Featured

BRIC today: A report on its countries’ economies

While some BRIC countries lived up to their potential, others fell from the burden of expectations.

BRIC was a term coined by investment institution 16 years ago in referring to what was considered a highly desirable cluster of emerging markets. These were the countries Brazil, Russia, India, and China. All BRIC countries promised growing economies, cost-effective ways of doing business, a consumer market that was open to the products and services of the West, and a workforce that could adapt to the massive changes that would soon engulf the entire global industry.

Emerging markets have always been on the radar of financiers, investors, and global players, and BRIC was regarded hotspots (in the positive sense of the word) 20 years ago.

But the rest of the world has caught up. Many more so-called emerging markets have also emerged in recent years, and a lot of them can be found in the nascent economies in Southeast Asia such as Vietnam, Malaysia, and the Philippines. The Asia-Pacific region itself, powered by China, has been forecasted to take the reins of economic leadership decades from now. With buzzwords like “Asian Century” becoming increasingly popular, it just might eclipse the West and specifically the United States, according to its supporters.

Given these rapid and seemingly unexpected changes, many observers and analysts are now saying it is time to re-evaluate the pioneering region that had redefined a new sector of a growing national economy. Where does BRIC stand today? How does it match up with the still-leading economic powers?

For that matter, how does it fare in comparison to the new kids on the block? And how much of its earlier glorious promise has it fulfilled? The investors of today would certainly want to know the accuracy of the forecasts of yesterday.

To begin with, says ETF Trends, it would be highly advisable to analyze and evaluate the four individual nations that compose BRIC separately. A lot has happened in the past two decades since Brazil, China, India, and Russia had been seen as one composite region. While globalization does make interdependence among nations inevitable, the economic synergy that once held the aforementioned four countries may not be strong anymore.

As such, one development that affects one country may not impact another. A lot of their own internal factors such as governmental policies, unemployment, and population growth might differ, affecting them in very different ways.

Brazil

Brazil, the so-called apple of the eye of investors in the early 2000’s, unfortunately, did not live up to its potential but actually fell from the heights of its glory to a very precipitous drop. Back then, the South American rising tiger seemed to be able to do no wrong.

According to PR Week, it’s hosting of the Fifa World Cup in 2014 and the Summer Olympics boosted its visibility in the world market, especially in the cultural and tourism sectors. However, uncontrolled corruption drained the country’s coffers and siphoned off the money that could have been spent on infrastructure, public services, and the stimulation of various industries. Brazil experienced one of the worst recessions any company could ever endure.

Still, it has its share of champions who would not give up the good fight. In his statements made to ICIS, Brazilian oil producer Marcos de Marchi said that the country is about to enter into recovery mode. The figures do seem to back him up. The incremental increase may not be spectacular, but they are ultimately inarguable: decrease in economic contraction from 3.8 to 3.6 percent from 2016 to 2015, 0.73 percent growth in 2017, and further expansion by 2.5 percent in 2018.

Russia

ETF Trends gives a generally optimistic prognosis of Russia by saying it is in recovery. The past two years had not been kind to the domain of the country’s president and strongman Vladimir Putin. The national government’s frequent disagreements with the Western countries and the United States have led to economic sanctions which have hurt both Russia’s consumer market and industries detail.

One of the major points of contention was Russia’s annexation of Crimea, which the United Nations had pronounced as “illegal.” Plunging oil prices also set the economy into a tailspin, depriving Russia of one of its reliable sources of revenue, or at least reducing it. All these combined to send about 13 percent of the overall Russian population sliding below the poverty level.

That was Russia’s ordeal since 2013. Fortunately, the economy has picked up since the last quarter of 2016, prompting analysts to say that recovery in the next few years may be slow, but it will be certain.

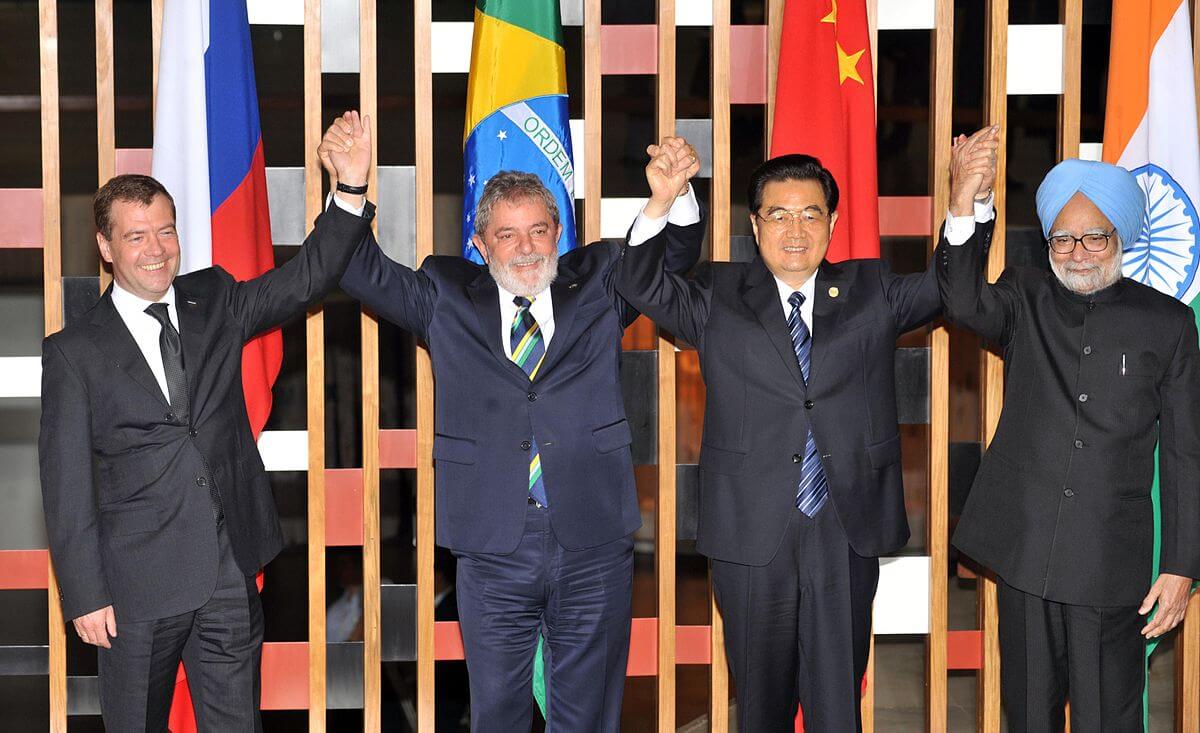

South Africa has joined Brazil, Russia, India, and China, expanding BRIC to BRICS. (Photo by Roberto Stuckert Filho via Wikimedia Commons. CC BY 3.0 br)

India

Meanwhile, Zee News India gives the good news by saying that India will replace Japan as the world’s largest economy by 2028. The publication cites a report by Bank of America Merrill Lynch which also says that by that time, the country will be on the economic heels of France and Great Britain.The current state of India certainly augurs that possibility. Growth is slated at seven percent while the overall value of the economy this year is poised at $2.26 trillion.

One driver of this growth is the country’s new “financial maturity” which has led to increased savings and investment rates. Homes and other properties and assets are becoming more affordable. The overall population also has more income and spending power, leading to greater consumption.

China

If India is the economy of tomorrow, China is challenging the position of the current leaders as an economic power in its own right. It has already been acknowledged as the second-largest economy in the world, next to the U.S. Growth has been continuous, which CNBC has pegged at 6.4 percent by 2018. The expansion is still imminent, with households continuing their spending.

What gives institutions like the Asian Development Bank is China’s vacillating relations with the West. Its hot-and-cold ties with the Trump administration have given rise to fears of protectionism. The tension between the U.S. and North Korea can also crimp the growth, especially if it escalates into full-scale war.

To sump up: has the bright young star that is BRIC fulfilled its promise? One can say it’s half-and-half. Brazil and Russia are recovering from the recession, China has considerable economic clout but is facing threats that can undermine its progress, and India seems to be on an upward motion with no obstacle in sight.

(Featured image by

-

Impact Investing1 week ago

Impact Investing1 week agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Fintech15 minutes ago

Fintech15 minutes agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Impact Investing1 week ago

Impact Investing1 week agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto2 weeks ago

Crypto2 weeks agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

You must be logged in to post a comment Login