Markets

Cotton Prices Climb Amid Speculative Buying, USDA Reports, and Hurricane Concerns in the Delta

Cotton prices rose last week due to speculative buying, spurred by USDA reports and concerns over potential crop damage from a hurricane in the Delta. USDA reduced production and ending stocks, while weak demand persists, especially from Bangladesh and China. Despite recent challenges, there are hopes for improved demand as cotton futures hit multi-year lows.

Wheat: Wheat was higher lasts week as world prices were stable amid weather problems here in the US and around the globe. The USDA reports held little significance for Wheat as USDA will update production at the end of the month in the Small Grains Report. Ideas are that the Great Plains are too hot and dry for best Wheat development are still around as the Winter crop gets planted. It is also hot and dry in western Canada.

Cash markets in Russia were unchanged even as production estimates have dropped to about 82 million tons and prices in Europe have been near unchanged so far this week. Ideas of good crops just harvested in the US and Canada went against reports of dry weather in eastern Europe and Russia and too wet weather in France and Germany along with Spring Wheat areas of Russia are still heard and the weather there affecting world production estimates. There were more reports of dry conditions coming this week to Russian growing areas although Spring Wheat areas have seen too much rain. Eastern Europe is also hot and dry. Western Europe has seen too much rain.

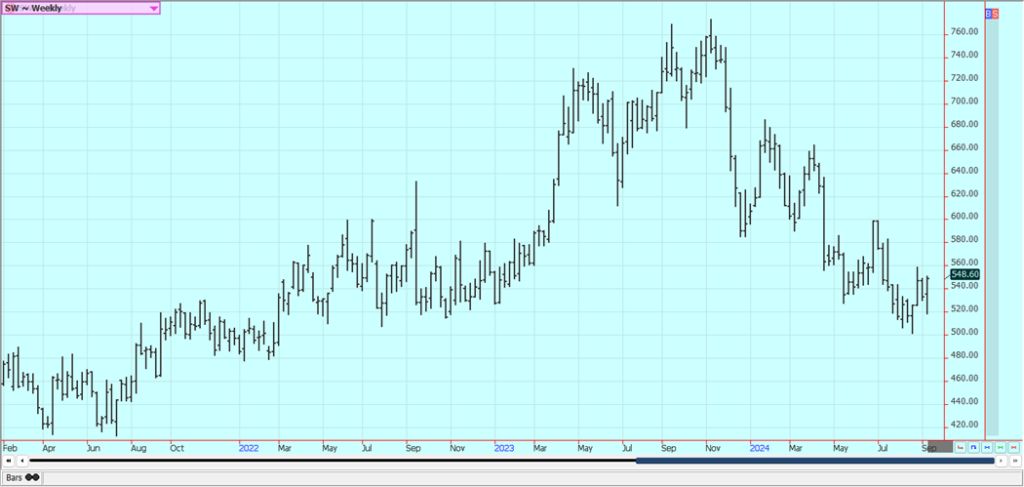

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn and Oats closed higher last week on speculative buying based on ideas that huge crops are already part of the price. USDA showed increased production but a bigger increase in demand for reduced ending stocks in its reports yesterday. Many of the changes to demand were in the old crop data that carried through to the new crop.

Ideas are that the production data will be the biggest seen all year due to the dry August and September in most of the Midwest. Producers plan to hold new crop supplies in hopes for higher prices. Ideas of very strong yields are still heard and harvest is just a few weeks away. Increased US demand comes from the fact that Corn prices are already the cheapest in the world. Current forecasts call for cooler and drier weather for the Midwest for the week or longer.

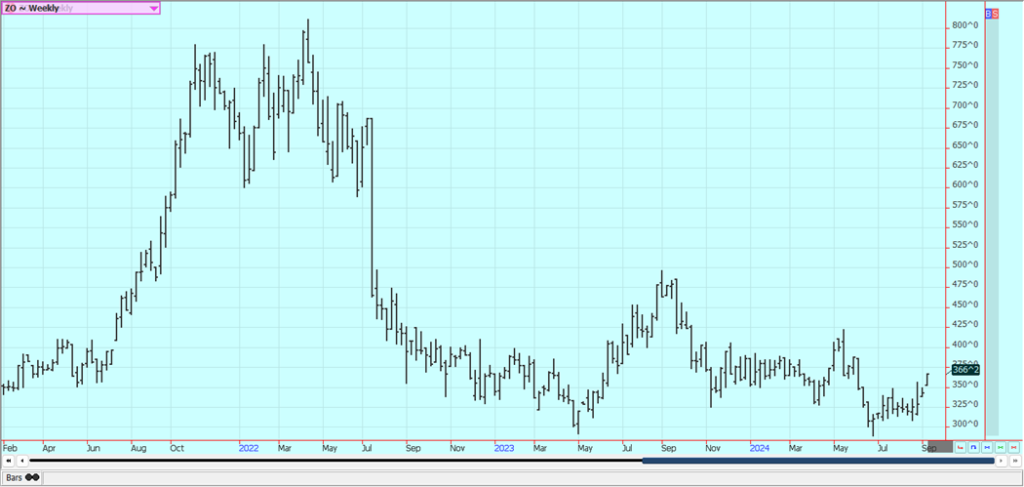

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and the products were a little lower last week despite the release of the USDA reports on Thursday that showed a slight reduction in production and ending stocks estimates in old crop data that carried through to the new crop. Ideas are that the production reports are the biggest that will be seen this year. There is concern about the dry weather seen in the Midwest since early last week that could hurt pod fill.

Ideas are that the beans could be smaller in the pods, but this will not be seen in this report that will include mainly pod counts. Bean sizes will be measured in subsequent months. The weather is warm now and it should remain dry. Reports indicate that China is buying a lot in the US but overall export demand is behind average. Export demand is catching up, however. Domestic demand has been strong in the US.

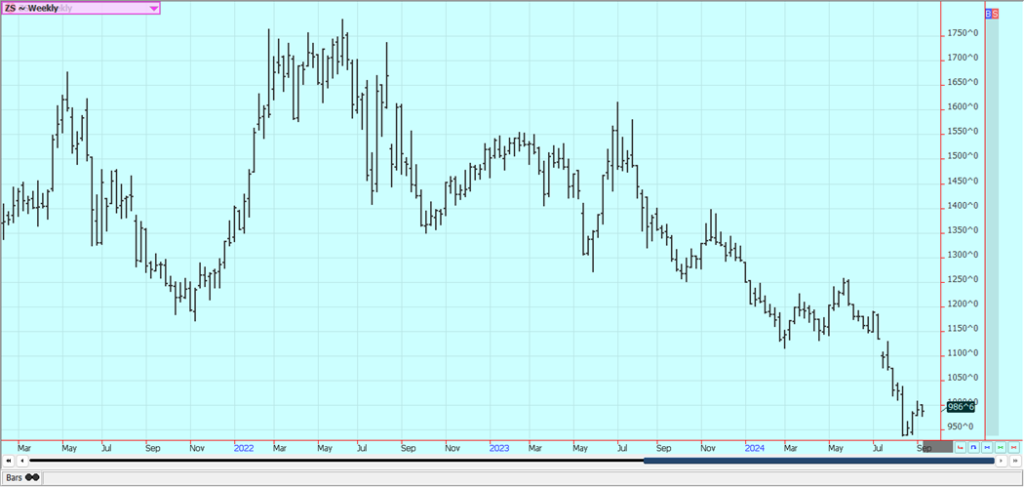

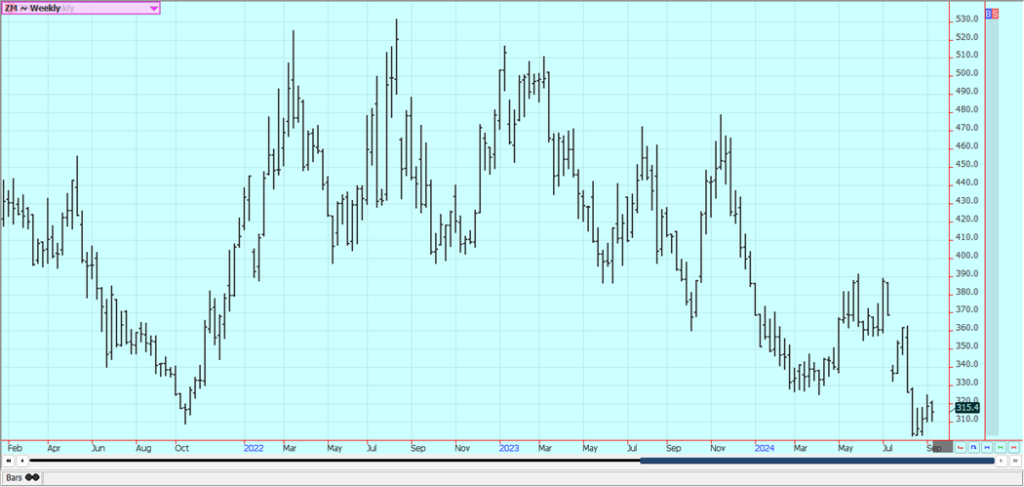

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

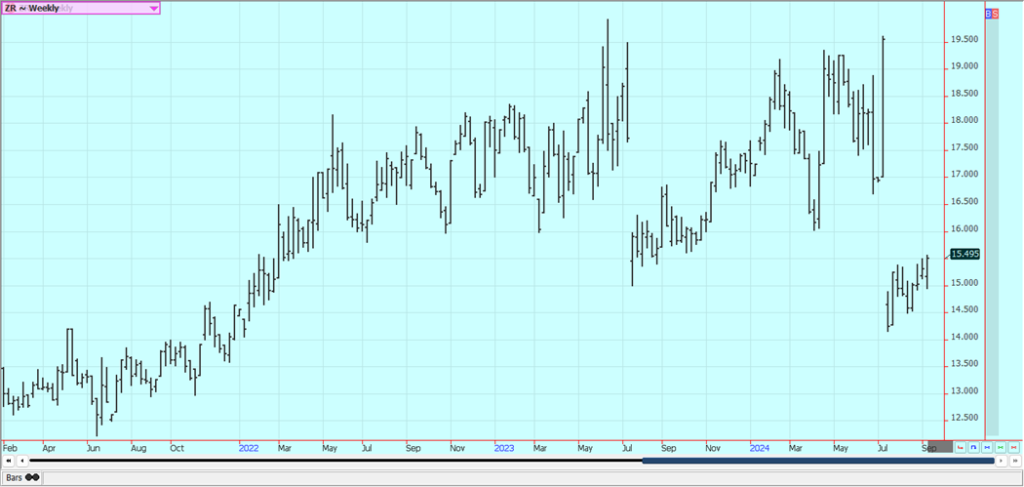

Rice: Rice closed higher last week on a lack of offers in the cash market and some reports of rain in Arkansas. A hurricane came on shore on Thursday in Louisiana and brought significant rain and wind to Rice lands in Louisiana, Mississippi, and Arkansas. The US weather has been an issue much of the growing season with too much rain early in the year. Some areas are now too hot and dry, especially in Texas, and Texas yields are down as the harvest is now over in the state. USDA showed increased production and less demand in the monthly reports, but the market traded higher anyway.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower last week after the release of bearish MPOB data with increased monthly ending stocks levels. Production reports indicate an increase in production at this time and disappearance has suffered with less demand from China. There is talk of increased supplies available to the market, and the trends are down on the daily charts.

Canola was lower last week as the harvest is coming. The weather has been hot and dry in Canada and it looks like Canola production has been impacted. The weather has called for dry conditions in the Prairies and yields are expected to be the same or less. Demand concern remain at the forefront with less demand expected from China with that country now in a trade war with Canada.

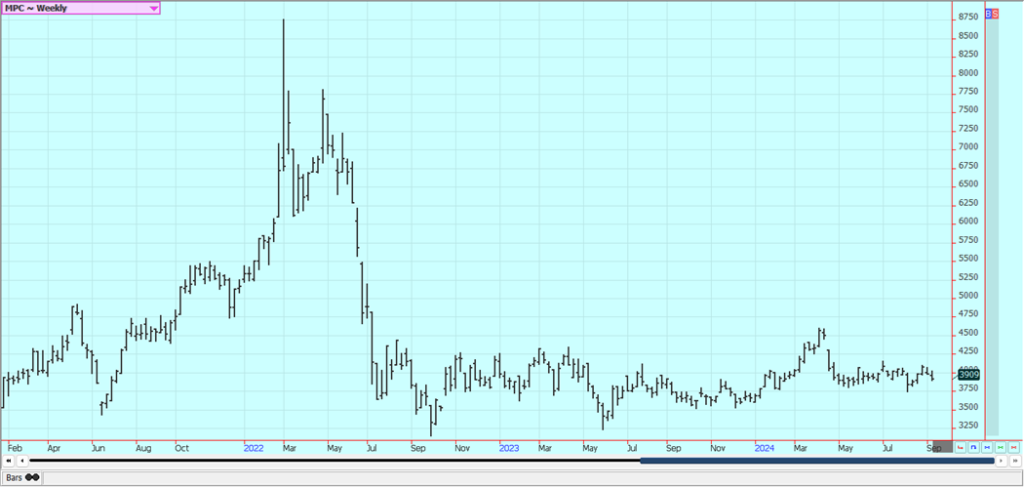

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was higher last week on speculative buying tied to the data in the USDA reports and reports that the weather in southern states that featured a hurricane that could damage crops in Delta states. USDA cut production and cotton demand for reduced ending stocks. There are still ideas of weaker cotton demand potential against an outlook for improved US production in the coming year. There have been cotton demand concerns about Bangladesh and China and ideas are that production is strong enough.

The Delta should have the best looking cotton crops right now even after some very hot weather recently and now some big rains moving through the region, but crops in other areas are more suspect. Texas and the Southeast have seen some extreme heat so far this year, and Texas has also seen dry conditions at times during the growing season. Cotton demand has been weaker so far this year but there are hopes for improved demand with the lower prices. Cotton futures are now as cheap as they have been for several years.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week and posted a reversal to down on the weekly charts as forecasts call for limited tropical activity in the near future in the Atlantic. Nothing appeared threatening in the forecasts for this or next week and there is nothing in the ocean to suggest that a storm is on its way to Florida but one is headed for the Texas-Louisiana border area.

A very active year has been forecast but has yet to come true. The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now although reports indicate that Brazil is hot and dry. Ideas are that demand haws suffered recently with the move to extremely high prices.

Weekly FCOJ Futures

Coffee: New York and London closed higher last week and at new highs for the move with offers from Vietnam and Indonesia still hard to find but offers from Brazil in the market. Indonesian offers are still less as producers wait for higher prices before selling. Damage was done to crops earlier in the growing season in Vietnam and lower production is now expected for the next crop. It is very dry in Brazil right now.

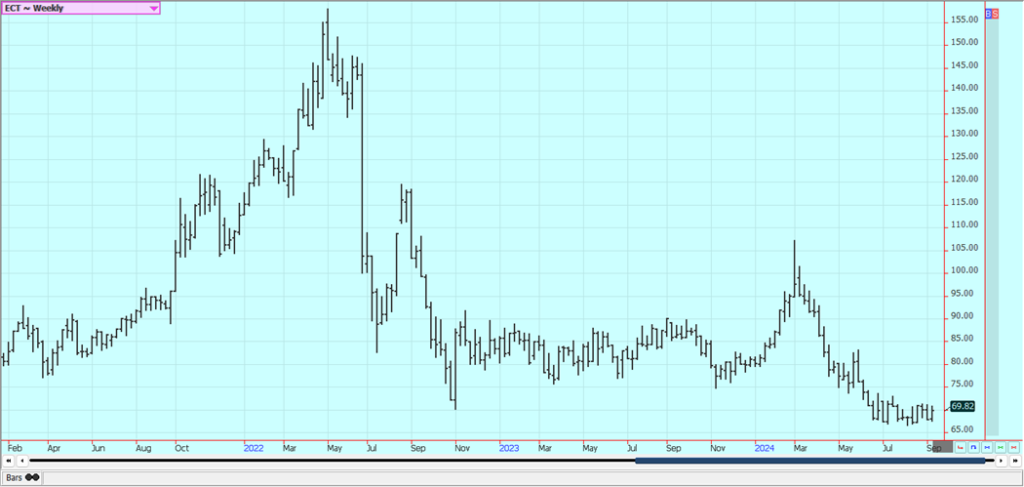

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed a little higher last week. Chinese demand is a problem amid the economic problems seen there. Harvest progress in Brazil and improved growing conditions in India and Thailand are the important fundamentals and growing conditions are dry in Brazil to help promote an active harvest period.

Indian and Thai monsoon rains have been very beneficial and mills are expecting strong crops of cane. They are pushing the governments to allow exports but so far the governments have not agreed to allow any exports. Production estimates were raised in the northern hemisphere. Harvest yields of Sugarcane in Brazil are strong.

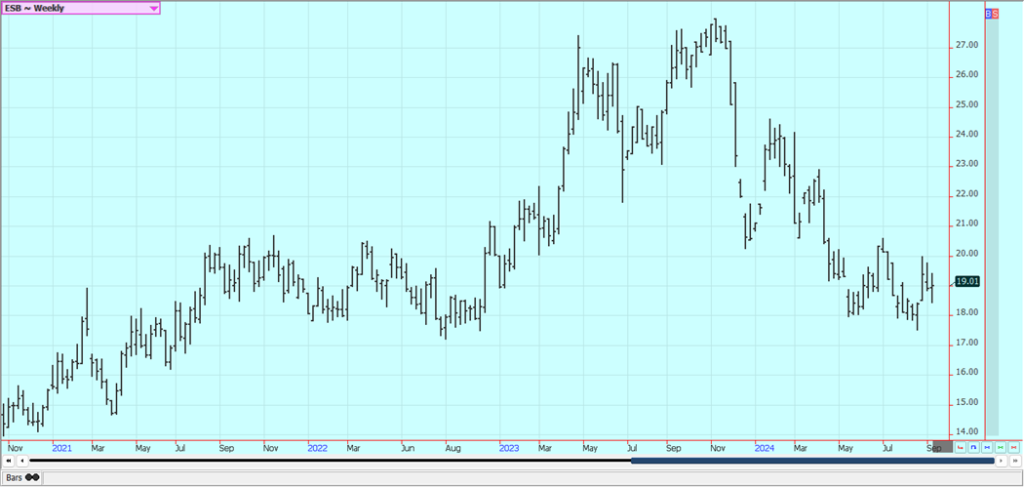

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed higher last week on ideas of tight supplies available to the market now as production for the next crop looks to be improved. Production in West Africa could be stronger this year on currently dry weather in Ivory Coast. Ghana has had hot and dry conditions and there are reports that pods are being aborted. Above average rain is now forecast for the next couple of weeks to improve conditions in West Africa. The availability of Cocoa from West Africa remains very restrict-ed, but surplus production against demand is expected in the next crop year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Trisha Downing via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results.

Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing16 hours ago

Impact Investing16 hours agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis1 week ago

Cannabis1 week agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Markets3 days ago

Markets3 days agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise