Markets

Cocoa Prices Soar Amid Rain Woes in West Africa and Rising Port Arrivals

Cocoa prices hit new highs as chart trends remain bullish. Excessive rains in Ghana and Ivory Coast hinder harvests, raising fears of pod disease. While overall West African production may improve, Ivory Coast reduced contract offers by 40% due to rain concerns. Port arrivals reached 549,000 tons, up from 417,000 tons last year.

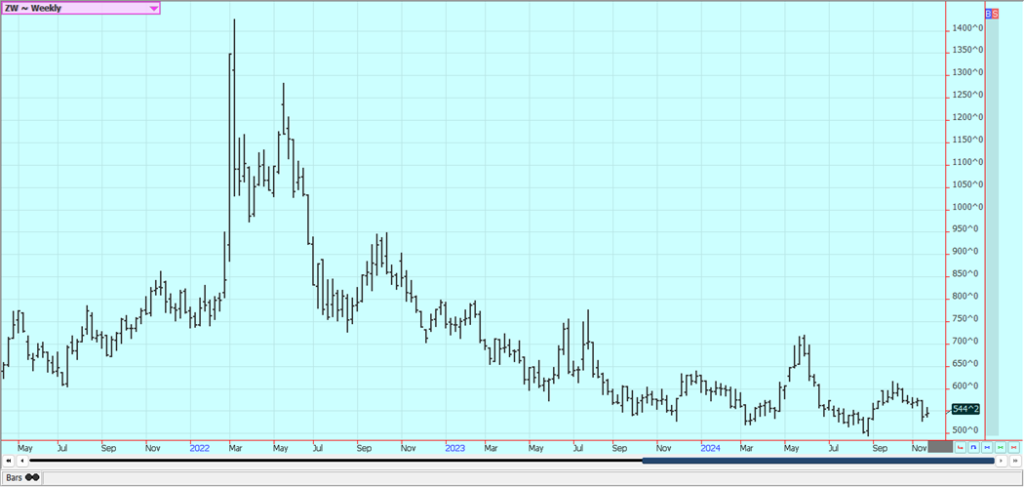

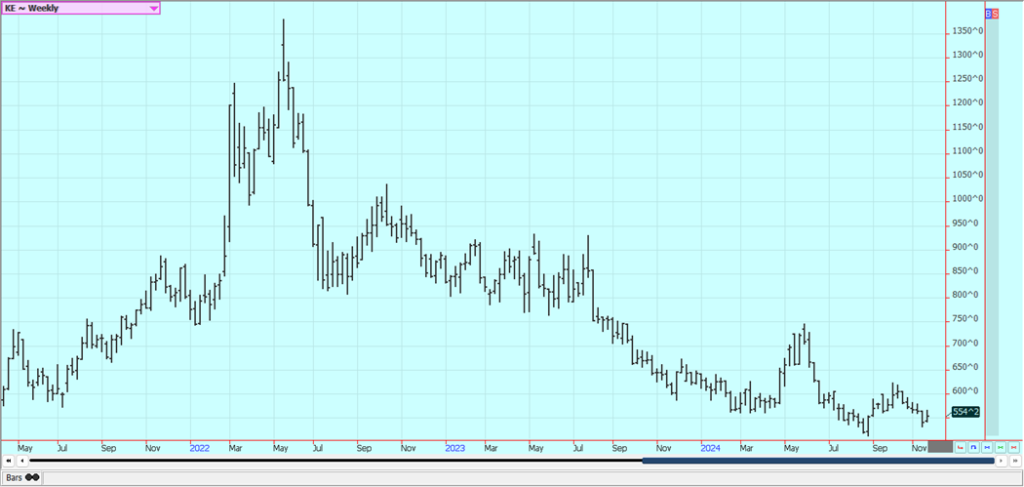

Wheat: The markets were higher last week as tensions remined high between Ukraine, the US, and Russia once again. The threat of war expanded with the US allowing longer range missiles to be used and as Russia is deploying North Korean soldiers alongside its own in battles. Russia also updated its nuclear use doctrine to include threats against it from the deployment of US missiles against Russian interests and shot seven ICBM missiles into Ukraine late last week.

There were reports of stable price last week in Russia and the growing conditions in the US are very good. Reports of very beneficial rains for the Great Plains and Midwest and reports of weaker offers in Russia were negative for prices. The rains are falling and will allow Wheat farmers in the US to plant the Winter crops under good conditions.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed a little higher last week and seems comfortable trading near to 430 December area as the US harvest wraps up and as demand remains strong. The export demand in recent weeks has been very strong and it seems like some of the buying is in anticipation of the new presidential regime starting here in January. President Trump ha promised new tariffs on goods and services and some buyers may be making purchases now to avoid the potential for the tariff at a later date. There were no sales announcements in the daily reports from USDA last week.

Oats were mixed to higher. The Corn harvest is almost over and yield reports in general have been strong. It has been very dry in the Midwest to promote the very active harvest progress but it has turned wet in the last couple of weeks. The harvest will be complete once the rain moves out. Corn is being harvested with dry grain. The Corn is often well below 12% moisture level and this could cost some yield at the end of the day. Crop conditions in southern Brazil and Argentina with reports of ample moisture in southern Brazil and report of improving moisture levels in Argentina.

Weekly Corn Futures

Weekly Oats Futures

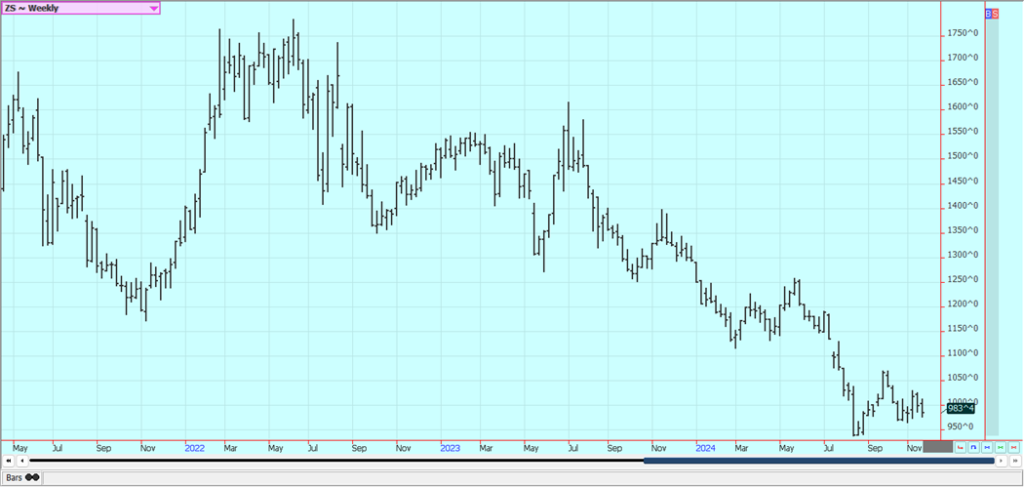

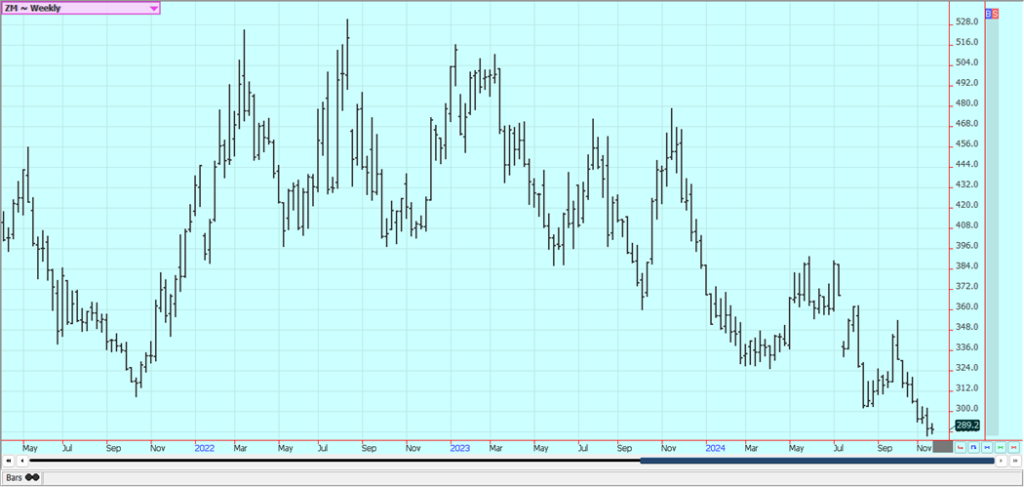

Soybeans and Soybean Meal: Soybeans and the products were lower last week on ideas of big south American production potential of Soybeans and Trump plans to curb the use of bio fuels order to promote more use of petroleum. The tariffs that Trump plans to impose could be another detriment to sales of all products. Brazil looks to produce much more than a year ago and some estimates range as high as 170 million tons for the country.

Brazilian farmers are planting what is expected to be a very big crop in central and northern areas of the country. Warm and dry weather in the Midwest recently has hurt US production ideas due to ideas of small and very dry beans in the pods. Farmers have focused on Soybeans harvest but now are almost done and are almost done with Corn as well. It is currently raining in the Midwest so the last of the harvest will be delayed by at least a few days.

Soybeans ae often harvested at moisture levels below 10% this year. Central and northern Brazil rains will continue as it looks like the rainy season is now underway. Soils are in much better shape in southern Brazil and Argentina.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

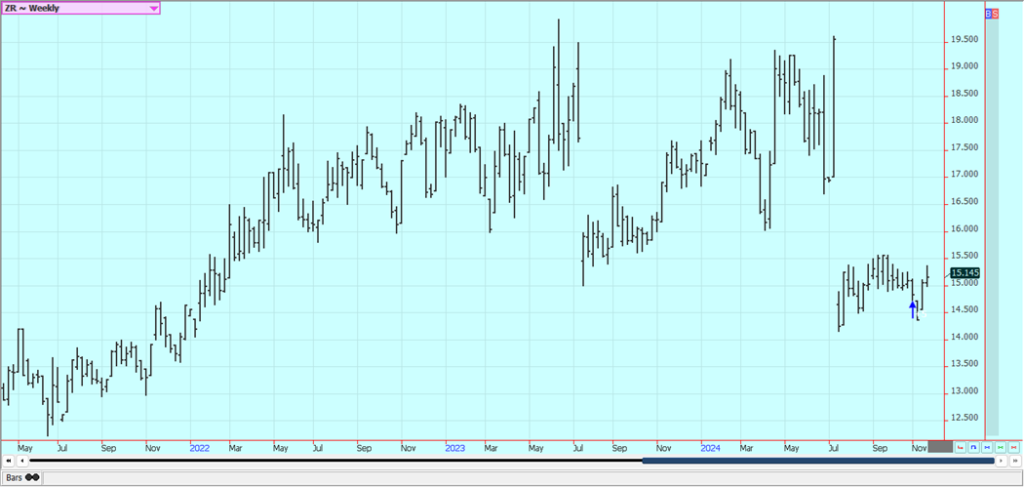

Rice: Rice closed a little higher last week and the trends are still up on the charts. However, current prices seem to be in a good spot right now with supply and demand seen about even at this time. Lower Asian prices are still reported. Brazil prices remain strong and well above US prices. The harvest is over now and the crops are being stored. Increased producer selling interest is likely at this time as futures have rallied.

Weekly Chicago Rice Futures

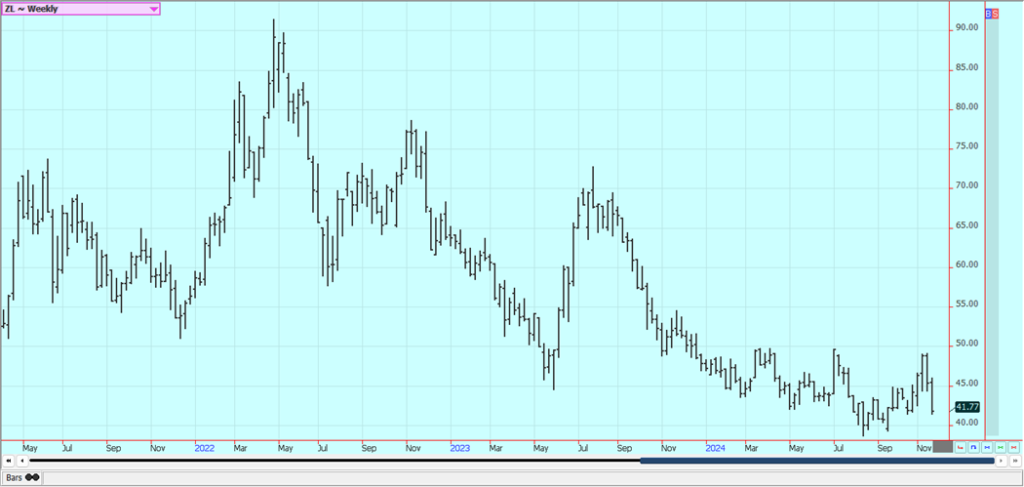

Palm Oil and Vegetable Oils: Palm Oil was lower today in response to weaker demand ideas. Demand from China has not been good. Ideas of weaker production caused by too much rain and reports of good demand provided support. The private surveyors have indicated that exports have been weaker so far this month. Canola was lower along with Soybean Oil. The harvest is winding down in Canada and the crops are locked away in the bin. Producers will try to wait for higher prices before selling much.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was higher last week and the trends are now mixed in this market. Support came from a very strong weekly export sales report as some buyers look to cover positions before the tariffs that President Trump is expected to impose. China has big problems with its domestic economy with consumer buying interest not strong and many people not working. There are still reports of weaker demand potential against an outlook for improved but still rather low US production in the coming year.

Weekly US Cotton Futures

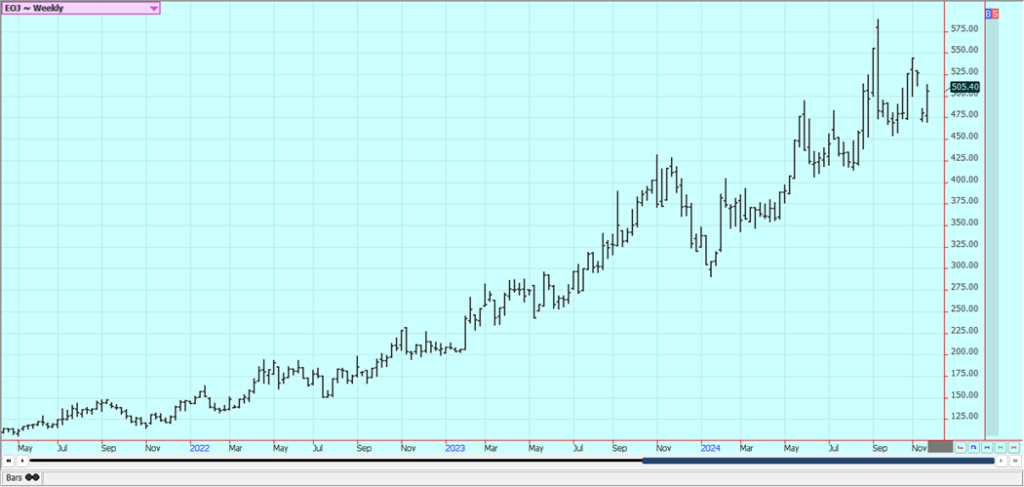

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week and filled a large chart gap on the weekly charts left by the roll from November to January as the top step month. The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease and some extreme weather seen in the last couple of years. There are no weather concerns to speak of for Brazil right now.

Weekly FCOJ Futures

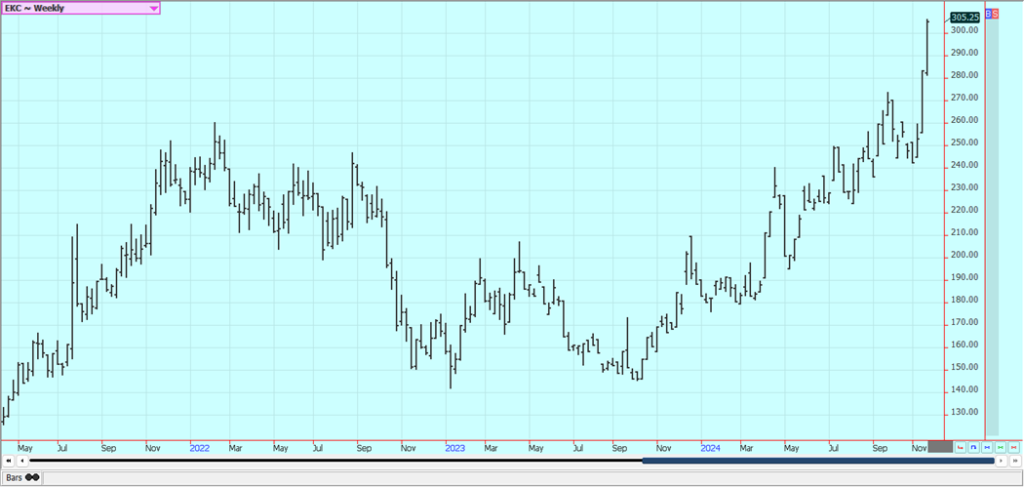

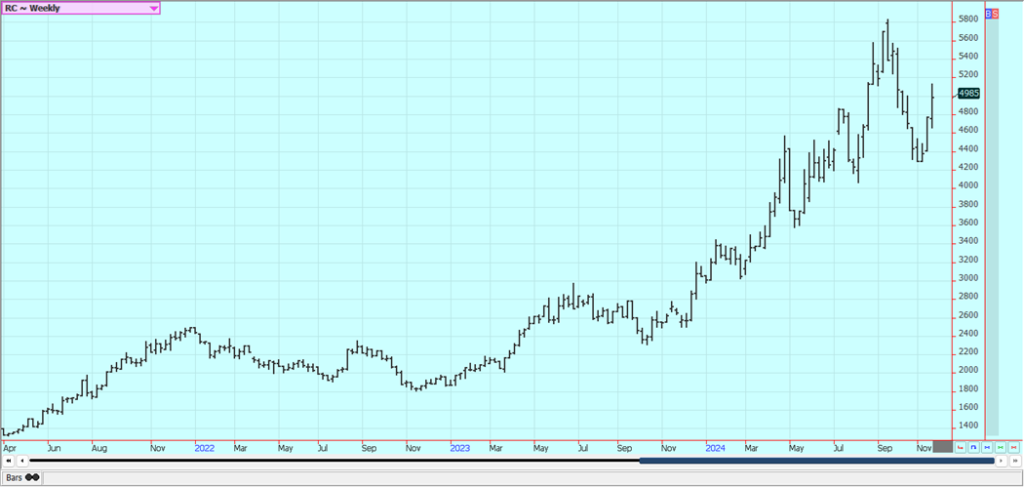

Coffee: New York and London closed sharply higher last week and made new multi year highs. Reports of reduced offers from Brazil and Vietnam on weather induced short crops continue. Tere are reports from Brazil that producers have already sold a lot of Coffee and are holding back on selling more even with good demand. The chart trends are still up in both markets.

The harvest in Vietnam is active, but selling has been slow. Rain remains in the forecast for Brazil crop areas. There are now reports for good rains in Brazil as the rainy season is now under way after very dry conditions.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

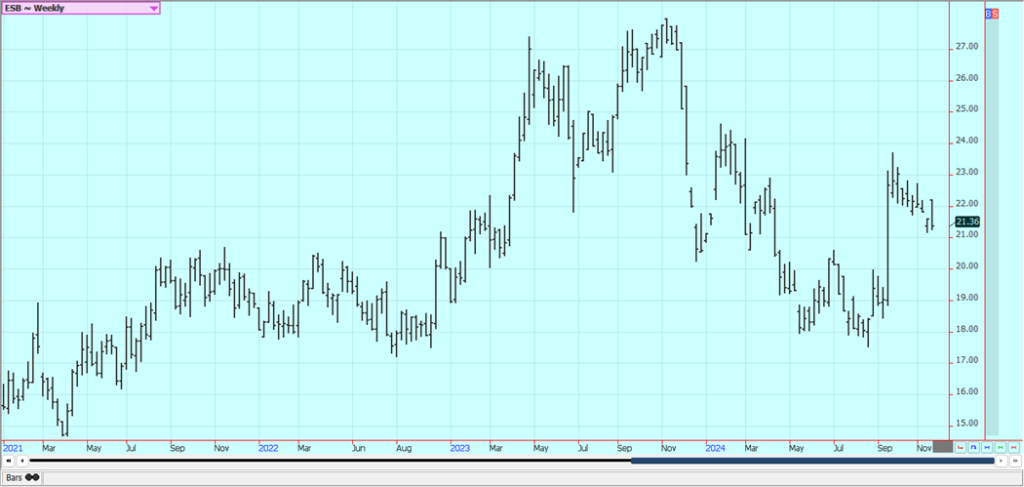

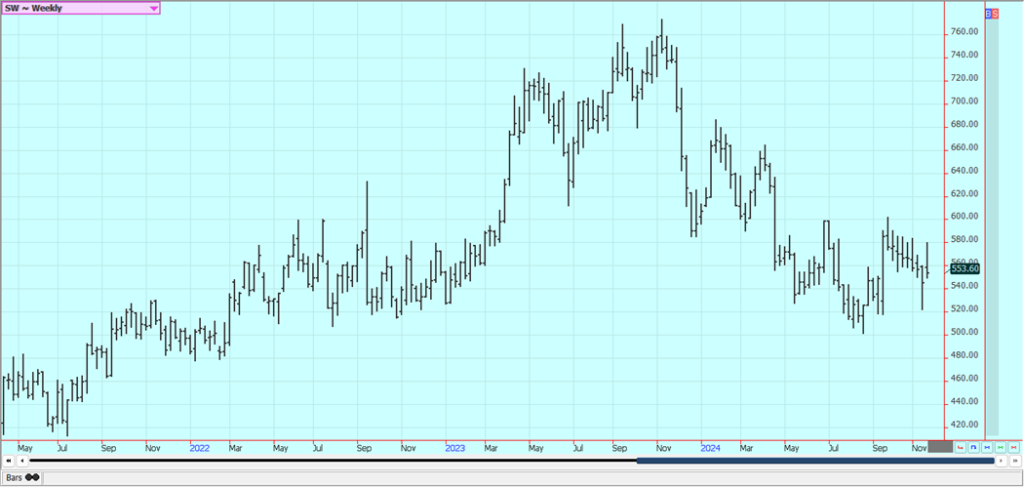

Sugar: New York closed slightly lower and London was a little higher last week. The current Brazil rains have kept the harvest and crushing pace down but could provide a boost to production for next year.

Trends are mixed to down in both markets on the daily charts but mixed on the weekly charts. Indian and Thai mills are expecting strong crops of cane. It is also wet in Brazil, and this has affected harvest progress. Supplies available to the market could be less in the next six months. Total Brazil production has been affected by drought seen earlier in the year and the fires that destroyed crops in some areas.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

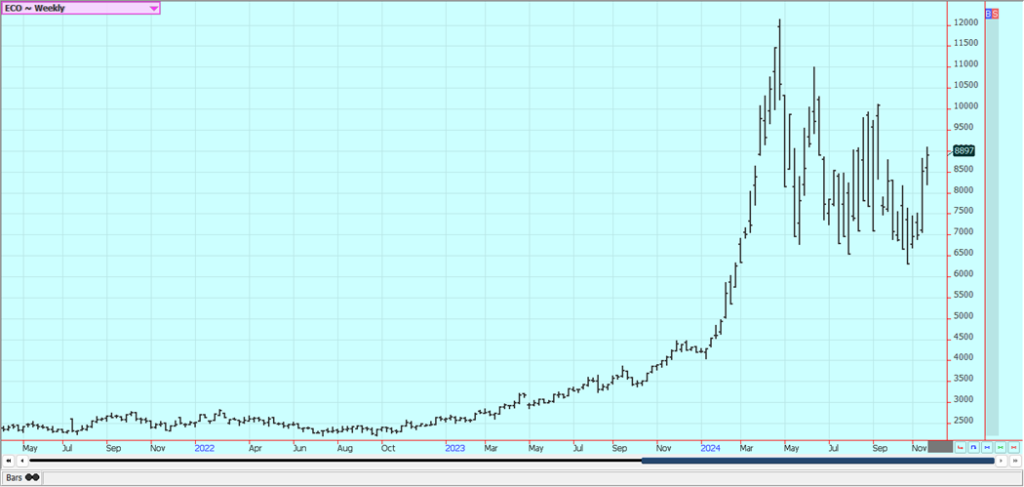

Cocoa: Both cocoa markets closed higher and at new highs for the move last week. Chart trends are up in both cocoa markets on the daily and weekly charts. Cocoa producers in Ghana and in Ivory Coast have been fighting against too much rain that has made it hard to harvest and deliver crops. It has been very wet in West Africa lately and this is bringing concerns that pod disease could develop.

Cocoa production in West Africa could be stronger this year on the overall improved weather in Ivory Coast and Ghana. The Ivory Coast government has now reduced contract offers by about 40% on worries about less cocoa production due to too much rain. Ivory Coast port arrivals now total 549,000 tons, from 417,000 cocoa tons last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Etty Fidele via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Africa6 days ago

Africa6 days agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

-

Crypto2 weeks ago

Crypto2 weeks agoBrazil’s Crypto Boom Threatened by Surprise Tax Proposal

-

Biotech13 hours ago

Biotech13 hours agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Markets1 week ago

Markets1 week agoCocoa Prices Drop Amid Speculative Selling and West African Supply Concerns