Mining & Energy

Argentina Lithium & Energy Leading the Charge as Demand for Argentine Lithium Grows

In response to surging demand from automakers for lithium, Argentina Lithium & Energy Corp. has entered into a major US$90 million (in ARS$ peso equivalent) deal with Stellantis N.V., a top global automaker. This strategic investment by Stellantis N.V. aims to secure potential future lithium supplies, placing the company in a strong position to potentially help meet future lithium demand.

No matter where you look, analysts with an eye on the lithium market are all pointing to the same thing: Argentina’s lithium industry is preparing for a boom over the next few years.

Highlighting this, one recent analysis from the Rosario Stock Exchange (RSE), as reported on by the Buenos Aires Herald, notes that Argentina will outpace Chile and Australia in the growth of lithium production within the next three years.

The report credits this growth outlook to sky-rocketing demand for lithium, particularly as demand ramps up for EVs and other renewable energy storage systems, stating that “in a context where lithium production is expected to grow 8% annually in Chile and 16% in Australia by 2027, the average annual increase in Argentina aims to be 50%.”

RSE analysts aren’t alone here, either. For its part, JPMorgan predicted in 2022 that Argentina’s share of the global lithium supply will increase from 6% in 2021 to 16% by 2030. This would put Argentina on track to overtake Chile by 2027, by which point it will become the second-largest lithium producer in the world, bested only by Australia.

Miles Rideout, Vice President of Exploration at Argentina Lithium & Energy Corp., [TSX.V: LIT | FSE: OAY3 | OTC: PNXLF] highlighted Argentina’s rising significance in the lithium market, stating, “All eyes are on Argentina as the country progresses to become a top player in the global lithium market.”

Argentina Lithium to Respond to Growing Global Lithium Demand

In response to the surging demand for this essential battery metal from Argentina’s salt flats, the Vancouver-based Argentina Lithium & Energy Corp. has entered into a major US$90 million (in ARS$ peso equivalent) deal with Stellantis N.V., a top global automaker. This strategic investment by Stellantis N.V. aims to secure potential future lithium supplies, according to Rideout.

As part of the deal, Stellantis N.V.’s subsidiary Peugeot Citroen Argentina S.A., (“Stellantis”) acquired a 19.9% interest in the Argentine subsidiary of Argentina Lithium, Argentina Litio y Energia S.A. (“ALE”), with the option to convert into an equivalent stake in the parent company.

More significantly — and this was the major motivator behind the deal — the agreement includes an “offtake agreement” provision, granting Stellantis the rights to buy from ALE up to 15,000 tonnes per year of potential future lithium production for seven years, with an option to renew the agreement.

Mr. Rideout explained that major car manufacturers are actively seeking to secure future lithium supplies for their electric vehicles, which is why Stellantis N.V. approached Argentina Lithium. The junior company’s task is to fast-track their projects from exploration to resource evaluation to determine their production potential.

“Most of the major automotive dealers are looking hard at securing lithium supply chains for their electric vehicles and that’s why Stellantis came to us … They want us to advance our projects as quickly as possible through the exploration stages to evaluate their production potential and that’s our objective,”

Miles Rideout, Vice President of Exploration, Argentina Lithium & Energy Corp.

Rideout also emphasized the growing demand for lithium among major auto manufacturers and praised Stellantis N.V’s proactive strategy. He continued, “Automotive producers have huge requirements for lithium in the coming years. This deal reflects a forward-thinking approach by Stellantis.”

Of course, Stellantis N.V. is not alone here. With the global market for EV batteries tipped to sustain a 21.1% compound annual growth rate (CAGR) through to 2030, at which point it will hit close to USD$200 billion annually, other automakers are racing to join the fray.

This is seeing major manufacturers like Ford, General Motors, and BMW flocking to Argentina’s booming lithium sector. Tesla’s CEO, Elon Musk, has also expressed that he is “extremely interested” in the country’s lithium reserves, as confirmed by Argentina’s President, Javier Milei. Musk is particularly interested in securing lithium sources geopolitically closer to the US to reduce risk. Tesla plans to start its battery production in Texas in 2025, aiming to produce batteries for one million electric vehicles annually.

Led By Rideout, Argentina Lithium’s Portfolio Gains Momentum

As Vice President of Exploration at Argentina Lithium & Energy Corp., Mr. Rideout, leads the company’s South American operations. He has played a key role in acquiring and exploring numerous lithium properties in northern Argentina and brings 34 years of experience in advanced exploration practice to the table, throughout which he has significantly contributed to the acquisition and exploration of dozens of lithium properties in Argentina.

Additionally, Argentina Lithium is part of the Grosso Group, a pioneering resource management team in Argentina’s mineral exploration sector since 1993. The Grosso Group aims to build investor value through the development of its member companies, which all focus on exploring and developing mineral resource deposits across gold, silver, copper, uranium, vanadium, and, of course, lithium. The group has been part of four significant mineral discoveries in South America and has collaborated with major industry players. Joseph Grosso, the company’s founder, was recognized as Argentina’s Mining Man of the Year in 2005.

In total, Argentina Lithium & Energy is advancing four large projects across over 67,000 hectares in the famous Lithium Triangle, each with significant potential:

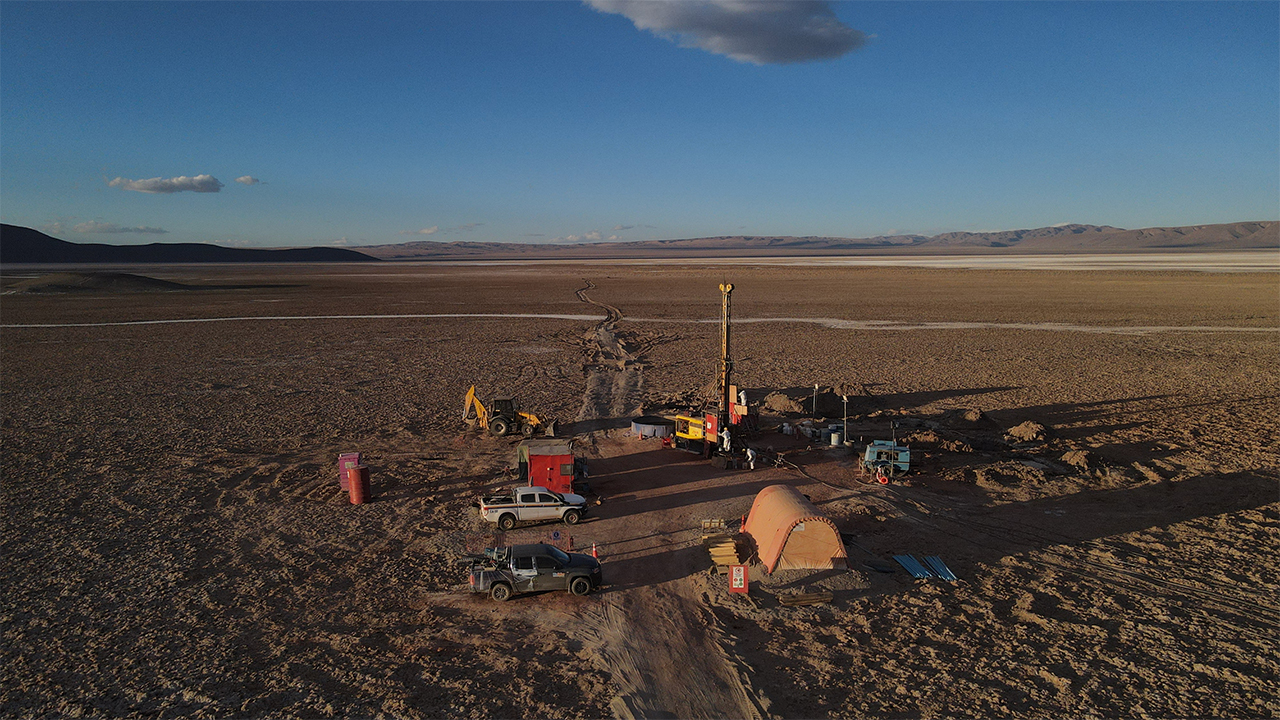

- Rincon West: Ongoing drilling at the Rincon West Project over 5,000 hectares, has identified lithium-rich brines. This project neighbors the Rio Tinto Rincon lithium project, which was purchased for USD$825 million.

- Antofalla North: The Antofalla North Project, located adjacent to properties held by global lithium producer Albemarle Corporation, spans over 10,000 hectares of high-potential lithium mining claims.

- Pocitos: The Pocitos Project is situated in a largely unexplored basin of about 1,200 square kilometers, where historic sampling has already returned lithium values.

- Incahuasi: Initial exploration efforts at the 25,000-hectare Incahuasi Project — including geophysical, surface sampling, and drilling programs — have been completed.

Rideout highlighted the impact of the Stellantis deal in further accelerating the development, noting that Argentina Lithium is now funded to advance its two core projects, Antofalla North and Rincon West, toward the resource delineation stage over the next two years.

“We are currently drilling our second major campaign on the Rincon West Project and expect results to be reported on an ongoing basis while waiting for permits to begin work in the Antofalla North Project,” Rideout said. “We expect the permits for Antofalla in Q2 this year and are looking at using two drills on the project, as it is quite a large area,” he continued.

Rideout also emphasized the automotive industry’s urgent need for lithium supplies, stating that “most of the major automotive dealers are looking hard at securing lithium supply chains for their electric vehicles and that’s why Stellantis came to us… They want us to advance our projects as quickly as possible through the exploration stages towards potential production and that’s our objective.”

Alina Islam, a mining analyst at Red Cloud Securities, sees the US$90 million investment from Stellantis as a strong endorsement for Argentina Lithium & Energy. “We believe that deals like this are very positive for the outlook for lithium, as it demonstrates the importance of the commodity in helping achieve the decarbonization goals set by various governments across the globe. We also believe that investment and M&A activity between automakers and miners will continue, as concerns around lithium scarcity grow, especially in the context of geopolitical issues,” she said.

Argentina Lithium Positioned Amidst Rising Global Demand and Adjacent International Investments

Argentina’s lithium sector received another promising endorsement earlier this year when India announced its intention to acquire five lithium blocks in Argentina. As a major emitter of greenhouse gases, India spent US$33 million on lithium imports in 2022-2023, primarily from China, as it advances its electric vehicle production as part of its aim to become carbon neutral by 2070.

The Indian project will involve the exploration and development of five lithium brine blocks spread out over 15,703 hectares in the Catamarca province. This is the same province where Argentina Lithium holds 100% ownership of more than 25,000 hectares in the Incahuasi Salar with its Incahuasi project, which it began exploring in 2017.

Rideout notes that “the Indian deal is further evidence that the interest in lithium from Argentina shows no sign of slowing down, especially because countries and auto manufacturers seek to reduce dependence on lithium imports from China.” He also highlighted that regulatory developments are providing further tailwinds for lithium demand in Argentina. Here, Rideout points to the EU’s requirement for zero CO2 emissions from new cars and vans by 2035, and America’s goal for EVs to achieve 50% of new vehicle sales by 2030 as just two recent developments.

Rideout is not alone here, either. In just the last month, The Oregon Group released a report forecasting that “the demand for lithium, essential for electric vehicles, is expected to face twenty years of rapid growth.”

To put a concrete number on that, Statista forecasts point to a global lithium demand exceeding 2.4 million metric tons by 2030, growing to 3.8 million tons by 2035.

Given these projections and Argentina Lithium & Energy’s portfolio of high-potential Argentine projects, the company finds itself in a strong position to potentially help meet future lithium demand.

To learn more about Argentina Lithium & Energy, visit its website here, or find it on social media:

This is a promotional piece paid for by Argentina Lithium & Energy Corp. who is a client of Market One.

__

(Featured image courtesy of Argentina Lithium & Energy Corp.)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business7 days ago

Business7 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Fintech2 weeks ago

Fintech2 weeks agoFintech Alliances and AI Expand Small-Business Lending Worldwide

-

Business2 days ago

Business2 days ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

-

Crypto1 week ago

Crypto1 week agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets