Business

Cocoa, frozen concentrated orange juice edge higher

Favorable weather conditions helped cocoa, cotton and frozen concentrated orange juice and citrus to close higher last week.

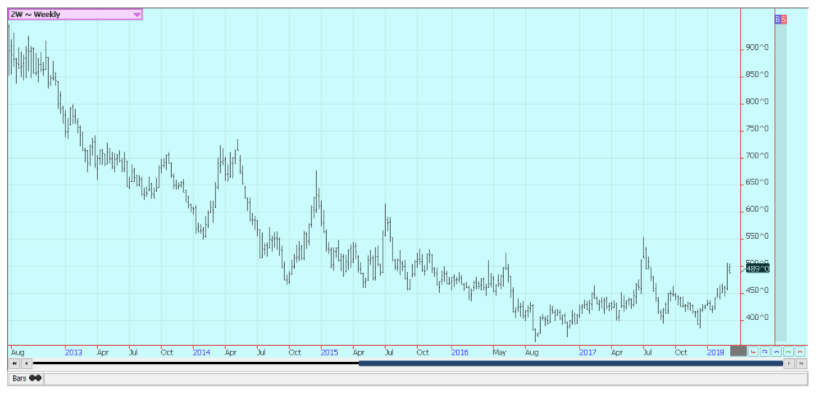

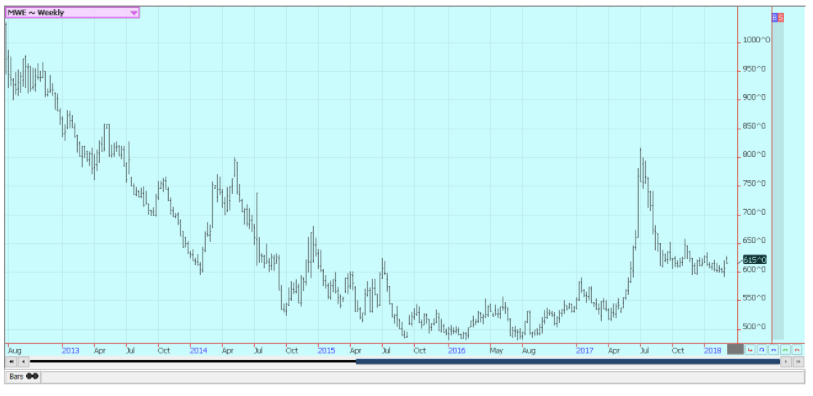

Wheat

Chicago Winter Wheat markets and Minneapolis closed a little lower last week as prices faded in response to the USDA monthly supply and demand updates. USDA cut Wheat export demand and increased ending stocks for the U.S. It was a move that reflected the reality of a poor export demand marketing year.

The U.S. remains a weather market, with La Niña conditions affecting the production potential for Hard Red Winter areas. A drought remains in the region and has become serious, especially in Oklahoma and Texas where the crops are now leaving dormancy.

The crop did not establish itself well last fall due to the dry weather. A large part of the crop is still rated in poor to a very poor condition.

Black Sea prices have been firm in the last couple of weeks due to currency considerations and some logistical problems in Russia and throughout most of Europe. Russia and Europe have seen some very cold weather and traders expect to hear reports of Winterkill and production losses from both areas. The cold weather has made transportation of all goods, including grains, to ports and loading onto ships that much more difficult.

The weekly charts show that both Winter Wheat markets are in uptrends and Minneapolis Spring Wheat markets remain in sideways trends. However, the daily charts for Winter Wheat futures are showing new down trends in response to the late week price action. Daily charts in Minneapolis are mostly sideways.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

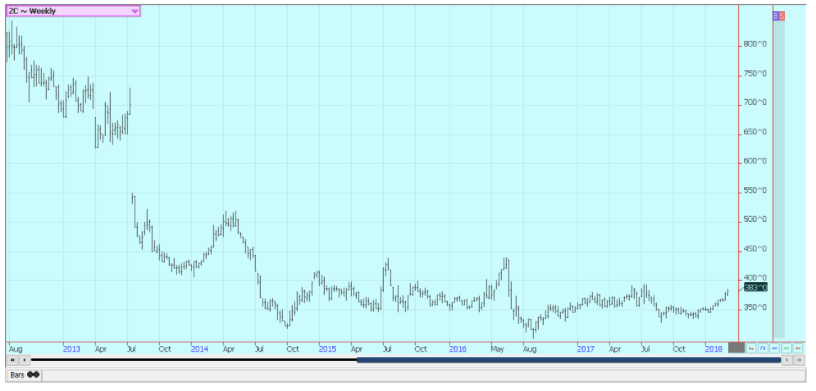

Corn

Corn closed higher for the week and trends remain up on daily and weekly charts. Oats saw selling pressure late last week and trends are trying to turn down in this market.

USDA showed strong demand in its latest monthly supply and demand updates that were released last week. Export demand was increased sharply to reflect the reality of the situation, and increases were posted for ethanol demand and food and industrial demand. Ending stocks estimates are still high, but the stocks are less and the trend for stocks is down. Corn remains a demand market.

The weekly export sales report was strong once again and the sales pace is still well above USDA projections for the marketing year. Ethanol demand also remains very strong.

The US Dollar still appears to be in a longer-term downtrend, so additional export demand is possible and is appearing. More demand is expected due to the problems in South America due to the weather. Brazil is not offering Corn while Argentina continues to struggle with dry weather problems of its own that are being caused by La Niña.

Argentina is expected to see some rains in production areas this week, but the rains might be coming too late to help the Corn. Brazil is still too wet in central and northern areas to get the corn planted well.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed lower for the week as prices fell in response to the USDA monthly supply and demand updates. USDA made no changes to the US supply and demand estimates and made only a few changes to the world estimates. World ending stocks estimates were increased due to increased production estimates for India.

Cash market bids remain generally strong amid tight supply availability. Reports still indicate that Texas producers are nearly sold out for the marketing year. Planting is about to begin in the state and also in Louisiana.

Limited amounts of Rice are reported to be owned by farmers in Louisiana and Mississippi. The amount of Rice still owned by farmers in Arkansas and Missouri is less clear, but the cash market indicates tight conditions.

Cash market traders suggest that the commercials are still short bought, and it looks like they are finally moving to get covered. Planted area is expected to increase in the coming year, as the tight domestic supply situation has created rather favorable nearby prices. The amount of the increase is being tied to the price spreads between Rice and competing crops, with some Rice areas in the Delta expected to plant more Soybeans as well. Some cash market traders expect only small increases in planted area this year due to the spreads and the higher cost of production for Rice.

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were lower last week. Trends turned down on the daily charts and are turning down on the weekly charts. World vegetable oils prices have had trouble holding strength in the last couple of weeks on ideas of big supplies despite the drought and lack of offer from Argentina, the world’s largest Soybean Oil exporter.

In particular, the market sees big supplies of Palm Oil right now in both Indonesia and Malaysia and has big questions about demand. India has moved to support local oilseeds producers by significantly increasing import tariffs for vegetable oils. Tariffs were increased across the board, but those for Palm Oil were increased in a big way. Palm Oil is effectively shut out of the Indian market for now, and buyers there are now looking to cancel purchases made earlier due to the tariffs.

Demand from China remains a question market. Many analysts now note the big Soybeans imports by China and think that China will have more than enough Soybean Oil produced from the imported Soybeans to cut import demand for all vegetable oils including Palm Oil. The trade is looking for Palm Oil production to continue to decrease in line with seasonal trends, and this expectation has provided the primary support.

The Malaysian Ringgit has been moving higher against the US Dollar, and this has firmed up prices for Palm Oil in the world market in Dollar terms. Canola markets remain mostly in up trends, but the market failed late last week. Deliveries to elevators have been strong due in part to forward selling earlier in the year. US demand for Soybean Oil in biofuels should remain strong, and stronger export demand is anticipated due to the threat of reduced production in Argentina.

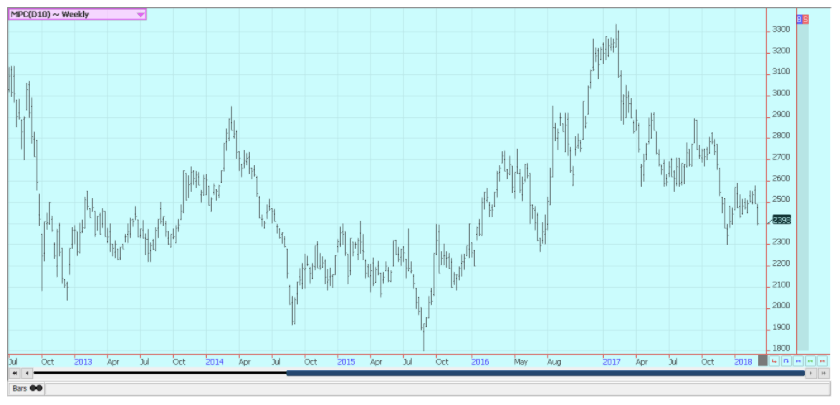

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher for the week but gave back much of the early buying by midweek. The weekly charts show that futures are now pushing against some big downtrend lines, so the market is entering an important period.

USDA released its monthly supply and demand updates. It featured improved export demand for the US and reduced ending stocks. The weekly export sales report was very strong once again. Demand remains strong and merchants have had trouble finding the Cotton in domestic cash markets.

Prices overall have been much higher than most commercials had expected, and they remain heavily short the market, with funds and index funds taking the other side. Prices could remain strong until closer to harvest due to tight domestic markets. There have also been quality concerns left over from the hurricanes and the freeze during the growing season.

USDA expects demand to remain very strong. The trade will also look for ideas of plantings as the spring is starting now in many production areas. Plantings could be higher than USDA projections due to the big problems with the Winter Wheat crops in the western Great Plains.

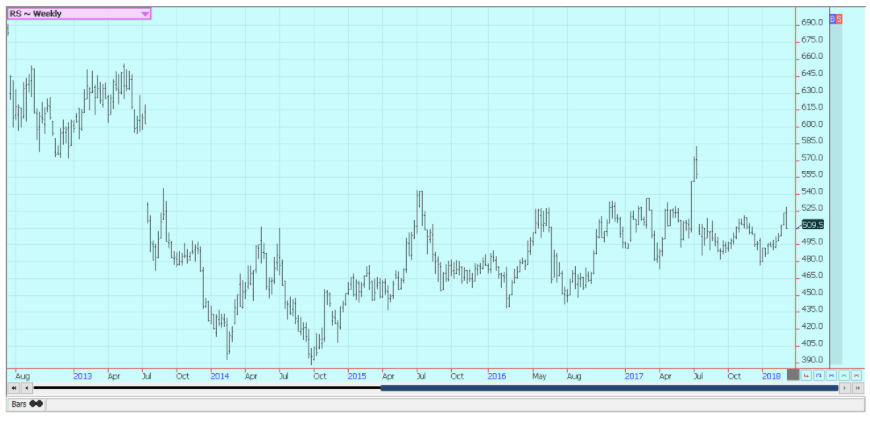

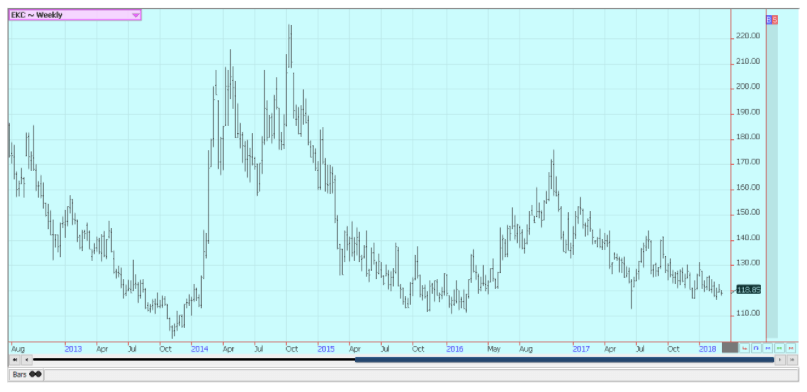

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

Frozen Concentrated Orange Juice (FCOJ) was a little higher again on Friday and a little higher for the week as the weather remains mostly good for the crops. Futures remain in a trading range but show a weak appearance on both the daily and weekly charts and Florida remain mostly warm and dry.

The market is still dealing with a short crop against weak demand. USDA estimated the crop at about 45 million boxes in its last report. The current weather is good as temperatures are warm, and it is mostly dry, but the crop is small.

The harvest is progressing well and fruit is being delivered to processors and the fresh fruit packers. Trees in Florida are showing fruit of good sizes, and producers are now into the Valencia crop with the early and mid-harvest completed. Florida producers are actively harvesting and performing maintenance on land and trees. Some early flowering has been reported in the groves, and some fruit is forming. Irrigation is being used.

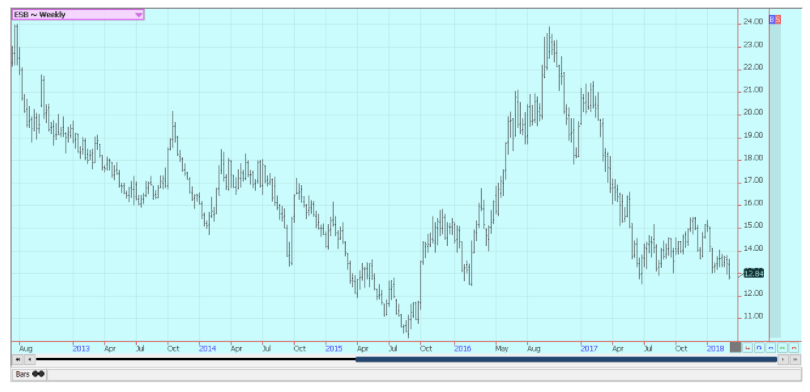

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower on Friday and a little lower for the week in New York. London was slightly lower on Friday. London was little changed for the week. Both markets are looking for news to cause a move in either direction.

The charts present a sideways appearance for now in New York, and speculators remain very short but have been starting to reduce part of those positions. London charts are showing a sustained uptrend. Traders anticipate big crops from Brazil and from Vietnam this year and have seen no reason to cover the short position in a big way.

New York traders are talking about good weather currently being reported in Brazil and expect another bumper crop. There were reports from London of increased Vietnamese selling, and Robusta is now more available. These reports are not being backed by the price action, and Robusta remains the stronger market. The situation seems little changed in Latin America.

There are reports of short crops in parts of Central America and some areas in South America due to the lack of farmer investment from the low prices. Honduras has been a very active exporter and offers from most other countries are seen. Differentials in Central America are low and the buy side is quiet.

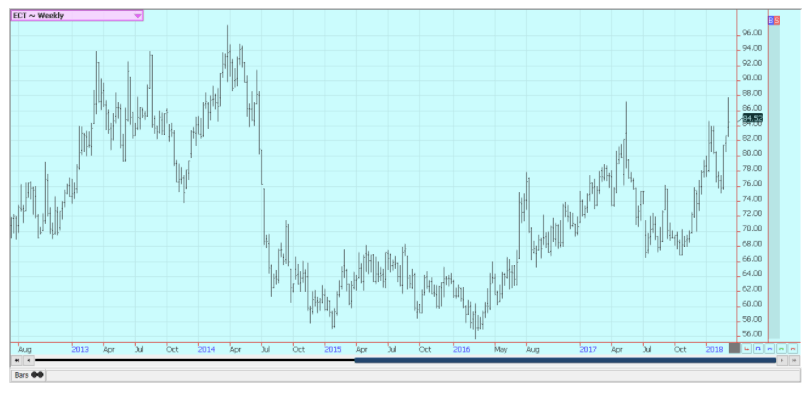

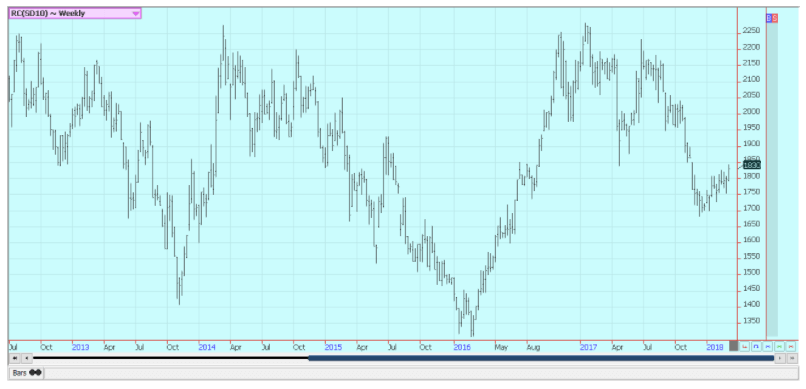

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

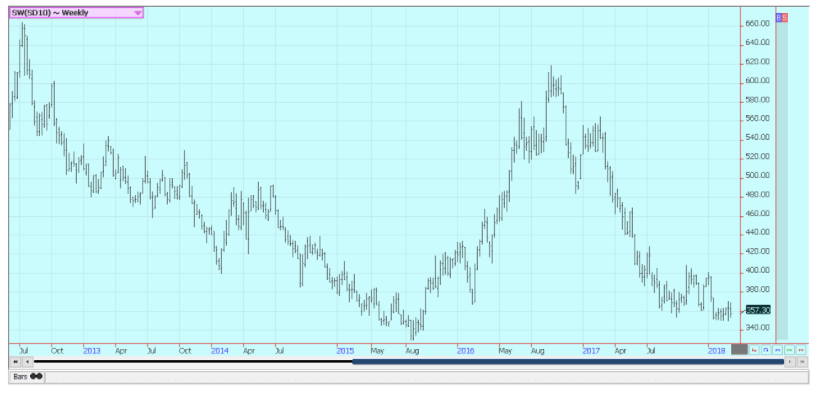

Sugar

Futures were a little lower for the week. Trends are down again in New York but held the recent trading range in London. The overall feel of the market is that prices for now are cheap enough, but both New York and London appear to need a catalyst to work higher in a big way.

Ideas that Sugar supplies available to the market can increase in the short term have been key to the selling. India will export up to 1.0 million tons of Sugar this year after being a net importer for the last couple of years. Thailand has produced a record crop and is selling.

Mills in Brazil have decided to make more Ethanol as world Crude Oil and products prices have been very strong. Brazil still has plenty of Sugar to sell even with the different refining mix. The ISO expects production to outstrip demand by more than 5 million tons this year as the market recovers from a 2.5 million ton production deficit last year.

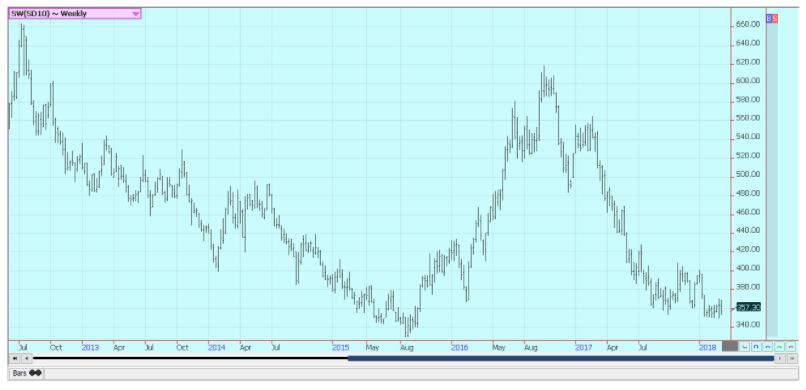

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures were higher for the week. Trends are up in both markets on the daily and weekly charts. It has been hot and dry in many parts of West Africa, so conditions are good for the winds to form. Some crop losses might be possible if the current conditions persist.

There have been reports of some showers in West Africa, so perhaps the season is changing now. The gut slot for offers from the main crop is passing, and the sales by the government suggest that offers down the road can be less. The mid-crop harvest is starting in some areas.

The recent grind data was weaker for North America, but positive for Europe and Asia. Demand is not universally strong, but has been improving and is likely to continue to improve as long as prices stay generally weak as processing margins are said to be very strong.

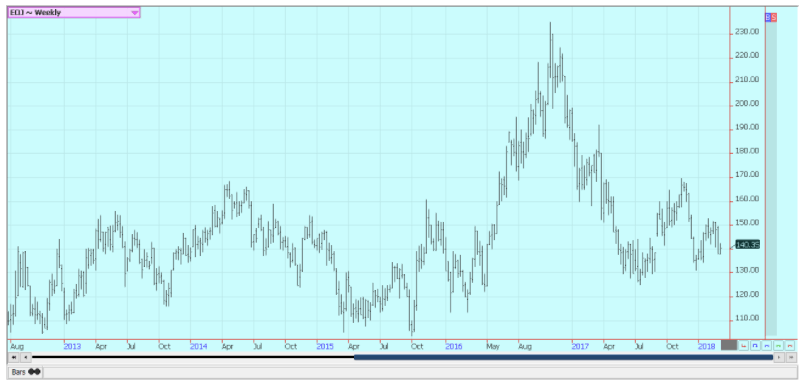

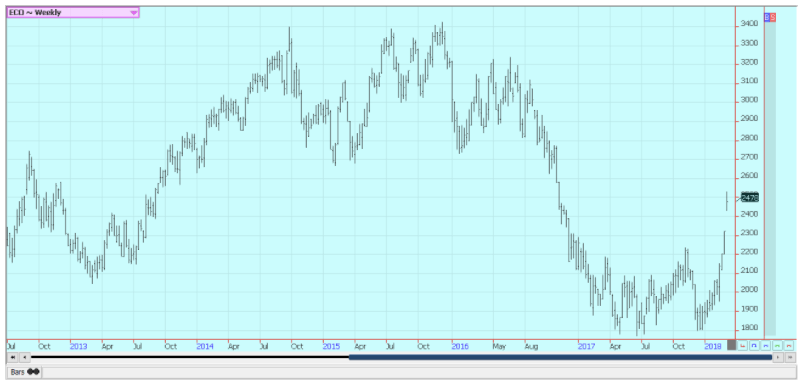

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

_

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis2 weeks ago

Cannabis2 weeks agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Fintech1 day ago

Fintech1 day agoVivid Expands Multi-Currency Interest Accounts for Business Clients

-

Cannabis1 week ago

Cannabis1 week agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

-

Crowdfunding5 days ago

Crowdfunding5 days agoCrowdfunding for Mobility: Wheelchair User Seeks Accessible Car

You must be logged in to post a comment Login