Markets

Corn Yields Questioned Despite Strong Exports and USDA Projections

Corn was steady last week despite strong export sales and USDA’s 16.74 billion bushel estimate with 188.8 bu/acre yields. Record crop forecasts spurred speculative selling, though Midwest weather looks favorable. Wisconsin flooding may cut yields. Demand remains strong. Illinois crop tour showed weaker yields, small ears, pollination issues, and tip back, suggesting national yields overstated.

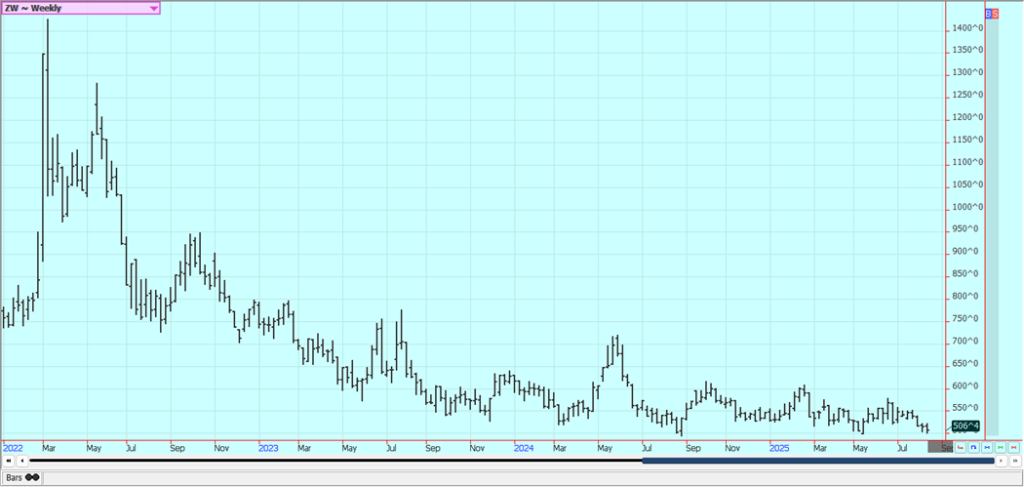

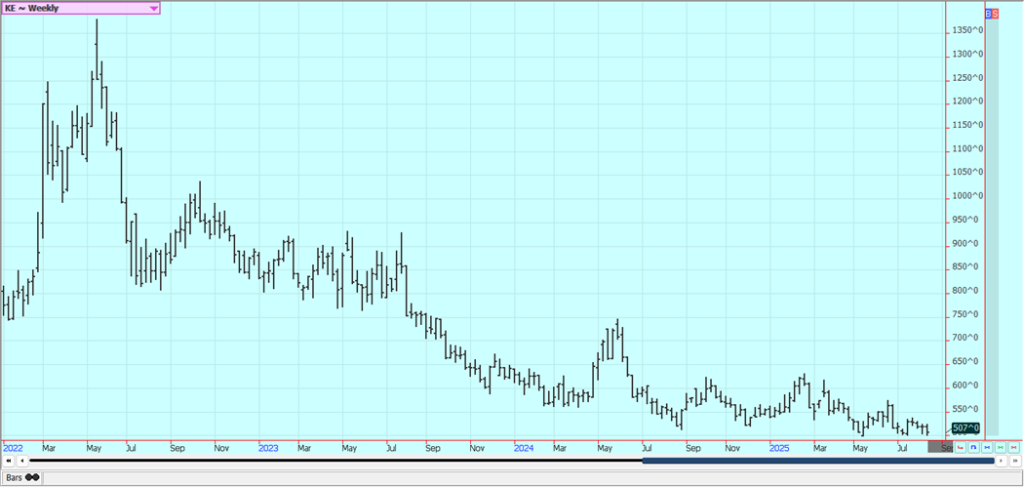

Wheat: Wheat was lower last week despite another week of solid export sales reported by USDA. USDA increased production estimates for Winter Wheat on Tuesday. Spring Wheat production was lower, but the big mover was the Winter Wheat production estimates. Ideas of good harvest progress and good yields are still around and are forcing the selling. Harvest conditions for Winter Wheat appear to be good in the US and Spring Wheat development is currently good.

Rains have been good in the northern Great Plains but Canada has been a little too dry for best yield potential and the northern Plains had hot and dry areas earlier in the year. Canada could still produce an average to above average crop. Russia is still being watched for dry weather that has so far hurt yields and Ukraine is watched for the same reason and because of the war that could destroy some fields. Russian Black Sea prices have been firming as producers are not making sales and are looking for higher prices to offset yield losses. Southern hemisphere crops appear to be good.

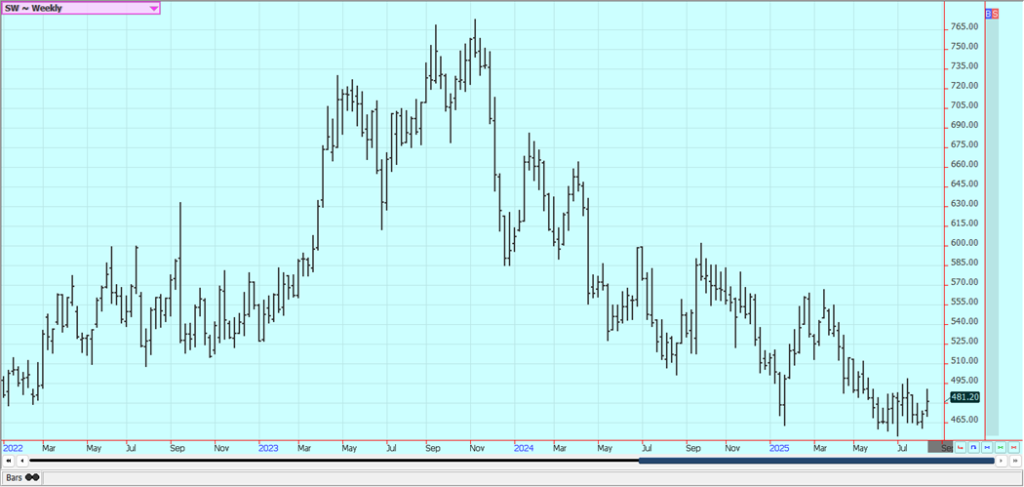

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Unavaiable today

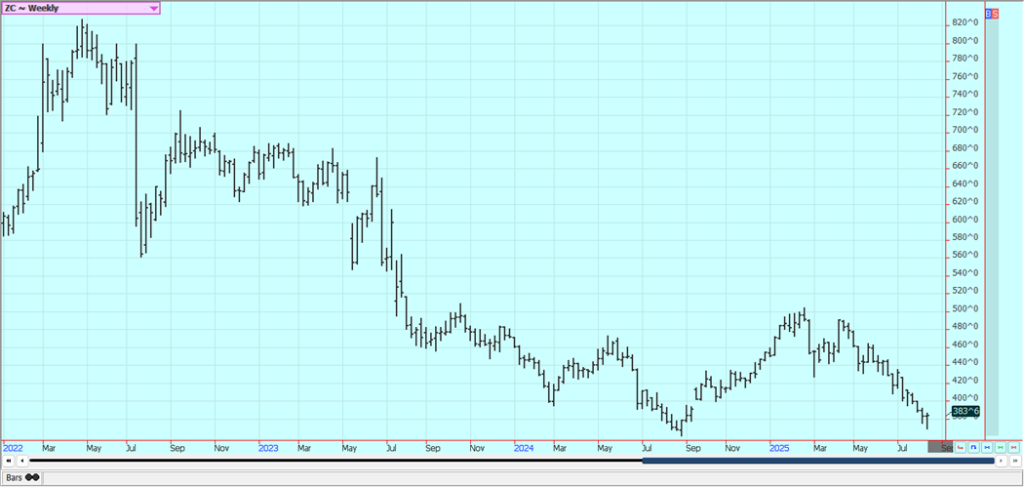

Corn: Corn was near unchanged last week after USDA reported another week of strong export sales and also big production estimates. USDA estimated production at 16.74 billion bushels with a yield estimate of 188.8 bu/acre. There still appeared to be speculative selling on widespread record crop production predictions based on additional forecasts for improving weather for the Midwest. Temperatures should average near normal this week and it should be mostly dry. However, flooding rains were reported in Wisconsin over the weekend and yields could be hurt in southern and eastern parts of the state.

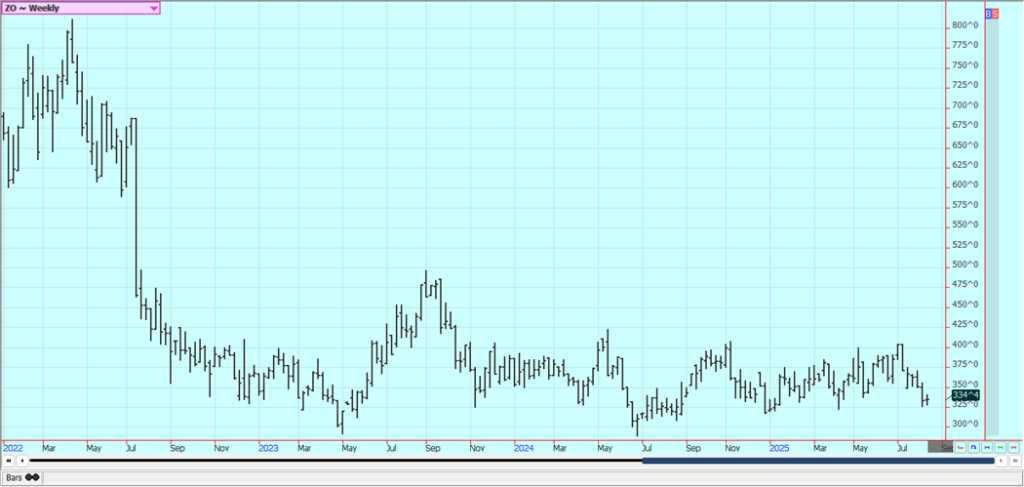

Most of the Midwest has seen adequate or greater precipitation and production ideas are high. Demand for Corn in world markets remains strong. Oats were little changed. We made our annual crop tour of central Illinois over the weekend and found good but not great crops. The tour yield average Was about 198 bu/acre, the second lowest yield calculation in the past 10 years. The ears were small and there were spotty pollination problems and quite a bit of tip back. It looks like the hot summer nights have hurt yield potential and that crop yields of 188 nationally are probably way too high.

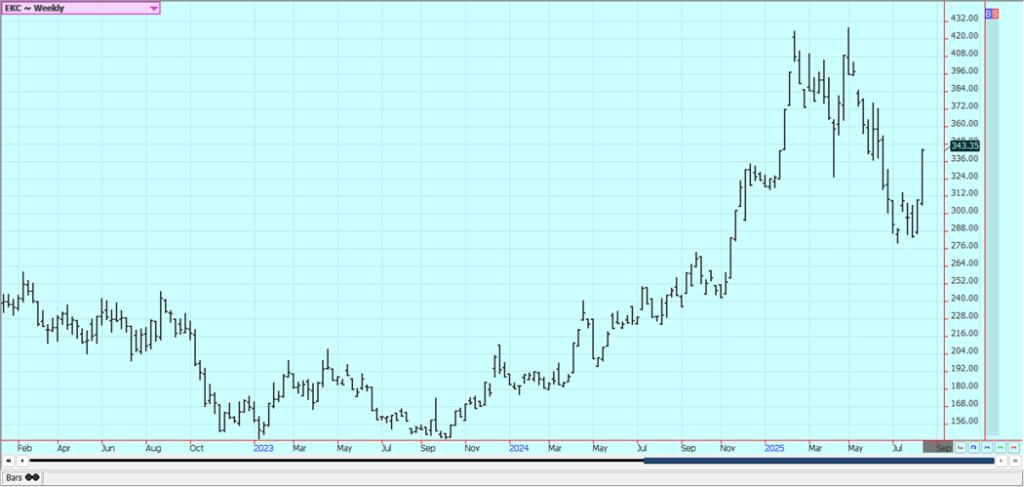

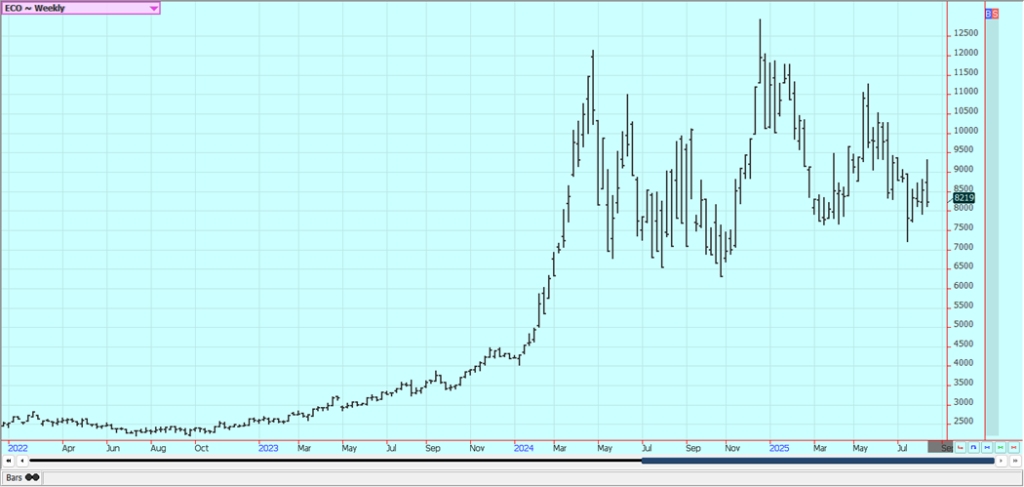

Weekly Corn Futures

Weekly Oats Futures

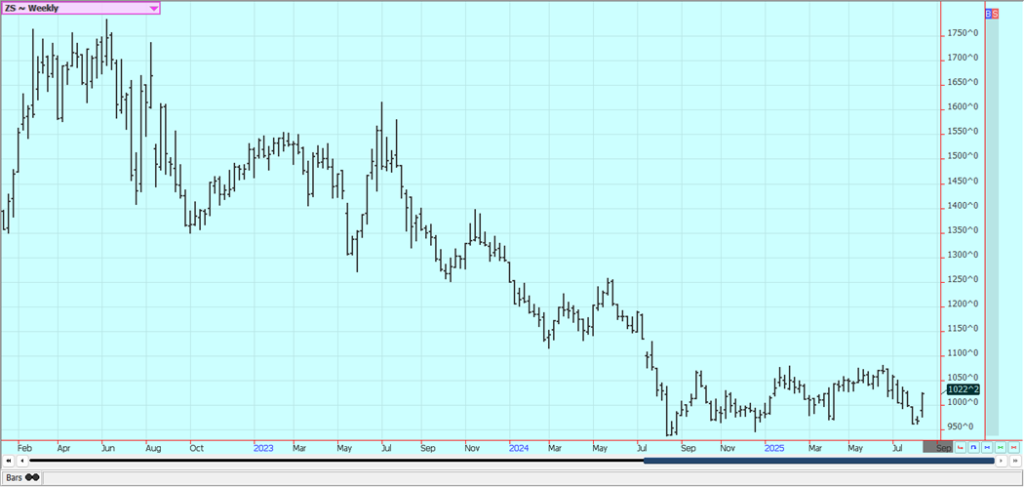

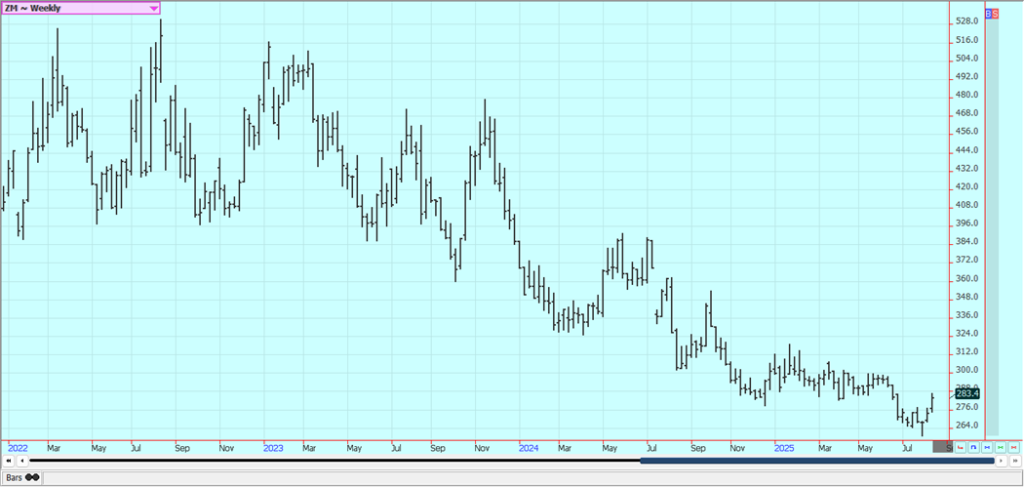

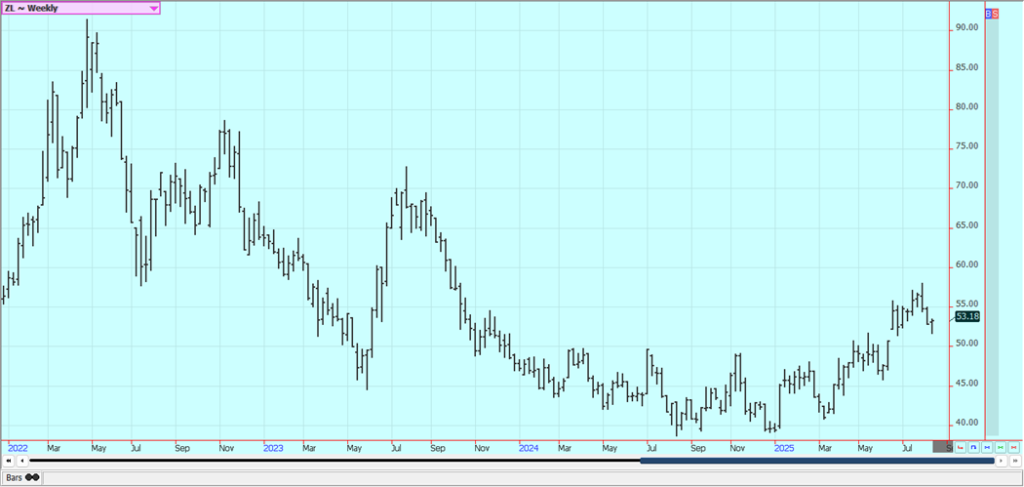

Soybeans and Soybean Meal: Soybeans and the products were higher last week. USDA estimates released on Tuesday showed US Soybeans production at 4.292 billion bushels with a yield of 53.6 bu/acre. Good growing conditions continue in the Midwest with warm and mostly dry weather in the forecast.

Wisconsin got flooding rais over the weekend but just a few light showers were reported in northern Illinois. Prices are now reported to be higher in Brazil, but China and other buyers are still buying there for political reasons. Export demand remains less for US Soybeans as China has been taking almost all the export from South America.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

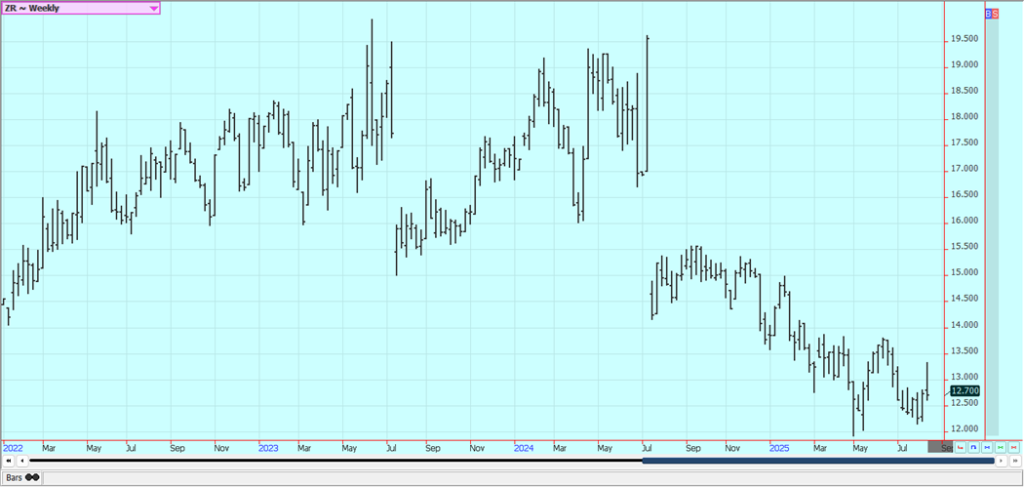

Rice: Rice was a little lower last week after rallying sharply earlier in the week in response to the USDA estimates. Chart trends are mixed on the charts. USDA estimated All Rice production at 208,464 million cwt, from 222.133 million last year. Long Grain production was estimated at 154.468 million cwt, from 172,029 million last year.

The cash market has been slow with low bids from buyers in domestic markets and average or less export demand. New crop harvesting has started in Louisiana with reports of good but not great yields and quality. There is more concern about the crops in Arkansas where it has turned very hot. Milling quality of the old crop Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters. Rice is heading in most growing areas now and harvest has started near the Gulf Coast.

Weekly Chicago Rice Futures

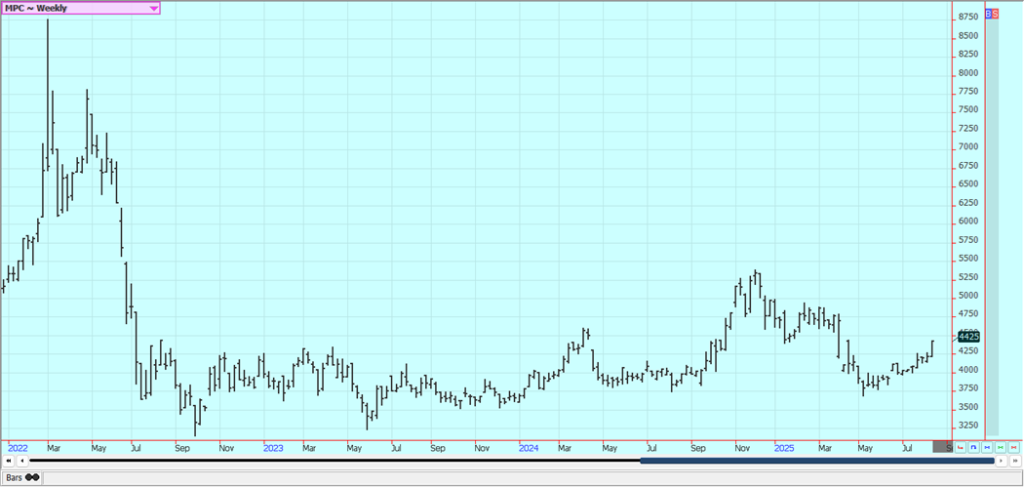

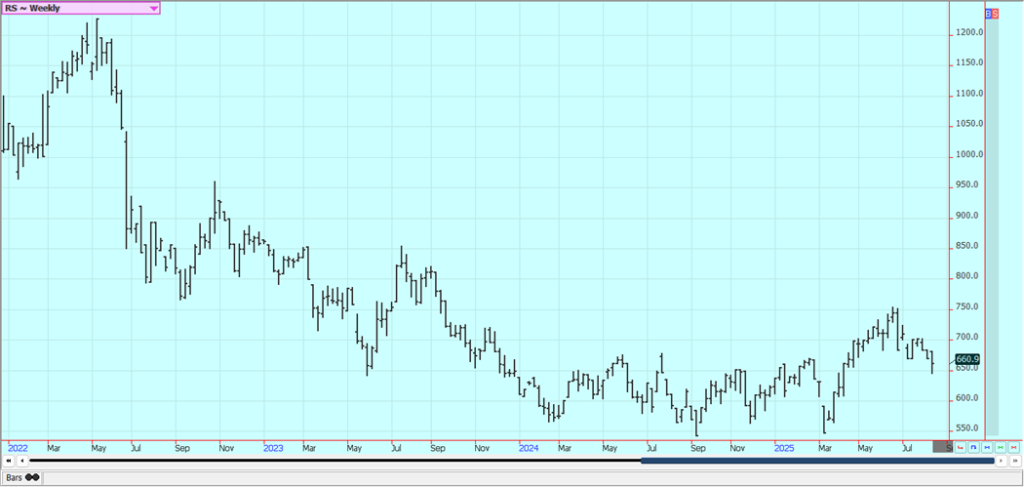

Palm Oil and Vegetable Oils: Palm Oil futures were higher today on stronger than expected export dqta for the firt half of the month. Demand for export has been strong to start the month. Futures were also higher today as the increase in ending stocks was not as much as anticipated. There was talk that India will soon be buying a lot with festivals coming soon.

Ideas that current increased production levels mean higher inventories in MPOB monthly data are still around. Canola was lower last week as China had imposed a punishing tariff on Canola imports from Canada in retaliation for Canadian tariff imposed on Chinese goods. Trends are mixed on the daily charts and on the weekly charts. The weather has generally been dry for crop development in the Prairies with warm and dry weather still around.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

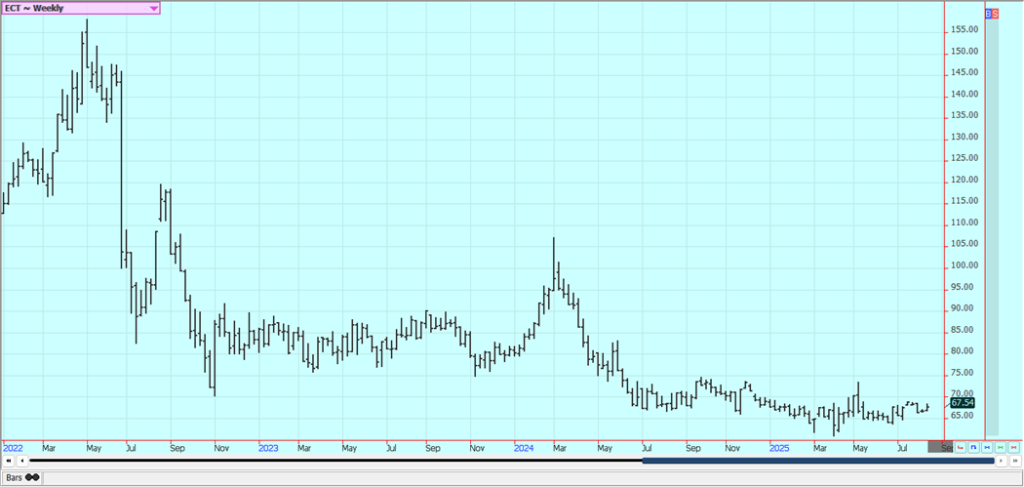

Cotton: Cotton was higher last week partly in response to the USDA reports on Tuesday that showed reduced production from reduced planted area. The USDA WASDE reports showed production of 13.214 million bales. US ending stocks were estimated at 3.60 million bales, from 4.60 million last month. World stocks were estimated at 73.9 million bales, from 77.3 million last month. Better weather is expected for the Delta and Southeast for the coming week as crop condition reports were mostly unchanged. The weekly export sales report showed weak demand once again, but demand was improved for the week.

The economic news on Friday of weaker than expected jobs data from the Commerce Dept for the recent quarter caused the stock market and crude oil and grains to sell off. There are still reports of hotter and drier weather in West Texas. There are still ideas that growing conditions are generally good. There are still reports of better weather in Texas and into the Southeast and demand concerns caused by the tariff wars are still around. It is starting to turn dry in west Texas again, however. Condition is rated behind last year. The monsoon in India is good and a good production there is possible.

Weekly US Cotton Futures

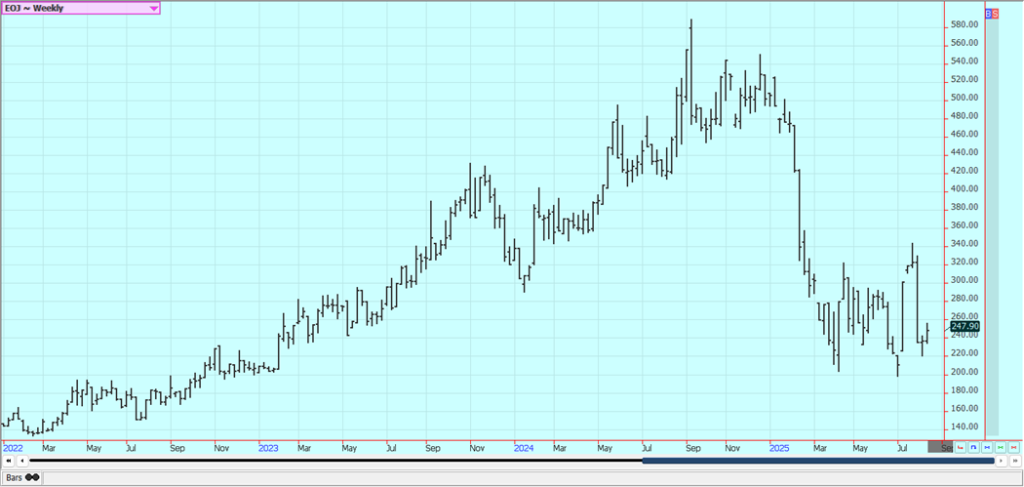

Frozen Concentrated Orange Juice and Citrus: Futures were a little higher last week on reports of freezing temperatures in production areas of Brazil, the major exporter of FCOJ to the US and the world. Temperatures there turned more moderate late in the week. Trends are turning up on the daily charts. Selling was seen in response to news that President Trump had decided to remove OJ from the punishing tariffs on Brazil it announced earlier in the year.

So, the actions by the president have created major highs and lows in the market. Development conditions are good in Florida now with daily rounds of showers. The poor production potential for the crops comes from weather but also the greening disease that has caused many Florida and closed near the lows of the week producers to lose trees.

Weekly FCOJ Futures

Coffee: New York and London were both higher last week with reports of freezing temperatures near Coffee areas of Brazil. Loss reports were not confirmed. Support also came from reduced deliverable supplies for the New York exchange. Robusta is still more available to the market and with Brazil looking for new markets not in the US for its Coffee due to the US tariffs imposed on imports from Brazil.

Arabica has been weaker recently also on the current good weather in Brazil. Prices had been dropping for several weeks and are much more moderate than before as supplies available to the market have ticked up. The Brazil Robusta harvest is over, and Indonesia continues to harvest. Vietnam is done with its harvest. The Brazil Arabica harvest is near the end and is expected to be less this year.

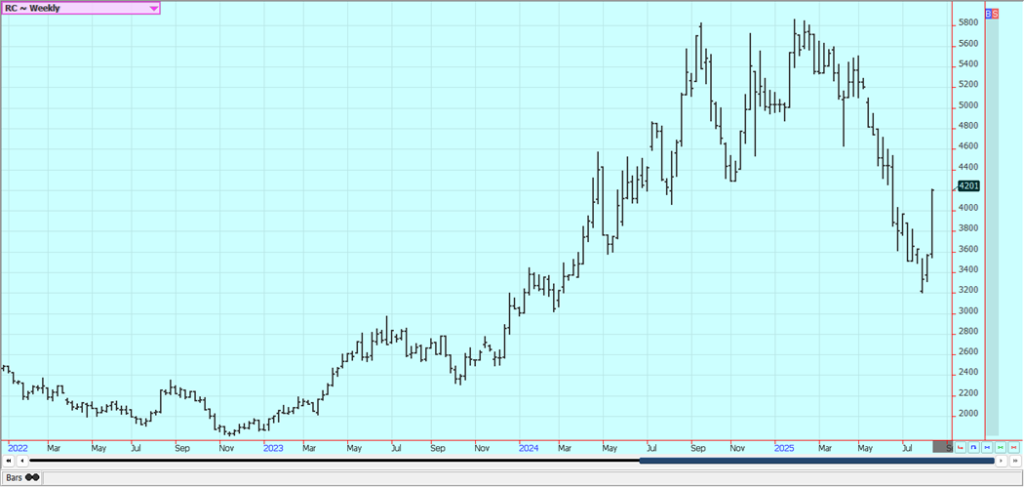

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London were higher last week. Ideas are that the losses from a Brazil freeze could be significant, but temperatures are moderate now. There were ideas of less European production this year that could rally prices later in the year but have drawn no interest so far. Pakistan has issued a new international tender earlier in the week to buy 100,000 tons of White Sugar. Ideas of good supplies for the market from good growing conditions for cane and beets around the world continue.

The South Center Brazil harvest is faster now amid drier conditions. Production in Center-South Brazil has also been strong. Good growing conditions are reported in India and Thailand after a fast start to the Monsoon season. Good rains are still reported in Thailand. Sugar prices in Brazil are now cheap enough that at least some refiners could increase ethanol production and cut back on Sugar production. However, the total recovered Sugar juice has been less in Brazil this year. UNICA said on Friday that center south Brazil Sugar production was 3.61 million tons in the second half of July, down 0.8% from last year. Sugarcane production was down 3% at 50.2 million tons.

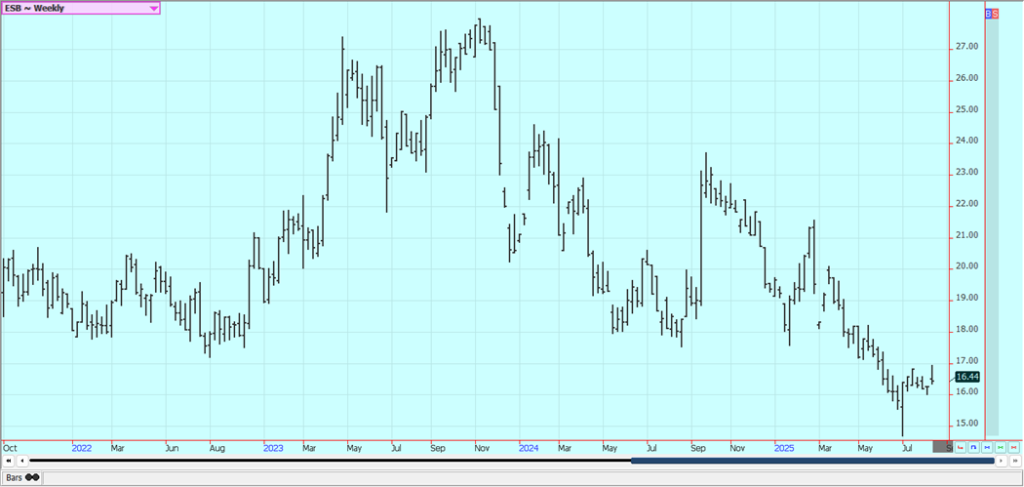

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: Both markets were a little higher last week on reports of increased selling pressure from producers after the recent rally and on reports that temperatures were moderating after reports of cold temperatures in Cocoa areas of Brazil. There are ideas that some of the Cocoa was damaged. Demand ideas were down on Friday after the Swiss Chocolate Association said that the Trump tariffs would hurt sales by its members into the US.

The President imposed a 34% tariff on Switzerland last week. There are still reports of increased production potential in other countries outside of West Africa, including Asia and Central America. The market anticipates good demand and less production from Ivory Coast and Ghana. Adequate soil moisture in Ivory Coast is fostering abundant flowering on trees, signaling a healthy October-to-March main crop.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Michael Fischer via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Markets7 days ago

Markets7 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Markets2 weeks ago

Markets2 weeks agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Fintech2 weeks ago

Fintech2 weeks agoFintech Alliances and AI Expand Small-Business Lending Worldwide