Featured

Is the coronavirus affecting commodities prices?

Corn moved higher last week and closed above the previous week’s highs and in line with the closes for several weeks before that. Wheat markets were a little lower for the week and were led lower by Chicago SRW. Soybeans closed near unchanged after probing the recent highs on the weekly charts. World vegetable oils markets were higher and were led higher by Palm Oil.

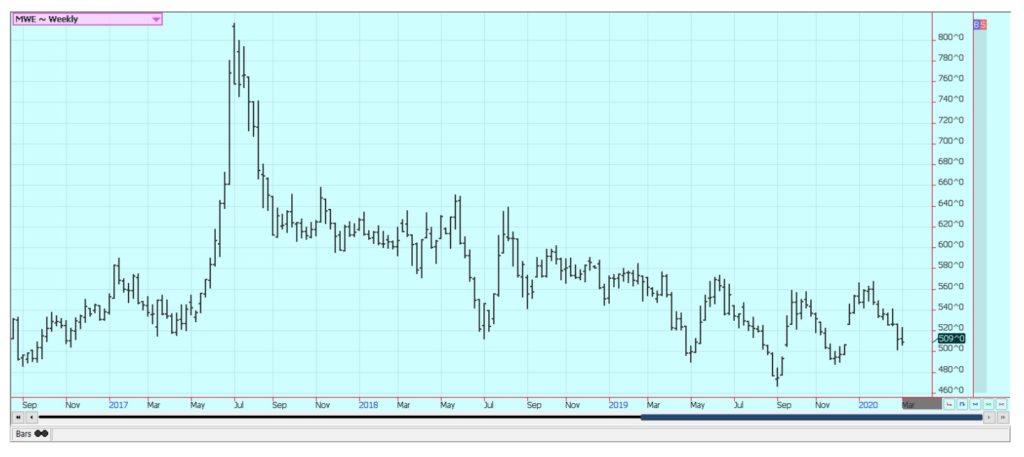

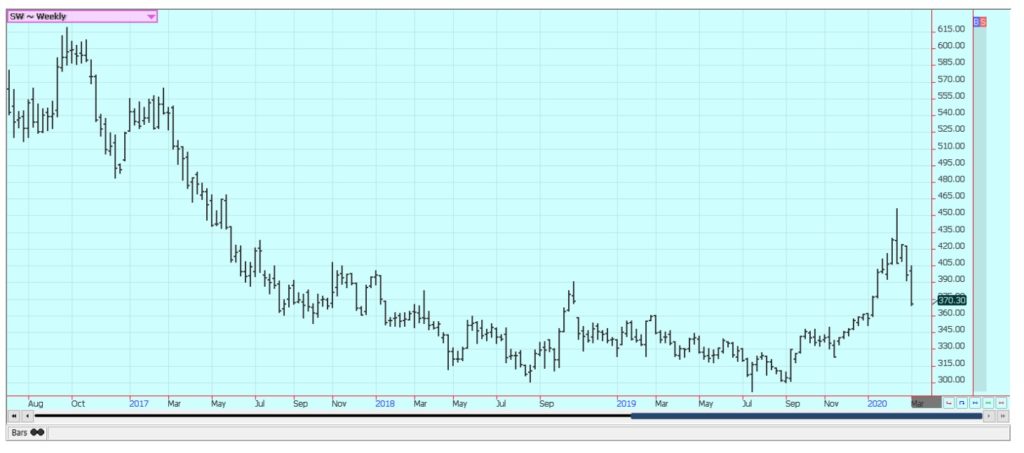

Wheat

Wheat markets were a little lower for the week and were led lower by Chicago SRW. The sellers appeared to be mostly speculators and funds getting out of long positions. The move lower came because of weaker world prices. Russia continues to lower its prices in an effort to stimulate sales and to move the old crop Wheat out of storage before the new crop comes in. East and West Europe have weaker prices as well. US Wheat continue to move along at a good pace. There is a space for US Wheat in the world market even with all of the competition from Russia and also Europe. The competition for sales is strong as seen in the Russian and European pricing and this is what has hurt the futures prices recently. The stronger US Dollar makes it more difficult for US producers and exporters to sell US Wheat into the world market. The US Dollar was weaker last week but still remains at strong levels. Chart trends are down.

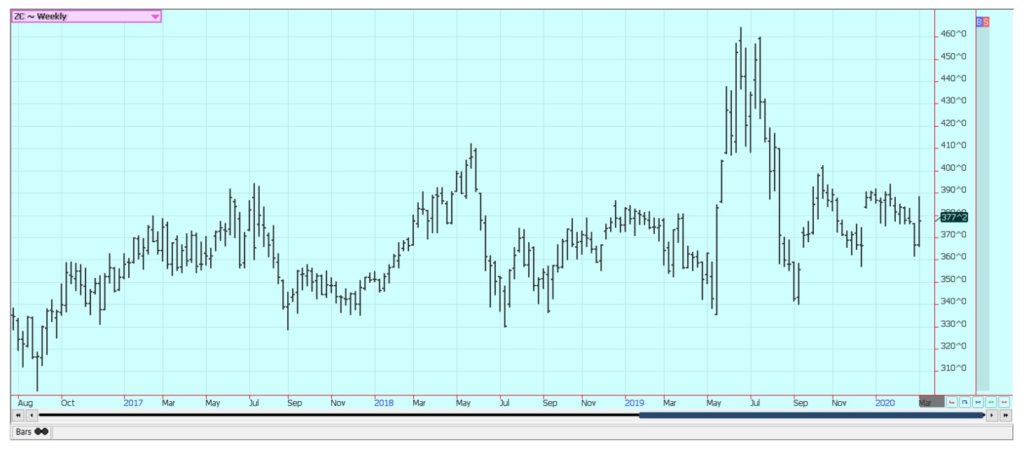

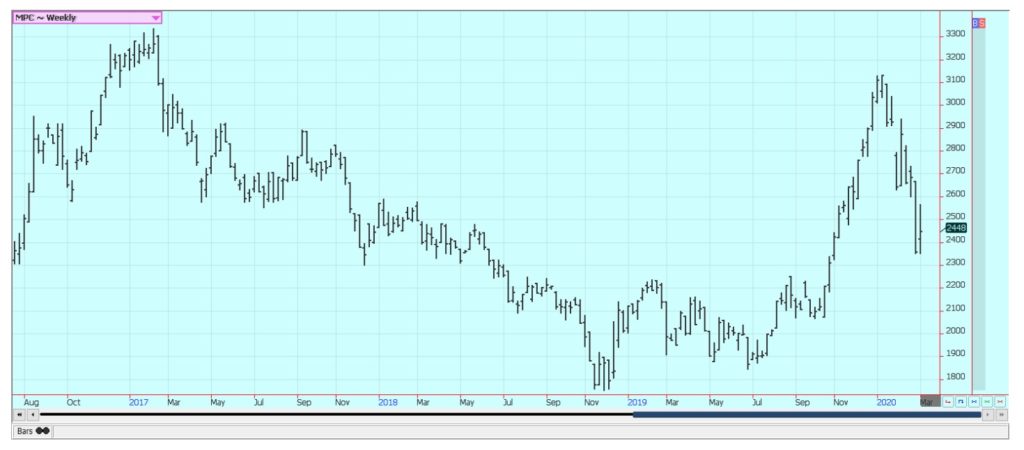

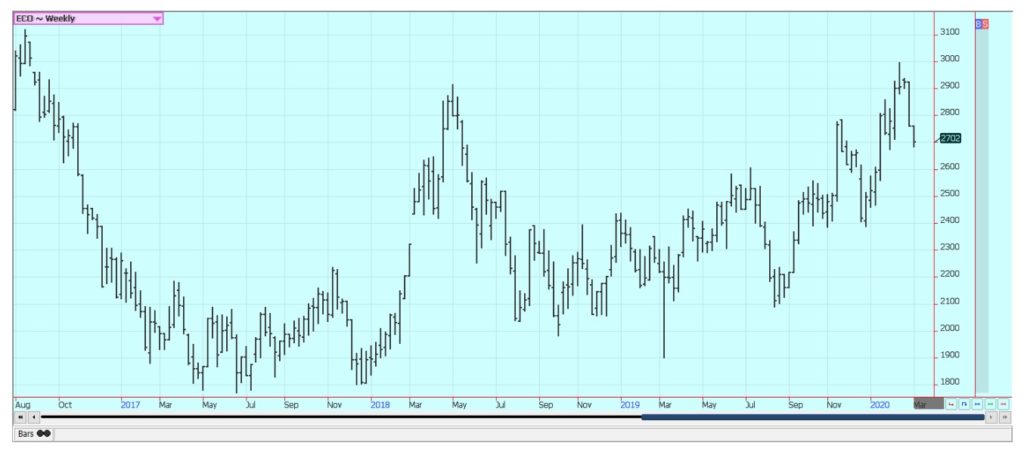

Corn

Corn moved higher last week and closed above the previous week’s highs and in line with the closes for several weeks before that. It tried to push to test resistance areas above 390 May but could not get that job done and encountered some selling to end the week. Oats were sharply lower. Demand for US Corn has been good despite everything that has been against big export sales. The spread of the Coronavirus was just one factor in the move lower. The Coronavirus has been seen in China and neighboring countries, but now is being reported all over the world. The US Dollar did move lower last week but remains at very high levels. Export demand was solid last week, and ethanol and other industrial demand has started to improve but faces an uncertain road ahead, in part due to weaker petroleum demand ideas caused by the virus. Export demand remains an open question despite the big sales in the last few weeks and the trade deals consummated in the last couple of weeks with Canada, Mexico, and China. Much of the improved ethanol demand will be seen if and when China starts to buy. Feed demand is improved.

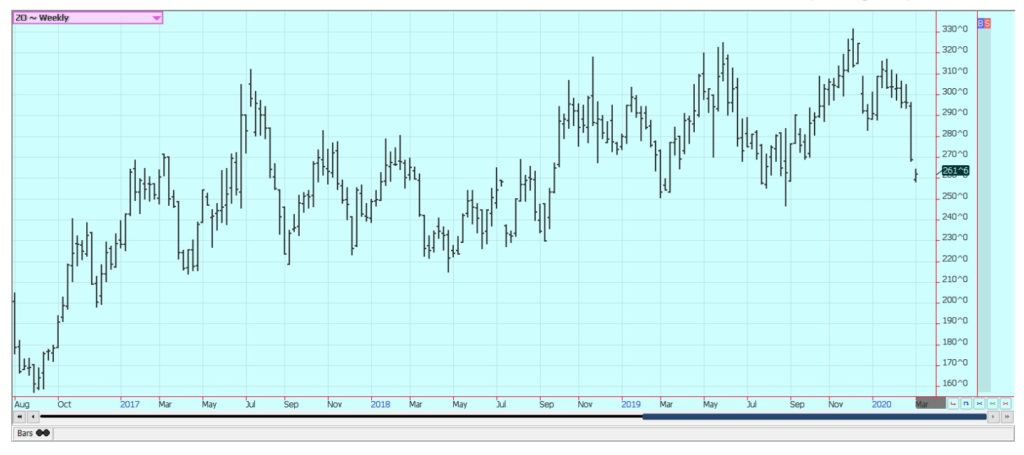

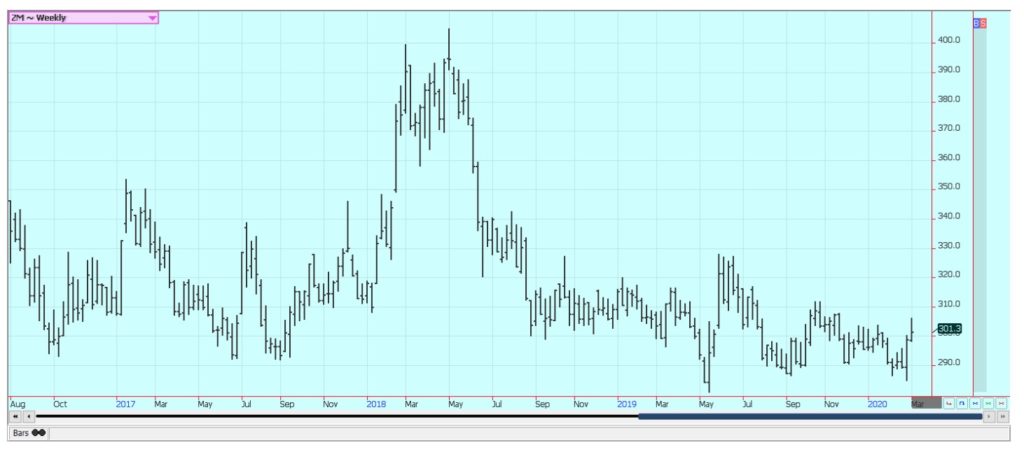

Soybeans and Soybean Meal: Soybeans closed near unchanged after probing the recent highs on the weekly charts. Soybean Meal was higher but well off the highs after making new highs for the move. It seems like everyone is waiting for the trade deal with China to kick in and for them to buy in quantity and there was some talk last week that China had inquired for cargoes of Soybeans from the PNW. This talk was not confirmed. China has not yet asked for a modification of the terms due to the Coronavirus outbreak currently decimating the south central area of the country and it is no longer expected to seek any modifications. There are hopes that China will start to buy in earnest from the US starting very soon. A lot will depend on the price of US Soybeans and those from Brazil and Argentina. Lower prices there will hurt overall demand here, and lower prices are very possible in Brazil. Brazil is harvesting now and yield reports from the field indicate that a bumper crop is coming. Argentina has been dry and has just raised its export tax by 3%. That will help push export demand to Brazil and potentially the US. A strong US Dollar has hurt US export chances in all products. The US Dollar was lower last week.

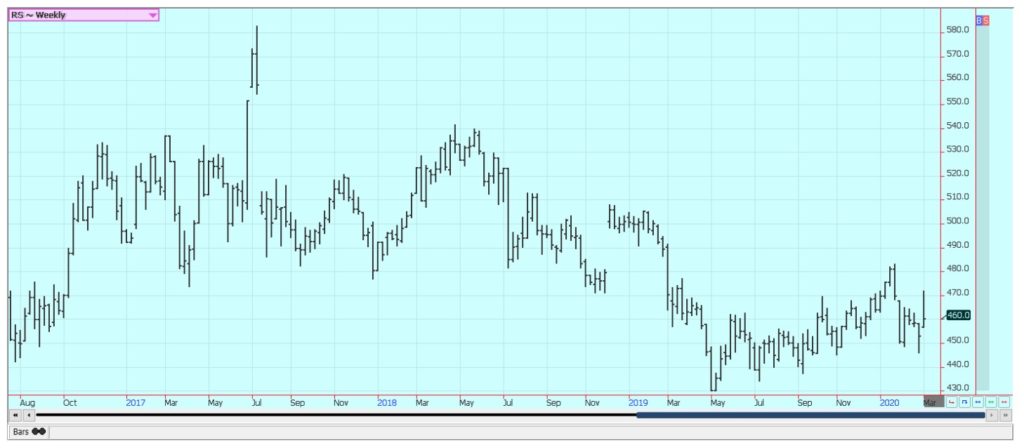

Rice

Rice was sharply lower after running out of reasons to buy. The domestic situation remains tight and sales to western countries have been good although below the levels of the previous weeks. Some producers are selling the next crop and some significant hedge selling has been seen in new crop months in futures. More selling from producers of the next crop is expected on any further rally attempts. Demand for US Rice remains generally positive and the export sales pace in general has been very good. The US domestic market is now quiet. It was a short crop grown under very difficult conditions, so producers are willing to hold out for better prices. Those that sold early have seen the Rice consumed already. Mills and exporters are thought to be covered for now.

Palm Oil and Vegetable Oils

World vegetable oils markets were higher and were led higher by Palm Oil. All markets are still factoring in potential demand changes but the demand outlook might be starting to improve. India was a buyer of Malaysian Palm Oil last month and so was China. Chinese demand had been hurt due to the outbreak of the Coronavirus. Demand for Palm Oil from China could take a hit with the new trade agreement between the US and China, but Malaysian authorities expect to send good volumes of Palm Oil there.

Cotton

Cotton was higher last week after a narrow range trade. The buying came in part due to the weaker, but still very strong US Dollar Index. The Coronavirus has the chance to hurt trade in Cotton between the US and China. Chinese buyers might need less Cotton now as factories inside their country were closed for an extended holiday. All are reopen now, but the manufacturing pace has been slow. China has also been slow to buy products from Southeast Asia and demand for US Cotton has been hurt in the entire region. The strong US Dollar hurts trade anywhere and pushes buying to alternative growths like Brazil. The US Dollar index was weaker last week but still gained on the Brazilian Real. Brazil has the quality to compete with the US and the Real is much cheaper than the US Dollar right now.

Frozen Concentrated Orange Juice and Citrus

FCOJ was slightly higher for the week in narrow range trading. There is a big crop of Oranges out there with not many outlets for consumption. Good growing conditions and increased oranges production estimates by USDA this season have been bearish. The weather has been great for the trees as there have been frequent periods of showers and no severe storms so far this year. Many areas have been dry lately and irrigation is being used. Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high.

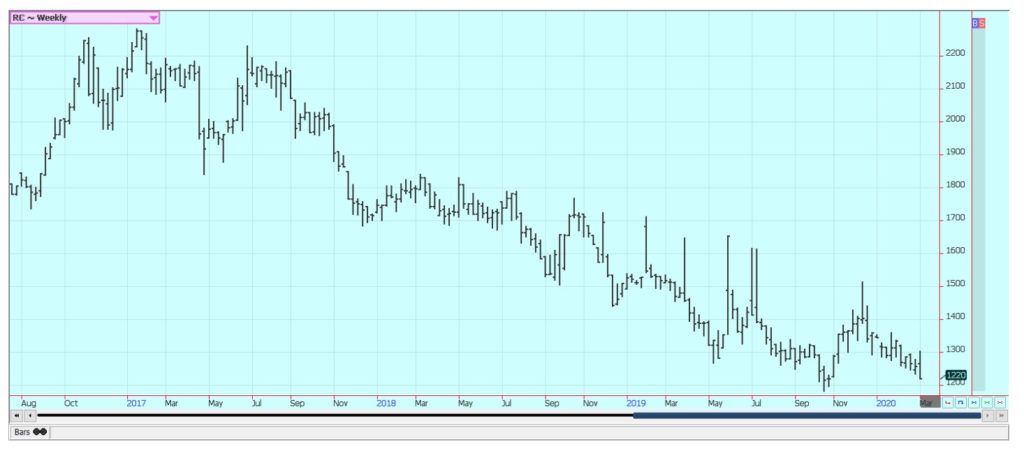

Coffee

Futures were lower in New York and a little lower in London. It was a wild week of trading that saw NY futures trade above the 120.00 per pound level before collapsing. Support came from a lack of supply in Brazil at this time and on concern that previous bad growing conditions have hurt production potential in the Cerrado, home of about 10% of all Brazil production. Many producers and exporters have run out of Coffee in storage to sell. The chart trends are mixed to up in New York and mixed in London due to the big production ideas, and futures could form a bottom in the current trading range. Rains were reported in Brazil Coffee areas over the weekend and showers are continuing through this weekend. It is dry in other parts of Latin America. Central America has had less than normal rains, especially in Honduras. The Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low. Vietnam exports remain behind a year ago, but the market anticipates bigger offers. Vietnamese crops are expected to be big despite uneven growing conditions earlier in the year. The Real lost once again to the US Dollar Index and remains very cheap.

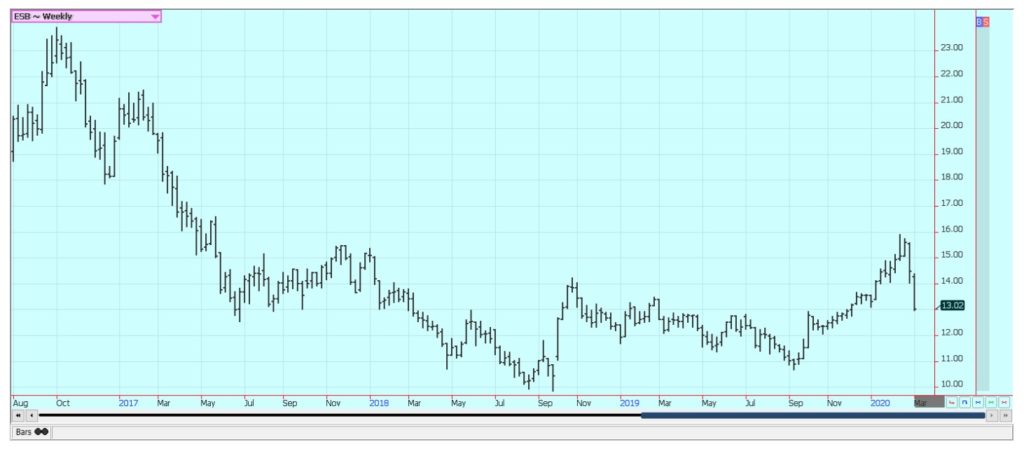

Sugar

New York and London closed sharply lower again on the back of weaker petroleum futures. The weaker petroleum futures make higher priced ethanol that much more expensive to blend and cuts demand. That makes more Sugarcane available for processing into Sugar. The Brazil mills are trying to cover the lack of White Sugar in the market. Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. Reports of good weather in Brazil imply good crops there. Farmers have been selling to mills but the harvest is now almost over so the supplies will start to tail off. Brazil mills continue to favor ethanol in the production mix, but current higher prices for Sugar make it economic for more processing to Sugar instead of ethanol at this time.

Cocoa

New York and London closed lower for the week and trends remain down on the weekly charts. Funds and other speculators were net sellers. Harvest is now almost over for the main crop in West Africa and the results so far are very good. Ideas are that demand is currently strong but less than before. The reports from West Africa imply that a big harvest is possible in the region. Ivory Coast arrivals are strong and are above year ago levels. The weather in Ivory Coast is good. The weather is too dry in Ghana and Nigeria and there are fears that the mid crop is not developing well at this time.

—

(Featured image by Pexels from Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech2 weeks ago

Biotech2 weeks agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Africa7 days ago

Africa7 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Fintech4 days ago

Fintech4 days agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps