Biotech

German Biotech Companies Raise 80 Percent More Capital

The biotech industry thrived during the pandemic, fueled by vaccine demand, but post-2022 saw capital declines. In 2024, capital increases reached €999 million, led by Qiagen and Immatics. Cancer therapies dominate research and venture funding, with ITM, Catalym, and Tubulis raising significant investments. Emerging sectors like foodtech are gaining traction, highlighting biotech’s innovation-driven potential.

The two bad years after the corona pandemic are over – a lot more capital is flowing into the German biotech industry again. The total amount of financing in 2024 rose by a total of 78 percent to 1.92 billion euros compared to the previous year. An all-time high, if you exclude the special effects of the corona pandemic, when the vaccine developers Biontechand Curevac raised record amounts.

This means that the amount of financing has more than doubled compared to the pre-Corona year of 2019. This is shown by the figures from the industry association Bio Deutschland and the auditing and consulting firm EY.

“It is great that financing for the biotech industry in Germany has recovered so well in 2024,” said Oliver Schacht, CEO of Bio Deutschland. “Some of our companies faced major challenges in 2022 and 2023.”

Capital slump in the biotech sector after the corona pandemic

The coronavirus pandemic was an exceptional situation for raising capital in the biotech industry. Initially, investors gave a lot of capital to companies looking for a vaccine against the Sars-Cov-2 virus. The entire biotech industry benefited from increasing interest and very high valuations. But these were not always covered by the companies’ actual developments. The hype was followed by disillusionment: investors held back from 2022, the capital market collapsed and many companies had to rearrange their investment plans and postpone projects in order to make ends meet.

Last year, however, both private and listed companies were able to enjoy significant cash inflows. The industry received 999 million euros through capital increases on the stock exchange, an increase of 82 percent. Most of this money was raised by the diagnostics provider Qiagen which secured 451 million euros through a convertible bond.

The Tübingen-based company Immatics carried out two capital increasesand received a total of 324 million euros. In September, the cancer specialist presented successful data on its personalized cell therapy against metastatic skin cancer (melanoma). The active ingredient is now entering the final clinical phase before submitting an application for approval.

Personalized cell therapy involves taking immune cells (called T cells) from the patient and then genetically modifying them so that they can recognize and attack cancer cells. The modified T cells are then given to the patient as part of their treatment.

Cancer therapies are the focus of research – and investors

Cancer therapies continue to be the world’s largest research area for the pharmaceutical and biotech industry. According to data from the market research institute IQVia, around 44 percent of current clinical trials are in this area. Venture capitalists are also focusing on cancer therapies. The three largest financing rounds last year went to companies based in the Munich area that specialize in oncology. Overall, the amount of venture capital invested in privately owned companies rose by 68 percent to 898 million euros in 2024.

The radiopharmacy specialist ITM raised 188 million euros. The company has been producing radioisotopes for pharmaceutical companies from all over the world for 20 years and is also researching active ingredients that are charged with radioactive isotopes in order to specifically destroy tumors.

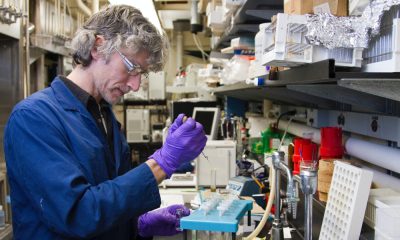

Research laboratory at Tubulis: The company is working on combinations of active ingredients that are intended to act as chemotherapy directly in the cell.Photo: Tubulis

Catalym received 137 million euros. The company has developed an active ingredient that prevents cancer cells from becoming immune to cancer drugs. This should improve the effectiveness of cancer therapies and thus also the quality of life of patients.

In March, the company Tubulis also secured financing of 128 million euros. It is researching so-called antibody-drug conjugates, i.e. chemotherapies that act directly and only in cancer cells.

New therapy – How more people could survive a heart attack or blood poisoning

In addition, 2024 also saw the first biotech IPO in years. Eckert & Ziegler, a manufacturer of radioactive components for medical, scientific and measurement purposes, brought its subsidiary Pentixapharm to the Frankfurt Stock Exchange and raised 20 million euros. However, this was more of a combination of a spin-off and a public offering.

In the German biotech industry, the more than 780 companies generated around 11.4 billion euros in sales in 2023. More than 51,000 people work in the industry. Almost 4.2 billion euros of sales go into research and development.

Medical biotech companies that specialize in the development of therapeutics usually dominate the financing rounds in the biotech industry. However, providers from the foodtech industry are also increasingly raising considerable sums. In September, the Berlin company Formo, which produces cheese from mushroom proteins, secured the equivalent of more than 55 million euros . Infinite Roots received 54 million euros. The Hamburg company has developed a fermented meat substitute from mushroom roots.

“At a time when traditional industries in Germany are facing major cuts, the federal government should also focus on highly innovative industries with high growth potential,” says Viola Bronsema, managing director of Bio Deutschland. Then technological sovereignty and innovative sustainable production systems in this country could not only secure supplies, but also the jobs of tomorrow, says Bronsema.

__

(Featured image by Marek Studzinski via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Handelsblatt. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Business3 days ago

Business3 days agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Fintech10 hours ago

Fintech10 hours agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Africa1 week ago

Africa1 week agoAir Algérie Expands African Partnerships