Markets

USDA Outlook Supports Cotton Gains Amid Favorable Growing Conditions

Cotton rose last week, with daily charts turning up while weekly trends stayed sideways. USDA kept U.S. production at 13.224 million bales and ending stocks at 3.60 million. World stocks fell on reduced importer levels. Growing conditions remain favorable in the U.S. and India, though demand concerns persist amid ongoing tariff wars.

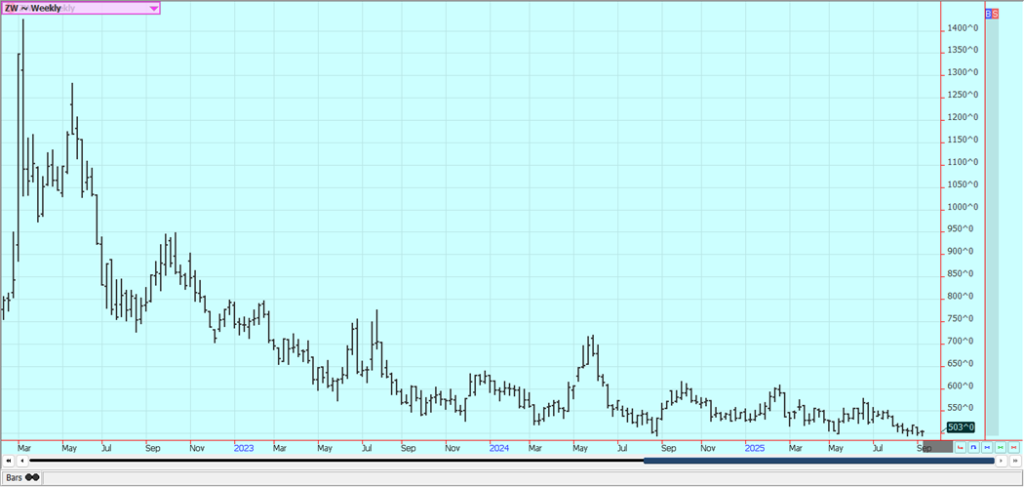

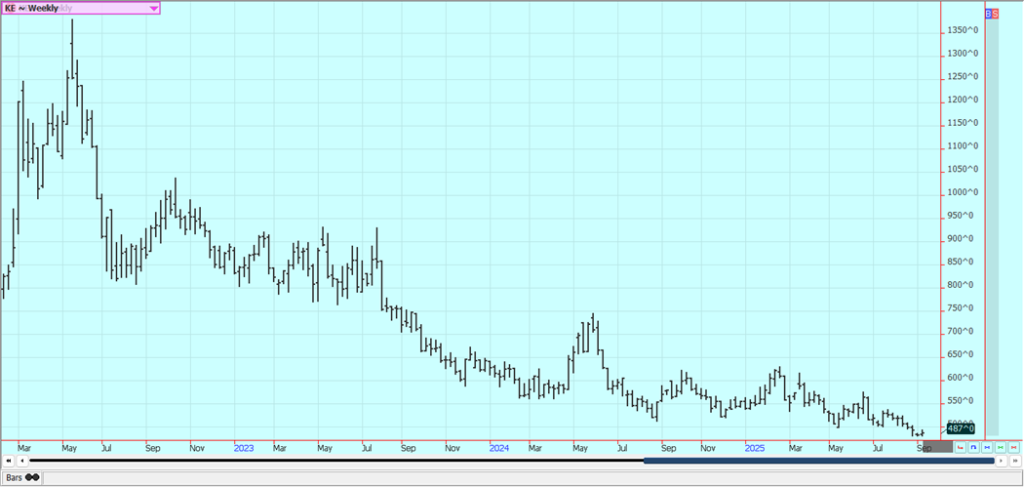

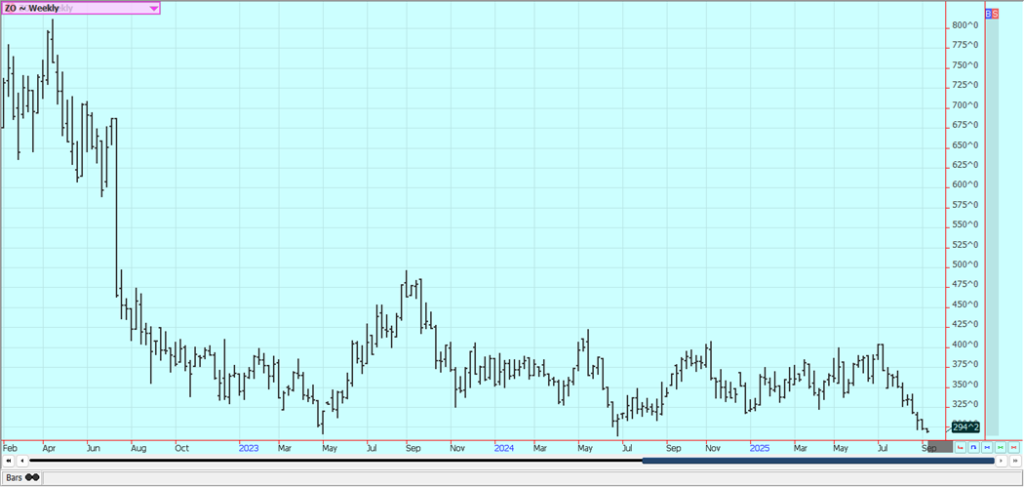

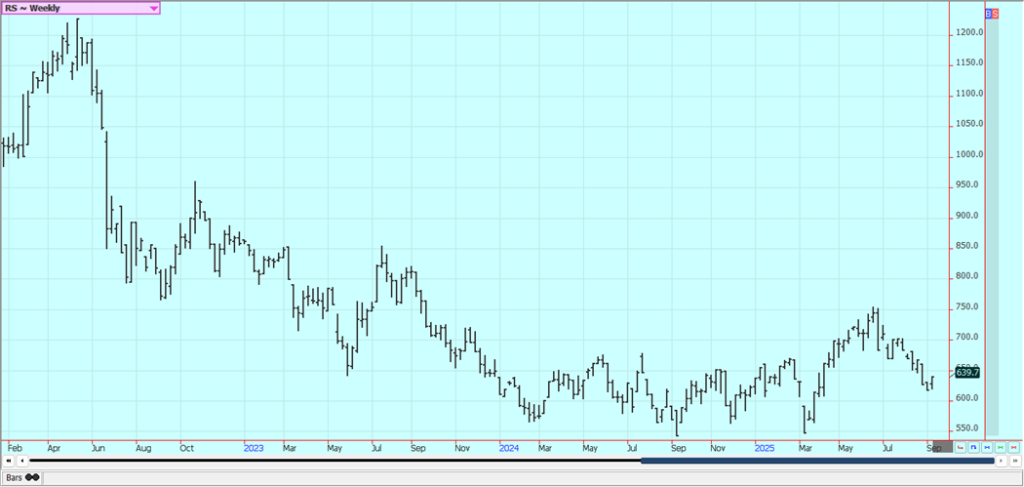

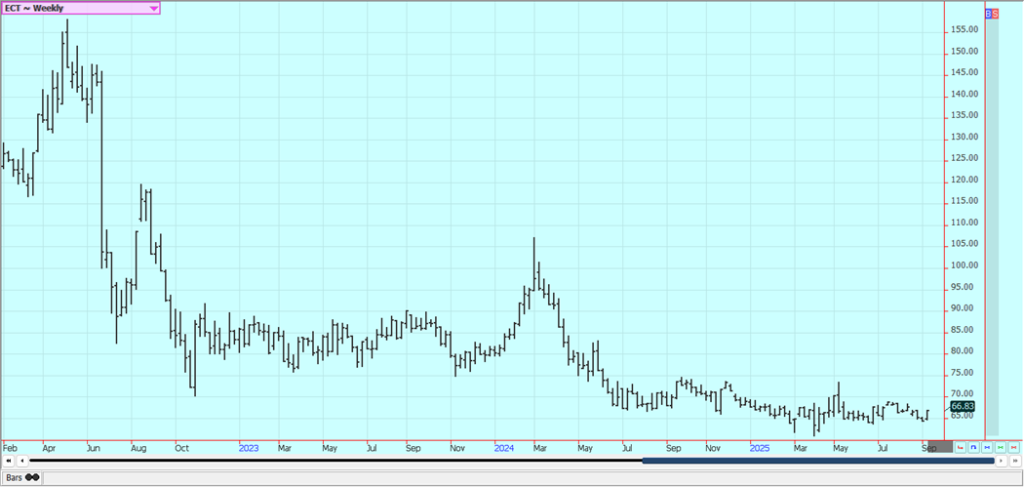

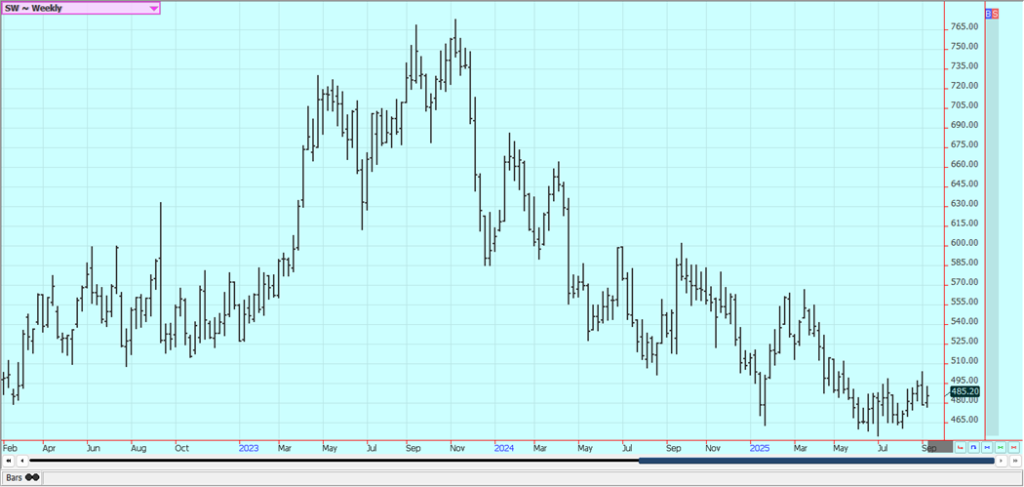

Wheat: Wheat was a little higher last week, but trailed the rallies in Corn and Soybeans as reports of weaker Russian prices are still around. USDA cut US ending stocks to 844 million bushels and cut world ending stocks to 262.4 million tons. Sovecon in Russia raised production estimates to 86.1 million tons, from 85.4 million in its previous estimate, due to increased Spring wheat production found in the Volga valley region. However, other private analysts question the big production estimates put forward by Sovecon and other large sources and claim they are way too large.

The Ruble has been weaker to help support higher internal prices paid to farmers in Russia. It remains too dry in Winter Wheat areas and too wet in Spring Wheat areas of Russia. A French government report showed plenty of production but lower quality. The Spring Wheat harvest is active and the Winter Wheat harvest is done. Rains have been good in the northern Great Plains but Canada has been a little too dry for best yield potential and the northern Plains had hot and dry areas earlier in the year. Russian Black Sea prices have been dropping as late yields have improved. Southern hemisphere crops appear to be good and Australia estimates that production this year will be high.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Unavaiable today

Corn: Corn was higher last week as the crop is maturing. Ideas are that futures have created a low as prices were able to rally on no news or bad news. The USDA reports were negative for futures as production was increased to 16.814 billion bushels on increased planted area and a decrease in yield estimates. Ending stocks were increased to 2.110 billion bushels and world stocks were decreased to 284.2 million tons. Ethanol demand was down 6% from last month at 456 million bushels and there are concerns about feed demand moving forward as feeder cattle imports from Mexico have been banned due to reports of screw worm disease in the cattle.

There are also ideas that US production might not be super strong due to disease such as rust to offset the demand losses. Temperatures should average near to above normal this week and it should be mostly dry. Most of the western Midwest has seen adequate or greater precipitation and production ideas are high. Areas east of the Mississippi River have been very dry for the last month or more. Demand for Corn in world markets remains moderate to strong. Oats were lower and made new lows on the weekly charts.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and both products were higher last week despite increased production estimates from USDA seen on Friday. Ideas are that futures have created a low as prices were able to rally on no news or bad news. USDA estimated US Soybean production at 4.301 billion bushels, from 4.292 billion last month. Yields were little changed at 53.5 bu/acre. Ending stocks were increased to 300 million bushels for the US but were a little lower for the world at 264.1 million tons.

Cool and dry weather has been seen recently in the Midwest. The dry weather could hurt pod fill and bean size. A drop in condition ratings by USDA was expected and given as a reason to buy. China has not bought US Soybeans yet and traders are worried that demand for the new crop will be a lot less this year. Good growing conditions continue in the Midwest with cool and mostly dry weather in the forecast. Prices are still higher in Brazil, but China and other buyers are still buying there for political reasons. Export demand remains less for US Soybeans as China has been taking almost all the export from South America.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

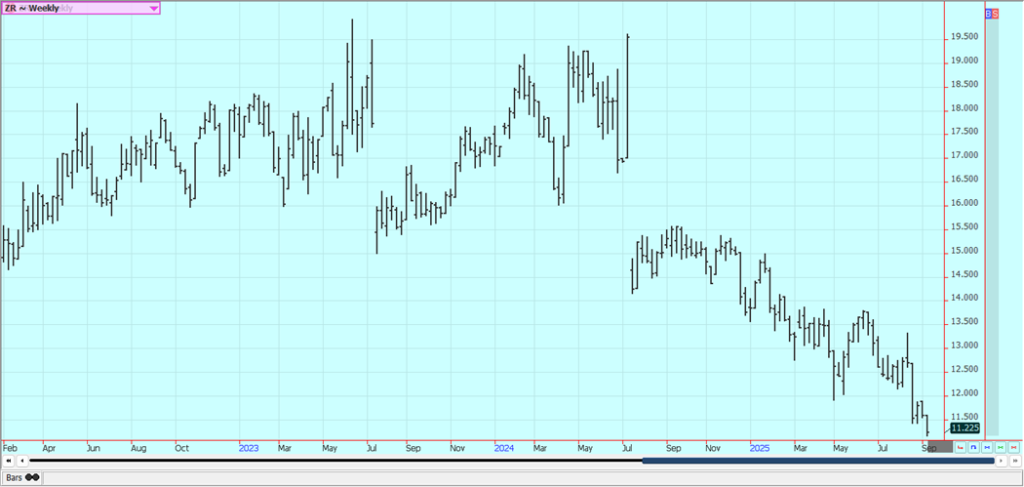

Rice: Rice was lower last week and USDA issued bearish reports on Friday. Production was higher at 208.777 million cwt on increased harvested area and a slight reduction in yields. Ending stocks were increased to 53.4 million cwt on more production and less demand, especially for export. The harvest is wrapping up in Texas and southern Louisiana. Crop condition ratings were mostly good last week. Chart trends are down on the charts.

The cash market has been slow with low bids from buyers in domestic markets and average or less export demand. Louisiana reports good but not great yields and quality. Texas reports average to below average field and milling yields. Milling quality of the old crop Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters. Harvest is increasing in Mississippi and Arkansas.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week. Demand for export has been strong to start the month. There was talk that India will soon be buying a lot with festivals coming soon. Ideas that current increased production levels mean higher inventories in MPOB monthly data are still around. Canola was higher. Concerns remain about demand potential. The Canadian government is moving now to support farmers in the face of the Chinese demand loss and also in the face of the Trump tariffs. Trends are up on the daily charts and are turning up on the weekly charts.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was higher last week and trends started to turn up on the daily charts but remained sideways on the weekly charts. USDA made few changes to the US production and supply and demand estimates, and the changes made were mostly very small. Production was estimated at 13.224 million bales and ending stock were unchanged at 3.60 million bales.

USDA did lower stocks levels for the world market, mostly by cutting major importer stocks. USDA showed improved conditions in its reports last week. There are still ideas that growing conditions are generally good. There are still reports of good weather in Texas and into the Southeast and demand concerns caused by the tariff wars are still around. The monsoon in India is good and a good production there is possible.

Weekly US Cotton Futures

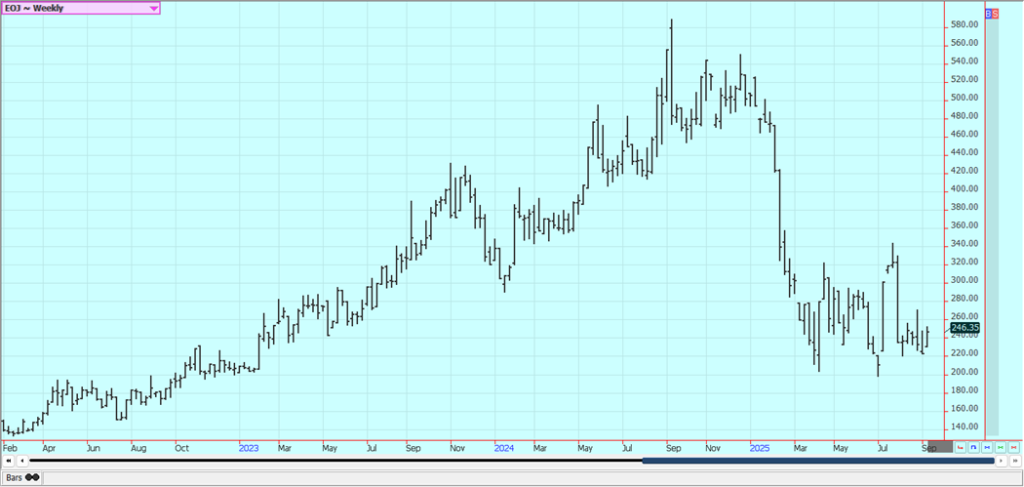

Frozen Concentrated Orange Juice and Citrus: Futures were higher last week but held to the current trading range as the weather is considered good for production here and in Brazil and Mexico. Development conditions are good in Florida and in Brazil now with daily rounds of showers in Florida and dry weather in Brazil. The poor production potential for the crops comes from early dry weather but also the greening disease that has caused many Florida and closed near the lows of the week producers to lose trees

Weekly FCOJ Futures

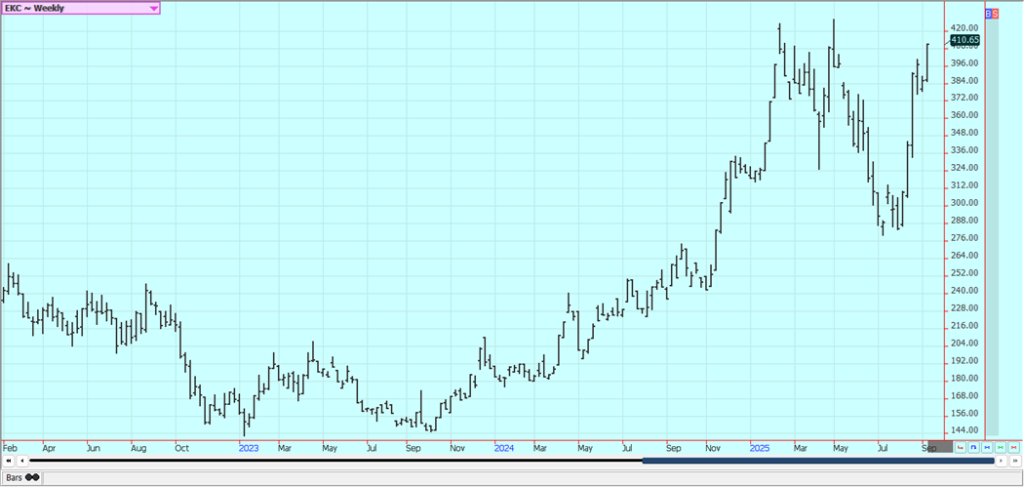

Coffee: Both markets were higher last week after strong gains on Friday. There are still reduced deliverable supplies for both exchanges as commercials have taken the supplies instead of buying in cash markets. Robusta is still more available to the market and with Brazil holding back on offers to world destinations. The lack of deliverable stocks in both markets and the lack of deliveries has supported the futures market.

Reductions in deliverable stocks are starting to abate. Arabica could correct sharply if the U.S. Supreme Court upholds last month’s federal appeals court ruling that President Trump overstepped his authority in enacting sweeping trade tariffs. Rains will be needed in September to improve the outlook for next year’s arabica crop in Brazil, which has been impacted by dry weather and cold snaps. Vietnam exported 85,000 metric tons of coffee in August, up 12.9% from a year ago. Exports of coffee from January to August rose 7.8% from a year earlier.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

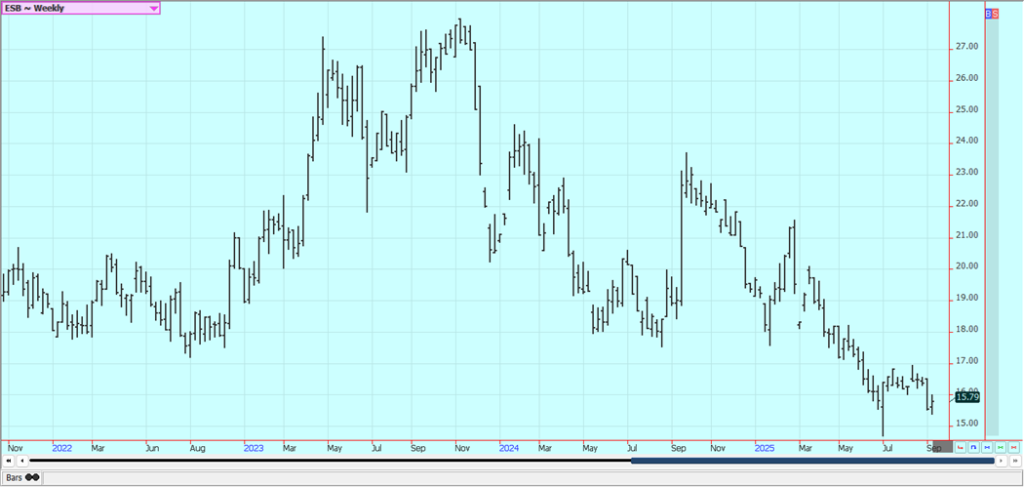

Sugar: New York and London were higher last week and it looks like a retracement of recent losses is underway. The Brazil production could be less, in part due to a recent freeze event and in part to reports of less sucrose in the cane. Ideas of good supplies for the market from good growing conditions for cane and beets around the world continue.

The South Center Brazil harvest is faster now amid drier conditions. Production in Center-South Brazil has also been strong. The outlook for cane crops in India and Thailand remain solid with reports of good rains this year, while Brazilian cane continue to favor producing sugar over ethanol. South Africa’s sugar farmers are having trouble from U.S. tariffs and from cheap imports from other African countries.

Weekly New York World Raw Sugar Futures

3.33

Weekly London White Sugar Futures

Cocoa: New York and London were both a little lower again last week as demand concerns in West Afri-ca continue. There are still reports of increased production potential in other countries outside of West Africa, including Asia and Central America, but African producers are concerned about potential losses now. The market feels that there is less demand and less production from Ivory Coast and Ghana and the lack of demand is expected to continue. Ecuador is expected to become the second largest pro-ducer of Cocoa, replacing Ghana on the list. ADMISI noted that chocolate maker Mondelez last week estimated that the pod count in Africa was 7% above the five-year average and much higher than last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Trisha Downing via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Biotech6 days ago

Biotech6 days agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Africa2 days ago

Africa2 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment