Markets

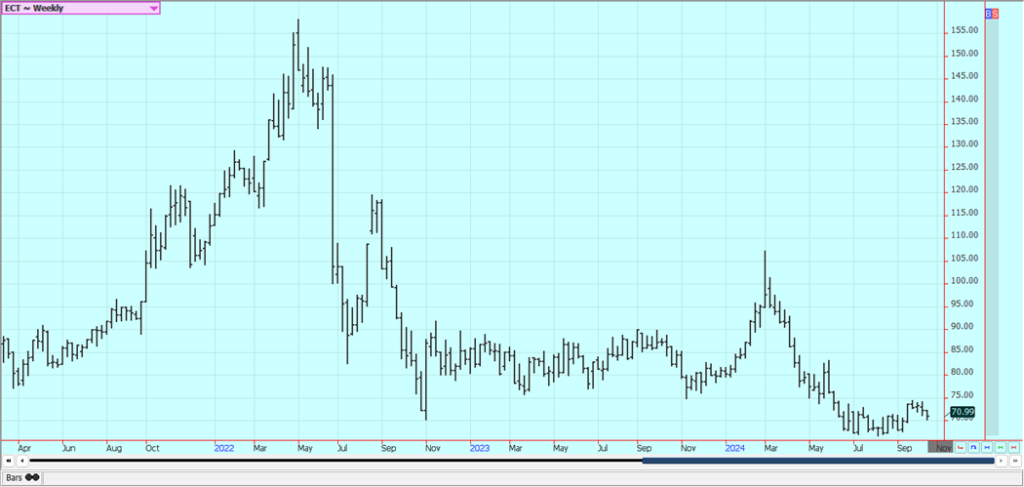

Why Cotton Prices Fell Last week

Cotton prices fell last week due to weak export demand, with little short-term improvement expected. Concerns persist over demand from Bangladesh and China, although Chinese demand might rise as the government stimulates the economy. Despite some favorable conditions in the Delta, heat and dryness have stressed crops in Texas and the Southeast.

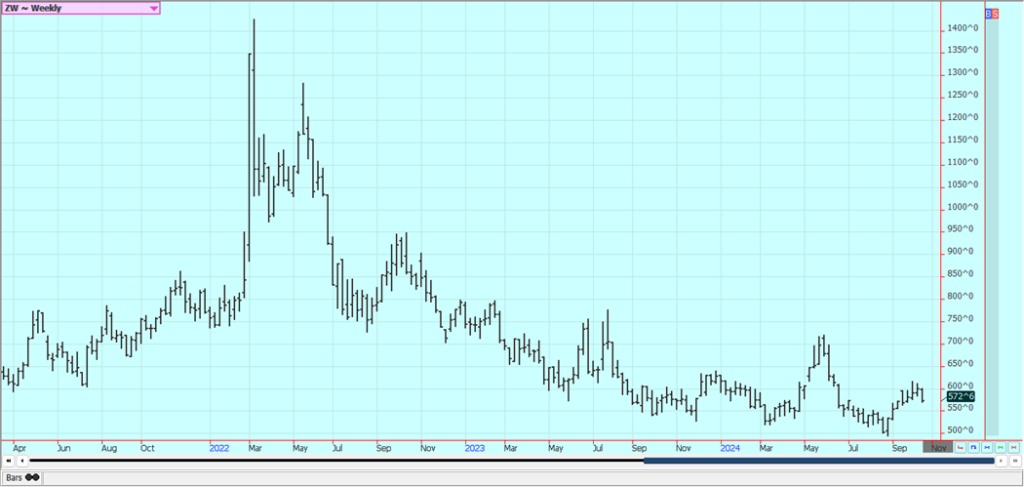

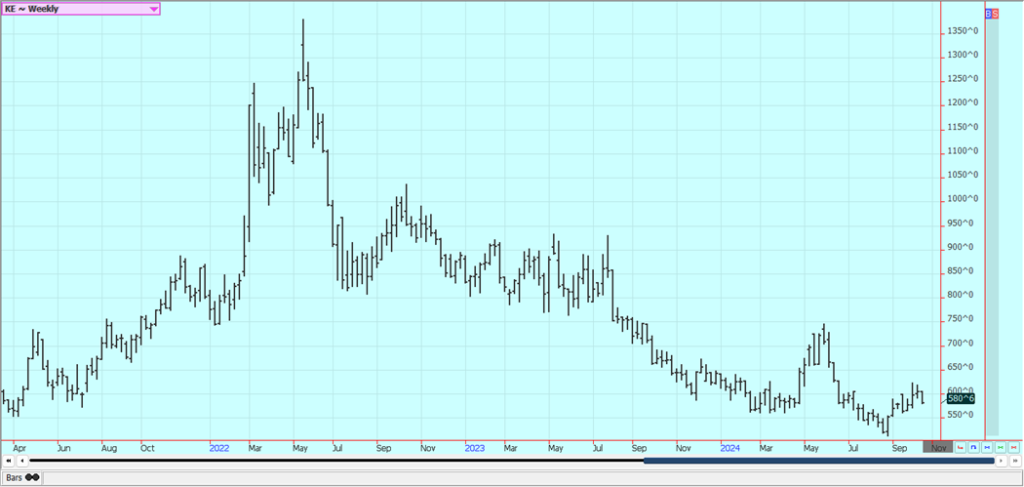

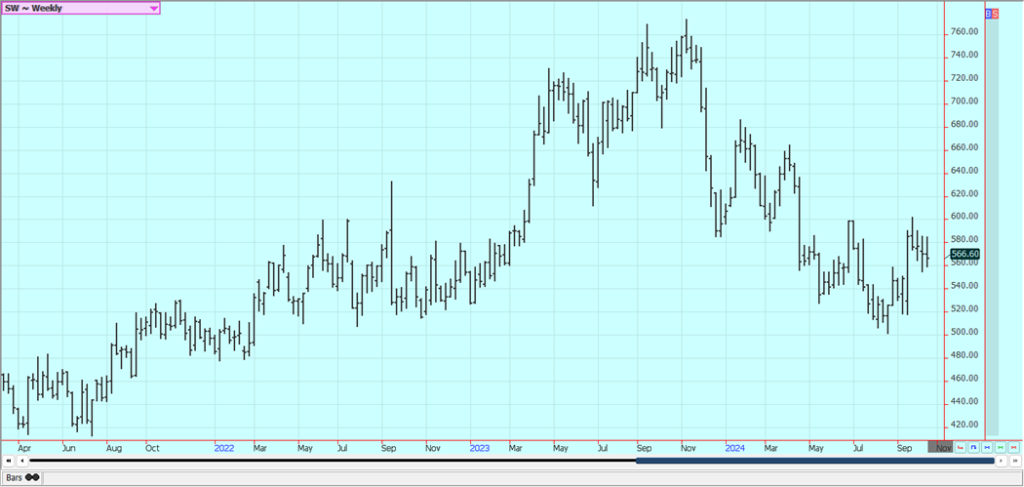

Wheat: All three markets closed lower last week. The dry weather outlook continues for Russia and the US. At least two Wheat producing regions in Russia have declared a state of emergency for Wheat producers due to a lack of rain and little to no rain has been a problem with Winter Wheat planting in the US.

Ideas are that the Great Plains are too hot and dry for best Wheat development are still around as the Winter crop gets planted. It is also hot and dry in western Canada. Cash markets in Russia were higher and are now about $230.00/ton as production estimates remain lower and two regions have been declared a farming emergency due to the hot and dry weather.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

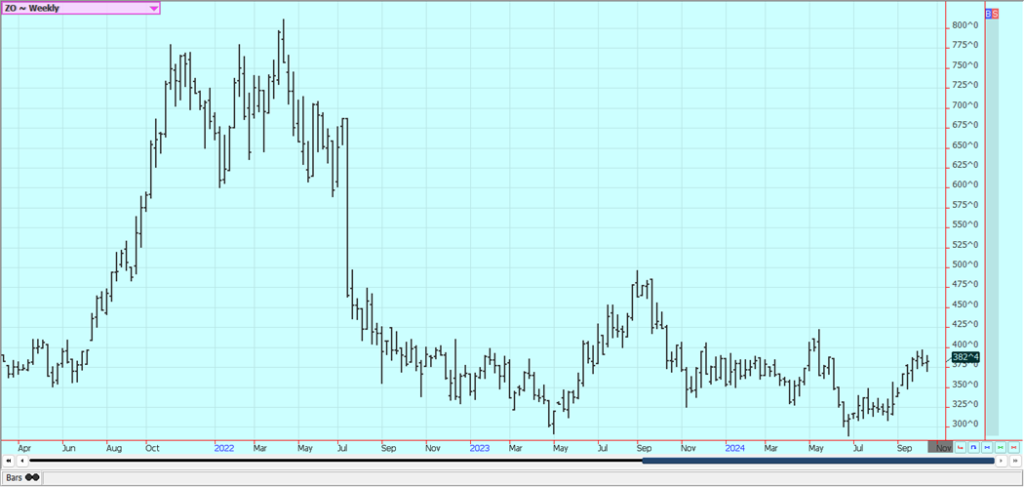

Corn: Corn closed a little lower with active harvest conditions in the Midwest. Oats were a little higher. Corn is often coming to the elevator at levels at 8% to 12% moisture instead of the desired 14% moisture and it has made a difference in yields overall. It remains dry in the Midwest, and there are now forecasts for dry conditions and cooler temperatures in the Midwest for the coming week.

Most producers have concentrated on the Soybeans harvest and are turning attention to Corn with Soybeans mostly in the bin for a lot of them. Producers plan to hold new crop supplies in hopes for higher prices. Increased US demand comes from the fact that Corn prices are already among the cheapest in the world.

Weekly Corn Futures

Weekly Oats Futures

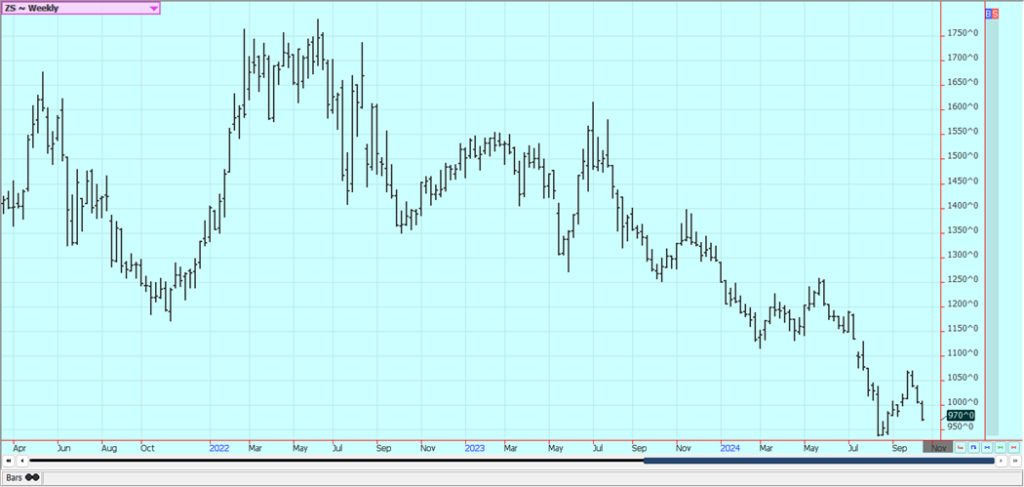

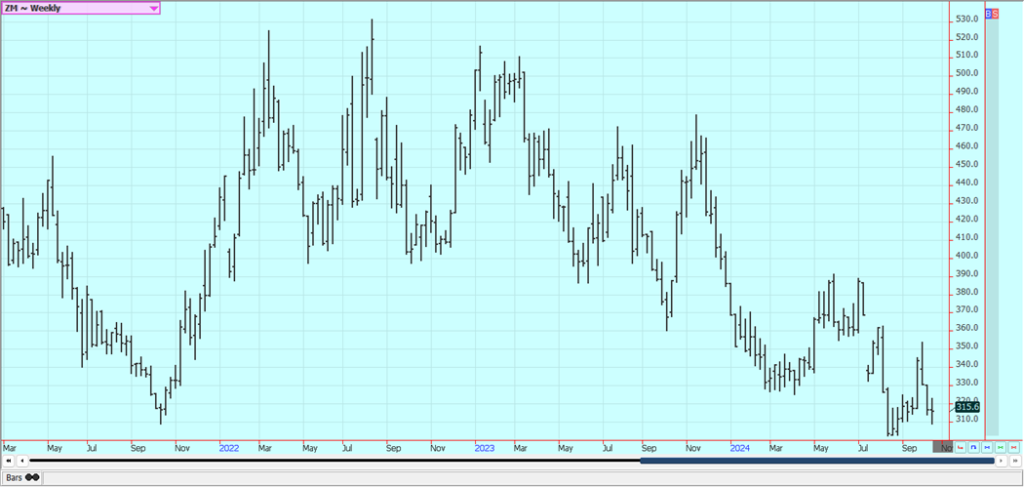

Soybeans and Soybean Meal: Soybeans and the products were lower last week as Brazilian farmers are planting what is expected to be a very big crop in central and northern areas of the country. Ideas are that a potential Trump presidency would hurt trade potential with many countries, but especially China. Traders were also disappointed that China did not announce new economic support measures for its economy last week with the country returning to work.

Many had expected some important new moves to support the Chinese economy by the government but were disappointed. Warm and dry weather in the Midwest recently has hurt production ideas due to ideas of small and very dry beans in the pods. Farmers have focused on Soybeans ha rest but now are almost done and are switching to Corn. Soybeans ae often harvested at moisture levels below 10% this year.

Dry weather will last all week and into next week. Central and northern Brazil has also been dry and reports indicate that soil moisture levels are at 30 year lows. Rains have appeared and will stick around as it looks like the rainy season is now underway. Soils are in much better shape in southern Brazil and Argentina.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

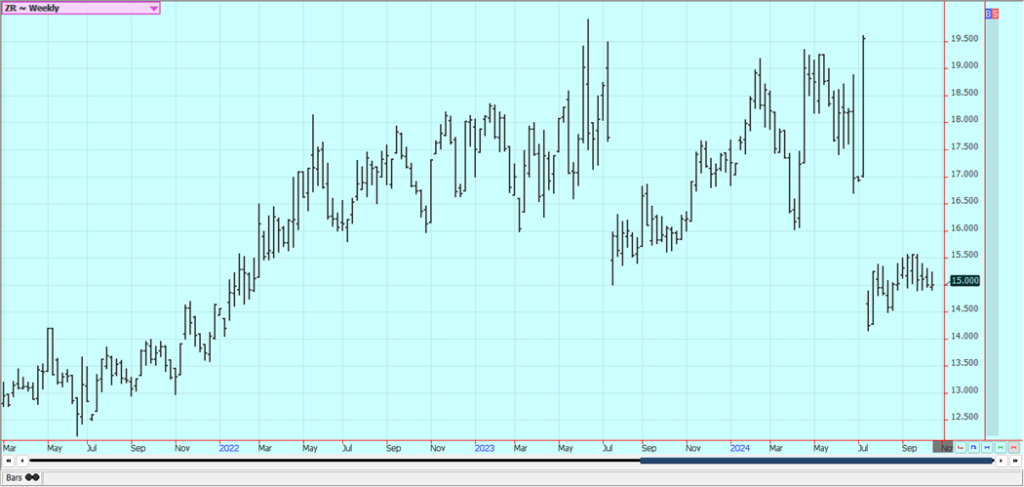

Rice: Rice closed little changed last week. Trends are still mixed on the daily charts. The USDA reports released a week ago showed no changes to US supply and demand results. Lower Asian prices are still reported after India opened up exports for non Basmati White Rice last week. Brazil prices remain strong and well above US prices.

The US weather has been an issue much of the growing season with too much rain early in the year. Some areas are now too hot and dry, especially in Texas, and Texas yields are down. The harvest should be wrapping up this week for most US producers.

Weekly Chicago Rice Futures

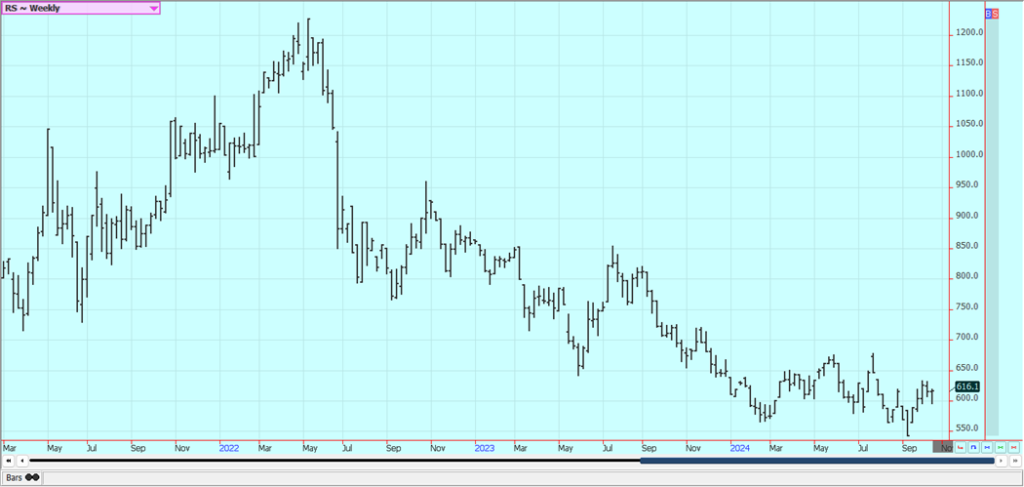

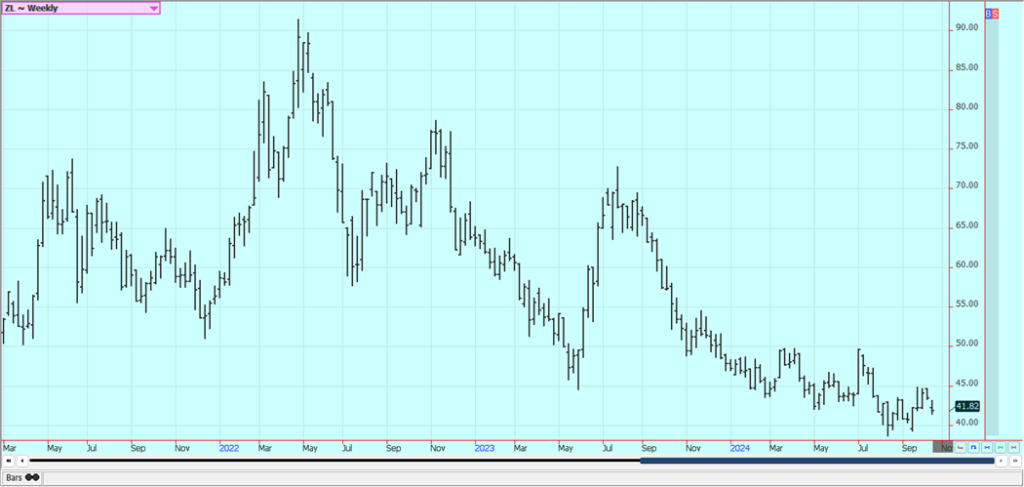

Palm Oil and Vegetable Oils: Palm Oil was a little higher last week on strength in outside markets and on reports of good demand. Demand has held together despite India increasing import taxes on Palm Oil and China is back from a holiday week to help demand ideas hold together. Canola was a little higher on a weaker Canadian Dollar.

The weather has been hot and dry in Canada, and it looks like Canola production has been impacted. The weather has called for dry conditions in the Prairies and yields are expected to be the same or less. Demand concern remain at the forefront with less demand expected from China with that country now in a trade war with Canada, but so far demand has held together well.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

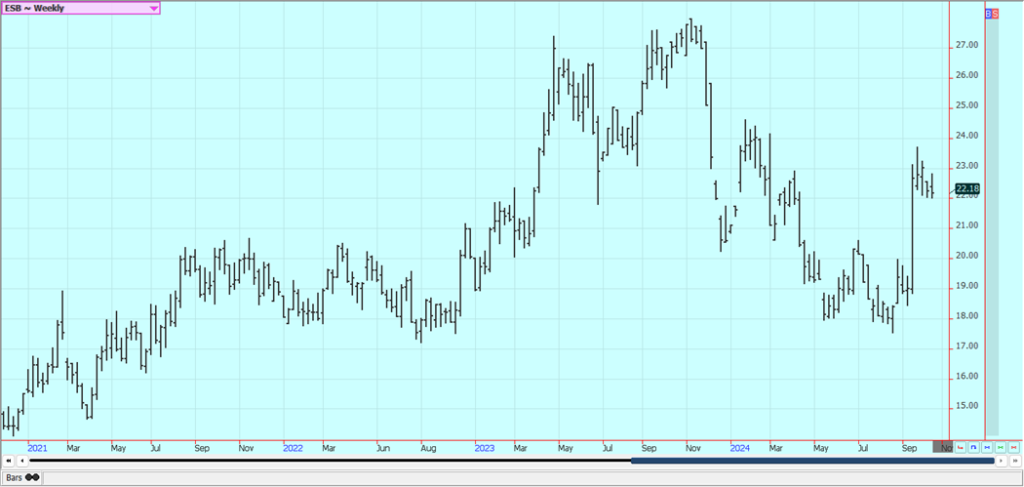

Cotton: Cotton was lower last week as export demand remains weak and trader do not expect much improvement in at least the short term. There are still ideas and reports of weaker cotton demand potential against an outlook for improved US cotton production in the coming year. There have been cotton demand concerns about Bangladesh and China.

However, Chinese cotton demand could start to improve as the government there is injecting a lot of money into the economy in an effort to get the country moving again. Texas and the Southeast have seen some extreme heat so far this year, and both areas also seen dry conditions at times during the cotton growing season. The Delta has had somewhat better growing conditions for cotton but overall the entire cotton crop has seen some stress.

Weekly US Cotton Futures

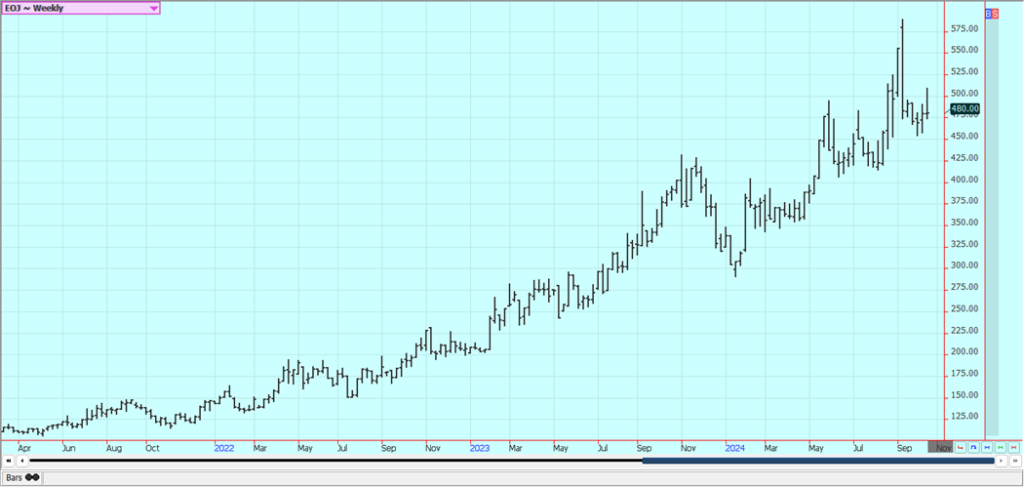

Frozen Concentrated Orange Juice and Citrus: FCOJ closed slightly higher last week as the effects of Hurricane Milton are now part of the price. The storm brought reports of more damage to orange trees and to infrastructure to the state and its industry. USDA cut Florida oranges production to 15 million boxes, from 18 million in its previous report and 20 million last year.

The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease. There are no weather concerns to speak of for Brazil right now although reports indicate that Brazil has been hot and dry. Rain is expected this week.

Weekly FCOJ Futures

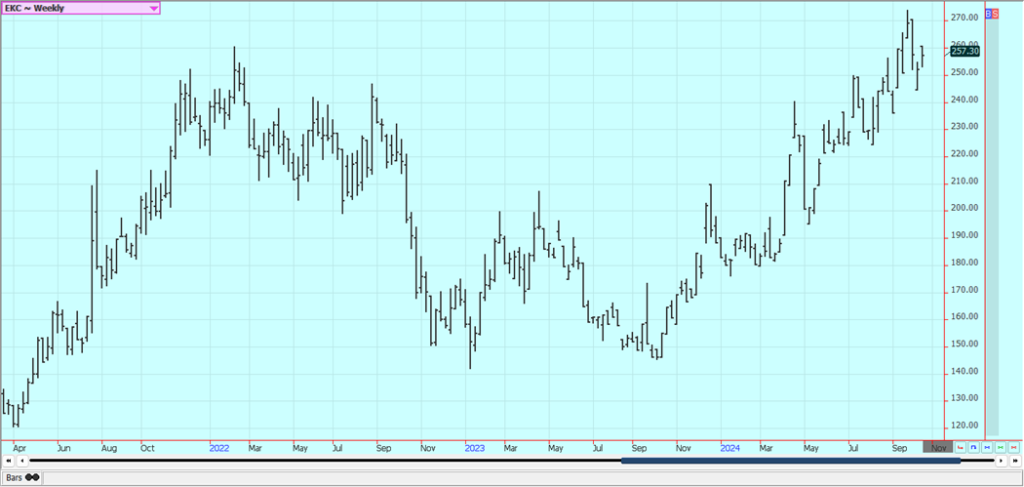

Coffee: New York was higher last week, but London was lower, and the chart trends in London remain down as the harvest in Vietnam becomes more active. New York chart trends are mixed. Rain remains in the forecast for Brazil crop areas but as crop losses are still a good possibility in Brazil and Vietnam.

There are now reports for some rains in Brazil as the rainy season is now under way after very dry conditions. Losses are still possible in Brazil and also Vietnam from previous bad weather. Indonesian offers are still less as producers wait for higher prices before selling. Damage was done to crops earlier in the growing season in Vietnam and lower production is now expected for the next crop.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

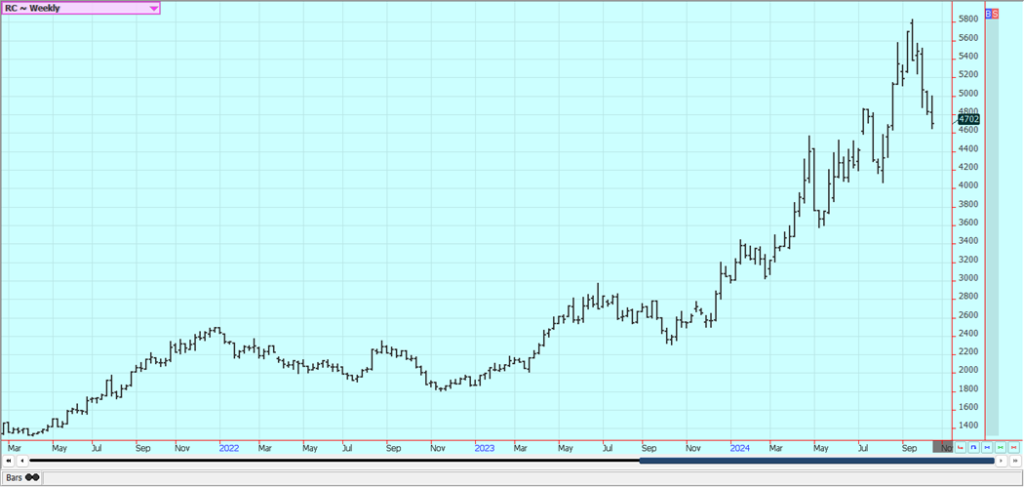

Sugar: New York and London closed a little lower last week on reports of better rains starting early in the month and variable world petroleum prices. A cold front has moved north from southern Brazil last week that has spread north and brought much needed rains to Sugar areas. Harvest progress is active in Brazil and growing conditions are much improved in India and Thailand. Indian and Thai monsoon rains have been very beneficial, and mills are expecting strong crops of cane.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

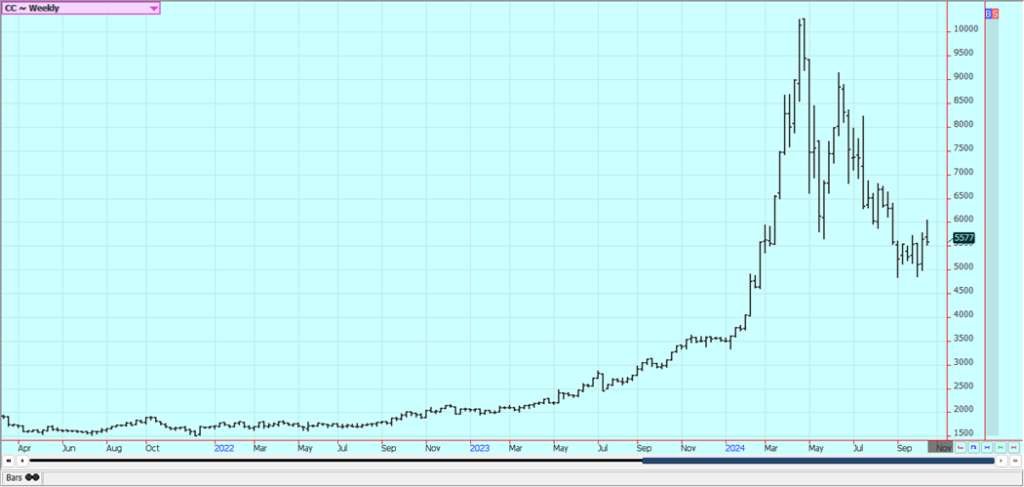

Cocoa: New York closed higher and London closed a little lower last week with the weather once again playing a price supporting role and the ongoing harvest keeping prices weaker. It had been very wet in West Africa lately and this is bring concerns that pod disease could develop. The current rally attempt is not expected to go very far as the harvest has started in West Africa. Production in West Africa could be stronger this year on currently wetter weather in Ivory Coast. Above average rain is now forecast for the next couple of weeks to keep conditions too wet in West Africa.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Sze Yin Chan via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Biotech6 days ago

Biotech6 days agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Africa1 day ago

Africa1 day agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment