Business

Coffee markets close higher, India continues to reject sugar import

It looks like India is determined not to import sugar this year even though domestic production is short and internal prices are very high.

Weekly agriculture news: Corn demand remains a key to the overall price strength, coffee markets close higher and India continues to reject sugar import.

Wheat

US markets were higher and closed the week on a strong note. Chicago SRW futures could complete a test of the lows and indicate a new up trend is underway if some follow through buying is seen this week. It was a strong week for prices and one dictated as much by ideas of better demand potential as with ideas of less production. The weekly USDA export sales report was not real strong last week, but the move lower in the US Dollar after the FED interest rate announcement brought hopes that a weaker US currency could increase demand in the world market. The US did sell to Algeria last week. The central and southern US Great Plains remains in drought, and some production in the Texas and Oklahoma panhandles, as well as western parts of Kansas and parts of Colorado, are being impacted. The potential for yield loss comes on top of sharply reduced planted area in the region, so the chance for a very short crop is increasing. That would mean bigger reductions in ending stocks estimates even if the overall stocks levels remain adequate to surplus. Even so, trends to reduced stocks levels almost never mean lower prices in futures. World stocks levels remain high according to USDA’s most recent supply and demand estimates. The weekly charts show that futures are on the cusp of starting a new leg higher. Moving higher now would indicate a potential for a move to and perhaps well above $5.00 per bushel basis the nearest Chicago SRW futures contract. Minneapolis is also near breakout levels that could imply a move back to the highs just under $6.00 per bushel for 2017, and also display the chance to move to new highs for the calendar year. Chicago HRW charts show that the market is still working on a potential bull flag formation.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

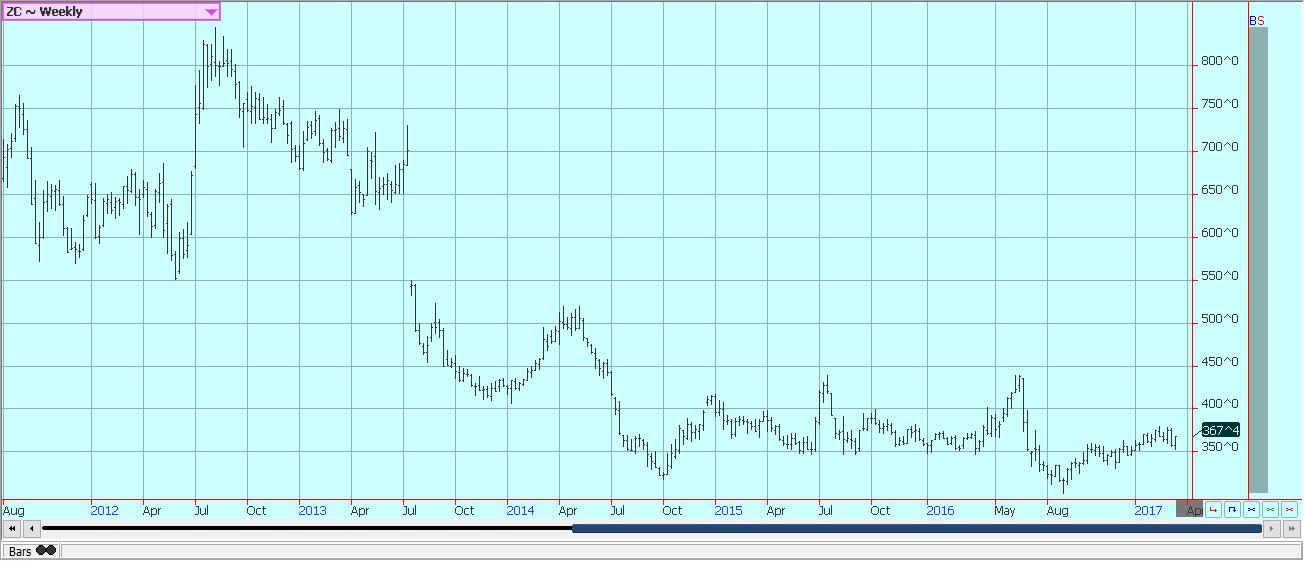

Corn was higher for the week. The weekly charts show that futures prices tested areas not seen since last Fall and then bounced. Prices are not currently in an uptrend but might have rejected further moves lower. The demand remains a key to the overall price strength. Export demand was excellent on the weekly USDA reports once again last week with over 1.2 million tons sold for the current marketing year. Some demand was reported from China as a few cargos of Corn were sold to the country. China is working hard to limit Corn imports as it works to reduce the amount of Corn held in government storage. Ideas are that this Corn is of bad quality and limited use, and must be blended with better quality Corn in many cases. Demand for Corn imports could remain stronger if this is true, so traders are watching now for new demand reports. Demand for ethanol production remains strong as well. The major weakness in demand for the marketing year has been from the feed side of the market, and the trade will have new indications on the size of the demand from this sector when the quarterly stocks reports are released at the end of the month. Planting has been reported in areas near the Gulf Coast, and fieldwork remains active in areas to the south of interstate 80. Temperatures turned cold last week and shut down a lot of the work, but more moderate temperatures are expected this week. It remains very early in the new crop year, but producers in many areas have been able to get a lot of the preparation done. Forecast indications for the next three months are for generally warmer than normal temperatures and no tendency for precipitation above or below normal for the next three months.

Weekly Corn Futures

Weekly Oats Futures © Jack Scoville

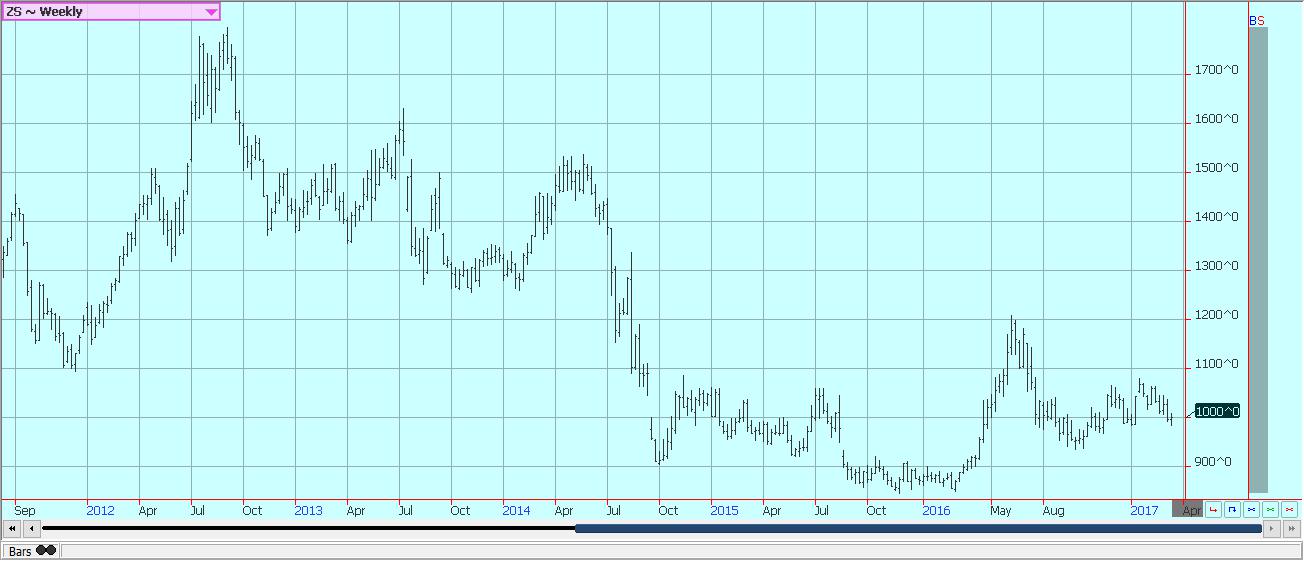

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week as the potential for sales in the world market from South America increased. There are also concerns about world demand in the wake of reports of Bird Flu in China. Crush margins in China turned negative last week, so processors importing Soybeans are now losing money on the sales of Soybean Meal and Soybean Oil. The Soy Complex could be set for some tough days ahead as these fundamentals manifest themselves. The weekly charts show that futures are near some important support areas. These areas held last week, but price action was not convincing that a low had been found and the weekly trading range was narrow. Big crops are still coming from South America as the Brazil harvest is now over halfway complete and as Argentina is about to get started. Production ideas are very high with many in the trade anticipating production up to 109 million tons in Brazil and above 55 million in Argentina. However, the selling from Brazil has not been as strong as anticipated due to currency issues. The Real remains above 32 cents and is about as strong as it has been in recent months. Producers are selling, but in reduced volumes, as they wait for the Real to move lower. They might be waiting for a whole as the US Dollar moved lower in response to the FED interest rate decision last week. Weaker markets overall are still anticipated for the Soy complex due to the potential large offer from South America and the potential for very strong production this Summer here in the US.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Futures closed higher last week and prices are now close to the highs for the calendar year 2017. The US cash market is still reported to be slow, but the trade is awaiting news on negotiations to sell Iraq up to 100,000 tons of US long grain milled Rice. It would be a big shot in the arm for the Rice market if the deal got done. Some paddy Rice continues to move in local cash markets. The most trade appears to be in Louisiana at this time. Farmers, there are planting, and some isolated planting has been reported in Texas. Most of the rest of the US area will not get planted until next month. Lower planted area is still anticipated as more producers look at alternatives such as Cotton or Soybeans. China imported about 244,000 tons of Rice in January, down about 15% from last year. Vietnam, Thailand, and Pakistan were the biggest sellers. Futures trading volumes are still slow, but the market has a different feel now and acts prepared to go higher. The current market still has no real strong fundamental to drive prices higher, but the overall situation appears to be changing and prices in futures markets could start to anticipate a different environment as trading moves into the Spring and Summer. If so, good buying support should be seen on any short term moves lower.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils markets were lower last week on ideas that world production was about to increase. Palm Oil production is likely to increase in the short term as trees start to produce more as they recover from the El Nino drought of last year. There are some anecdotal reports that the production in Malaysia is not recovering at as fast a rate as the market had anticipated. Those ideas supported some buying last week. Demand recovered for Malaysia at the middle of the month after a weak start and now is running slightly ahead of a month ago. Demand for US Soybean Oil in the world market was disappointing as the weekly export sales report showed net cancellations instead of net new sales. South America will soon enter the mix as the Brazil Soybeans harvest is over half complete and Argentina is getting underway. Argentina is the world’s largest seller of Soybean Oil and will be strong competition in the world market. Brazil is also a big seller. The weekly charts for both Palm Oil and Soybean Oil show that prices are holding at some important support areas. These areas could be tested further this week, and penetration of these support areas could indicate that significant price weakness is coming.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

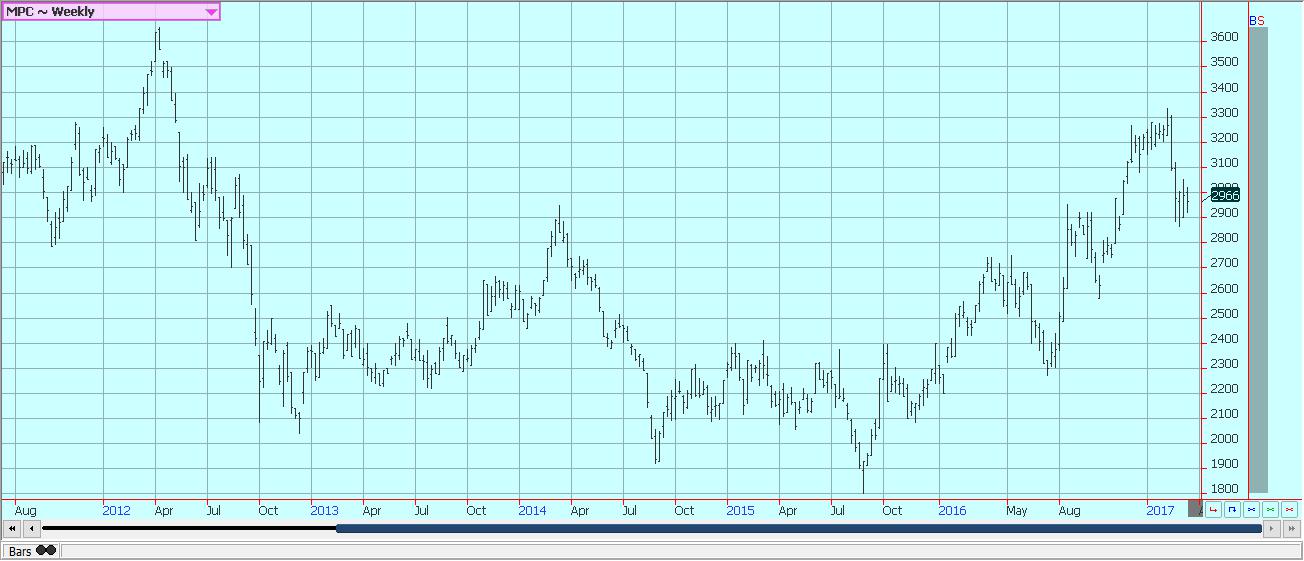

Cotton

Futures closed higher last week as the uptrend reached the one year mark. Futures closed about unchanged for the week. Cotton remains mostly a demand story as US export demand has been stronger than any trade expectations so far this year. USDA has been forced in its recent monthly updates to increase export demand estimates at the expense of ending stocks and might be forced to do the same thing again soon. The demand for US Cotton remains solid despite the fact that the Chinese government is once again offering Cotton into the domestic market. China is selling about 30,000 tons of Cotton per day into the internal market as it reduces its government supplies. These supplies are up to seven years old and Chinese industry will need to keep buying imported Cotton to blend with the old government supplies. Ideas that US buyers have a large amount of Cotton bought remain the other reason for futures to trend higher. These buyers will need to buy futures sooner or later to fix prices. The key time for them to get covered will be near the start of the delivery periods for the May and July Contracts. Prices can hold strong until then, with many now looking for a push to perhaps 8300 May. The US demand should stay strong as the US has a lot to offer and is only starting to see some competition from Australia. US demand from the Middle East and the Far East remains strong and consistent. Farmers in the US are starting to make final planting decisions now and there are widespread ideas that Cotton area will be higher than last year. Cotton is paying much better than Rice and is also paying better and is more reliable to grow in parts of Texas than Sorghum or Corn. Wheat is also cheap compared to Cotton. Planted area ideas range from 11.5 million to 12.0 million acres.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed higher and it looks like a new uptrend has started already on the daily charts and on the weekly charts. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. USDA reduced Florida Oranges production estimates to 67 million boxes in its recent reports, so domestic production remains very low due to the greening disease and drought. Industry data has shown that imports of FCOJ from Brazil have increased to cover some of the lost production. Florida remains very dry. This is great for harvesting, but not good for the development of the next crop. It got cold last week, but not cold enough to damage fruit or flowers. Trees are in bloom in all areas of the state, and petals are starting to drop in some areas as the fruit is starting to form. Good rains are needed for the bloom and initial fruit development. Irrigation is being heavily used to prevent loss. The harvest has been very active. Early and Mid Oranges are moving mostly to processors. The Valencia harvest is moving to processors and into the fresh market.

Weekly FCOJ Futures © Jack Scoville

Coffee

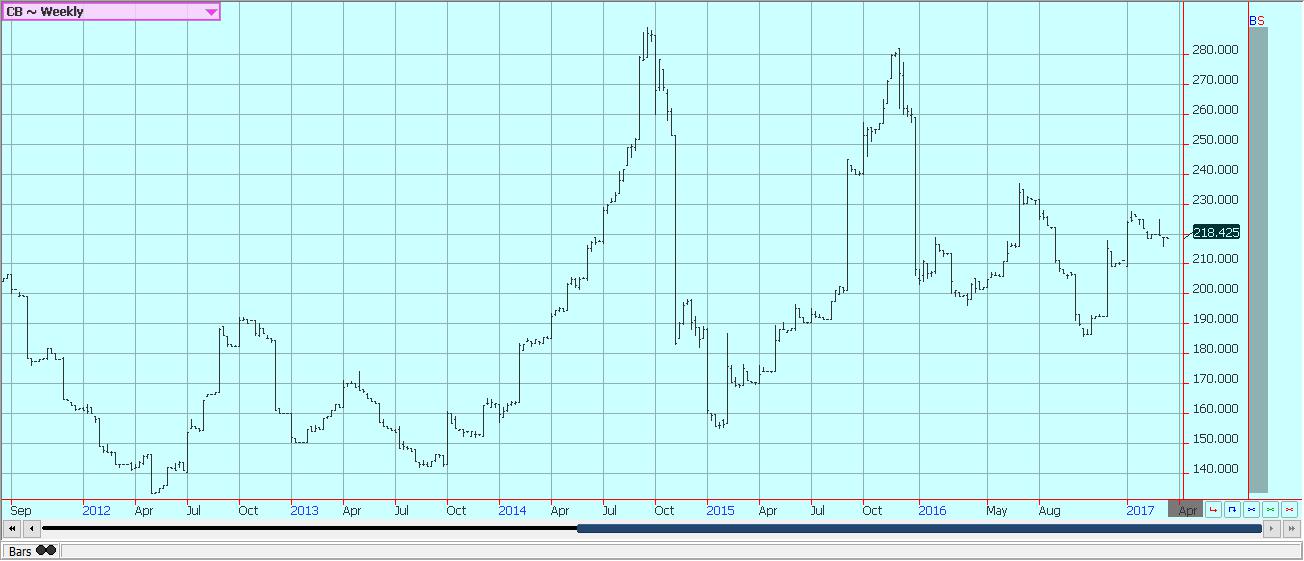

Futures were higher for the week. New York is still trying to move away from support areas on the charts. London is trying to break resistance and renew the uptrend. The ICO said that the 2016 Coffee supply is down 18.7% from 2015, but anticipates a more favorable production in 2017. Global January exports were 9.8 million bags. Marketing year exports are up 8.9% from last year. Arabica exports are 9.7% higher and Robusta exports are 7.4% higher. Brazil will allow imports of 1.0 million tons of Robustas to enter the country to boost internal supplies. Domestic prices remain large and the export of lower end Arabica coffees has been cut in order to feed the domestic industry. There is less production in Brazil this year due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia is also very low on supplies. The demand has weakened for inferior qualities of Coffee from the rest of Latin America, although prices paid remain low and differentials paid remain weak. Differentials for better qualities are stable, but demand is not real strong. Roasters have been busy fixing prices for coffees bought previously and are showing less interest in adding to positions. The charts show that the price action has been choppy and that choppy price action can continue.

Weekly New York Arabica-Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

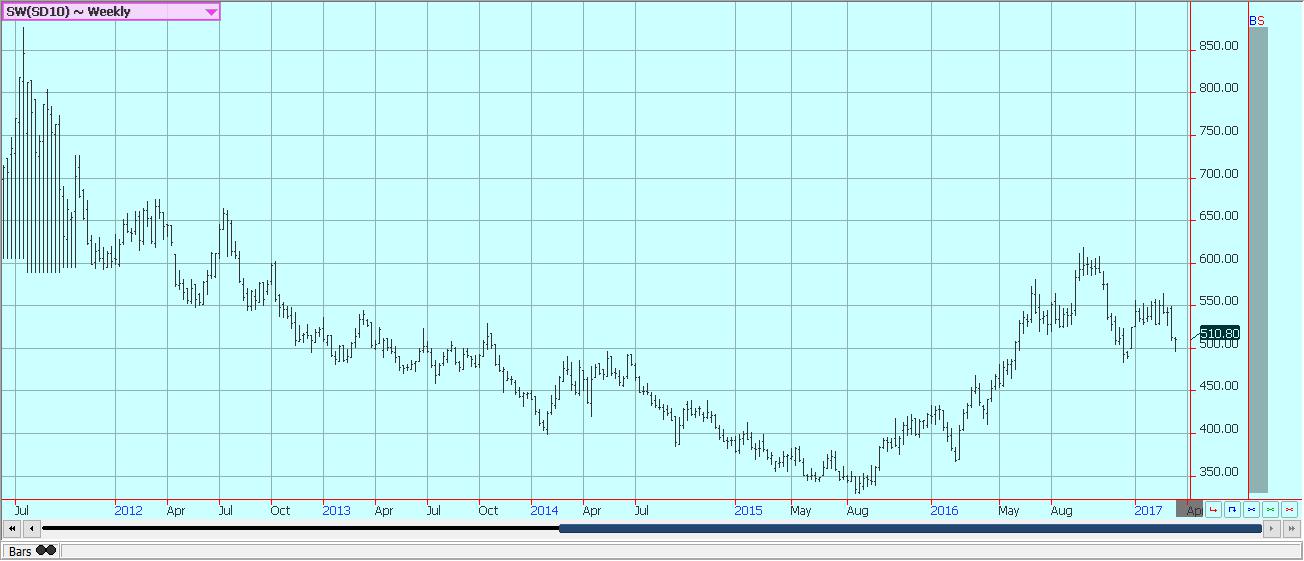

Sugar

Futures closed slightly lower for the week after rejecting a sharp move lower on Friday. Some initial selling on Friday turned trends down again, but the selling dried up quickly and some short covering and bottom picking pushed prices back to the highs of the day. It was an impressive recovery effort and new buying might be seen this week. It looks like India is determined not to import Sugar this year even though domestic production is short and internal prices are very high. India had lower production last year due to the uneven monsoon rains. Analysts had expected the country to import about 2.5 million tons of White Sugar, but the government has resisted even as some mills have closed early and internal prices have gone higher. The Sugar Association there recently announced that domestic demand has dropped, no doubt in response to the high internal prices. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. It continues to investigate dumping charges on imports, and last week said that the investigation will continue for several more months. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remains too dry. Center South areas have had plenty of rain and good production is expected. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were higher last week. The tone of the market has also changed, and it is possible that the worst of the bearish price news has now been absorbed. The weekly charts imply that a low has been found but that an uptrend has not yet started. The mid-crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the mid crop is not good and that much of the mid crop delivered so far is not of exportable quality. Ivory Coast could produce 1.9 to 2.0 million tons, and a record production is possible. Ghana could produce about 800,000 tons, a good crop for them. Overall world production is expected by the ICCO to be strong and above demand. In fact, the ICCO now anticipates that production could be above demand for several years and that prices could remain generally weak for an extended period. The demand from Europe is reported weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid-crop. So far the winds have not developed. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia, but it remains too dry in Bahia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were mostly lower as big and increasing supplies of milk are available to the market. Supplies are increasing seasonally in all areas as the annual flush is active in the US. Milk and Cheese futures made new lows for the move, and Butter futures remain in a trading range. Demand is good for cream, but cheese makers are displaying moderate, but weakening, demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing. Bottled milk demand has been steady to lower. Cheese supplies are increasing and much of the production is going into aging coolers. Butter manufacturers are mostly producing bulk butter for inventories even with increasing sales for print butter needs for the coming holidays. Dried products prices are steady to lower.

US cattle and beef prices were firm last week amid on strong prices. However, futures markets once again had a tough time responding. Packers paid higher prices in the auction market last week and volumes traded were strong. Beef prices have also been strong and have led Cattle futures higher. There is talk that Cattle supplies might be light for the next couple of weeks, but that is expected to change soon and that is why April futures are not really responding to the current stronger prices. However, it appears that a lot of the cattle is not yet ready for market. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase. Overall beef exports have been very strong this marketing year.

Pork markets and Lean Hogs futures were stable last week. Pork demand remains stronger than expected and ham prices have been contra-seasonally strong. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. There are big supplies out there for any demand. The charts show that the market could remain in a trading range at good levels for both processors and producers.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Markets7 days ago

Markets7 days agoRice Market Slips as Global Price Pressure and Production Concerns Grow

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Wavers Below $70K as Crypto Market Struggles for Momentum

-

Biotech4 days ago

Biotech4 days agoInterministerial Commission on Drug Prices Approves New Drugs and Expanded Treatment Funding

You must be logged in to post a comment Login