Business

A $245b Wave Is Sweeping eCommerce, and CardCash.com Is Going for a Ride

The live commerce wave that took the Chinese eCommerce sector by storm is now tipped to hit the US in a very big way, with top analysts estimating a CAGR of 87% through to 2026. Here we take a closer look at what’s behind the trend, what’s got people so excited about it, and why certain companies like CardCash.com are poised for outsized growth throughout the livestream shopping boom.

In the last few years, a phenomenon has swept over Chinese eCommerce. That phenomenon is, of course, live commerce. And it is currently used by roughly half (526 million) of all Chinese internet users (1.08 billion).

That’s huge.

And it’s a trend that’s also coming to America.

Or, at least, it is coming to America if we can trust reports from the likes of McKinsey and a bunch of other firms (from big 4 to boutique) who are tipping the live commerce trend to be worth at least $245 billion by 2026.

To put that into perspective, live commerce in the US was worth about $20 billion in 2022 (up from like, next to nothing a few years ago).

And if you churn the numbers above through the old CAGR formula, it spits out the sort of numbers that will make you spit out your morning coffee.

So put down your coffee before you read the next paragraph.

Ready?

The US live commerce market is expected to grow at a CAGR of 87% through to 2026. (And yes, I double-checked those numbers.)

Read that again.

That’s a CAGR of 87% which, if you ask me, sounds like a nice little investment thesis.

The only question is, how do we invest into this?

Never Heard of Live Commerce? Here’s What You Missed

To start with, let’s all get on the same page. Many of you may never have heard of live commerce (also known as livestream shopping).

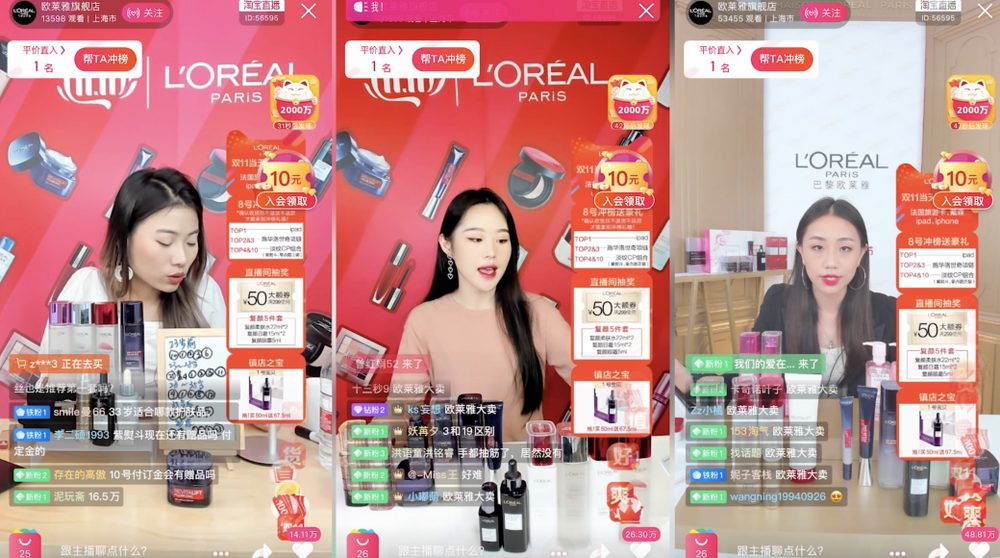

Now, I’m not going to dwell too long on what live commerce is. Instead, I’m just going to show you a few pictures, starting with this.

And, if you’re getting any sort of “everything old is new again” vibes from the above, then you’re not alone.

Here’s what it reminds me of.

In a nutshell, if you replace the “1800” with a “WWW”, and swap out the pro TV crews and presenters for social media influencers, you basically get live commerce.

So now we’re all on the same page, let’s get back to exploring the investment thesis here.

Theory #1 — Invest in Growing Brands and Products, Not Oversized Legacy Brands or Platforms

If you take a retrospective birds-eye view of the past twenty-odd years of eCommerce, there are a few key takeaways.

- For every Amazon [NASDAQ: AMZN], there are a thousand names like Buy.com, Borders.com, and countless others you’ve already forgotten about.

- Legacy brands that embraced the transition to eCommerce well not only survived but thrived. Compare the state of Nike [NYSE: NKE], Walmart [NYSE: WMT], and Best Buy [NYSE: BBY] to brands like Toys “R” Us, Blockbuster, and Sears (all of which have filed for Chapter 11 Bankruptcy).

- Of the newer brands that have grown into global powerhouse brands, an eCommerce-first strategy has been a surprisingly common pattern. (For example, Anker [SZSE: 300866])

What do we take away from this?

Let’s go through these three scenarios one by one and apply them to live commerce.

#1 — Backing Live Commerce Platforms

If you think dropping straight-up bets on a roulette wheel is a sound investment strategy, then go ahead and try and pick the next Amazon.com of live commerce. Otherwise, this sort of strategy is probably best avoided.

Sure, the payoff will be huge… if there is a payoff. But the more likely scenario is that you’ll lose the lot. And this latter outcome (losing the lot) is probably even more likely with live commerce than it was for eCommerce per se.

You see, there are a couple of major headwinds for any would-be live shopping platform here.

The first is that everything online eventually concentrates around a small handful of major platforms.

The second problem is that the platforms most likely to dominate this space (TikTok, Twitch, YouTube, etc.) are already so big that any gains from livestream shopping are going to disappear into insignificance in the belly of these much larger beasts.

#2 — Backing Legacy Brands That Are Doing Live Commerce Well

Moving on to #2 — backing oversized legacy brands doing live commerce well.

On this point, there is certainly a case to be made that any legacy brand without a live commerce strategy deserves some serious scrutiny.

However, there’s also a case to be made that there’s not a lot of growth potential for them here either. The argument here boils down to the following logic.

- Large legacy brands already have their finger in most parts of the $7.4 trillion US retail market pie. And while the promise of a $245 billion live commerce market by 2026 is nothing to sneeze at, it doesn’t represent the seismic shift that bricks ‘n’ mortar vs. online represented.

- In order to really capitalize on the live commerce market, brands need to see this as a two-pronged opportunity in which one of the prongs is bigger.

- The first (and smaller) prong is, of course, the direct-from-live commerce sales that are up for grabs. Again, grabbing a slice of a $245 billion market is nothing to turn your nose up at.

- The second, and much bigger prong is the brand exposure opportunity smart brands can use to multiply their growth. To illustrate this, when a company like L’Oréal [ENX: OR] joins the live commerce trend, it’s more of an “adapt or die” strategy. However, when a lesser-known brand secures live commerce partners, it’s a major opportunity for it to not only sell stuff to a new audience, but to also build massive brand awareness it can parlay into broader growth beyond live commerce.

#3 — Backing Growing Brands That Are Poised to Leverage Live Commerce to the Max

And that finally brings us to the third scenario — identifying brands that are not only embracing live commerce, but also have massive headroom left for growth.

With all of the above considered, this last scenario seems where investors looking to ride the live commerce boom are going to have the most success. Between the new market exposure (and a booming one at that), plus the benefit of massive brand exposure that can translate into additional growth in other markets, there really is a huge opportunity here.

The only question is, what brands fit these criteria while also being publicly traded companies that ordinary people like you and I can invest in?

Let’s take a look at one very good answer.

What’s the Godfather of the Infomercial Up to These Days?

With the strong resemblance between infomercials and livestream shopping, it seemed natural to take a look at what the old-school infomercial guys were up to these days for some clues about where to invest.

So who better to start with than with the “Infomercial Godfather” himself — Kevin Harrington? (Probably more well known for his stint as an original Shark on Shark Tank. But, in a past life, he was the pioneering figure of the modern infomercial format.)

As it turns out, Harrington is up to something. Here’s the timeline:

- July 2023: Kevin Harrington partners with RDE, Inc. [OTCQB: RSTN]

- August 2023: RDE, Inc. signs an agreement to acquire CardCash.com.

- December 2023: CardCash.com announces that it’s joined the multi-vendor, multi-presenter livestream social shopping platform MARKET.live [Verb Technology | NASDAQ: VERB].

On that last event, that’s looking like it’s shaping up to be a solid partnership.

In its press release announcing the partnership, Verb [NASDAQ: VERB] CEO Rory J. Cutaia. stated, “We’re thrilled to add CardCash to the MARKET.live platform, offering our shoppers much welcomed holiday discounts on leading brands. The holiday season is the ideal time for gift card purchases, and with our digital delivery system, shoppers can access savings instantly.”

For the uninitiated wondering what the significance of this is, Verb [NASDAQ: VERB] runs one of the leading livestream shopping platforms at the moment in its MARKET.live platform. As hinted at above, this is a multi-vendor, multi-presenter network, meaning it offers brands an infinitely more scalable solution than, let’s say, doing individual outreach to a bunch of TikTok/Instagram/etc. Influencers.

Instead, brands selling through MARKET.live get a full-suite solution taking care of everything from finding influencers to full-blown livestream storefront integrations. Here’s an example from a recent CardCash.com livestream via the MARKET.live platform, replete with an integrated buy now CTA.

Here’s Why CardCash.com Will Dominate Live Commerce

What’s really interesting here is that, if there’s one brand that’s really set to dominate live commerce, then CardCash.com probably fits the bill.

To understand why CardCash.com is poised to dominate live commerce, let’s rewind back to the opening of this article. There, we referenced a McKinsey report covering the growth of live commerce.

And part of the report was a section investigating why people were turning to live commerce.

In this section, McKinsey identifies that the second-biggest driver for live commerce adoption (trailing slightly behind “entertainment”) was “live shopping potentially being a way of securing better prices and deals.” (35% of respondents cited this.)

Now let’s take a look at the CardCash.com business. Its entire business is premised on supplying better prices and deals on everything, everywhere (well, almost).

To do this, it operates a gift card exchange. On one side, people sell their unwanted gift cards (or non-essential gift cards if they just need the cash). On the other side, people buy those unwanted gift cards at a discount.

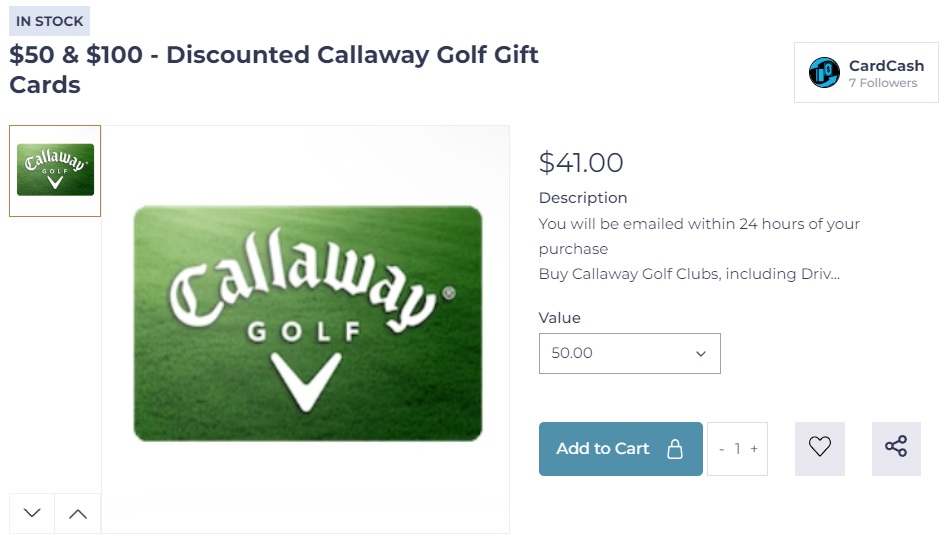

Now, obviously, the discounts on offer here are variable. A big part of what determines the prices here is simple supply/demand market dynamics.

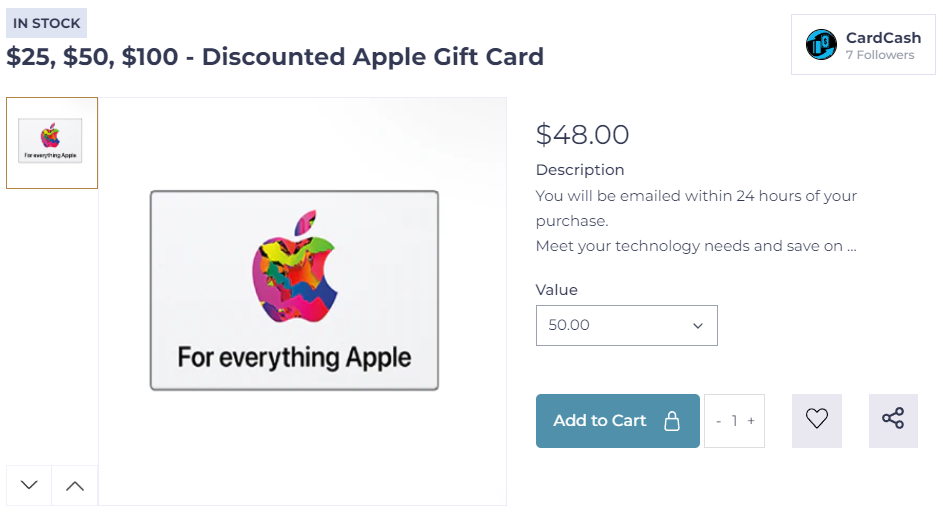

On one hand, popular, highly sought-after gift cards only see small discounts on the order of a few percent off.

But on the other hand, some frankly outrageous discounts crop up on less sought-after cards, like this Callaway golf gift card at almost 20% off.

In total (and this is where it gets exciting, so pay attention), CardCash.com has over 500 brands’ gift cards available on its platform.

That means there are gift cards for just about everything.

And that means that, unlike something like a makeup brand that only has a place on a ‘beauty influencer’ live stream, CardCash.com has a place on any live stream. (After all, if people come to live commerce streams for discounts and deals and CardCash.com has, let’s say, discounted Sephora cards on offer, you can guarantee a bunch of beauty influencers will be all over it.)

And that, right there, is what makes the live commerce story so exciting for CardCash.com.

We have a company that’s actively pursuing a live commerce strategy.

We have a company that will get massive brand exposure out of this strategy (again, expect to see CardCash.com gift card deals on just about any stream, no matter what the product focus is).

And we have a company that’s still got huge growth potential. (At the time of the CardCash.com acquisition, combined revenues for CardCash.com and RDE’s other major brand, Restaurant.com, were estimated to be in the range of $100+ million. Meanwhile, the gift card market is worth $325 billion, and livestream shopping is a potential $245 billion. That leaves massive headroom for growth.)

In short, we have the perfect recipe for a runaway success.

__

(Featured image by Libby Penner via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto2 days ago

Crypto2 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto1 week ago

Crypto1 week agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Biotech4 days ago

Biotech4 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-400x240.jpg)

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-80x80.jpg)