Featured

The Lack of Coffee Offers from South America and Vietnam Is Still Supporting Prices

New York and London closed higher last week on ideas of little on offer from producers and reports of increasing coffee demand. Demand ideas remain strong, especially for Robusta on price comparisons with Arabica and demand for Arabica has been maintained. Producers in Vietnam are said to have low stocks left to sell and producers in Colombia and Brazil are also reported to be short on Coffee to sell.

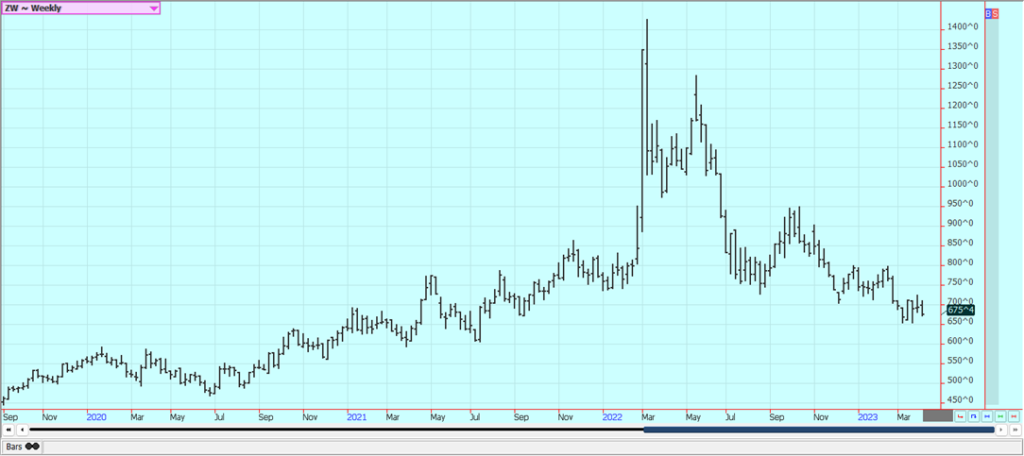

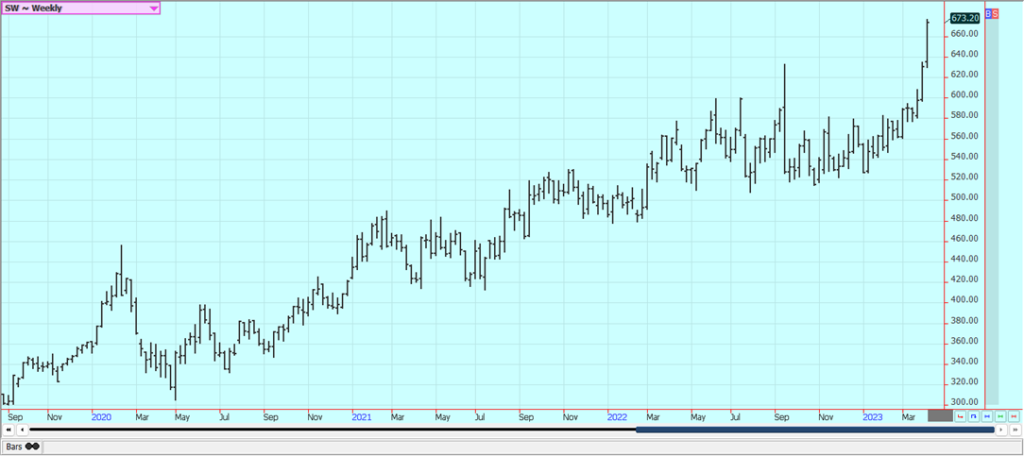

Wheat: Wheat markets were lower last week on what appeared to be new selling from speculators. Trends are turning down on the daily charts. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market were the driving force for the weaker prices. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

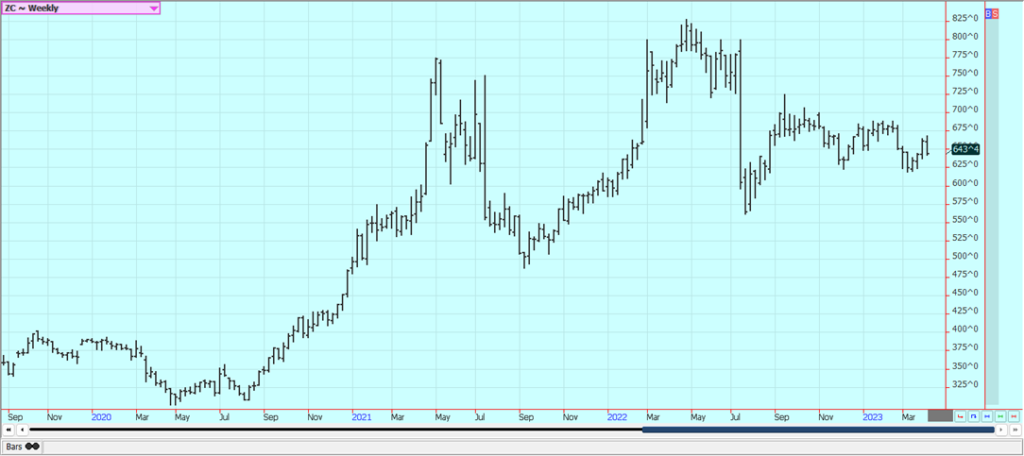

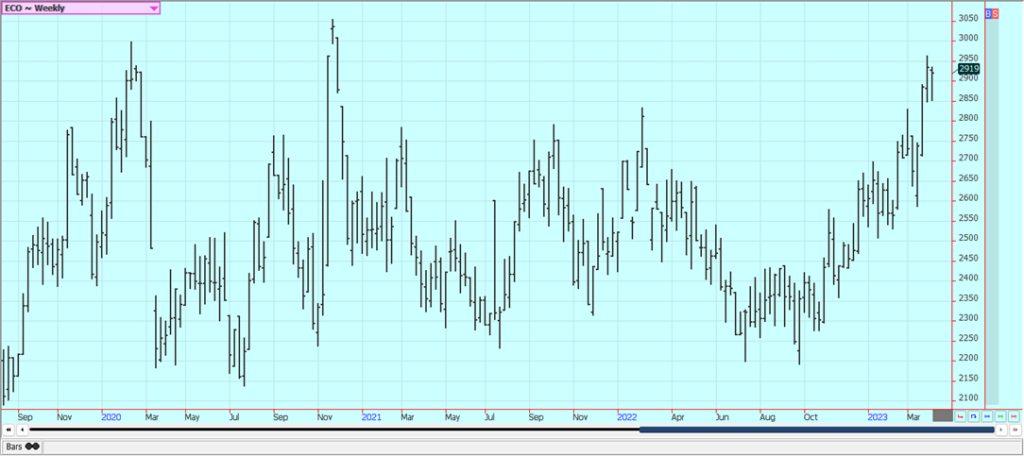

Corn: Corn and Oats closed lower last week, with Corn lower on reports of increased selling of cash gain by American farmers and forecasts for improved field working conditions next week as the weather is expected to turn drier and warmer for much of the central US. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand has improved because of the price differentials and the lack of a Brazil offer into the market. This trend should continue for the next few months if not longer. Prices from South America should now remain strong as countries there concentrate on Soybeans exports and not Corn. Safrinha Corn planting in Brazil is delayed. These delays continue, but the harvest of Soybeans and the planting of Corn is now progressing well. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions are usually good when this happens. However, it is very wet now and some early planting has been delayed. Warmer and drier weather is expected this week to allow for at least some fieldwork to get done.

Weekly Corn Futures

Weekly Oats Futures

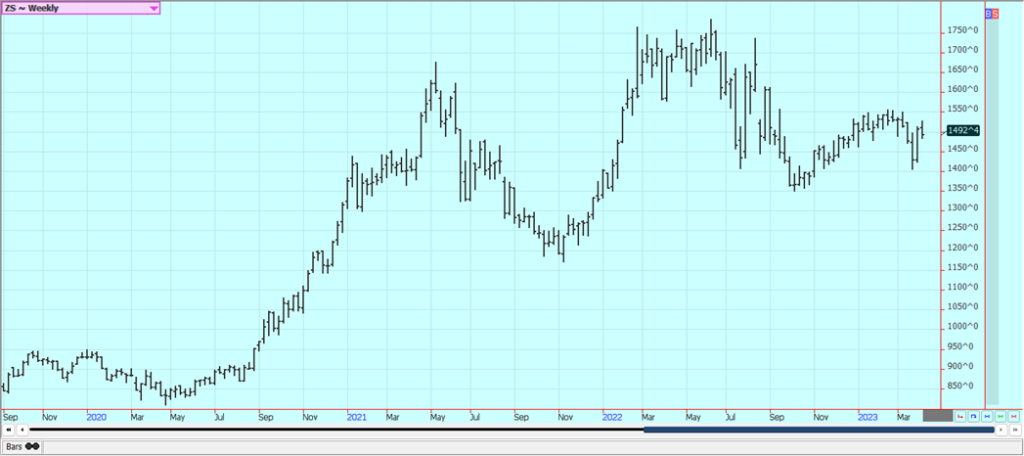

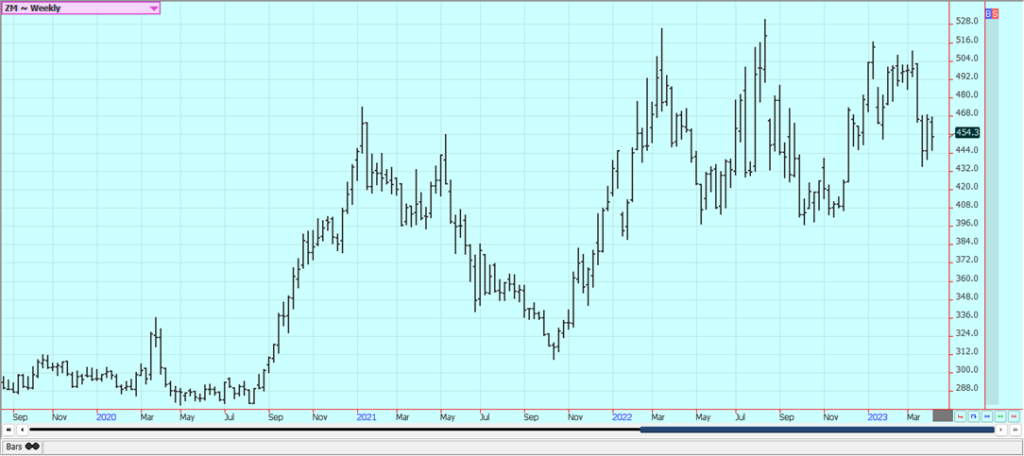

Soybeans and Soybean Meal: Soybeans and the products were lower last week on reduced demand ideas for US Soybeans. Reports from Brazil show that basis levels there are under pressure due to the large crop being harvested now. The basis might get higher later in the marketing period as total South American production is probably about the same as last year. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be wiped out by the losses in Argentina. Argentina has been forced to import from Brazil to keep its crushing facilities operating. Soybeans export demand is flowing to Brazil now. It remains hot but rains are reported in Argentina and crop conditions are getting stable. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor, but there is too much rain in most growing areas right now. Warmer and drier weather is in the forecast for this week, so some areas can get started with fieldwork

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice was lower last week and trends are down on the May daily charts. Demand has been good from domestic sources and offers seem hard to find right now. Export demand has been uneven and was low last week. Export demand has been an issue for the market all year. Mills are milling for the domestic market in Arkansas and are bidding for some Rice. Markets from Texas to Mississippi are called quiet. Demand in general has been slow to moderate for Rice for exports. Planting remains active in Texas and southern Louisiana with field conditions called very good in Louisiana and too dry in parts of Texas.

Weekly Chicago Rice Futures

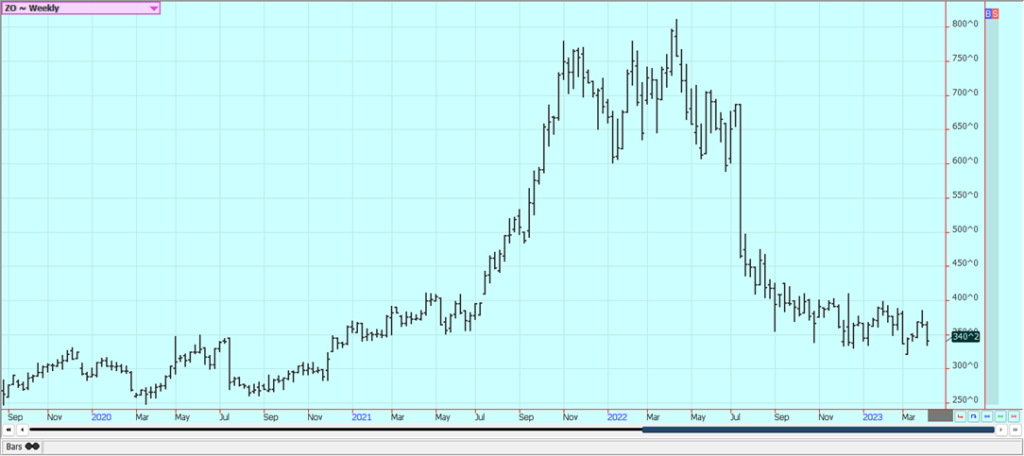

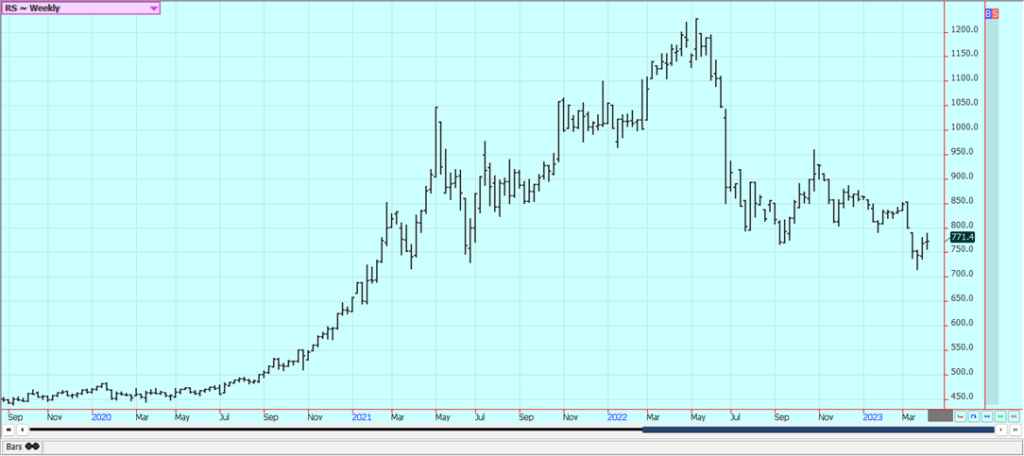

Palm Oil and Vegetable Oils: Palm Oil closed higher again last week on follow-through buying tied to the OPEC news and on a lack of offer from Indonesia. Trends turned mixed on the daily charts despite news that OPEC was cutting oil production again. There are ideas that prices can remain elevated due to bad weather in Malaysia but demand remains weaker than hoped for from India and China. Indonesia has not been offering as it tries to build stocks for its own biofuels industry but it is expected to start offering very soon. Canola was a little higher last week on bad weather now. Forecasts for warmer weather to show up in the Prairies this week could start to allow for fieldwork to start. Brazil is expected to dominate the oilseeds market for the next few months. Reports indicate that domestic demand has been strong due to favorable crush margins.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was a little higher yesterday in anticipation of a positive export sales report to be released this morning. The weekly export sales report was weaker last week but still featured buying from Vietnam and China. Prices were higher after the release of the report on Thursday and built on the gains on Friday. Ideas are that the world economic problems were fading into the background as the US stock market rallied. Chart trends turned up. Chinese buying should stay strong as the country improves economically as it opens up from the covid lockdowns.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower on Friday but was higher last week and made new highs for the move. Trends remain up in the market. Futures remain supported by very short Orange production estimates for Florida. Demand is thought to be backing away from FCOJ with prices as high as they are currently. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good.

Weekly FCOJ Futures

Coffee: New York and London closed higher last week on ideas of little coffee offer from coffee producers and reports of increasing demand. Coffee demand ideas remain strong, especially for Robusta on price comparisons with Arabica and demand for Arabica has been maintained. Coffee producers in Vietnam are said to have low stocks left to sell and producers in Colombia and Brazil are also reported to be short on Coffee to sell. The lack of coffee offers from South America and Vietnam is still supporting prices and reports indicate that demand for Robusta from Vietnam is strong and increasing due to cost differentials with Arabica. Differentials are now weakening in Brazil, Honduras, and Colombia, but reports indicate that differentials might start to firm up again as coffee production ideas are low for Colombia and Brazil. Brazil exports were 163,444 tons in March, from 202,984 tons last year.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

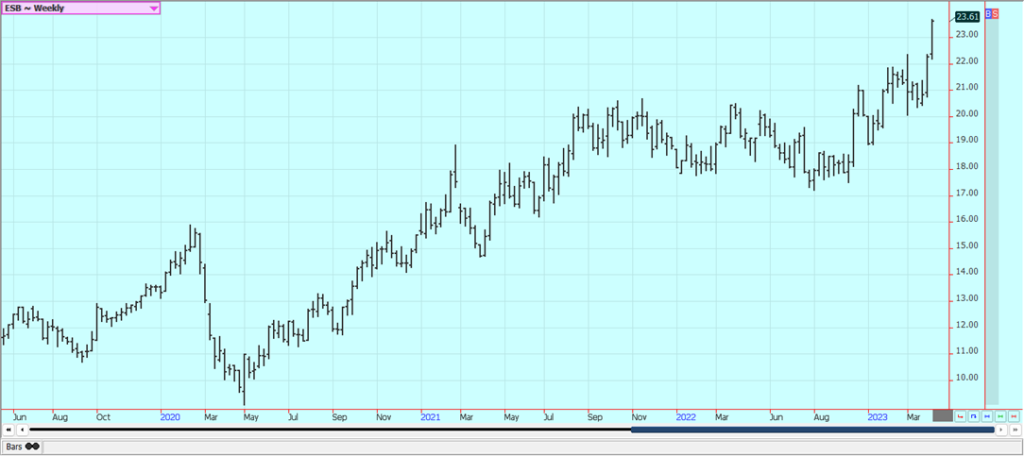

Sugar: New York and London closed higher last week and at new highs for the move. Trends are up on the daily and weekly charts. Indian production is thought to be less than 33 million tons this year as mills are closing early there and Pakistan also has reduced production. India has produced 30.0 million tons of Sugar so far this season, down 3.3% from last year. Thailand mills are also closing earlier than expected so the crop there might be less. New crop Brazil production is solid this year but is still in the fields. Reports from private analysts suggest that Brazil can have a 13% increase in center-south production. Private estimates suggest that production could be 40.3 million tons of Sugar. Brazil producers are currently active in the futures market placing hedges on the production. European production is expected to be reduced again this year. Some analysts now say that Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

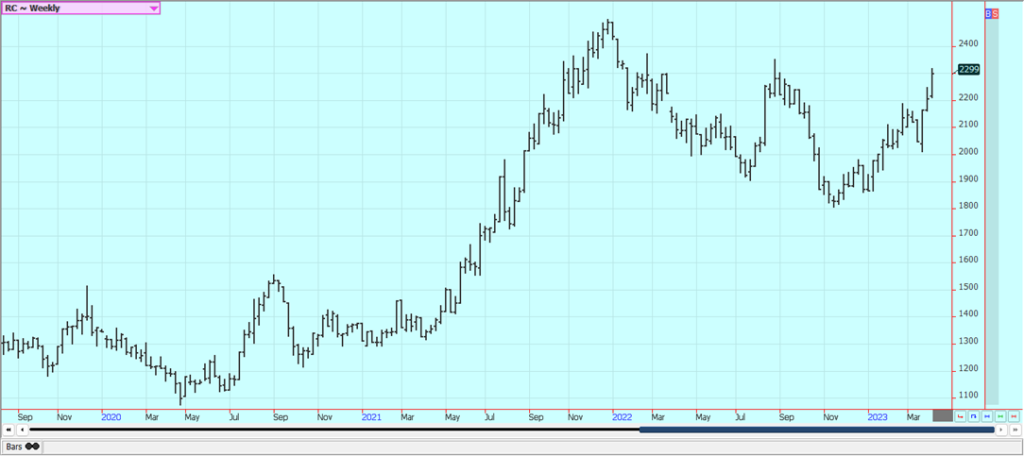

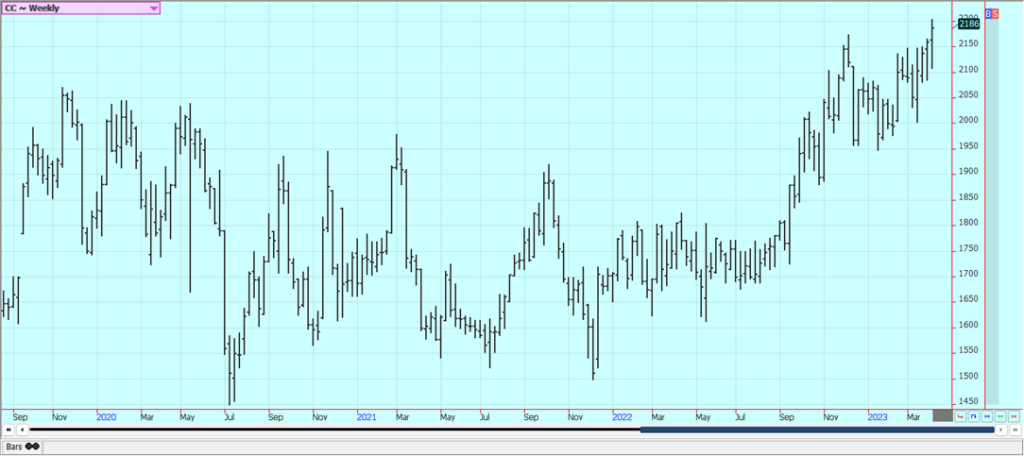

Cocoa: New York closed mixed to higher and London closed higher again Friday. New York was a little lower for the week but London closed higher and at new highs for the move. Wire reports suggest that producer selling increased on the recent rally in these markets. Trends remain up for at least the short term. The talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Mid-crop production ideas are strong due to rains mixed with some sun recently reported in Cocoa areas of the country. Ghana has reported disease in its Cocoa to hurt production potential there, but overall production expectations are high. The rest of West Africa appears to be in good condition. The weather is good in Southeast Asia. Ivory Coast Cocoa arrivals are now estimated at 1.779 million tons, down 4.8% from last year. Callebaut said yesterday that overall chocolate volume has fallen by 3.6% in the first six months with reductions in Europe and the Americas outweighing a small increase in Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by eliasfalla via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing5 days ago

Impact Investing5 days agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Company Adopts Dogecoin for Treasury Innovation

-

Markets10 hours ago

Markets10 hours agoRice Market Slips Amid USDA Revisions and Quality Concerns

-

Business1 week ago

Business1 week agoLegal Process for Dividing Real Estate Inheritance