Featured

Cotton Futures Trends Remain Sideways

Cotton was higher last week and trends are trying to turn up in this market but so far the trends remain sideways. The trade is still worried about demand moving forward due to recession fears and Chinese lockdowns but is also worried about total US production potential. The USDA crop condition rating were a little lower again this week with the biggest problems still found in Texas

Wheat: Wheat markets were higher on Friday and for the week but held to recent trading ranges as the harvest for Winter Wheat wraps up and as the Spring Wheat harvest expands. Demand needs to improve as export sales have not been strong for the last year despite weaker production for much of the world and the war in Ukraine that has held up shipments of Wheat from there and from Russia until recently. The markets remain affected by the war in Ukraine and the chances for increased exports from both Ukraine and Russia. Those chances are very strong right now. Russia reports that it has produced a big crop and has reduced export taxes recently in an effort to get Wheat sales on the books. Ukraine has taken advantage of the shipping corridor agreement with the UN and Russia and has been shipping Corn and Wheat. Europe is too hot and dry and the US central and southern Great Plains have also been too hot and dry. Dry weather is affecting the Indian production as well.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed higher in anticipation of bullish production estimates from Pro Farmer and on talk that China is about to end its zero-tolerance Covid policy and start to reopen the economy. That could mean new Corn demand for the market. This talk has not been confirmed. Corn followed Soybeans and Wheat higher. South Dakota yield potential was rated as below last year and the five year average. The crop tour rated Nebraska and Indiana at below last year and the average as well. Iowa crops were also below the three year average and last year. The eastern leg of the tour found above average yield potential in Ohio and parts of eastern Indiana but below average yield potential for Indiana as a whole. Illinois crops were below last year but above the three year average. Minnesota crops were rated above last year and the three year average and was the only state to be so rated. The Pro Farmer national Corn yield was estimated at 168.1 bushels per acre Basis levels in the Midwest are strong amid light farm selling. It is still very hot and dry in parts of China and there is increasing concern about Corn production there this year. It has also been very hot and dry in Europe.

Weekly Corn Futures

Weekly Oats Futures

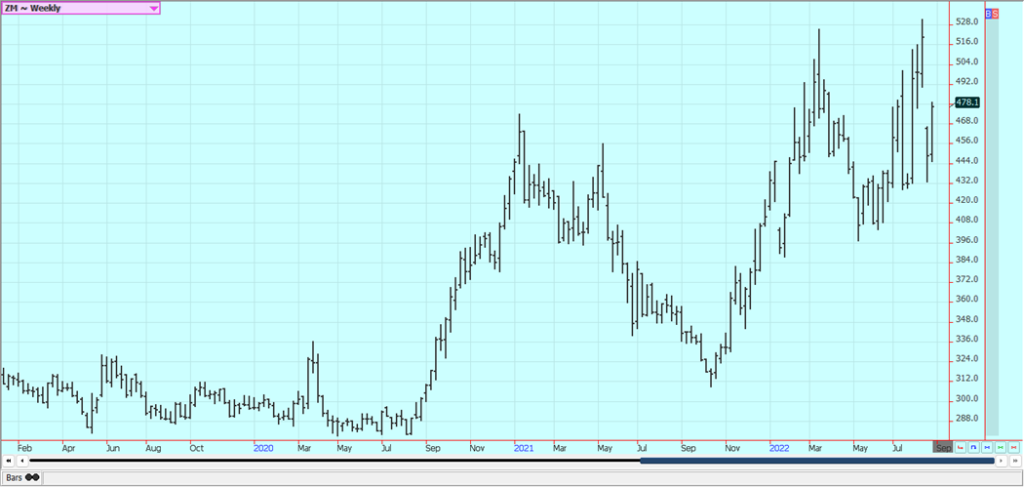

Soybeans and Soybean Meal: Soybeans and the products were higher on Friday and for the week. Worse than expected crop condition ratings posted by USDA as well as the crop tour results from the Pro Farmer crop tour remain the best support for futures. The tour does not predict yields for Soybeans, but it does count pods in a 3 foot by 3 foot square. The counts showed potential for poor crops in South Dakota but above average crops in Ohio and parts of eastern Indiana. Tour participants rated the Soybeans counts in Nebraska as below last year but in line with the three year average. Iowa crops were also below last year and the three year average. Indiana counts were below last year and the three year average. Illinois crops were below last year but above the three year average. Minnesota crops were rated above last year and the three year average and were the only crops so rated. The national yield estimate from Pro Farmer was 51.7 bushels per acre. Basis levels are still strong in the Midwest as demand has been very strong with the purchase of over 500,000 tons of new crop Soybeans by the Chinese last week. There are still renewed Chinese lockdowns and there are fears that China has been importing less as a result. However, there was talk on Friday that the Chinese government is about to lift controls and end its zero tolerance policy to create new economic growth. This talk has not been confirmed. Brazil is still exporting Soybeans so the US demand could be weaker. Brazil is still selling Soybeans as well, but for now the Chinese appear to be buying here. There is still a chance for weaker demand for US Soybeans once the Chinese demand is satisfied.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

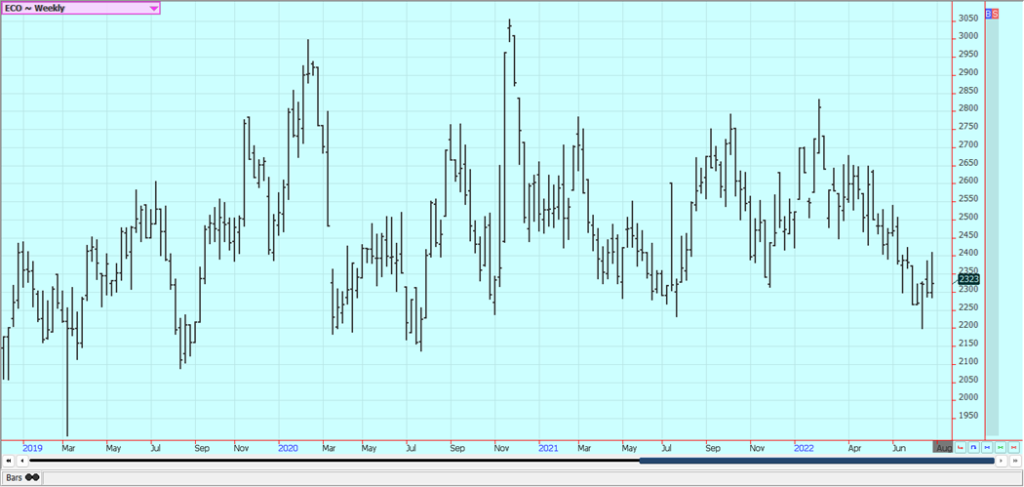

Rice: Rice was higher Friday in choppy trading. The charts are in mostly a sideways mode but appear to have rejected a move to lower prices. The Texas harvest is in full force and yield reports have been variable as have been quality reports. Some producers are getting done with harvesting in Texas as well as in southern Louisiana Yield reports have been generally good in Louisiana and quality reports are generally good. Trends are turning up on the daily charts. Crop conditions are mostly good to excellent for now in Arkansas and Mississippi.

Weekly Chicago Rice Futures

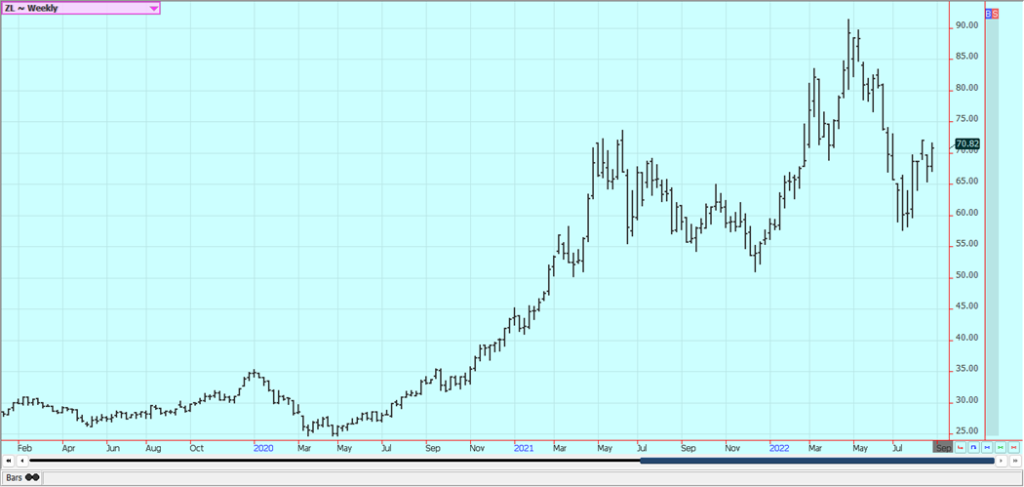

Palm Oil and Vegetable Oils: Palm Oil was a little higher last week but closed near the lows of the week. MPOB data will be released this week and will help direct the next move for the futures market. Ideas are that supply and demand will be strong. Malaysia and Indonesia are making moves to expand demand in the face of increasing supply. Refiners in Malaysia have pledged to lower the price of cooking oil for internal consumption in an effort to help control inflation. Indonesia is offering incentives to move the product into domestic and export channels. Export reports from the private sources are showing the weaker demand this month and this has been the trend for the last few months. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was higher along with Chicago Soybean Oil. Soybean Oil has been the strongest of the world vegetable oils markets despite a strong US Dollar as ideas are that Soybeans production can be less this year The Canola growing conditions are much improved with rans being reported in recent days but the rains are bringing some concerns about disease showing.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

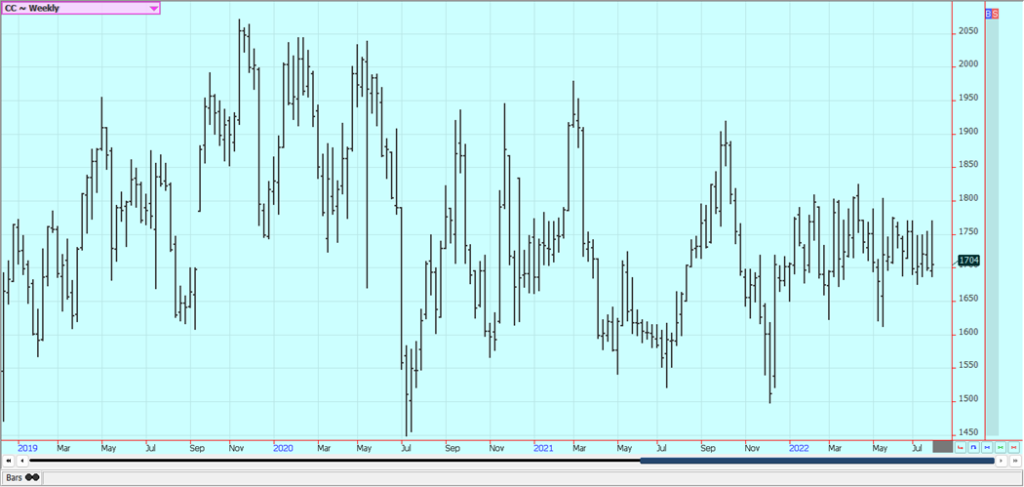

Cotton: Cotton was higher last week and trends are trying to turn up in this market but so far the trends remain sideways. The trade is still worried about demand moving forward due to recession fears and Chinese lockdowns but is also worried about total US production potential. The USDA crop condition rating were a little lower again this week with the biggest problems still found in Texas. Conditions in Georgia and the rest of the Southeast and Delta appear to be mostly good to excellent. The Chinese had been reopening the economy and country lately as Covid faded, but some reports of a new variant found there could shut the country down again in the near term. The quarantine is one week now instead of one month as before. The cities of Shanghai, Shenzhen, and Wuhan are all subject to lockdowns of one type or another. It is possible that the continued Chinese lockdowns will continue to hurt demand for imported Cotton for that country and that a weaker economy in the west will hurt demand from the rest of the world. Current weather forecasts call for hot and dry conditions for much of the Great Plains including west Texas Cotton area.

Weekly US Cotton Futures

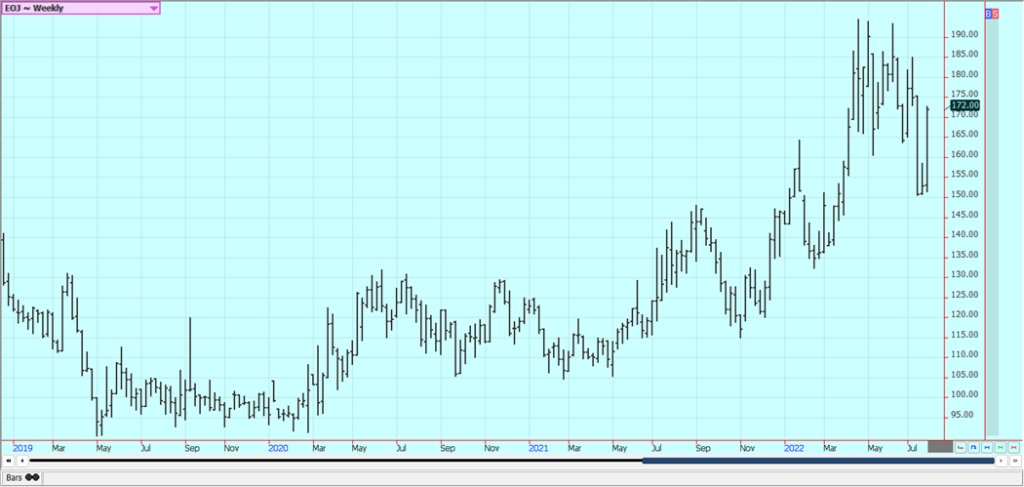

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week and trends are up on the daily and weekly charts. A price recovery has started as the harvest winds down. The recent market weakness has been dramatic since the market made new contract highs earlier this month. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

Weekly FCOJ Futures

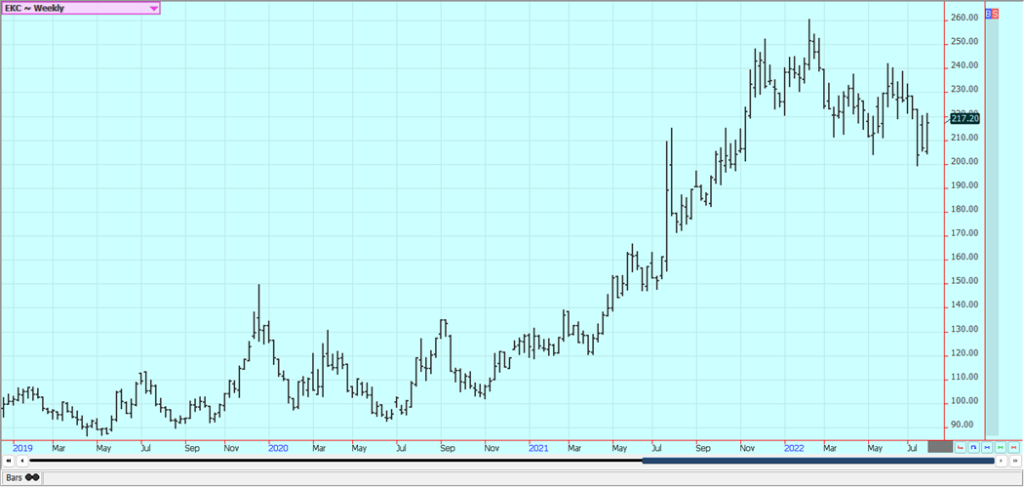

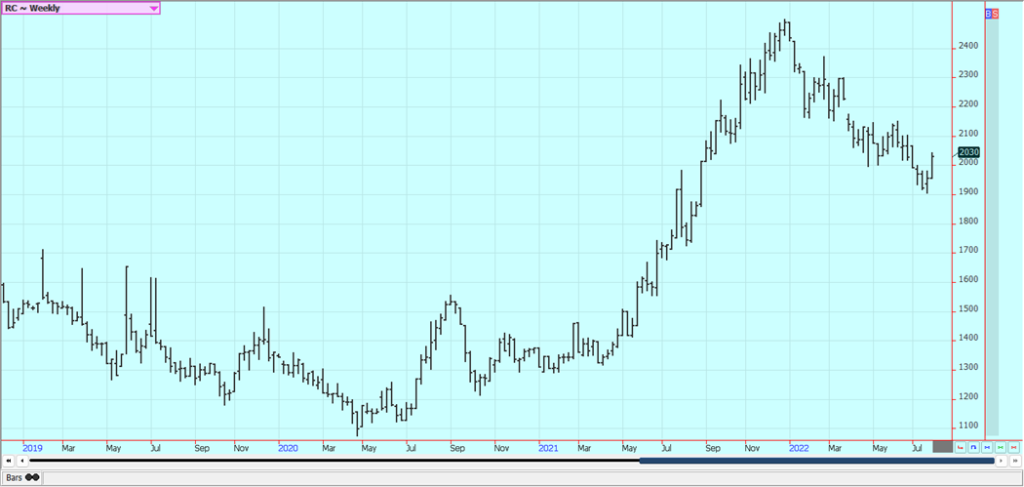

Coffee: New York and London were higher last week on renewed fund and other speculator buying interest. Some speculative long liquidation was noted late in the week before the end of the month. Trends are mixed on the daily charts in both markets. Certified stocks keep dropping but GCA stocks are holding strong. Demand for Coffee overall is thought to be less but the cash market remains strong. There is less Coffee on offer from origin, with Brazil offering less and Central America and Vietnam offering less as well. The weather in Brazil is good for Coffee production and any harvest activities. Temperatures are above normal in Brazil and conditions are mostly dry. The dry weather is raising some concerns about the next crop potential but it is normally dry at this time of year.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

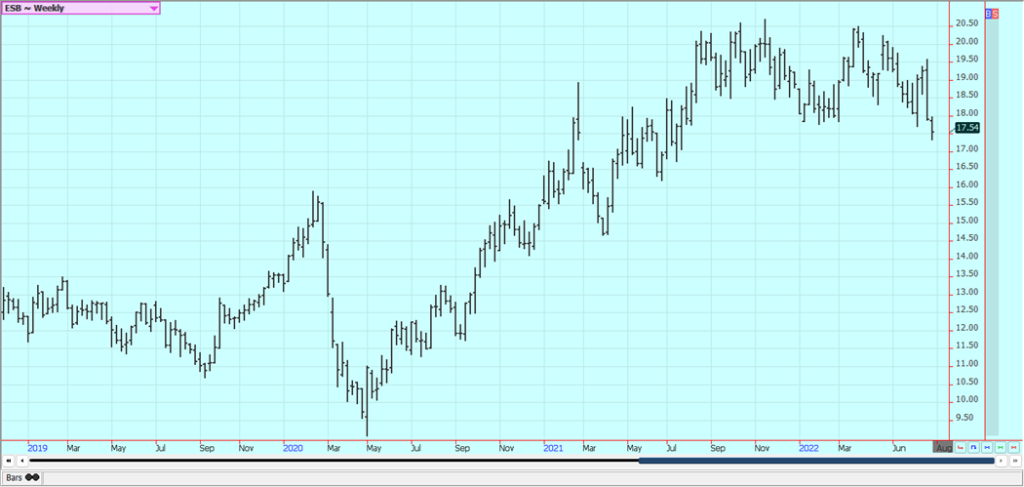

Sugar: New York and London closed a little lower last week on what appeared to be speculative selling based on production data from Unica in Brazil. Unica estimated the Sugar production at about 2.97 million tons, above trade estimates near 2.84 million. Sugarcane crushed totaled 46.34 million tons. The selling in these markets has been relentless for the last week to 10 days. The New York market is worried that the lack of clarity about ethanol demand in Brazil will force mills down there to produce more Sugar for export. The London market had been looking for increased supplies from origin and now is more worried about demand after recent price strength. Trends are down in New York and in London. Brazil is reported to have a big crop of Sugarcane coming and as it is harvesting its crop of Sugarcane and turning much of it into Ethanol but is still making some Sugar and some of that Sugar is making it into export channels. The production mix could change in the short term to include more Sugar. Reports from India indicated that conditions are generally good for Sugar production. Monsoon rains have been good in India this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

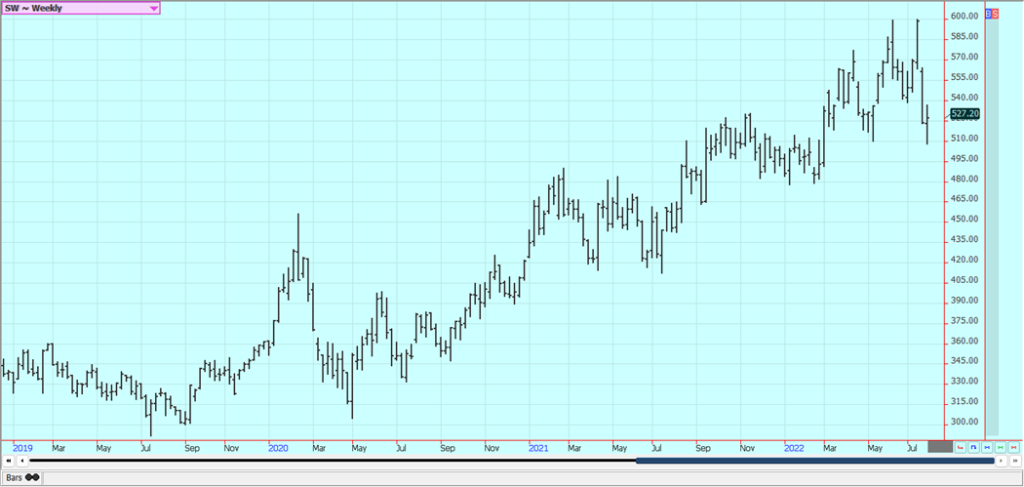

Cocoa: New York and London were a little lower last week. Supplies of Cocoa are as large as they will be now for the rest of the marketing year but the market is trying to hold the recent lows. Trends are turning up in both markets. Reports of sun and dry weather along with very good soil moisture from showers keep big production ideas alive in Ivory Coast. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa but the harvest should be winding down now. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain. The weather is good in Southeast Asia. Ivory Coast arrivals are now estimated at 2.013 million tons for the current marketing year, down 4.1% from the previous year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by pianweizhuannong via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Biotech2 weeks ago

Biotech2 weeks agoWhy Bioceres Shares Slide Into Penny Stock Territory

-

Crowdfunding4 days ago

Crowdfunding4 days agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Africa2 weeks ago

Africa2 weeks agoAgadir Allocates Budget Surplus to Urban Development and Municipal Projects

-

Cannabis12 hours ago

Cannabis12 hours agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions