Markets

Cocoa Markets Flat as Supply Improves and Demand Remains Weak

New York and London cocoa markets ended last week nearly unchanged, reflecting mixed short-term trends. West Africa expects a strong main harvest, with favorable rains supporting crops in Ivory Coast. Production prospects are also rising in Asia and Central America. Meanwhile, demand appears weak, and subdued consumption is expected to persist through coming months ahead.

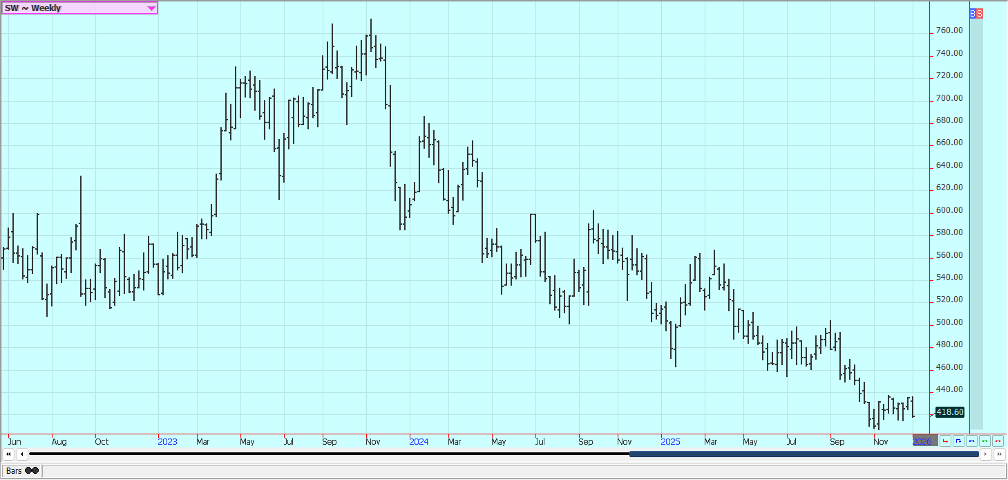

Wheat: Wheat closed lower again last week and for the year in holiday trading and on continued reports of big world production and weaker demand. News that Russia had bombed Ukrainian ports over the previous weekend did not move the market much as the bombing has been heavy for a couple of weeks now. Demand ideas are under pressure from ideas and reports of big competition for sales.

The threat for additional bombings of freighters by either Russia or Ukraine kept futures supported to some extent. World prices were weaker last week due to reports of strong production in exporter countries and mostly the countries in the global south. Production has been good in northern hemisphere countries. Southern hemisphere crops appear to be very good. Demand has been weaker for various origins including Russia.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Unavaiable today

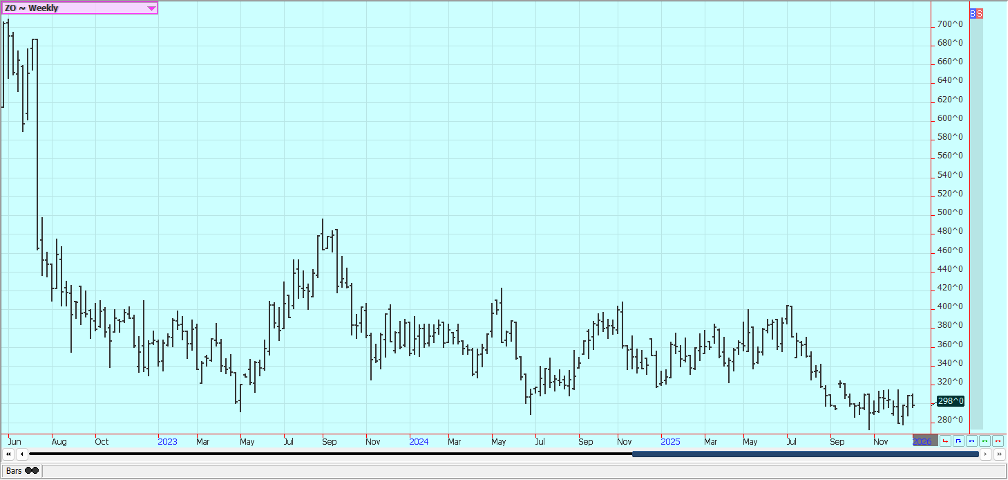

Corn: Corn was lower last week and for the year. The demand for export and for bio energy needs has held strong. Trends are mixed. There have been ideas that traders expect weaker demand news from now on but demand overall has been very strong and above USDA projections until now.

Ideas are that export demand is less now due to increased competition in the world market and ethanol demand is less as well. Reports indicate that many elevators are holding less Corn than expected. Temperatures should average near to above normal next week. Oats were lower.

Weekly Corn Futures

Weekly Oats Futures

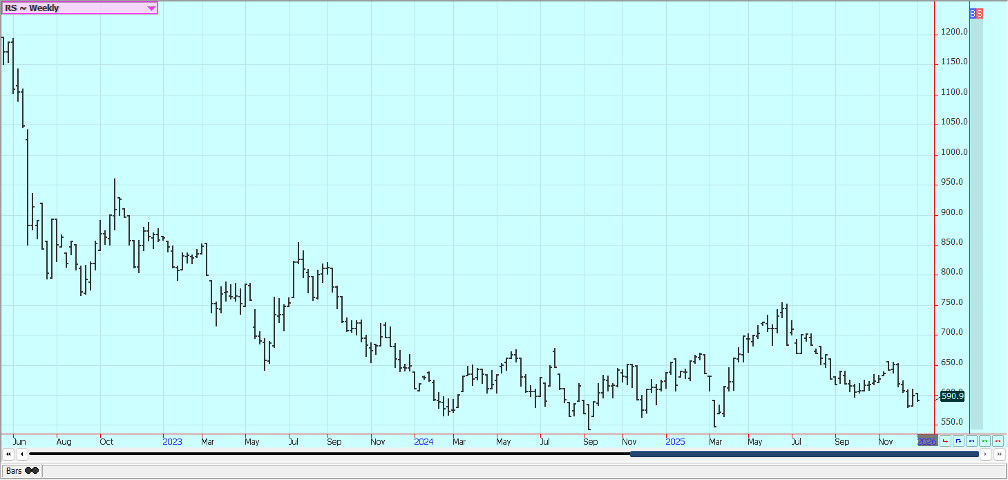

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed lower last week, but Soybean Oil closed a little higher. Soybeans and Soybean Oil were a little higher last year, but Soybean Meal Was a little lower. It seems that the market is now more concerned about big supplies coming soon from South America with the Soybeans harvest there just weeks away.

The Trump administration says that China is on pace to buy the 12 million tons of US Soybeans it announced a few weeks ago by the end of February, and China has already bought a lot to reach that goal. US prices are currently too high to complete many new sales anywhere in the world market except Canada and Mexico. Temperatures will average above normal in the Midwest this week.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice was lower last week and much lower for the year. Ideas are that the market is too cheap and that farmers have sold what they need to for now. The recent selling appears tied to the weaker prices in Asia and especially India. Trends are turning down in the market.

The harvest is over in the delta and Mid South. California is about done with its harvest. Yields and quality are mixed, but quality appears better than a year ago. The cash market has been slow with low bids from buyers in domestic markets and average or less export demand.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil futures were lower last week. There are still ideas of increasing supplies available to the market along with weaker demand. There are still Indonesian plans to increase the use of Palm Oil in biofuels blends.

There are still ideas of increasing production. The market sentiment overall is turning bearish on ideas of increasing stocks to the market and some concerns about demand Canola was a little lower. There are ideas of a big Soybeans harvest coming from South America.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

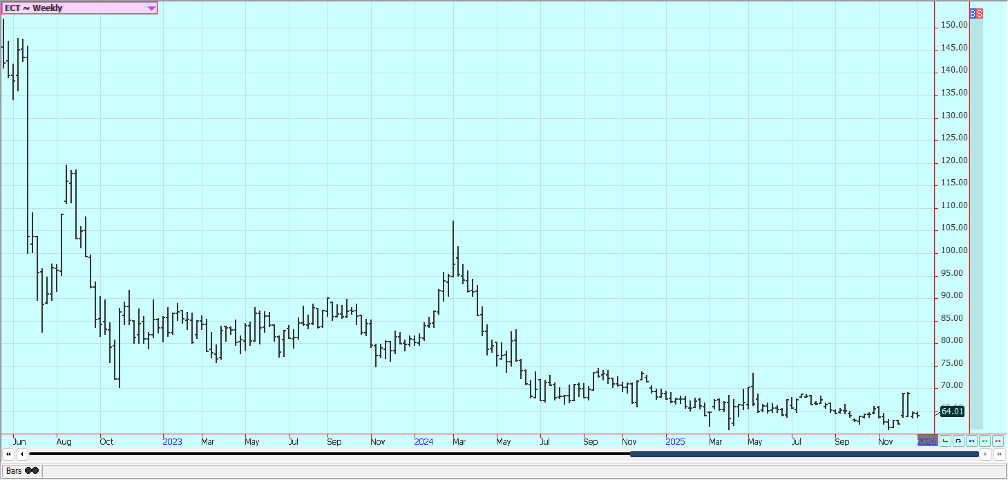

Cotton: Futures were higher on Wednesday. Prices have rallied after cold weather hit the state of Florida and reminded everyone what time of the year it was. Florida has also been dry and irrigation is needed. Traders are worried about demand even with overall lower prices. The weather is considered good for production here and in Brazil and Mexico. Scattered showers are reported in Brazil, but the amounts and coverage has been less than normal.

Weekly US Cotton Futures

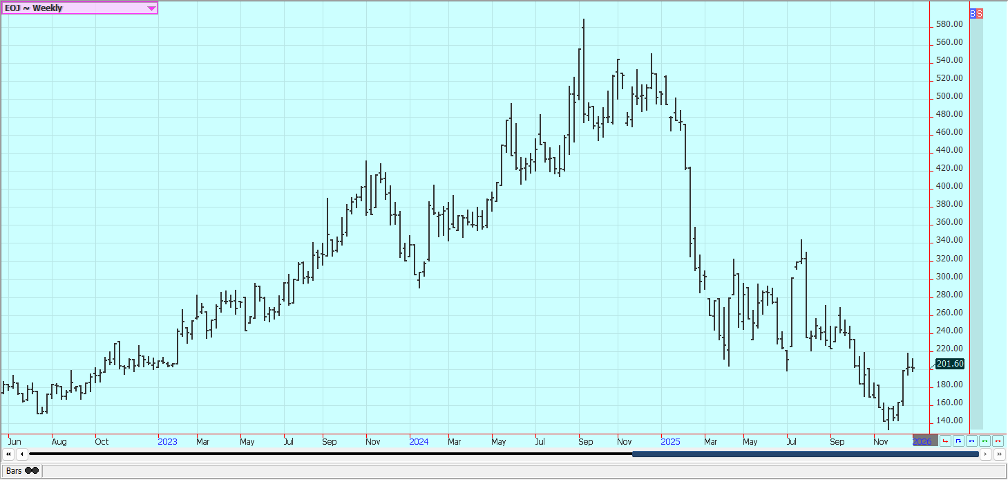

Frozen Concentrated Orange Juice and Citrus: Futures were higher last week but lower for the year. Prices have rallied after cold weather hit the state of Florida and reminded everyone what time of the year it was. There is no freeze in the forecast, but areas north of the state have been very cold. Florida has also been dry and irrigation is needed. Traders are worried about demand even with overall lower prices. The weather is considered good for production here and in Brazil and Mexico. Scattered showers are reported in Brazil, but the amounts and coverage has been less than normal.

Weekly FCOJ Futures

Coffee: New York was lower and London was higher last week, and trends are mixed in New York on the daily charts and are now mixed on the daily report in London. The charts do suggest that a move higher is coming. There are still ideas and reports of increasing harvest sales from Vietnam.

There are reports of very good conditions in Brazil that has caused some farm selling in recent days, but most are holding for better prices. Scattered showers are being reported now to improve tree condition in Brazil. Mexico is in good condition, as is Central America. Vietnam has scattered showers lately and conditions there are called good. Vietnamese producers are selling but only in small amounts.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

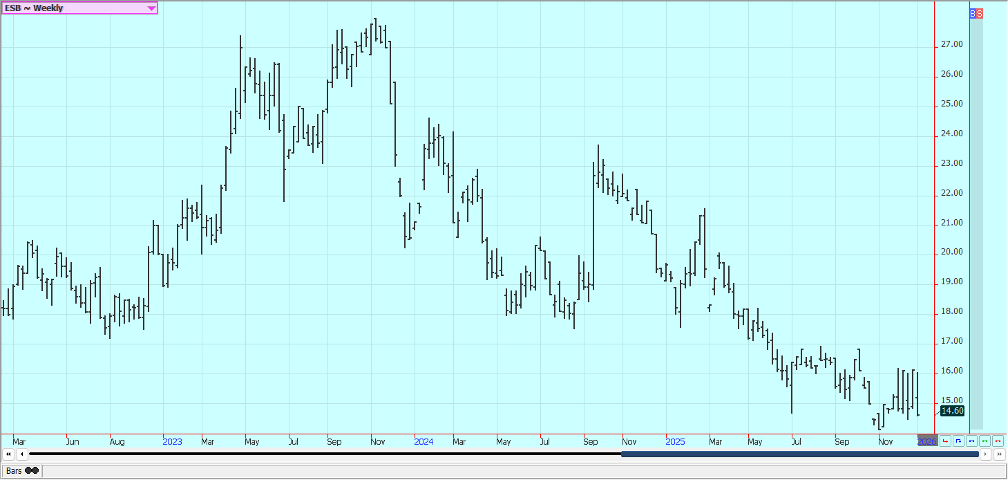

Sugar: New York and London were lower last week. New York continues to trade violently between 15a00 and 1600 March and London has maintained trading range in the weekly charts. There are still ideas of good supplies for the market from good growing conditions for cane and beets around the world continue.

The prospect of a big global surplus in the 2025/26 season was keeping the market on the defensive with a rise in production in India and Thailand set to increase supplies while global consumption is expected to remain steady.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed almost unchanged last week. Short term trends are mixed. A big main cocoa crop harvest is anticipated in West Africa and rains have been positive for cocoa crops lately. Light rains mixed with heat in Ivory Coast’s cocoa-growing regions last week signaled a positive outlook for the main crop.

There are still reports of increased cocoa production potential in other countries outside of West Africa, including Asia and Central America. The market feels that there is less cocoa demand and the lack of demand is expected to continue.

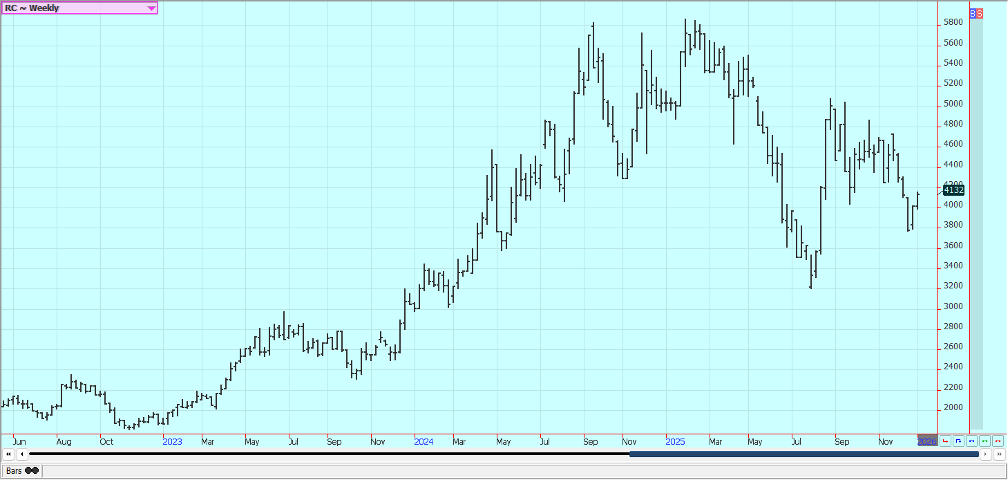

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Felicitas Fragueiro via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis3 days ago

Cannabis3 days agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks

-

Biotech7 hours ago

Biotech7 hours agoAI and Real-World Data Boost Oncology Clinical Research

-

Africa1 week ago

Africa1 week agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances