Markets

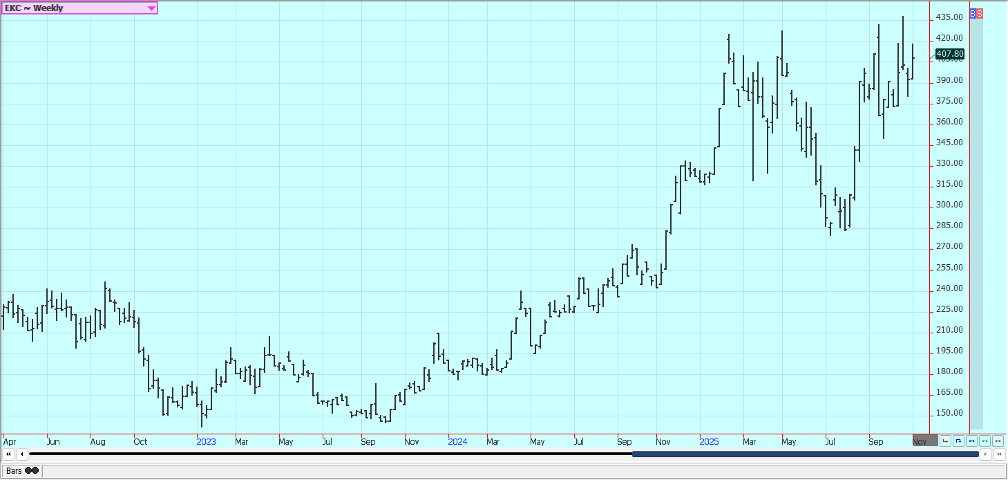

Coffee Prices Rise on Weather Woes and Tight Supplies Despite Brazil Tariff Debate

New York and London coffee markets rose on weather concerns: Brazil is dry, while Vietnam faces heavy rains from Typhoon Kalmaegi. Vietnam’s exports rose 13.4% to 1.31 million tons. A proposed U.S. tariff cut on Brazilian coffee may lower arabica prices. Limited stocks support futures, though Brazil’s exports fell to 233,094 tons in October.

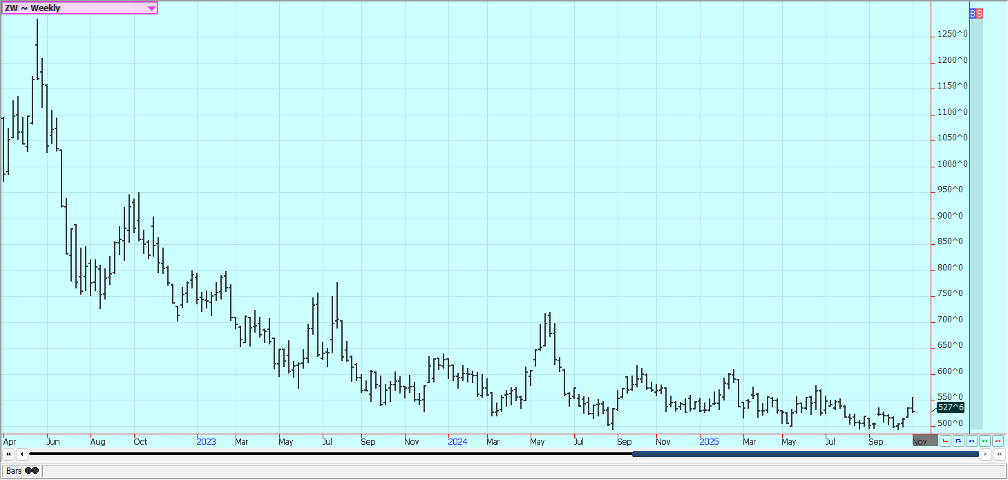

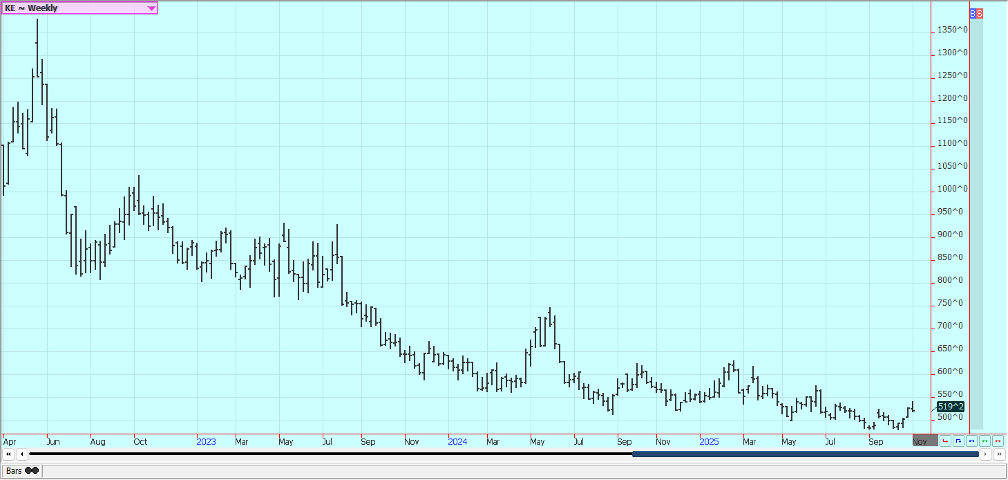

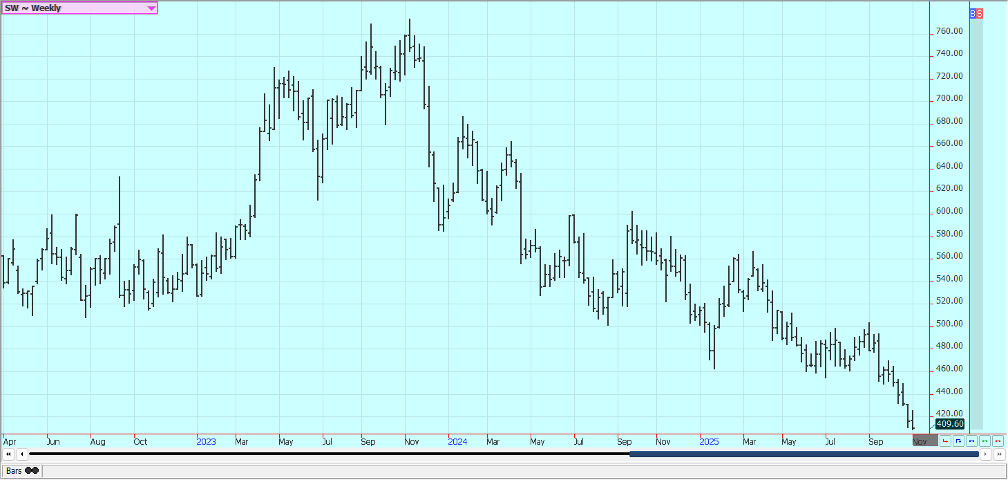

Wheat: Wheat closed lower last week after making new highs for the move as there has been no new China demand news or rumors. China had bought some cargoes of US Wheat a week ago but there has been no talk of any additional purchases. No USDA reports were released due to the government shutdown, but USDA will issue the November WASDE reports and production reports later this week.

Russian crop areas remain too dry in Winter Wheat areas and too wet in Spring Wheat areas, but crop size ideas have increased due primarily to reports of big yields in Spring Wheat growing areas. Rains have been good in the northern Great Plains and Canada. It has turned cooler in the Great Plains. Southern hemisphere crops appear to be good.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Unavaiable today

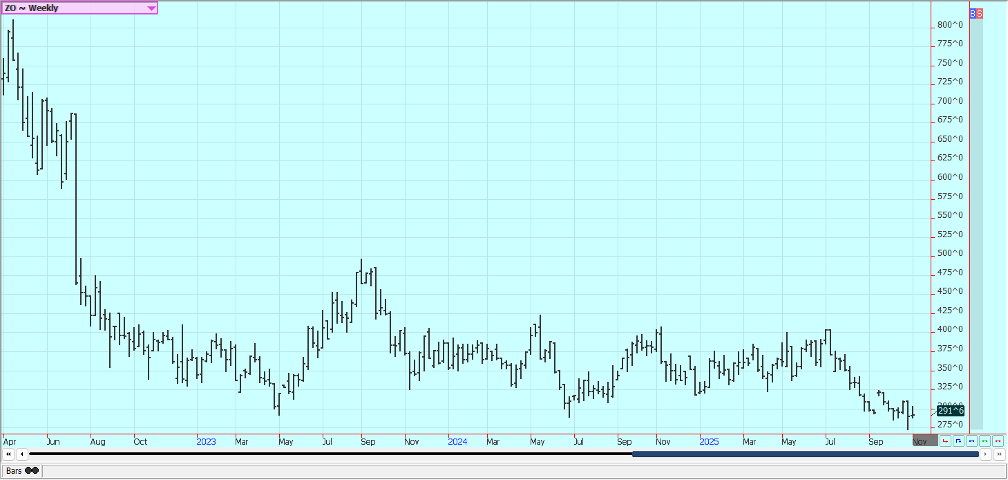

Corn: Corn was lower last week but held the recent trading range as the Supreme Court is deciding on the Trump tariffs. Trends are sideways in the market. Most USDA reports are cancelled as the government is still closed, but the November WASDE and production reports are to be issued on time later this week. There is talk in the country that Corn production is being overestimated by analysts. The harvest is winding down in all areas of the Midwest.

There are ideas that US production might not be super strong due to disease such as rust to offset the demand losses. Yield reports are showing at or above APH yields in western areas, with very good crops reported in Minnesota. Yields have been reported at or less than APH in areas east of the Mississippi River. Temperatures should average below normal this weekend and there are forecasts for some precipitation. Demand for Corn in world markets remains moderate to strong. Oats were a little higher.

Weekly Corn Futures

Weekly Oats Futures

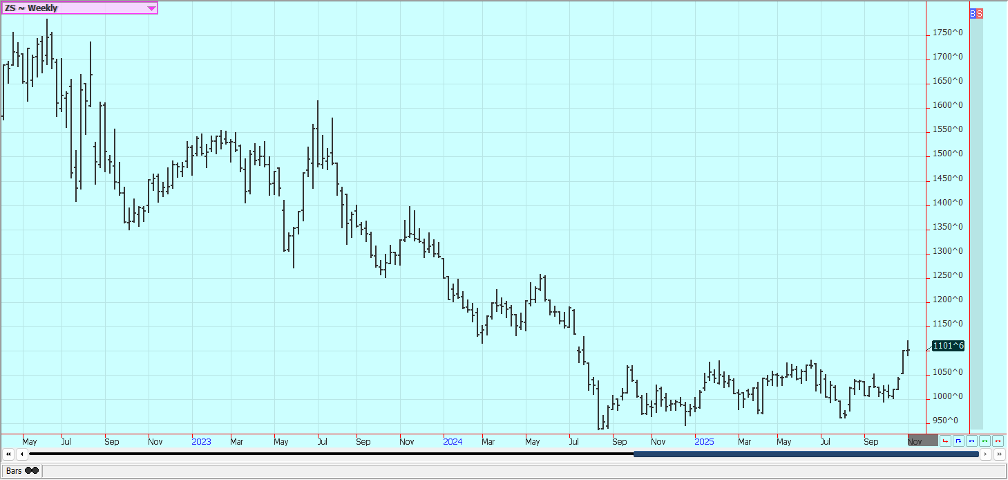

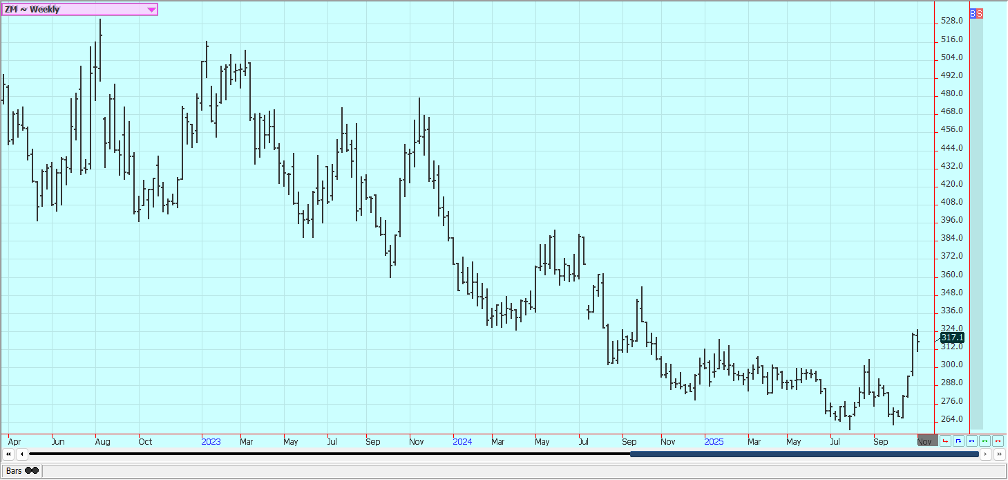

Soybeans and Soybean Meal: Soybeans and Soybean Oil were a little higher last week despite a lack of new news or rumors of more Chinese demand. China bought cargoes a week ago but has not been reported to buy anything since. Soybean Meal was a little lower. The US Supreme Court is now deciding on the legality of the Trump tariffs. China is almost done with purchases for this year and as the US will have to compete with South America for sales in a diminishing Chinese market.

The Chinese hog herd is being reduced and this means less demand for Soybeans and Soybean Meal. The US government has announced that it will support farmers with money, but so far no money has been flowing. Forecasts call for some precipitation to be seen in the Midwest this weekend. Temperatures will average below normal. Export demand remains less for US Soybeans as China has been taking almost all the export from South America due to the Trump tariff regime.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

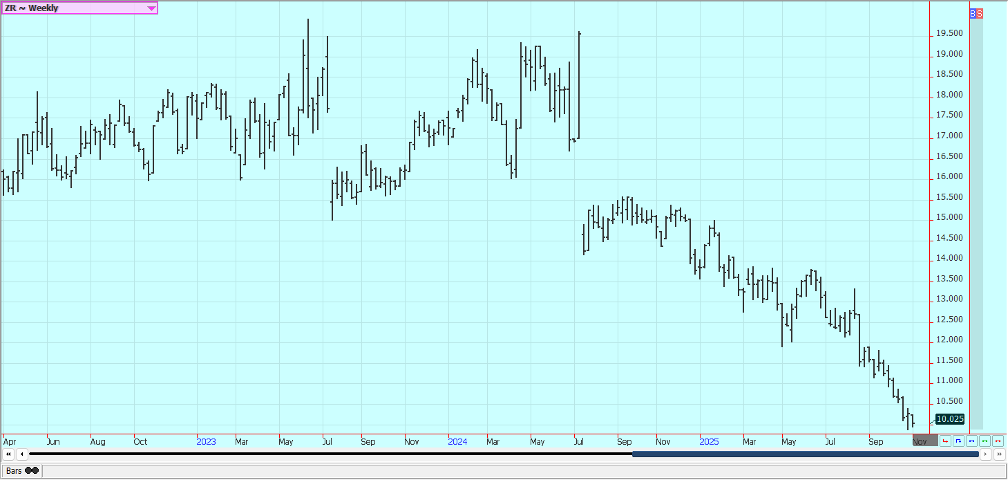

Rice: Rice was lower last week despite ideas that the market is too cheap and that farmers have sold what needs to be sold for now. The recent selling has been to be relentless and appears tied to the weaker prices in Asia and especially India. Trends are down in the market. The harvest is wrapping up in Texas and southern Louisiana.

Harvest is now wrapping up in Mississippi and Arkansas. California is also about done with its harvest. Yields and quality are mixed, but quality appears better than a year ago. The cash market has been slow with low bids from buyers in domestic markets and average or less export demand.

Weekly Chicago Rice Futures

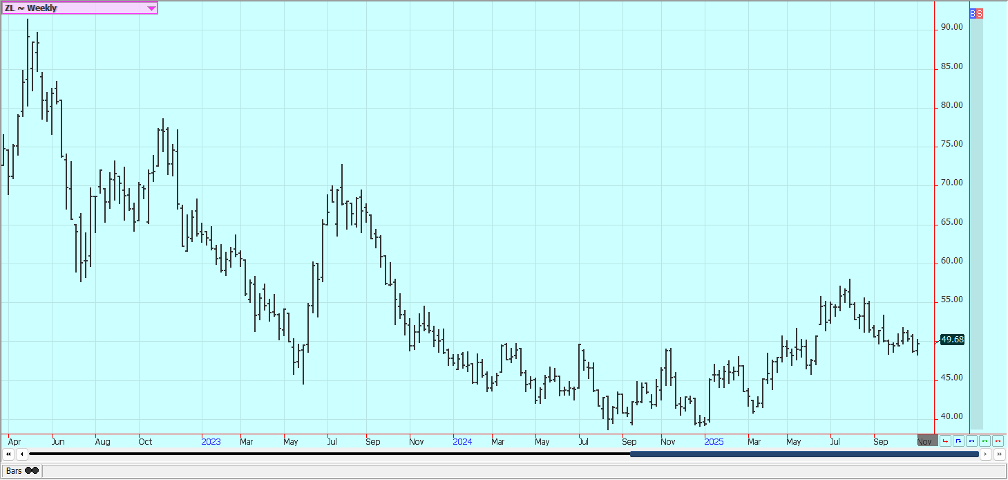

Palm Oil and Vegetable Oils: Palm Oil futures were lower last week on ideas of increasing supplies. There are still ideas of increasing production. The market sentiment overall is turning bearish on ideas of increasing stocks to the market and on some concerns about demand Canola was a little higher. Trends are mixed on the daily charts and on the weekly charts.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was lower last week on a lack of new Chinese demand since the event of the lower tariffs and on weakness in Wall St. US tariffs are now being decided by the Supreme Court. An end to the tariff wars could start demand for US Cotton in world markets again There are no more USDA reports coming due to the closure so no demand news is heard.

The WASDE and production reports are expected to be released on time this week, however. The US harvest is starting to finish in most areas and initial yield reports are positive. There are still ideas that harvesting conditions are generally good. There are still reports of good weather in Texas and into the southeast with variable temperatures and a few showers. The monsoon in India is good and a good production there is possible.

Weekly US Cotton Futures

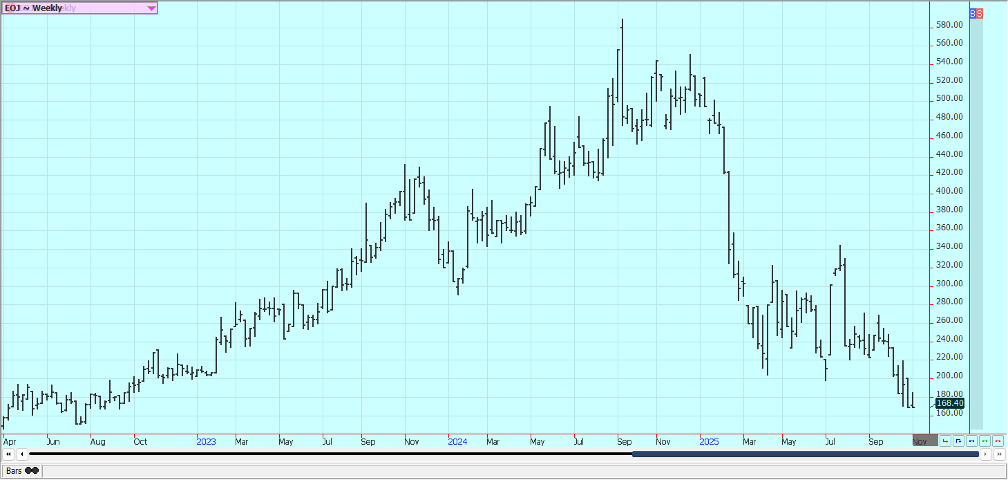

Frozen Concentrated Orange Juice and Citrus: Futures were higher last week and the trends are turning down on the daily reports, but sideways on the weekly charts. The US government remains shut down. The weather is considered good for production here and in Brazil and Mexico.

Development conditions are good in Florida and in Brazil now with occasional showers in Florida and dry weather in Brazil. The poor production potential for the crops comes from early dry weather but also the greening disease that has caused many Florida to lose trees. Brazil production potential got hurt by cold and dry weather seen earlier in the year and dry weather now.

Weekly FCOJ Futures

Coffee: New York and London were higher last week on weather concerns. It has been a little too dry in Brazil for best yield potential. Vietnam has seen too much rain. Typhoon Kalmaegi slammed into Vietnam on Thursday bringing heavy rain to both coastal and Central Highlands provinces. Activity remained quiet in Vietnam on limited supplies as offers of fresh beans from the current harvest have yet to pick up. Vietnam exported 1.31 million metric tons of coffee over the January-October period, up 13.4% from a year earlier.

A revision of the 50% U.S. tariff on Brazilian imports, including coffee, could push arabica prices lower. A bill has been introduced in the Senate to cut Brazil tariffs but is apposed by the administration. There are still reduced deliverable coffee supplies for both exchanges, and the lack of deliverable stocks in both markets has supported the futures market.

Global coffee traders are shipping about 150,000 60-kg bags of Brazilian arabica coffee to ICE exchange warehouses in Europe, a move that could help replenish stocks and ease nearly record-high prices. Brazil exported 233,094 metric tons of green coffee in October, down from 279,233 tons a year ago.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

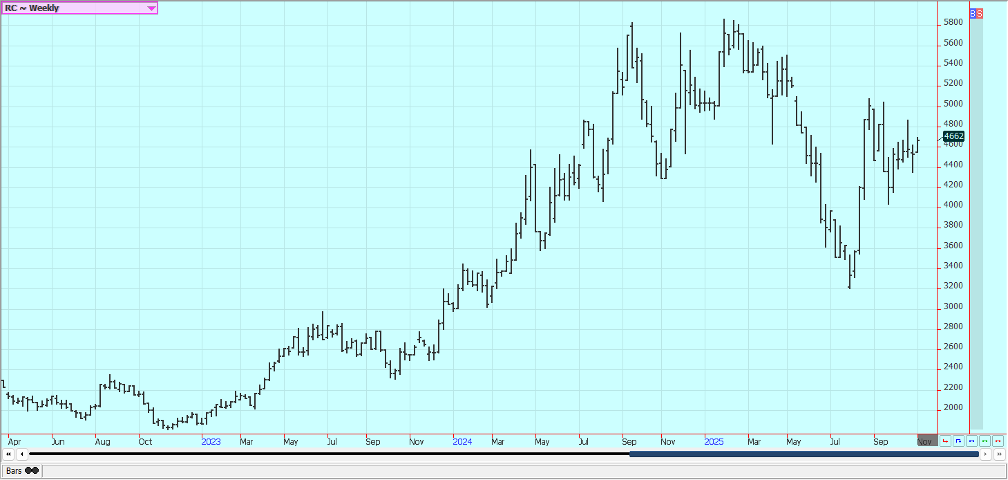

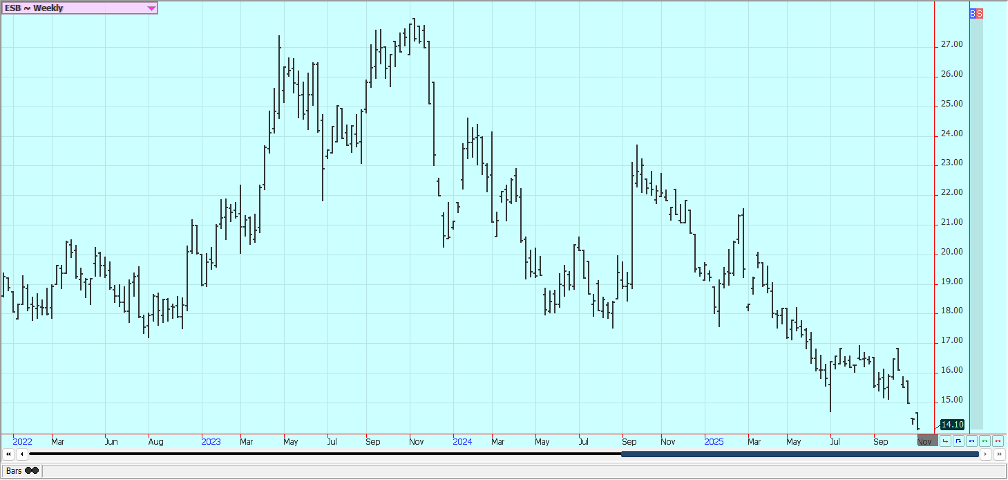

Sugar: New York and London were lower last week and trends are turning down again. Ideas of good supplies for the market from good growing conditions for cane and beets around the world continue. Production in Center-South Brazil has also been strong, but the south center harvest is almost over. Too much rain has been reported in northern areas. The outlook for big cane crops in India and Thailand that are in good condition with reports of good rains this year.

The prospect of a big global surplus in the 2025/26 season was keeping the market on the defensive with a rise in production in India and Thailand set to increased supplies while global consumption is expected to remain steady. India has just raised prices that mills must pay producers for Sugar, and Brazil prices are now below those for ethanol.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed lower last week and trends are mixed to down. A big main crop harvest is anticipated in West Africa. Demand concerns in West Africa continue. Bigger supplies are expected at West Africa ports soon as Ivory Coast has raised the farmgate price paid to farmers and they are expected to sell. Ghana has also raised farmgate prices. There are still reports of increased pro-duction potential in other countries outside of West Africa, including Asia and Central America.

The market feels that there is less demand and the lack of demand is expected to continue. Malaysia and the US have apparently agreed to allow Malaysian Cocoa into the US with 0 tariffs. Cocoa arrivals in ports in top grower Ivory Coast were picking up after a slow start to the season. A total of about 90,000 tons were delivered between October 27 and November 2, up from 80,000 tons in the same week of the previous season.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Mike Cox via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Markets5 days ago

Markets5 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech2 weeks ago

Biotech2 weeks agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis2 days ago

Cannabis2 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Cannabis1 week ago

Cannabis1 week agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule