Biotech

AstraZeneca Acquired Biotech Company EsoBiotec, for One Billion Dollars

AstraZeneca is acquiring Belgian biotech EsoBiotec for up to $1 billion to enhance its cancer therapy portfolio. EsoBiotec’s innovative ENaBL platform enables rapid, cost-effective cell therapy inside the body. The deal includes a $425M upfront payment and potential milestones. EsoBiotec will remain in Belgium, with CEO Jean-Pierre Latere continuing to lead the company.

This is the story of a Walloon start-up of thirteen people, created in 2020, and bought for a billion dollars. To strengthen its position in cancer therapies, the British pharmaceutical giant AstraZeneca has just done its shopping in Mont-Saint-Guibert, announcing this Monday a deal that could reach a billion dollars to get its hands on an unsuspected Walloon nugget: EsoBiotec.

EsoBiotec? If this name doesn’t ring a bell, it’s because the ultra-innovative project of this young start-up founded in 2020 has flown a little under the radar. Created by Jean-Pierre Latere (CEO, and former operational director of Celyad) and Philippe Parone , the idea of EsoBiotec is to simplify and make cell therapies more accessible.

AstraZeneca: New approach to cell therapies

In short, the approach involves turning the patient’s body into a cell factory (“CAR-T” in the jargon) that can recognize, then target and eliminate tumor cells. Conventional cell therapies , on the other hand, work by taking blood from the patient, and the cells are then transformed in the laboratory – a process that can take several months . Months that are crucial for some cancer patients.

The “Engineered NanoBody Lentiviral” (ENaBL) platform , developed by the company, is capable of genetically modifying immune cells directly inside the human body, making it possible to carry out cell therapy treatments “in about ten minutes and for a fraction of the current cost, and with possible scaling up, since these are not personalized treatments ,” explains EsoBiotec CEO Jean-Pierre Latere.

“AstraZeneca was the best option. It’s a European company with a deep understanding of cell therapies, is sensitive to cost and patient access issues, and wants to maintain EsoBiotec’s identity,” saidJean-Pierre Latere.

First clinical study underway

The first data from a first clinical study still in progress showed convincing results in January of this year, and the market seems to have grasped the enormous potential embodied by this Walloon innovation – which could, in addition to cancers, also be used to treat other autoimmune diseases.

The agreement announced on Monday provides that AstraZeneca will make an initial payment of $425 million (€391 million) to acquire all of the company’s equity , and could raise up to an additional $575 million (€529 million) depending on milestones, different development phases and regulatory milestones that the company may achieve.

EsoBiotec, which had previously raised just under €22 million, will become a wholly-owned subsidiary of AstraZeneca, with operations in Belgium. The transaction is expected to close in the second quarter of 2025 and “will have no impact on AstraZeneca’s 2025 forecasts,” the group said.

“AstraZeneca was the best option. It’s a European company, which knows cell therapies very well, is sensitive to issues of cost and access for patients, and wants to maintain EsoBiotec’s identity, as well as its local roots,” continued the CEO, who will remain at the head of the company. “I am very proud of what the team has managed to achieve, and we want to go much further, and continue to grow in Wallonia.”

Shareholders pocket much more than the stake

UCB is a shareholder in EsoBiotec via its corporate fund UCB Ventures , with approximately 20%. Other shareholders include Wallonie Entreprendre (approximately 12%), which came on board in 2021, but also Sambrinvest and Investsud, the Spanish fund Invivo Partners, and the Dutch private equity fund Thuja Healthcare Investors.

Wallonie Entreprendre, which invested around €2.1 million, is recovering around €40 million, we are told, just from the initial payment from the British drug manufacturer. In the event of a billion-dollar deal with AstraZeneca, the capital gain would exceed €100 million.

In addition to the immediate multiplication of its investment by almost twenty in barely four years, “it is a strategic vision that is confirmed: investing in a local hero, and a hyper-innovative project, which is now in the hands of a player capable of deploying the billions necessary to push this innovation to the market,” rejoices Christina Franssen, Investment manager in the life sciences unit of Wallonie Entreprendre.

__

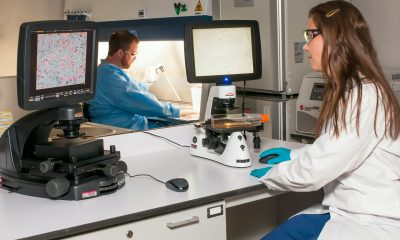

(Featured image by National Cancer Institute via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in L’Echo. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Markets1 week ago

Markets1 week agoRice Market Slips as Global Price Pressure and Production Concerns Grow

-

Crowdfunding8 hours ago

Crowdfunding8 hours agoCrowdfunding for Mobility: Wheelchair User Seeks Accessible Car

-

Biotech1 week ago

Biotech1 week agoInterministerial Commission on Drug Prices Approves New Drugs and Expanded Treatment Funding

-

Fintech3 days ago

Fintech3 days agoPomelo Raises $160 Million to Power AI-Driven Digital Payments Across Latin America