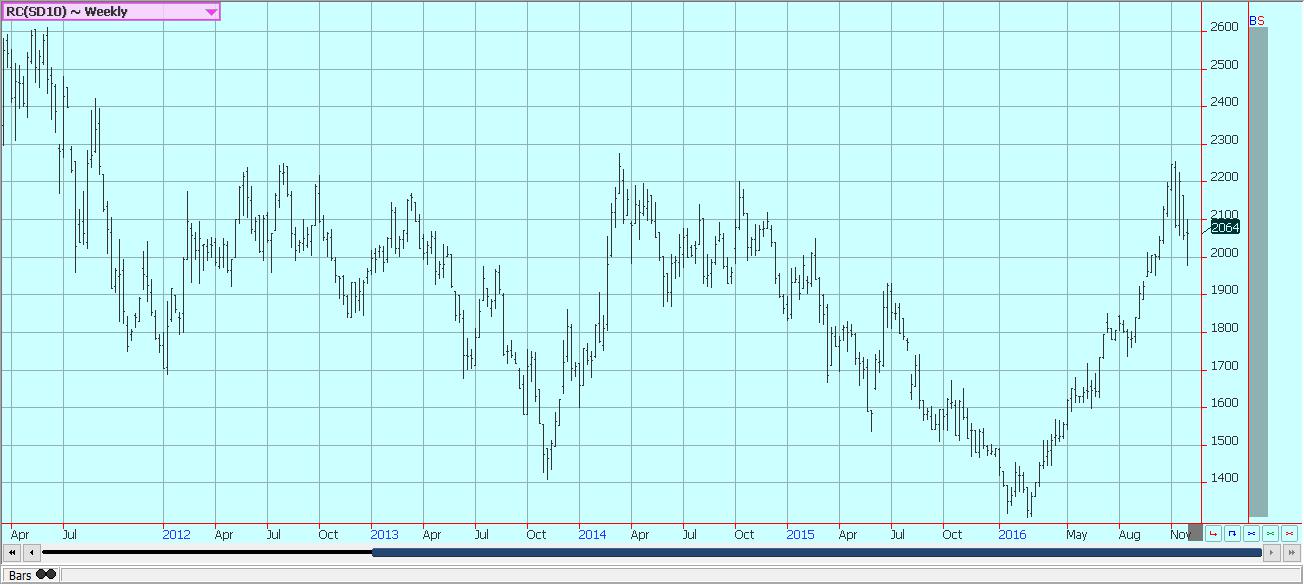

Coffee

Prices were lower in New York and in London. However, London recovered on Friday and appears to have rejected a new down move on the daily charts. The weakness in London came on less demand for Robusta against Arabica, but also on news that the Vietnamese Coffee was about to start flowing to ports and that production appeared to be solid. New York saw some selling pressure as trends turned down on the charts. New York has moved through swing targets on the daily charts. It came close to initial swing targets of about 140.00 on the weekly charts.

Differentials paid in Central America appear stable at weak levels. Differentials are also stable in Colombia. Brazilian producers are said to be more active sellers as the Real has weakened significantly against the US Dollar. However, this selling is not really being felt in the international market in a big way. The market has turned weaker as futures adjust to increased supply potential. Roasters have become more withdrawn in the marketplace due to the recent surge in prices, and now due to the price weakness. They will probably start to buy again if a more stable price outlook appears.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

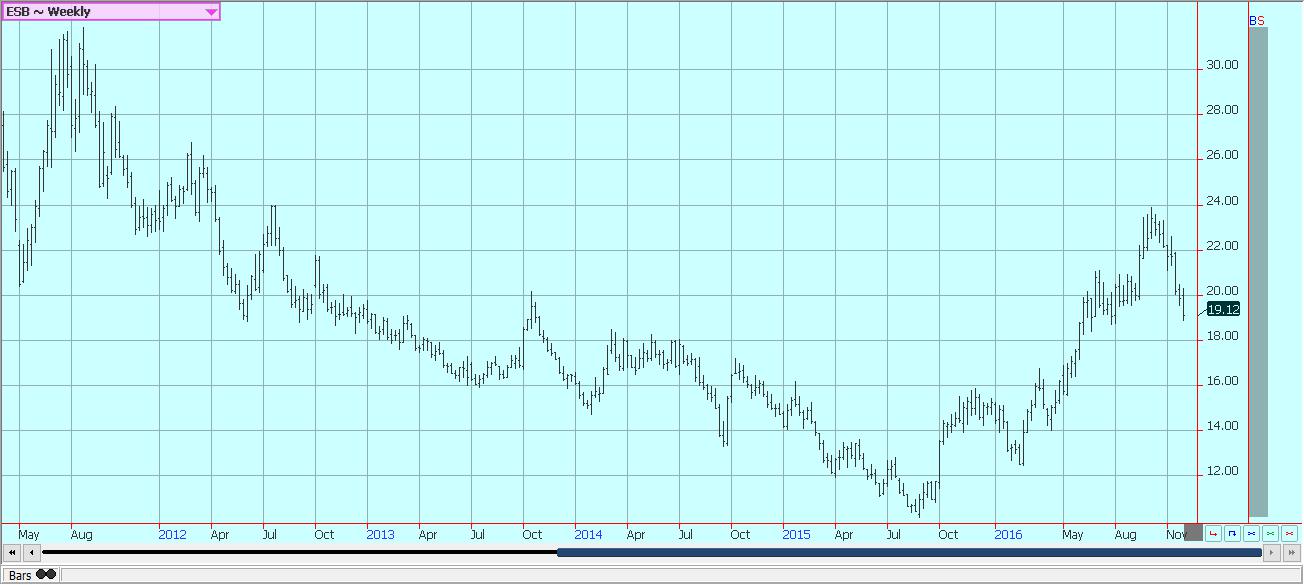

Sugar

Futures closed lower again last week on worries about overall demand potential and on bigger than expected exports from Brazil. Funds and other speculators were the best sellers as the down trend continues. The speculative side of the market should be consistent sellers for the near term as they work to reduce market exposure. Demand news remains bearish for futures prices. China is the world’s largest importer of Sugar, but has imported significantly in the last couple of months as it starts to liquidate massive supplies in government storage by selling them into the local cash market.

The Brazilian Real has moved sharply lower in the past few sessions and kept mills in a selling mode. There could be smaller crops coming from India and Thailand due to uneven monsoon rainfall in Sugar areas in both countries. India has said that its production and amounts in storage are sufficient and that there is no need for imports that had been expected earlier. The weather in other Latin American countries appears to be mostly good as rains remain sufficient.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

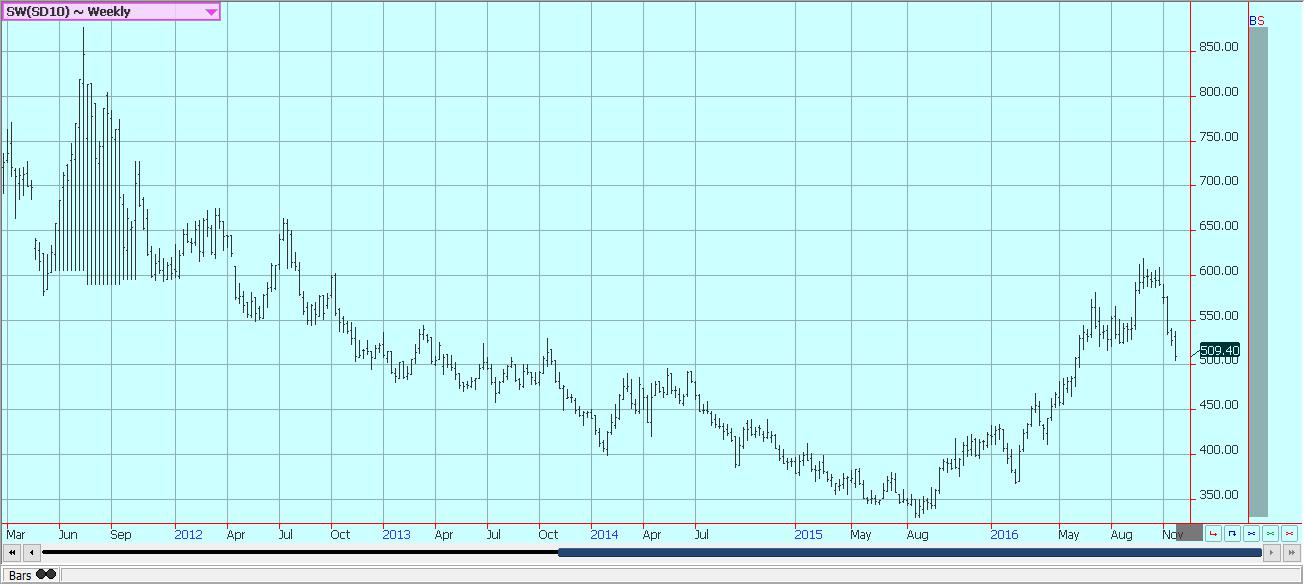

Cocoa

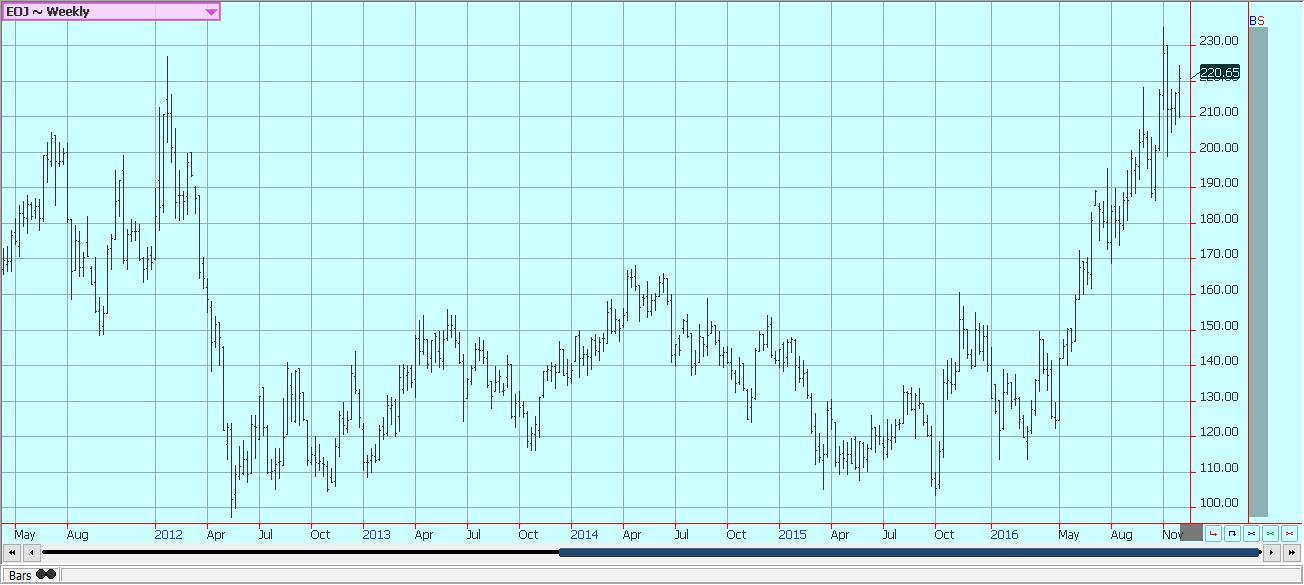

Futures markets were lower again. Trends are down in both New York and London. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. However, some buying did appear last week as prices have moved to levels not seen in a long time. Speculators are mostly done liquidating and some commercial buying has been noted. Reports indicate that consumptive demand is increasing at these lower price levels. The demand from Europe is reported improved based on some corporate data released in the last few weeks. However, all eyes were on the Italian referendum last weekend and its results as European demand needs to stay stronger and improving for demand to stay stronger at this time.

The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. There have been some reports of disease to crops in the wetter areas, but so far there is not a lot of market concern. Bigger production is expected this year in all countries. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

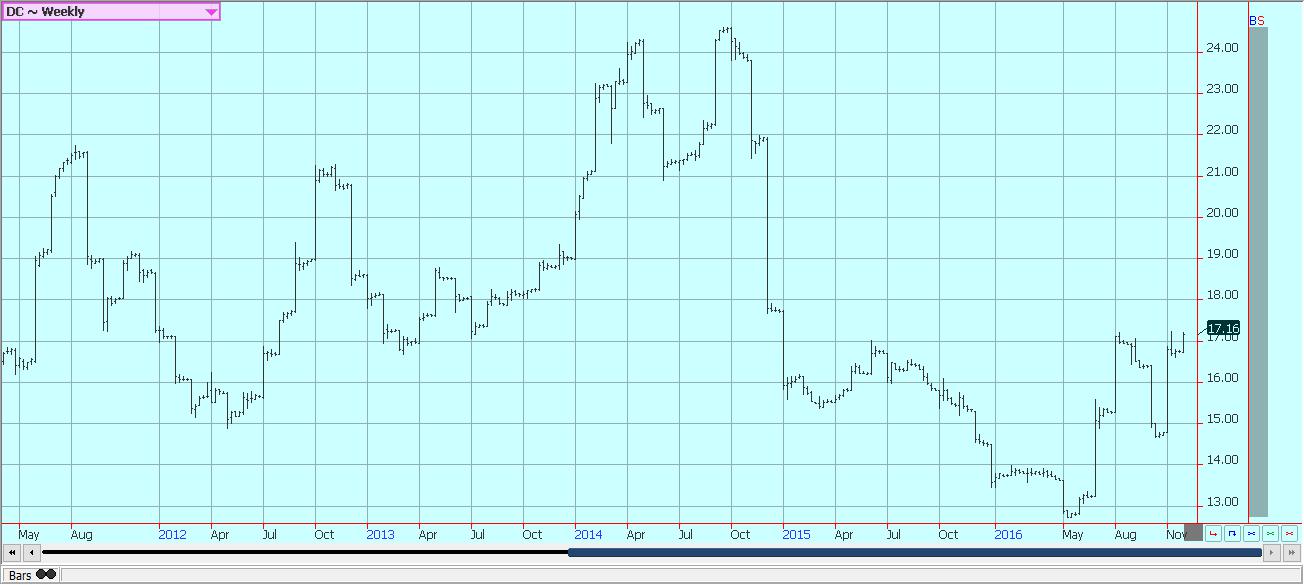

Dairy and Meat

Dairy markets were firm as good supply met very good demand. Butter and cheese manufacturers report strong demand. Butter manufacturers are reporting a harder time finding cream and have been moving stored inventory. Inventory levels still remain above year ago levels. Cheese demand is being met with strong milk supplies and manufacturing is active. Raw milk production has also been stronger, with only the Pacific Northwest reporting less production due to weather stress. Dried products prices are mixed to firm. Whey prices are strong, and whole milk prices are firm. NDM prices are weak.

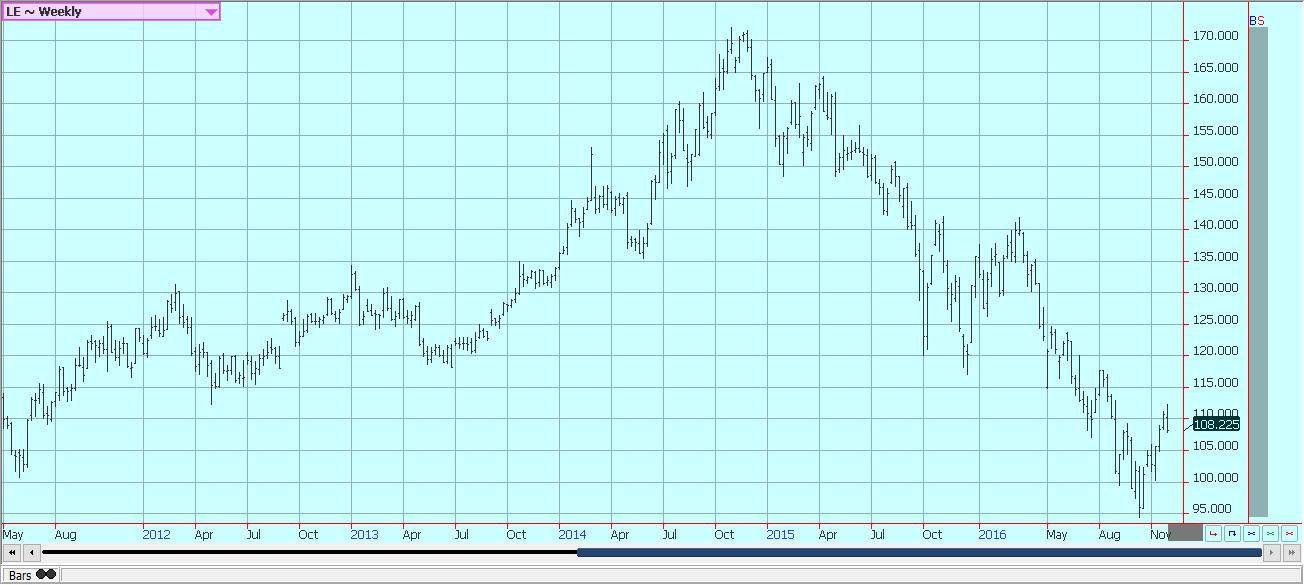

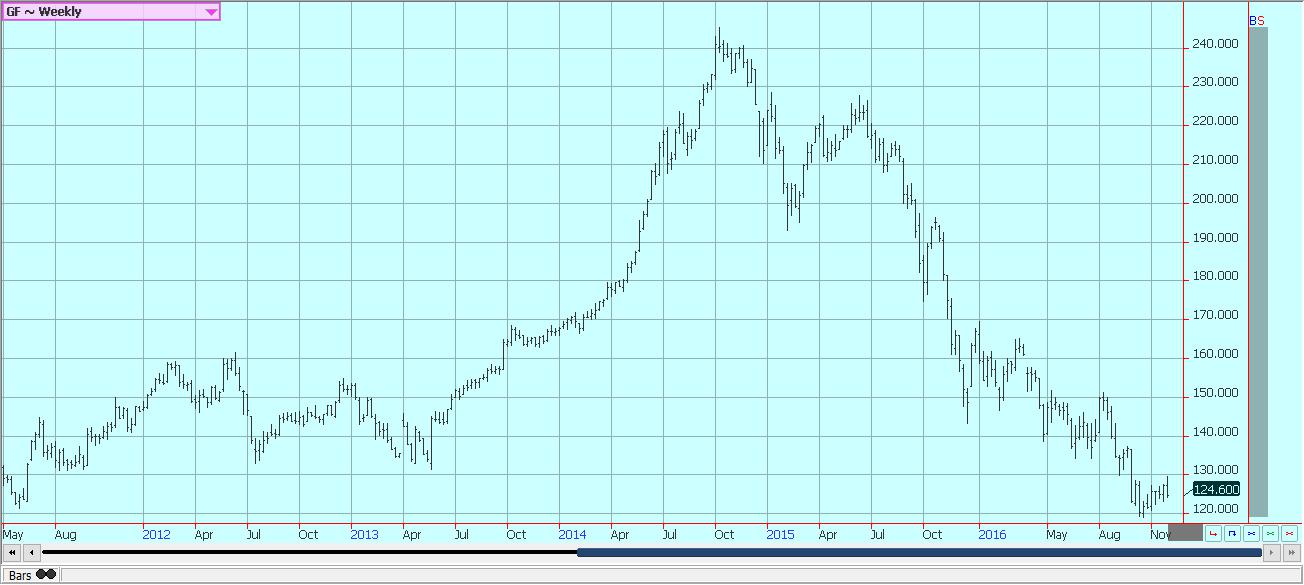

US cattle and beef prices were higher last week in reaction to reports of higher beef prices and in re- sponse to higher prices paid in cattle markets the previous week. Cash cattle markets traded at higher prices at the end of last week and in good volumes. The charts show that market could move higher. Demand is starting to improve overall as the wholesale market starts to look past Thanksgiving. Austral- ia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries is better than a year ago.

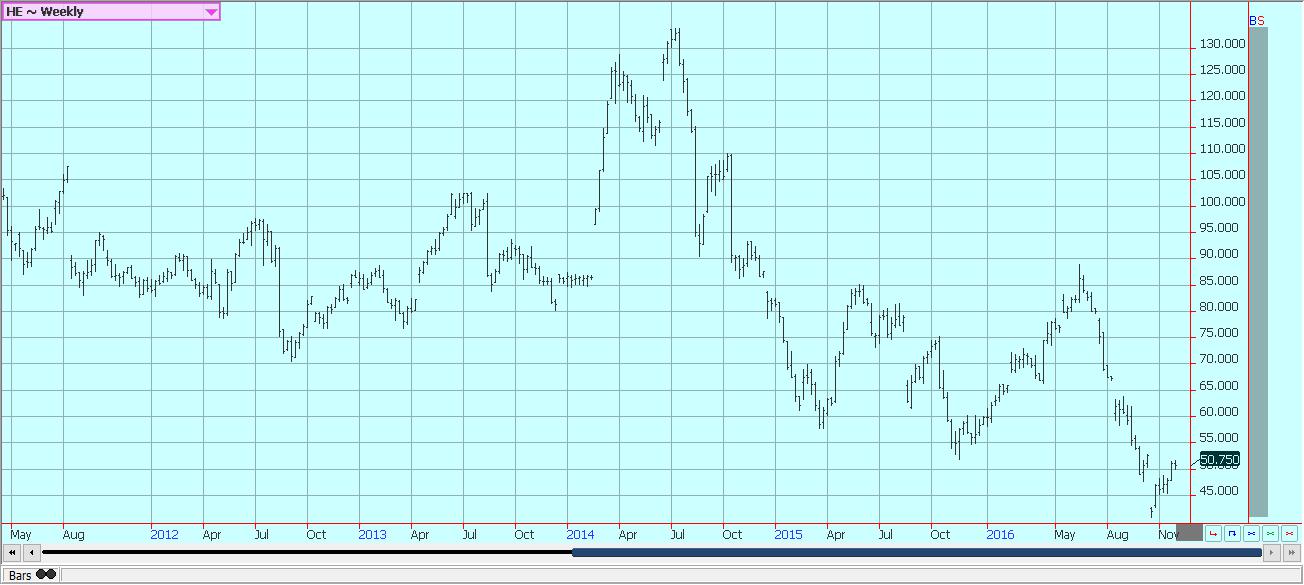

Pork markets have been stable to firm, and live hog futures trends are higher. Pork demand has been stronger than expected and a primary ham consumption period is here with the holidays. There has been a lot of featuring in supermarkets in the US in an effort to stimulate demand, and it is starting to work as the pork cash market has improved in volume and somewhat in price. Pork demand should in- crease in the next couple of weeks as hams and other cuts will be featured for holiday buying. US export demand should start to improve on the lower prices. The charts show that the market could remain higher.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Africa2 days ago

Africa2 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

-

Impact Investing1 week ago

Impact Investing1 week agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing6 days ago

Impact Investing6 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

You must be logged in to post a comment Login