Biotech

Biosimilars Market Expected to Grow by 20% Until 2028 Supported by R&D and Business Agreements

The biosimilars market is poised for growth driven by increased R&D investment, favorable regulations, and strategic industry partnerships. Key opportunities arise from the expiration of patents on major biologics, including Stelara, Prolia, Keytruda, and Ozempic, representing over $150 billion in global sales by 2033. EU and U.S. markets will benefit most, fostering competition and innovation.

The biosimilars market has good prospects for the future. Sales of this type of drug could exceed $64 billion by 2028, which will represent an increase of 19.3%. These are the figures detailed in the global biosimilars report prepared by Alira Health.

Growth in the coming years will be determined by several factors. Firstly, increased expenditure on Research and Development (R&D) will be key to the expansion of the biosimilar business. In addition, favourable regulation towards this type of drug in certain key markets will boost the sector.

Finally, the report points to how strategic partnerships between the main players in the industry will be one of the growth drivers for the biosimilars business.

However, what will really change the biosimilar industry will be the expiration of patents on several currently successful biologics that will expire in the next four years.

In the coming years, fifteen biological drugs that are important in terms of industry turnover will lose patent protection

Countries in the European Union and the United States will benefit most from this end to licensing in favour of biosimilars. Patent expirations not only affect whether a biosimilar can be launched, but also how closely the drug’s manufacturing process can mirror that of the original manufacturer.

In this regard, by 2033, fifteen of the main biological products currently marketed without biosimilars will lose patent protection . In total, this group of drugs represents around 150 billion dollars of global sales in the biological sector.

The market opportunity for biosimilars will be significant over the next ten years. Johnson & Johnson’s Stelara and Amgen’s Prolia/Xgeva are the most affected by this scenario.

The two products have a market value of $17 billion, based on 2023 sales. BMS’ Opdivo and BMS/Pfizer’s Eliquis will also lose their exclusivity in the near term, opening up a $21 billion market.

Biosimilars: Keytruda and Ozempic will lose their exclusivity in 2028 and 2026, respectively

Beyond the projection period, the market is expected to continue to grow, particularly in light of the first exclusivity losses for Ketruyda and Ozempic in 2028 and 2026, respectively. Both drugs were the top-grossing biologics last year, with total sales of nearly $40 billion .

The report also points to the opportunity this creates for generic companies, which have also expressed interest in biosimilars. However, they will need to foster partnerships of biological products with smaller biotechs focused on R&D.

__

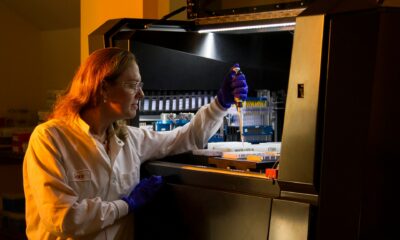

(Featured image by jarmoluk via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crowdfunding1 week ago

Crowdfunding1 week agoSavwa Wins Global Design Awards and Launches Water-Saving Carafe on Kickstarter

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business3 days ago

Business3 days agoDow Jones Nears New High as Historic Signals Flash Caution

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators