Featured

Corn Closed Higher Last Week and Short-Term Trends Are Up

News that China had bought almost 2.0 million tons of US Corn over several days last week was positive for higher prices. Oats were higher after trading in a very small trading range last week. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand could improve because of the price differentials.

Wheat: Wheat markets were higher last week as negotiations with Russia to extend the grain corridor deal with Ukraine are just now getting started. Russia is talking about a short-term extension while everyone else wants one for at least 120 days. Reports say that Russian offers continue to hit the world market and world prices. Trends turned up on the daily charts but remain down on the weekly charts. The problem remains demand as world supplies are not so large and US inventories are less. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market was the driving force for the weaker prices, and price weakness could continue. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. Russia has a large production and is undercutting most world prices in the international market. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

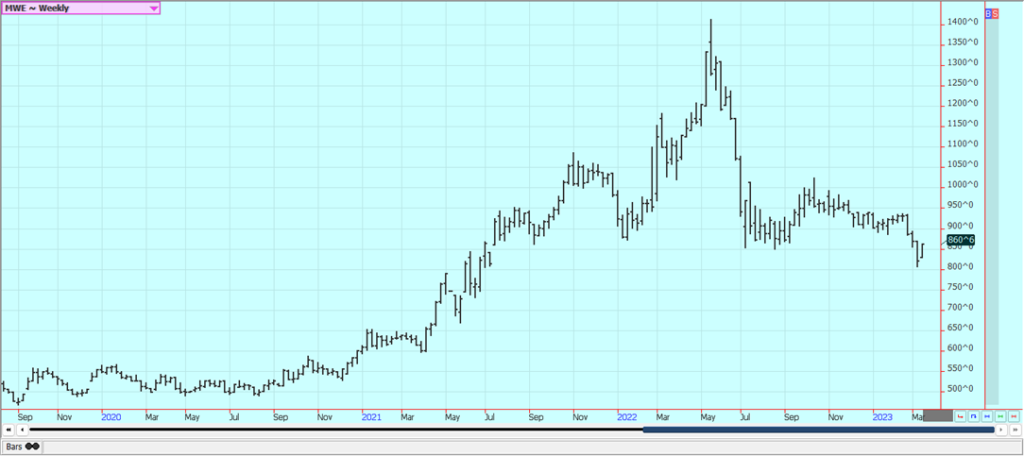

Weekly Minneapolis Hard Red Spring Wheat Futures

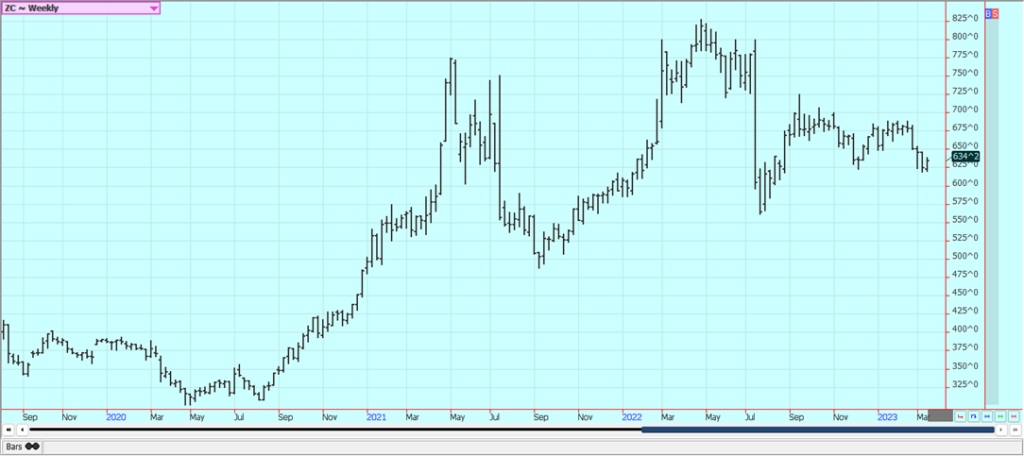

Corn: Corn closed higher last week and short-term trends are up. News that China had bought almost 2.0 million tons of US Corn over several days last week was positive for higher prices. Oats were higher after trading in a very small trading range last week. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand could improve because of the price differentials. Corn prices from South America should now remain strong as countries there concentrate on Soybeans exports, so the US has a chance now to see export demand improve. The Brazil Winter crop is harvested and China has been buying the surplus. The Summer crop and the Argentine crop is developing under stressful conditions. It has been wet so the Soybeans harvest has been delayed and the Safrinha Corn planting is becoming delayed as well. Brazil sources say that 20% of the Winter crop could be planted outside of the ideal window so yields could be hurt in the end. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions for corn are usually good when this happens.

Weekly Corn Futures

Weekly Oats Futures

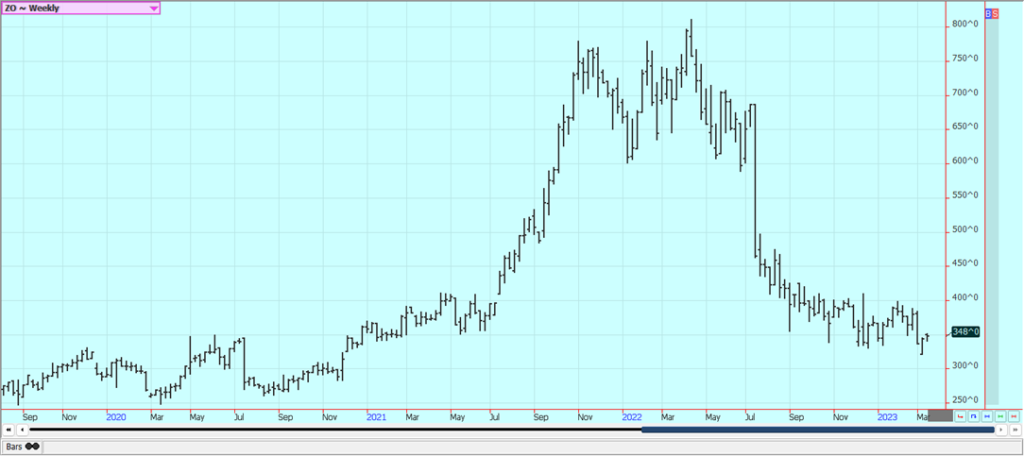

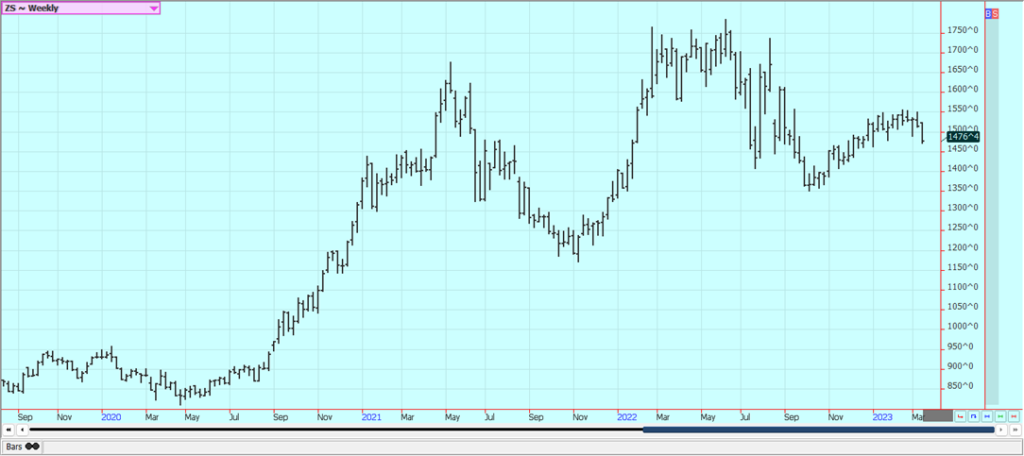

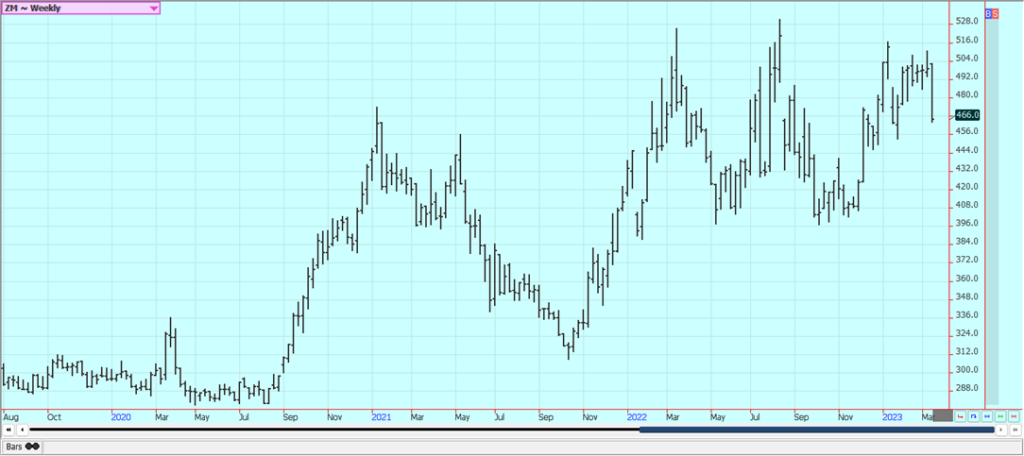

Soybeans and Soybean Meal: Soybeans and Soybean Meal were lower last week as the Brazil harvest makes it way to the market but the Argentine harvest gets reduced again. Soybean Oil was higher but held to a trading range. Reports from Brazil show that basis levels there are under pressure due to the large crop being harvested now. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor. Soybeans export demand is flowing to Brazil now. Argentina is the world’s largest exporter of Soybeans products while the US and Brazil battle for supremacy in Soybeans exports. It remains hot and dry in Argentina and crop conditions are getting worse. Production ideas there are still dropping and the Rosario exchange now estimates production near 27 million tons. The Buenos Aires Grain Exchange said production could be between 25 and 27 million tons. Weather is becoming less important now as the harvest is already underway in central and northern Brazil and will spread south soon. Central and northern Brazil have seen harvest operations interrupted with too much rain but the weather is now improving and the harvest pace is increasing. Production potential for Brazil is called very strong even with potential problems and losses in the south. Argentine production ideas continue to drop with the drought as planting is delayed and the crops already in the ground are stressed.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week and trends are up on the charts. Demand has been good from domestic sources. Export demand has been uneven but was a marketing year high in the most recent weekly export sales report. Demand has been an issue for the market all year. There is not much going on in the domestic market right now although mills are milling for the domestic market in Arkansas and are bidding for some Rice. Markets from Texas to Mississippi are called quiet. Demand in general has been slow to moderate for Rice for exports. Planting is active in Texas and southern Louisiana.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil closed lower last week on weakness in Chicago and despite demand concerns and ideas are that prices can remain elevated due to bad weather in Malaysia and the potential for increased demand from India and especially China. Weekly chart patterns are sideways. Indonesia is now revoking some export permits to keep internal prices controlled and to support the biofuels industry. The controls are expected to last through Ramadan. Peninsular Malaysia is getting flooding rains. Flash floods are being reported. Canola was much lower last week and trends are down. Brazil is expected to dominate the oilseeds market for the next few months. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during last Summer. It is dry in the southern and southwestern prairies now and this could mean reduced yields when the production season begins in a couple of months.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was nearly unchanged last week, and trends are still turning down. The weekly export sales report showed good demand, and demand ideas are improving. Demand has been ramping up for the last couple of months but fell off. Some ideas that demand could soon increase more as China could start to open its economy in the next couple of weeks. China has also started buying again from Australia after refusing imports from that country for political reasons.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was lower last week but held some support areas on the weekly charts and remains supported overall by very short Orange production estimates for Florida. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and the conditions are rated good. Brazil continues to export to the EU and is increasing its exports to the US. Mexico is also exporting to the US.

Weekly FCOJ Futures

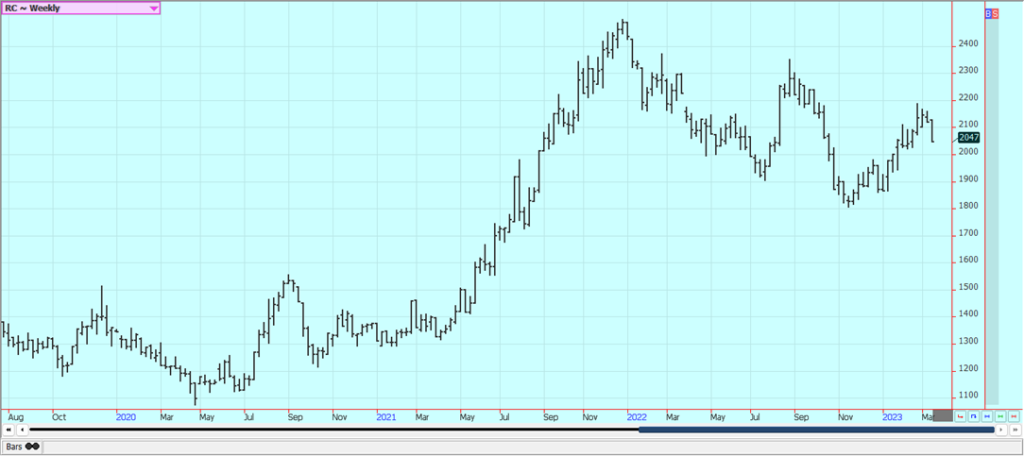

Coffee: New York closed slightly higher and London closed lower last week on mixed reports of offers into the cash market from producers after the recent fall in prices. Trends in New York turned sideways with the price action, but London trends are still mostly down. Differentials are now weakening in Brazil, Honduras, and Colombia as the recent rally has increased offers. Ideas of a big production for Brazil continue due primarily to rains falling in Coffee production areas now. Vietnam is estimated to have very good production this year due to a good growing season. There are ideas that the production potential for both countries has been overrated. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Vietnam is getting less rain now to aid harvest progress but the volumes offered have not increased.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

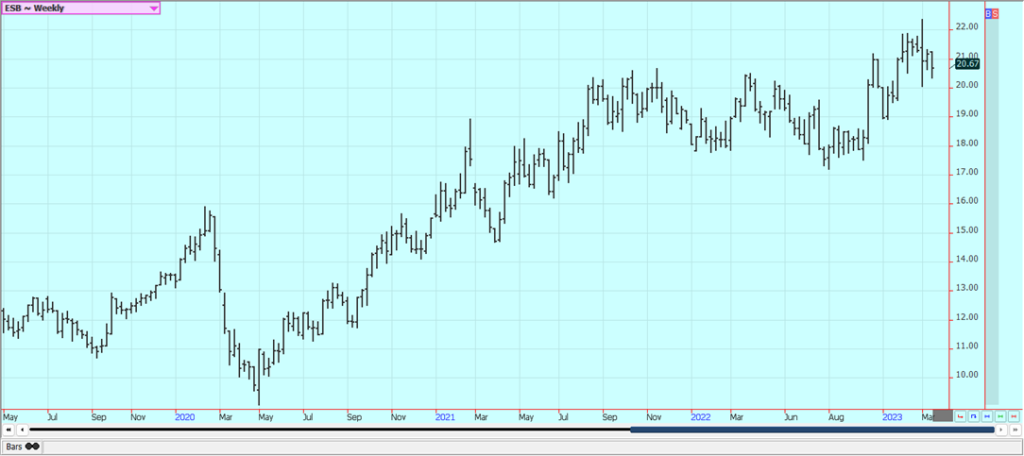

Sugar: New York and London closed lower last week, and the trends are turning mixed in both markets. The world is still short Sugar. Indian production is thought to be 33 million tons this year or less and Thailand mills are closing earlier than expected so the crop there might be less. Brazil’s production is solid this year. Reports from private analysts suggest that Brazil can have a 13% increase in center-south production. Good production prospects are seen for crops in central and northern areas of Brazil, but the south has seen drier weather. Most areas have good rain now. European production is expected to be reduced again this year, with French planted area likely to decline to a 14-year low for Sugarbeets. Some analysts now say that Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

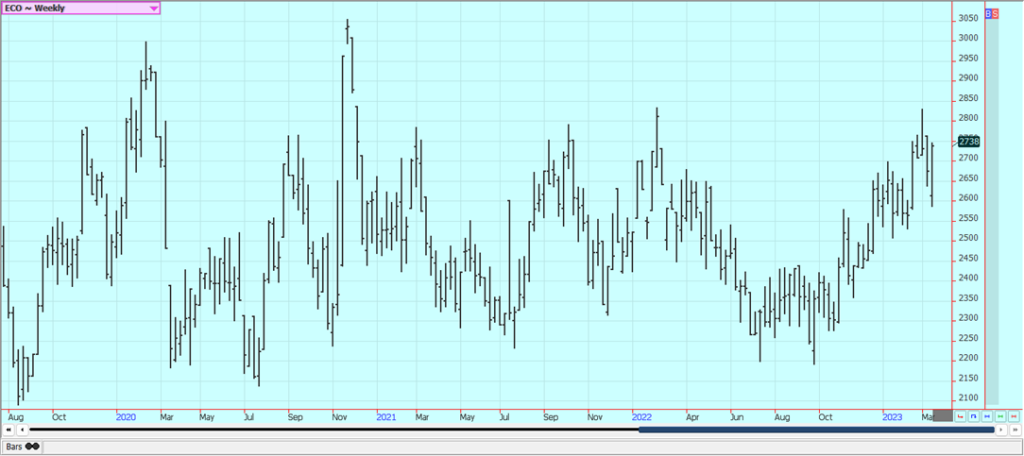

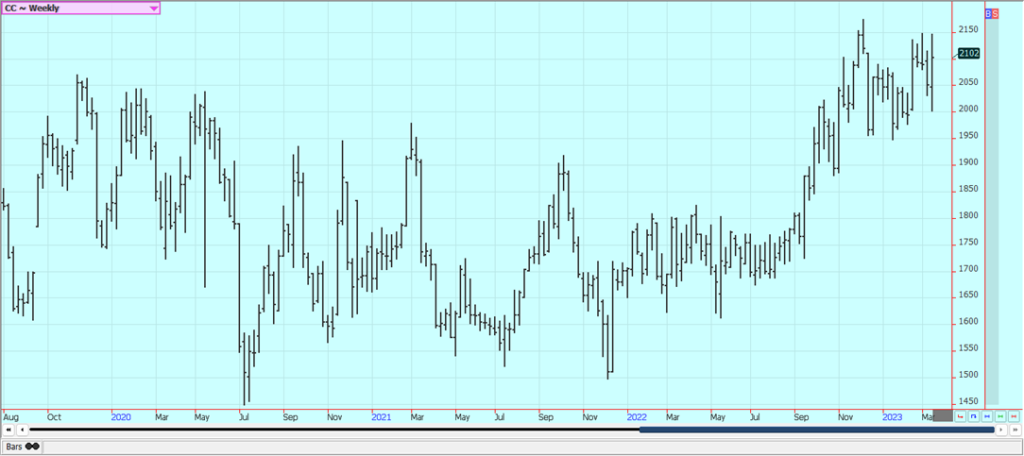

Cocoa: New York and London closed higher, and trends are up for at least the short term in both New York and London. Talk is that hot and dry conditions reported in Ivory Coast could curtail mid-crop production, but main crop production ideas are strong. Those ideas changed a little over the previous weekend due to heavy rains reported in Cocoa areas of the country. Ghana has reported disease in its Cocoa to hurt production potential there. The rest of West Africa appears to be in good condition. Good production is reported for the main crop and traders are worried about the world economy moving forward and how that could affect demand. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by stevepb via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis1 week ago

Cannabis1 week agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

-

Crypto4 days ago

Crypto4 days agoUltimate Convenience: Why Consumers Expect Instant, Secure, and Borderless Payments

-

Cannabis2 weeks ago

Cannabis2 weeks agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution

-

Crypto1 day ago

Crypto1 day agoXRP vs Solana ETFs: Retail Hype Meets Institutional Interest