Markets

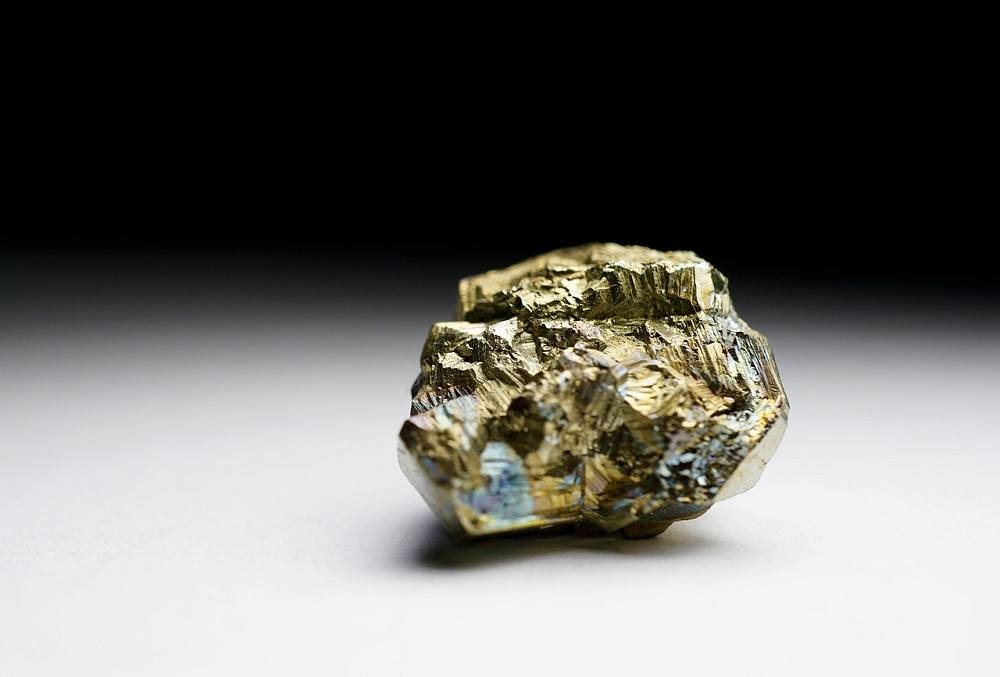

Friday news: China is taking over the gold market

In recent years, Singapore has been transitioning into a global gold hub, challenging the previous dominance of traditional locales such as London and Switzerland.

This Friday’s metals market report focuses on the Chinese demand for gold.

Welcome to Friday’s metals letter with special attention to Chinese demand for gold. Remember, gold is only one Twitter blast away from new highs.

Congratulations to our friends at Dillion Gage who just opened in Singapore. Thom McMahon has been named as Dillon Gage Asia’s Chief Executive Officer. Great timing Dillion and I look forward to trading with you, Thom.

With this strategic expansion, Dillon Gage Metals is now poised to increase their global footprint in a burgeoning precious metals market area. To continue providing expedited delivery in the immediate region, Dillon Gage Metals plans to supply and maintain locally based inventory of highly desirable product lines such as silver and gold Canadian Maple Leafs, kilo gold bars and 100-ounce silver bars.

In recent years, Singapore has been transitioning into a global gold hub, challenging the previous dominance of traditional locales such as London and Switzerland. Beginning in 2012, Singapore’s removal of a seven percent tax on investment metals spurred investment interest. It is now estimated that 80 percent of the leading global commodities firms maintain a presence in this economic sector, employing approximately 15,000 people. The prestigious research firm Wealth Insight predicts that Singapore will overtake Switzerland as the world’s largest hub of offshore-based wealth by the year 2020.

Friday’s Trivia:

As metals are added to gold during jewelry making, the gold becomes less fine and the number of karats drops. For example, 12 karat gold contains 50 percent gold and 50 percent alloys by weight. Just where did the word Karat come from?

How hungry is China for gold/Byron King:

Here’s what he said to me: “I’ve seen estimates out of China that over 375 million Chinese want to buy gold. But they can’t. They live in the remote interior of the country, not the more open, coastal cities. These Chinese have little or no access to gold markets. And even if they did have access, there’s not enough gold.”

The man explained that any Chinese with means and access is buying gold. He told me that just the Shanghai Gold Exchange has over 10 million customers. 10 million separate, account-holding customers. Just for gold.

Pete:

While we were talking, I did some quick math in my head. Suppose the average customer, a middle class Chinese worker, has about $2,500 socked into gold. At $1,250 per ounce, that’s the equivalent of about two ounces of gold.

Asia – home to the two biggest physical bullion markets, China & India – as the key growth markets/Jan Harvey:

In a warehouse a dozen miles to the northwest of Cardiff, the Royal Mint is running its machines through the night to keep up with demand for one of the big beneficiaries of the last year’s political turmoil – gold and silver bullion.

The 1,100-year-old Mint, based here since the 1960s, is producing 50 percent more gold bullion coins and bars than it was this time last year, director of bullion Chris Howard says, while its sales in January rose by a third. With growth prospects for its core minting business limited by the advent of the cashless society, the Mint has focused heavily on growing its bullion arm in the last few years. Its contribution to the overall business’s bottom line has gone from negligible levels in 2012 to more than a quarter in the last year.

“We used to send these out by the box,” head of bullion sales Nick Bowkett says, indicating stacks of silver coins packed for transit in the Mint’s bullion striking room. “Now we ship them out by the pallet.”

Mining.com:

Higher commodity exports delivered a record trade surplus of $3.5 billion in December, the second monthly trade surplus Australia has recorded in nearly three years.

Gold also played a part, with exports surging 23% to $1.7 billion. The encouraging data sharply contrasts with the record deficit of $4.3 billion the country recorded only 12 months ago. HSBC chief economist Paul Bloxham told AAP the export boom should considerably boost company profits, dividend payments, share prices and wages in the mining sector. Almost all the base metals and precious metals are headed to Asia.

Standard Bank on Gold for 2017:

A testing first half before the outlook brightens, we are bearish gold in the short-term. We forecast an average of $1,170 this quarter and $1,140 in Q2. A test of the late 2015 low around $1,146 is possible. Why this low, because we expect the Trump news flow now to turn more to his fiscal program – notably corporation tax, repatriation of overseas earnings and infrastructure. That would reverse the recent fall in US yields and the dollar. Consequently, we expect nominal rates to rebound faster than inflation, and real interest rates to move back into positive territory again.

Sharps Pixley:

The latest Swiss official gold export figures for December show that this just isn’t necessarily the case anymore. Swiss gold exports direct to the Chinese mainland in December were almost FOUR TIMES those into Hong Kong and were MORE THAN THREE TIMES the amount of gold shipped from Hong Kong into the mainland. We hear anecdotally that the four major Swiss gold refining companies, Heraeus, Metalor, PAMP and Valcambi have all been working around the clock to meet the Asian demand,

Enoch Yiu:

Hong Kong’s gold market rose on its debut in the Year of the Rooster, to close at HK$11,192, up 0.9% from Friday’s close as investors flocked to gold as a safe bet amid market worries. Local gold resumed trading on Wednesday at the Chinese Gold and Silver Exchange Society after a four-day holiday for the Lunar New Year, which saw international gold rally by 0.5% this week to trade at US$1,200.70 on Tuesday night, up 0.8% from Friday.

Citigroup:

For palladium prices outlook for the year, Citigroup said in December that palladium would be the best precious metal in 2017. Citigroup said the global automotive sales will stabilize as expected, but as a catalyst for automotive raw materials, platinum group metals demand will increase due to increasingly stringent emission standards. At the same time, the Chinese government subsidies for new cars has declined, electric cars or hybrid vehicles will be used as an alternative. Citigroup believes that US environmental policy as the second largest auto consumer in the United States will support the demand for palladium.

Platinum’s next step for Britain/Numismatic News:

British Royal Mint announced a partnership Dec. 15 with the World Platinum Investment Council (WPIC) to launch a range of platinum bullion coins and bars throughout 2017. The move into platinum marks the first for the BRM. The principal aim of the partnership is to stimulate investor demand for physical platinum worldwide. The physical products will be tailored to the requirements of international retail investors.

Nickel/Mining.com:

Nickel fell to a 13-year low of $7,725 a tonne ($3.50 a pound) in February last year; then rallied to more than $11,700 by mid-November only to fall back nearly 20% to trade at a six-month low on Friday. Nickel, mainly used as an anti-corrosive in steel alloys, rallied in 2016 on the back of a clampdown on mines in the Philippines which took over as the main supplier to China following an ore export ban in Indonesia in place since 2014.

Stoppage at northern Chile Escondida copper mine could start as soon as Monday/Bloomberg:

Workers at BHP Billiton Ltd.’s Escondida copper mine in Chile voted against the company’s latest wage offer, opening the door for a strike and potentially heralding a wave of stoppages at global suppliers after a rally. Prices rose above $6,000 a metric ton in London. Some 99% of members voted in favor of a strike, which could start on Monday, according to a statement from Union Number 1. Its 2,492 members represent about 95 percent of Escondida’s workers. The project is the world’s largest copper mine, and is forecast to produce about 1.1 million tons in the 12 months to June 30, according to BHP.

Pete’s Corner:

Steve Forbes, the founder of the influential Forbes magazine, has put together an overview of a tax plan that I feel will work for this country. Click here to see how this could be in the near term.

Kitco News/Sarah Benali:

Gold prices continue to benefit as investors seek safe-haven assets, and although one professor is not a ‘wild bull’ on the metal, he remains optimistic. “If I was advising a central bank, which I do, the recommendation is buy,” Steve Hanke, professor of Applied Economics at the Johns Hopkins University and a known trader, told Kitco News in a phone conversation Tuesday.

“Uncertainty in general…and all kinds of things going on [right now] are favorable to gold.” Gold prices have rallied this week as markets await more central bank policy announcements, with the metal holding above $1,200 an ounce. April Comex gold futures last traded at $1,204.60 an ounce, down 0.56% on the day. “I do think gold is relatively cheap now,” he said.

ICTA:

The Industry Council for Tangible Assets (ICTA) has formed a task force to mobilize law enforcement resources to protect the integrity of U.S. coinage by educating officials on the economic impact and growing threat counterfeit circulating, collectible and bullion coins pose to the collecting community as well as the public at large.

The Anti-Counterfeiting Task Force (ACTF) was formally established January 6 during a meeting in Fort Lauderdale attended and fully supported by numismatic community leaders and associations that attended an August 8, 2016, summit to assess the harmful effects of counterfeit coins entering U.S. markets from China, Russia, Eastern European countries, and the need for action to address the problem.

RT.com:

An Argentine treasure hunter aims to raise a British warship which sank off the coast of Uruguay more than 250 years ago, in hopes of uncovering its cargo – thought to be a mountain of gold worth £1 billion ($1.25 billion).

The Lord Clive was sunk in 1762 following a naval battle with the Spanish, as her maverick captain Robert McNamara tried to retake the city of Colonia del Sacramento. About 272 sailors went down with the ship, while the 78 who made it to shore were quickly tried and executed by hanging.

FT:

Rio Tinto had its people hassled in Hong Kong but this is bad news for business and it should speed up the flight into offshore investments into gold. Hong Kong’s status as a global financial center has now been damaged even more than it was by the case of the missing booksellers. In that case, international businesspeople, bankers and indeed journalists could perhaps console themselves with the fact these were small-time publishers scraping a living from unproven rumors about Chinese politicians. But Mr. Xiao is worth $6bn and his political connections include close ties with at least three “princelings” (as the children of Communist party leaders are known). At one point, he even bought a company from the sister of Chinese president Xi Jinping. In mainland China, itself, his abduction will send a chilling message to the super-wealthy, who already believe Mr. Xi has launched a war against them. It will also accelerate the pace of capital flight.

Putin loves his gold and he intends to strengthen his country by amassing more:

Alexander Bratersky, Special to RBTH:

Russia’s fondness for gold reserves dates to the czars, who used gold to strengthen the national currency. The Russian empire attained its largest gold reserves in 1894 when they amounted to 800 million imperial rubles. Until 1914 the gold reserves of the Russian Empire were the largest in the world, weighing 1,400 tons. This vast quantity of gold allowed Finance Minister Sergei Witte to carry out monetary reforms, which resulted in the introduction of the gold standard in 1897.

In 2005, the far Eastern region of Magadan, the place known for cruel Gulag camps, hosted a government meeting on gold chaired by President Putin that sought a solution for the critical situation with the country’s gold reserves. At that time the repositories contained only 387 tons of gold and the condition of the industry was catastrophic.

New measures were adopted to improve the situation in the industry, which had been working according to old rules from the Soviet era. The meeting turned out to be revolutionary for the industry, and it was decided to find ways to attract private investment in exploration. Under Mr. Putin the current holding is posted at 1542 tons.

Trivia Answer:

The word karat comes from the carob seed. In ancient Asian bazaars, the seeds were used to balance scales that measured the weight of gold.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto4 days ago

Crypto4 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets2 weeks ago

Markets2 weeks agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Business3 days ago

Business3 days ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

You must be logged in to post a comment Login