Markets

Cocoa Prices Drop Amid Speculative Selling and West African Supply Concerns

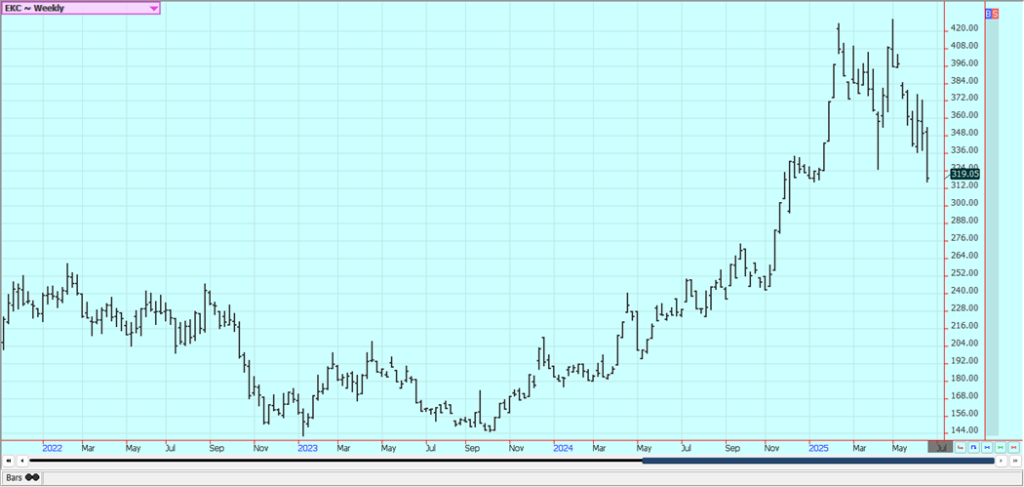

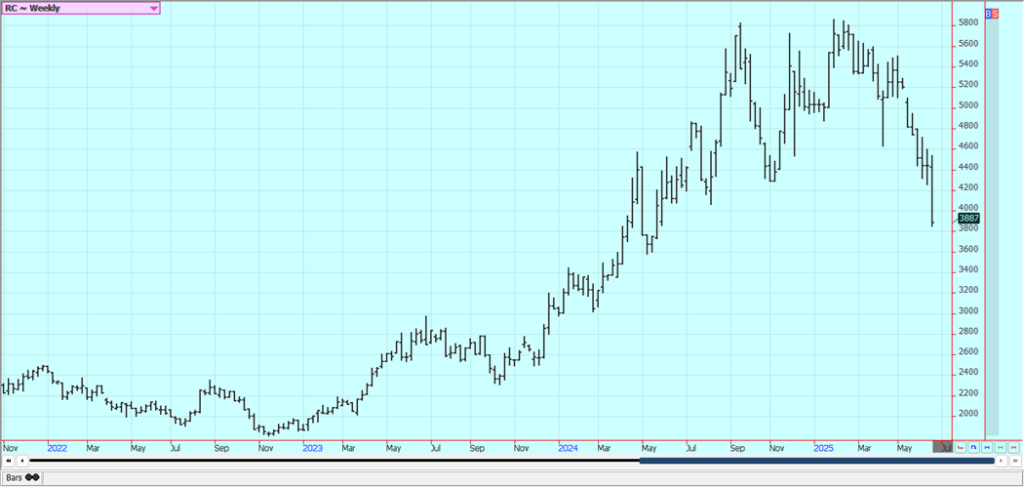

Cocoa markets fell sharply Friday and ended the week lower due to speculative selling. While Asia and Central America show increased production potential, Ivory Coast and Ghana face dry weather and weak pod counts, limiting output recovery. Despite strong demand, trends are down in London and New York. Ivory Coast arrivals hit 1.54 million tons.

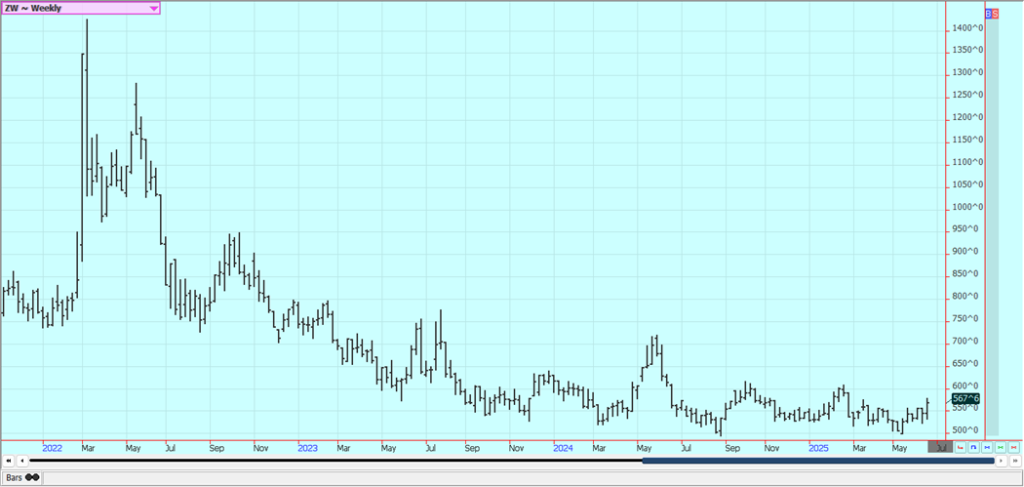

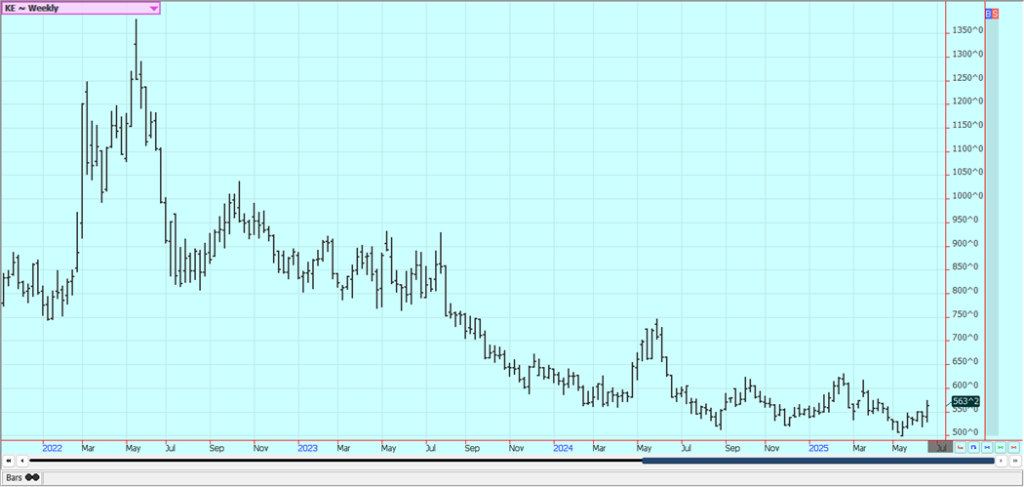

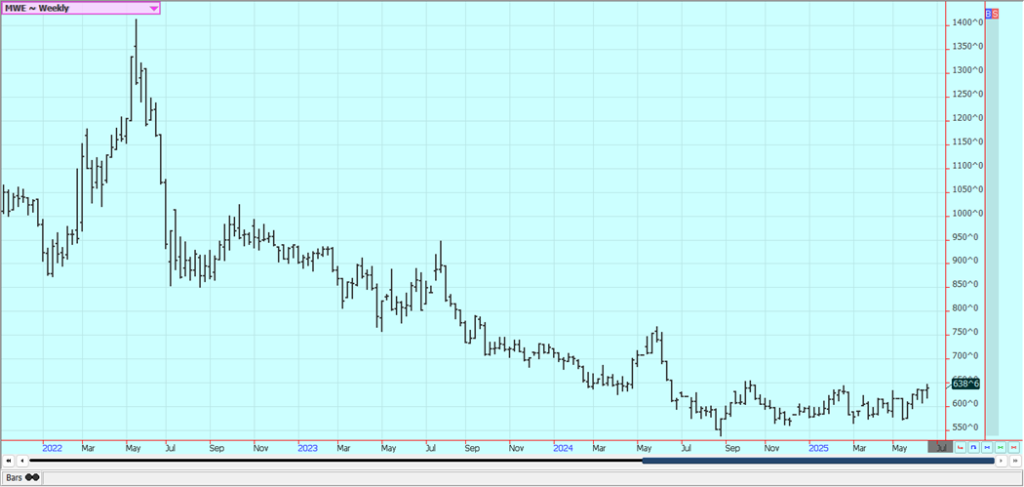

Wheat: All three Wheat markets closed higher last week as growing and harvesting conditions at home and abroad have improved. Winter Wheat markets were the strongest last week, but Minneapolis had been the stronger market for the previous few weeks. There are still reports that the weather has reduced production potential in Ukraine and Russia and reports of recent dry weather in some parts of the EU and China was a concern, but there has been rains in these areas recently.

Russia is forecasting a large reduction in Wheat production for the coming year. Winter crops in the Great Plains are reported to be in good condition, but Spring Wheat crops in the northern Great Plains and into Canada had been dry. Conditions in the US are now generally good.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

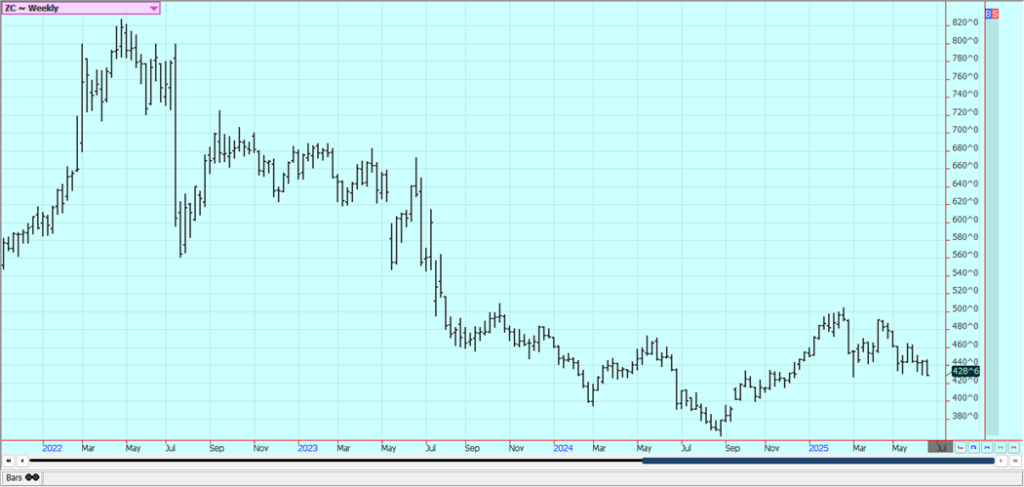

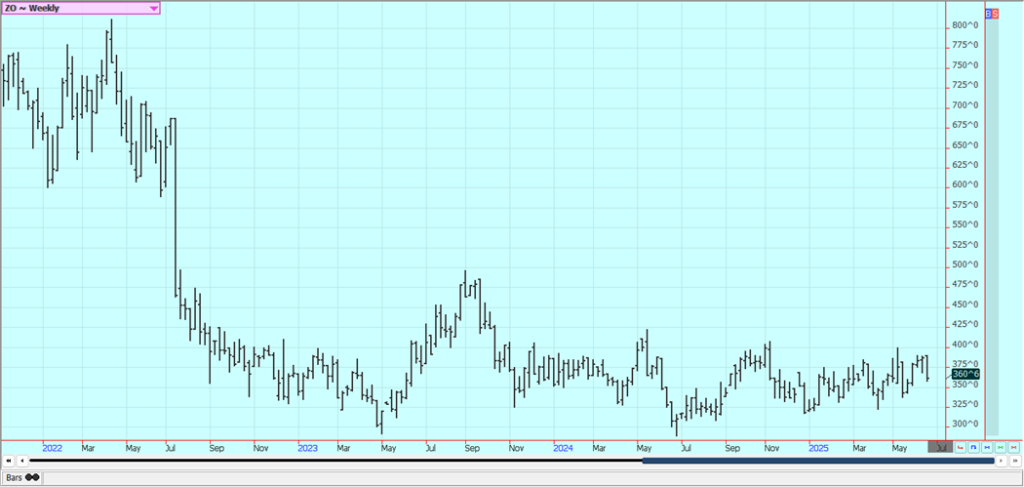

Corn: Corn was lower last week with July the weakest month as forecasts turned hot and dry for at least a few days in the Midwest. Warmer and drier weather is in the forecast into this week after a hot and dry weekend. Warm weather returns in the forecasts for next week. A severe drought is seen in central Nebraska and moderate drought extends east in a corridor into the Chicago area. The rest of the Midwest has seen adequate or greater precipitation. Demand for Corn in world markets remains strong. Oats were lower.

Weekly Corn Futures

Weekly Oats Futures

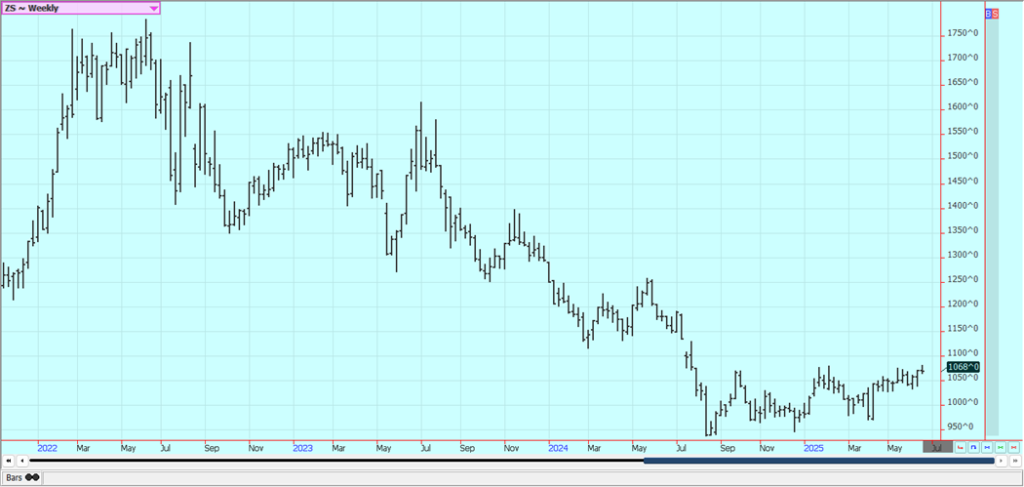

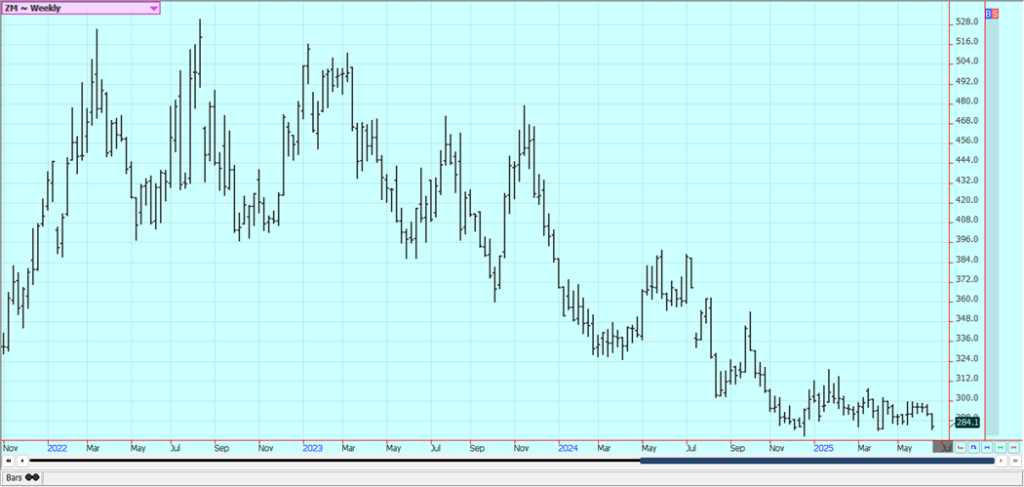

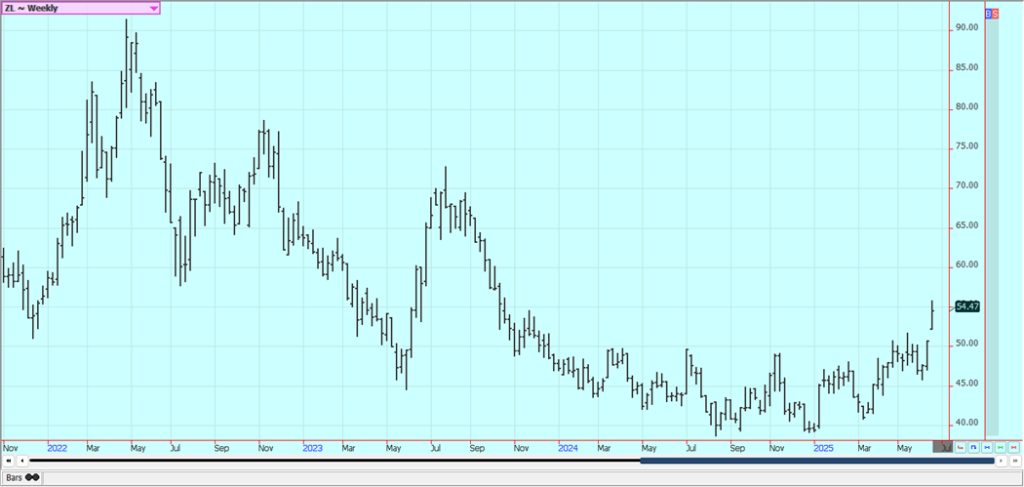

Soybeans and Soybean Meal: Soybeans were slightly lower last week, and Soybean Meal was lower while Soybean Oil closed sharply higher. Forecasts for good growing conditions in the Midwest and as cheaper prices reported from Brazil are still being heard, but the Midwest has turned hot for the next few days or longer.

The market could remain under pressure as Brazil basis levels have been under pressure the last few weeks and prices in world markets for Brazil Soybeans are now less than those from the US. Export demand is in its seasonal doldrums. Export demand remains less for US Soybeans as China has been taking almost all the export from South America. Soybean Oil was the upside leader on the news of increased biofuels requirements coming soon to the US petroleum industry.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

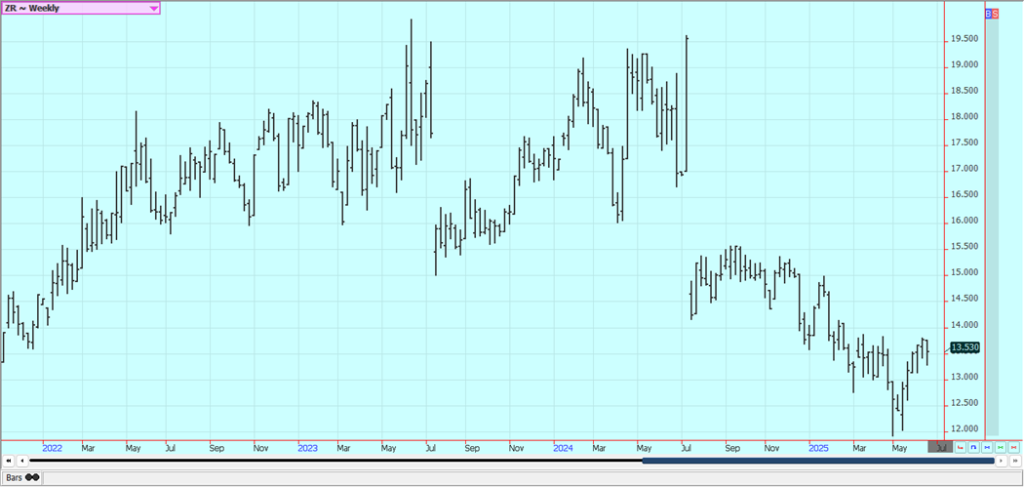

Rice: Rice was lower last week but recovered from the lowest levels over the second half of the week. Chart trends are mixed on the daily charts. The cash market has been slow with mostly quiet domestic markets and average export demand. Milling quality of the Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters. Rice has emerged in most growing areas now. Condition has been rated as good but too much rain has been reported in southern areas.

Weekly Chicago Rice Futures

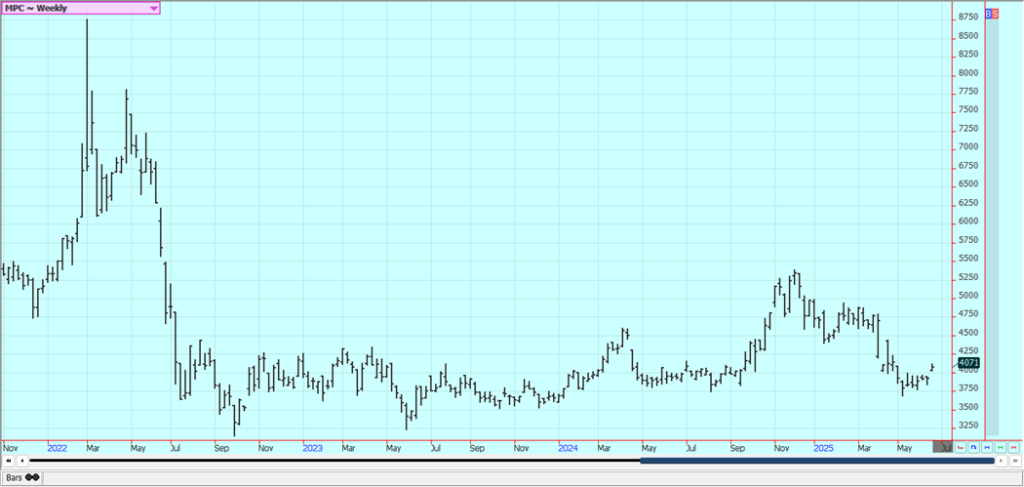

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week on news of improved export demand. Ideas that current increased production levels mean higher inventories in MPOB monthly data are still around. Ideas of increasing production and reduced demand are also heard. Canola was lower on speculative selling tied tzo profit taking. Trends are up on the daily charts and are turning up on the weekly charts. The weather has generally been dry for planting and crop development in the Prairies with warm and dry weather around lately.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little lower last week. There are still reports of better weather for planting in Texas and on demand concerns caused by the tariff wars and after USDA reported moderate to poor weekly export sales. Planting conditions remain good in Texas, but it is still too wet in the Delta and Southeast. Planting progress is still a little behind the five year average and condition is rated behind last year. The monsoon in India is off to a good start and a good production there is possible.

Weekly US Cotton Futures

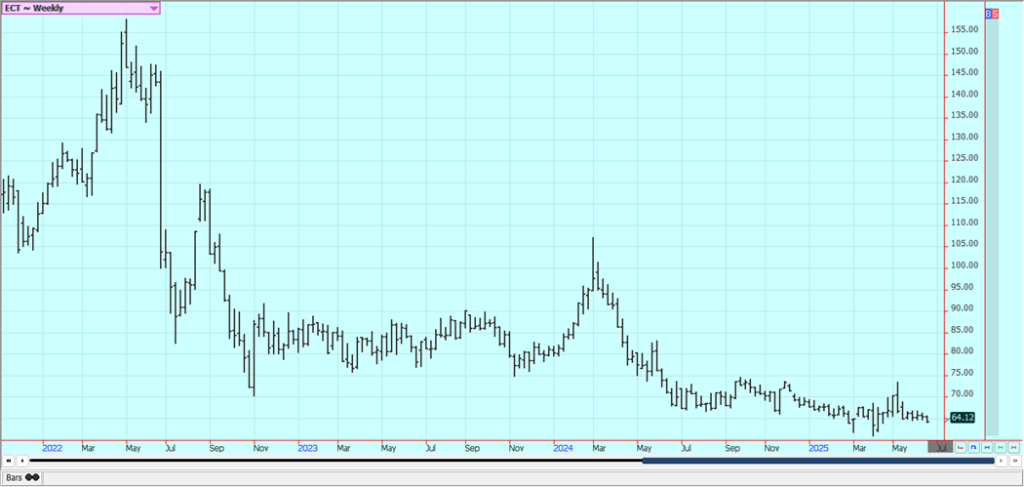

Frozen Concentrated Orange Juice and Citrus: Futures were lower on Friday and for the week and trends are down in the market. Development conditions are good in Florida now with daily rounds of showers. Production estimates from USDA remain well below those from a year ago.

USDA estimated Florida production up slightly from the previous estimate at 12.0 million boxes, but that is still down 34% from last year. All US production was also a little higher from the previous report, but still down 37% for the year. The poor production potential for the crops comes from weather but also the greening disease that has caused many Florida producers to lose trees.

Weekly FCOJ Futures

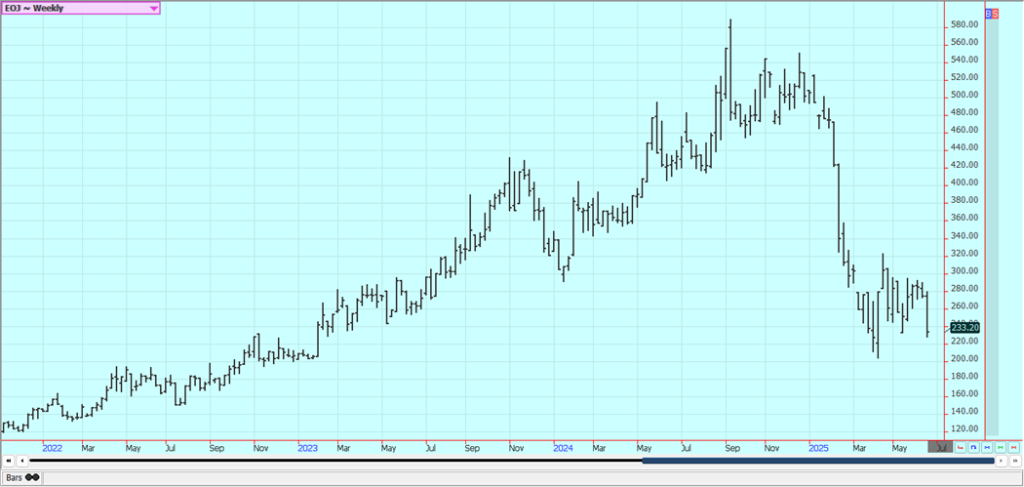

Coffee: New York and London closed lower on Friday and for the week as the market feels supplies are increasing, particularly the Robusta availability in Brazil. London moved to new lows for the move. Prices have now been dropping for several weeks and are much more moderate than before as supplies available to the market have ticked up.

The Brazil Robusta harvest continues, and Indonesia continues to harvest. Vietnam is done with its harvest. The Brazil Arabica harvest is starting and is expected to be less this year. Cooxupe said on Wednesday that its farmers had harvested 17.8% of the expected 2025 crop as of June 13, from 26.6% last year.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

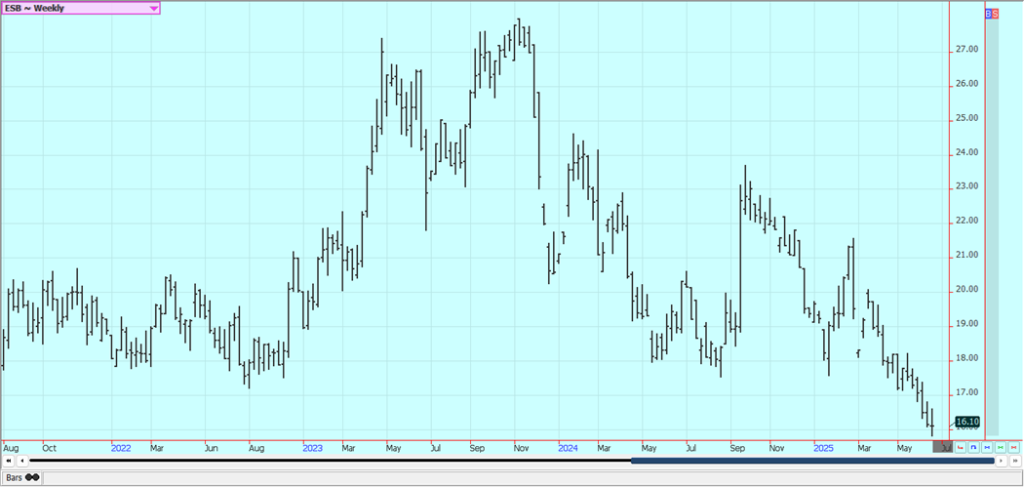

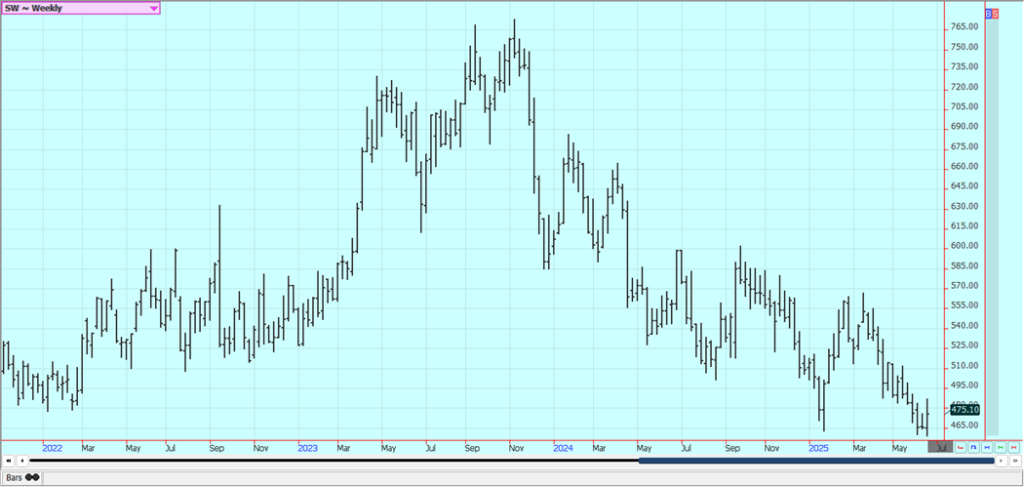

Sugar: New York closed lower for the week and at new weekly lows for the move. London closed higher for the week. Ideas of good supplies for the market continue. The South Center Brazil harvest is faster now amid drier conditions. Production in Centre-South Brazil has also been stronger than expected in recent weeks.

Good growing conditions are reported in India and Thailand after a fast start to the Monsoon season. The Monsoon has featured above average rains. Sugar prices in Brazil are now cheap enough that at least some refiners could increase ethanol production and cut back on Sugar production. These ideas have helped support Sugar futures.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

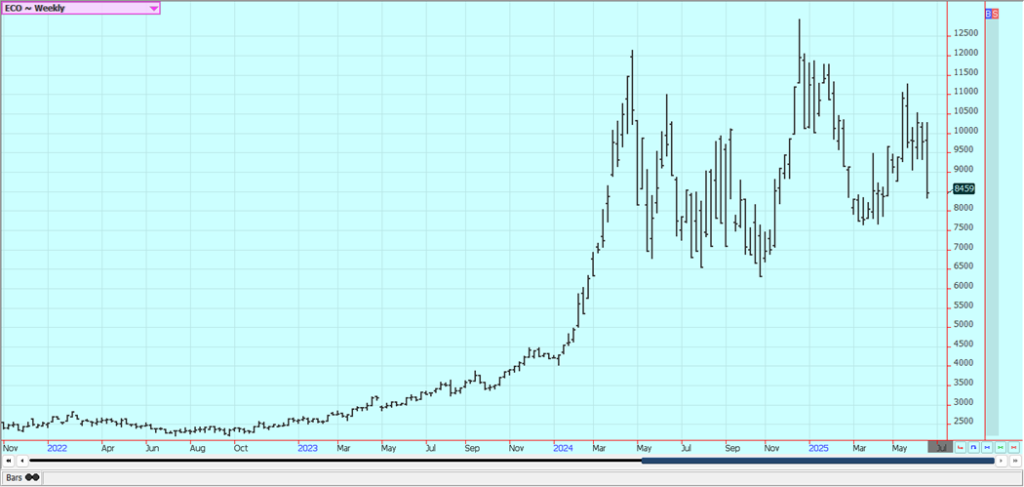

Cocoa: Both cocoa markets were sharply lower on Friday and lower for the week on speculative cocoa selling. There are still reports of increased cocoa production potential in other countries outside of West Africa, including Asia and Central America.

The market anticipates good cocoa demand and less cocoa production from Ivory Coast and Ghana. Pod counts for the mid crop suggested there is unlikely to be a significant recovery in cocoa production this season, and current weather is dry for the crops for the coming cocoa crop. Trends are down again in London and in New York. Cocoa arrivals at ports in Ivory Coast reached 1.540 million tons in May.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Etty Fidele via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Africa1 week ago

Africa1 week agoMorocco’s Tax Reforms Show Tangible Results

-

Africa2 weeks ago

Africa2 weeks agoTunisia Holds Interest Rate as Inflation Eases, Debate Grows

-

Biotech2 days ago

Biotech2 days agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.