Markets

Weaker Dollar Boosts Cotton Prices Amid Favorable Crop Conditions and Cautious Market Sentiment

Cotton prices rose slightly due to a weaker US Dollar, spurring demand hopes. Despite favorable crop conditions and strong yields reported by the USDA, speculators remain cautious, only covering short positions. The Delta region shows the best crop conditions. Demand has been weak, but lower prices may boost it.

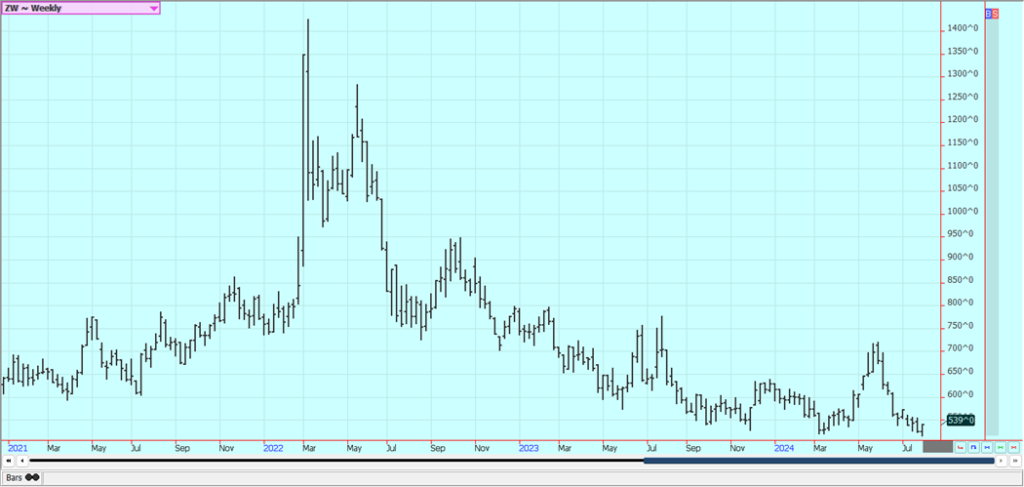

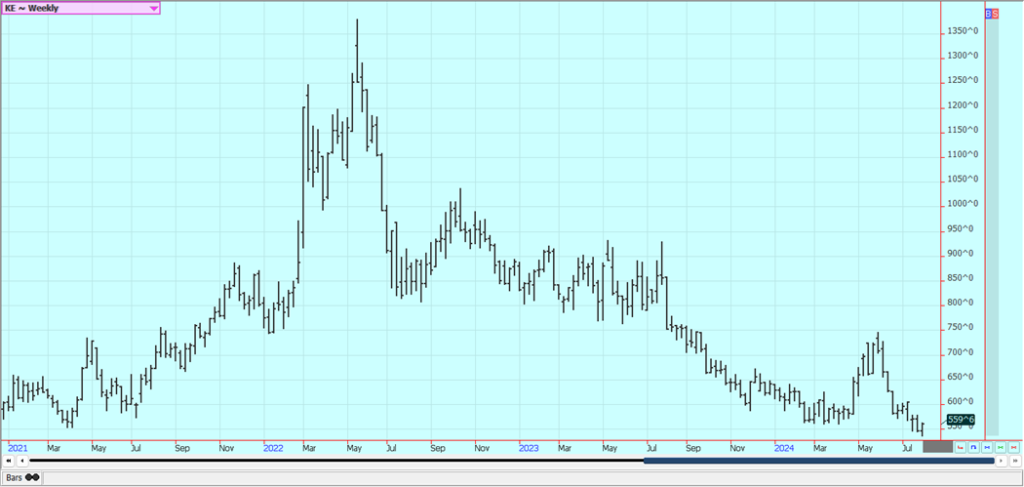

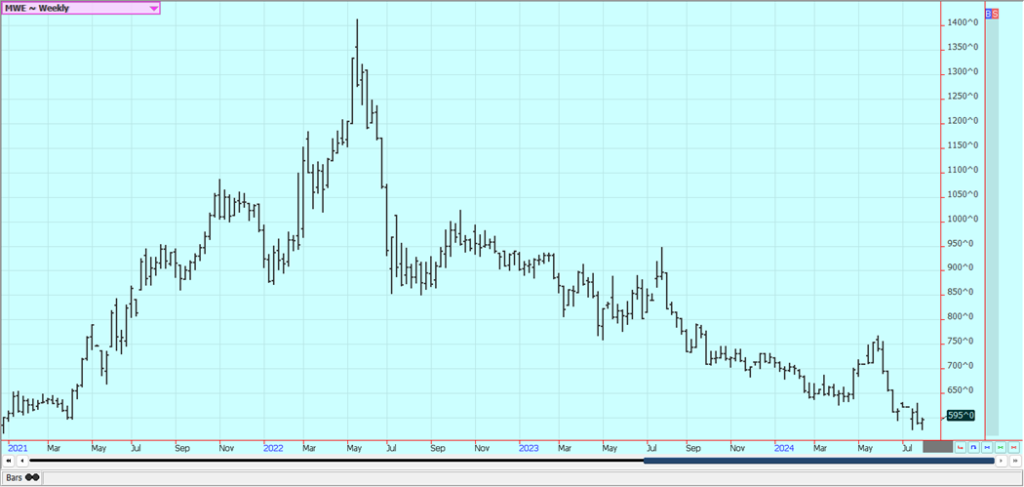

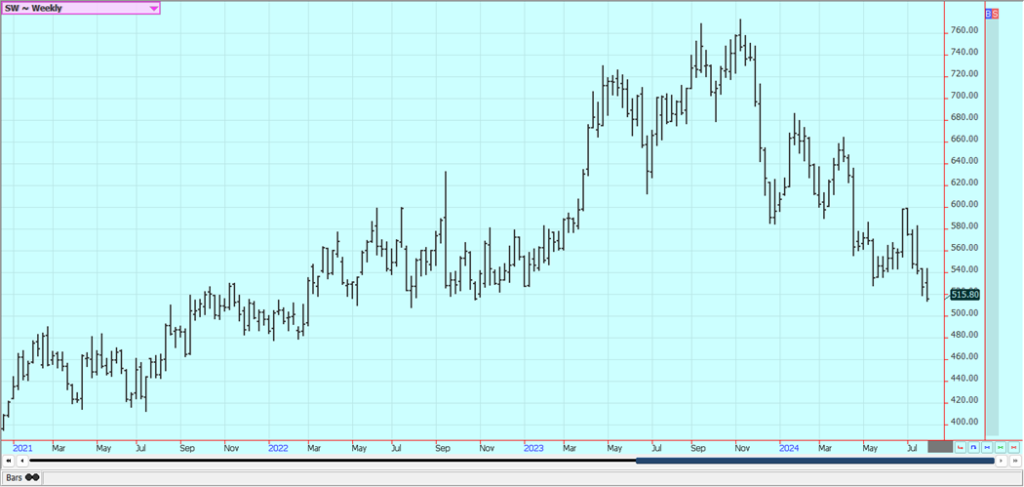

Wheat: Wheat was higher in all three markets last week on fund short covering and some new speculative and commercial buying and as there has been some positive demand news amid production problems in Russia and Europe. The weekly export sales report was good.

US harvest progress and ideas of good yields and crops went against reports of hot and dry weather in eastern Europe and Russia and too wet weather in France and Germany are still heard and the weather there affecting world production estimates. There were more reports of hot temperatures coming this week to Russian growing areas. It has also been very dry there. Eastern Europe is also hot and dry. Western Europe has seen too much rain.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

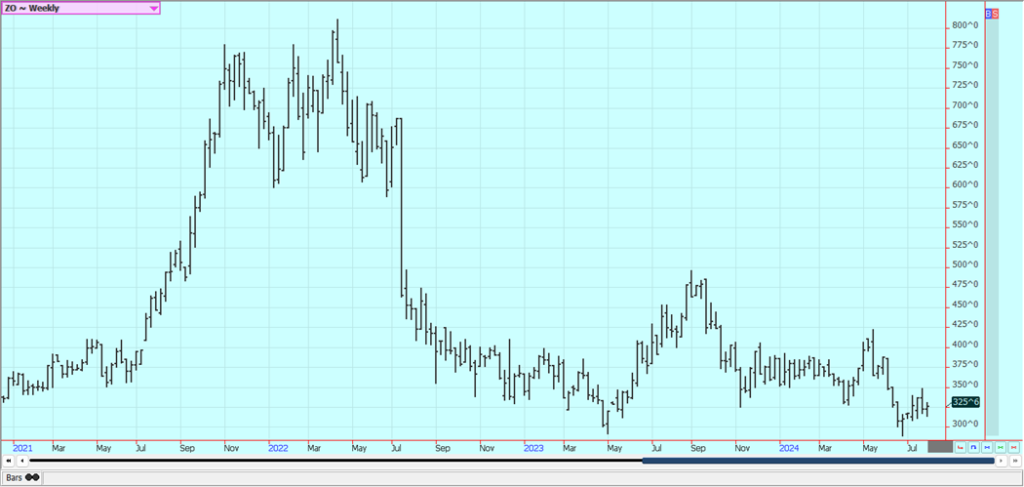

Corn: Corn closed lower and Oats closed higher last week on ideas of good growing conditions in the Midwest and talk of very strong yield potential. Current forecasts call for cooler and drier weather for the Midwest this week but hot weather could return next week. Northern areas such as southern Minnesota have had way too much rain but the weather is better now. Some selling came from reduced demand ideas but demand remains solid overall.

Weekly Corn Futures

Weekly Oats Futures

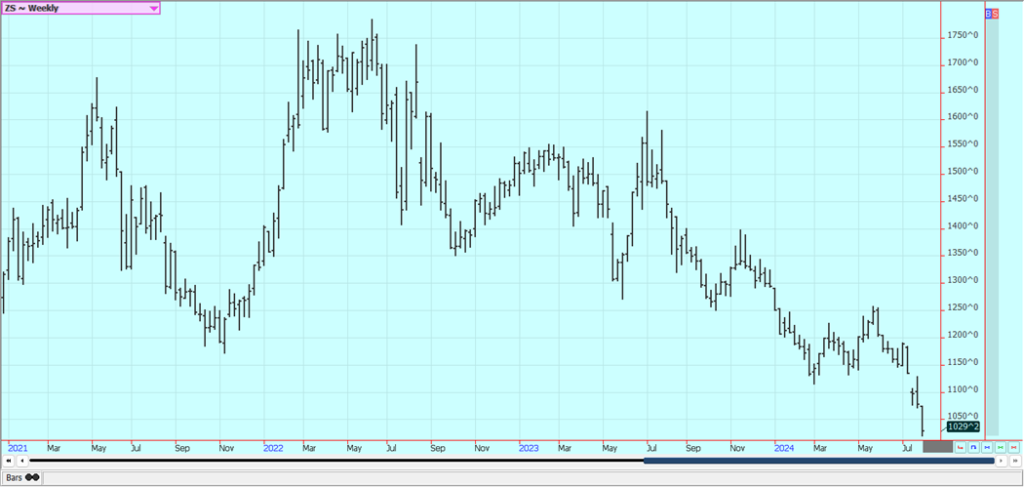

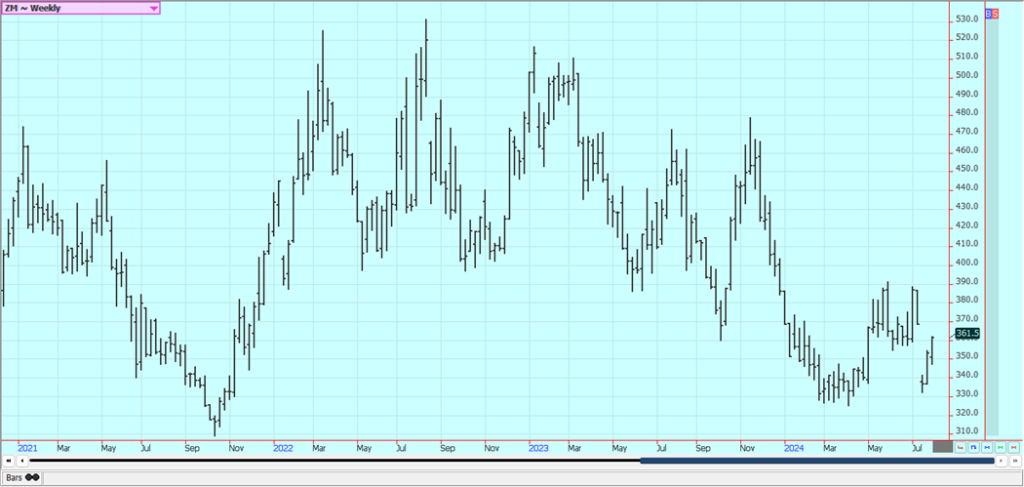

Soybeans and Soybean Meal: Soybeans and Soybean Oil closed lower last week and Soybean Meal was higher. Demand news was strong for both Soybeans and Soybean Meal last week with big sales announced on the daily system. The weekly export sales report showed new sales to China and this was positive as well.

There was more beneficial precipitation in much of the Midwest over the last week. This week should be dry and temperatures should turn cooler amid dry weather this week. Some selling came from reduced demand ideas. Reports indicate that China remains an active buyer of Soybeans in Brazil. Domestic demand has been strong in the US but has suffered as crushers were crushing for oil.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

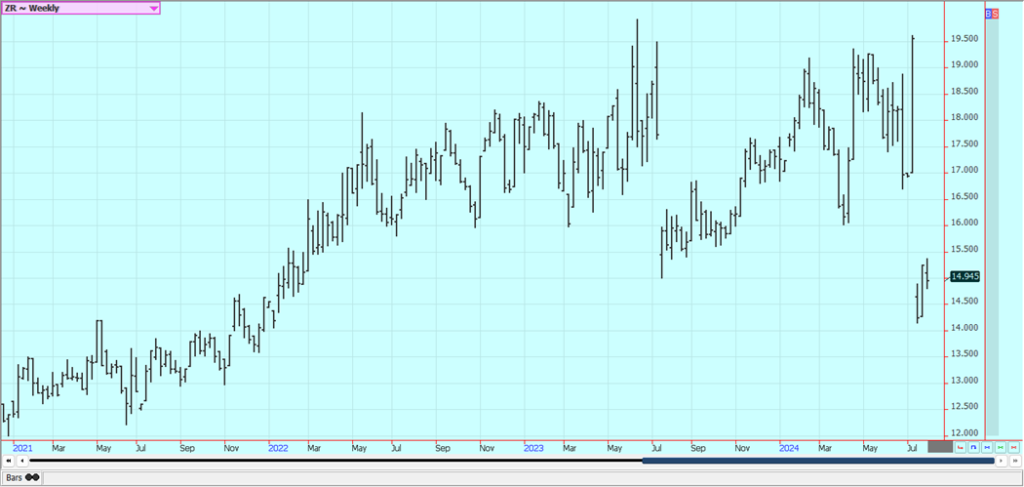

Rice: Rice closed lower last week after making a new high for the move on Thursday. The US weather has been an issue much of the growing season with too much rain early in the year. Some areas are now too dry, especially in Texas. However, planted area has increased from last year and so most are looking for a rebound in production this year. Supply tightness is expected to give way to increased production this year and greatly increased supplies this Fall.

Weekly Chicago Rice Futures

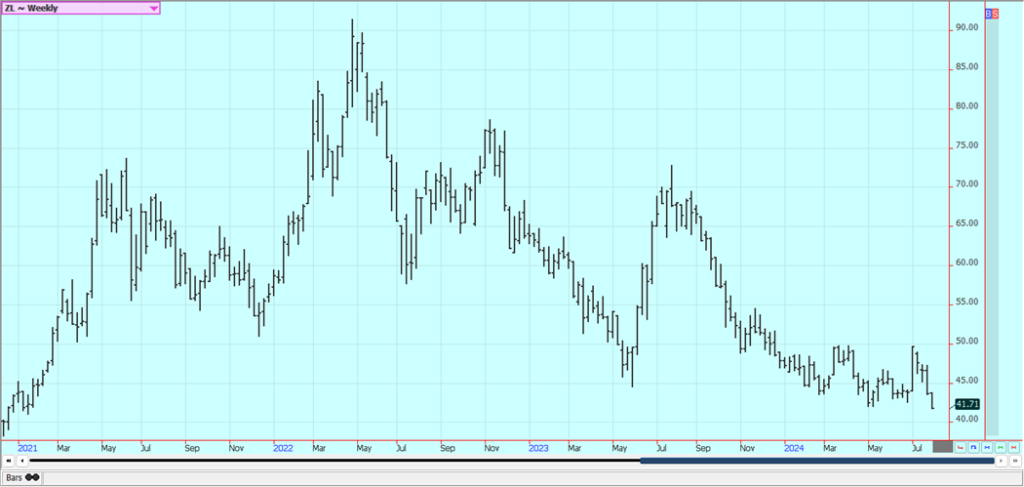

Palm Oil and Vegetable Oils: Palm Oil was lower last week with ideas of expanding world oilseeds production. Reports indicate that production is rising as well. Export demand has been very strong in recent private reports but has been weaker in recent days.

There is talk of increased supplies available to the market, and the trends are down on the daily charts. Canola was lower last week as oilseed supplies look to be ample in the coming year and as demand ideas are down. The weather has called for dry conditions in the Prairies, but growing conditions overall are good.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

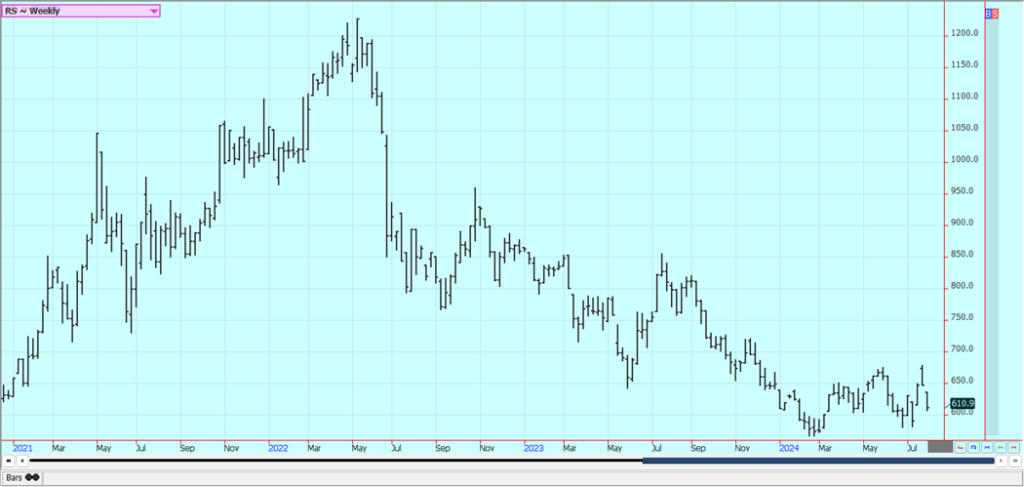

Cotton: Cotton was a little higher again last week on US Dollar weakness that created new demand hopes. Getter crop condition ratings from USDA kept ideas of big production around. It looks like futures are cheap enough for now but speculators see no reason to buy except to cover short positions.

USDA showed overall good crop conditions that have kept abandonment ideas at a minimum and supported strong yields along with increased planted area. The Delta should have the best looking crops right now. Demand has been weaker so far this year but there are hopes for improved demand with the lower prices.

Weekly US Cotton Futures

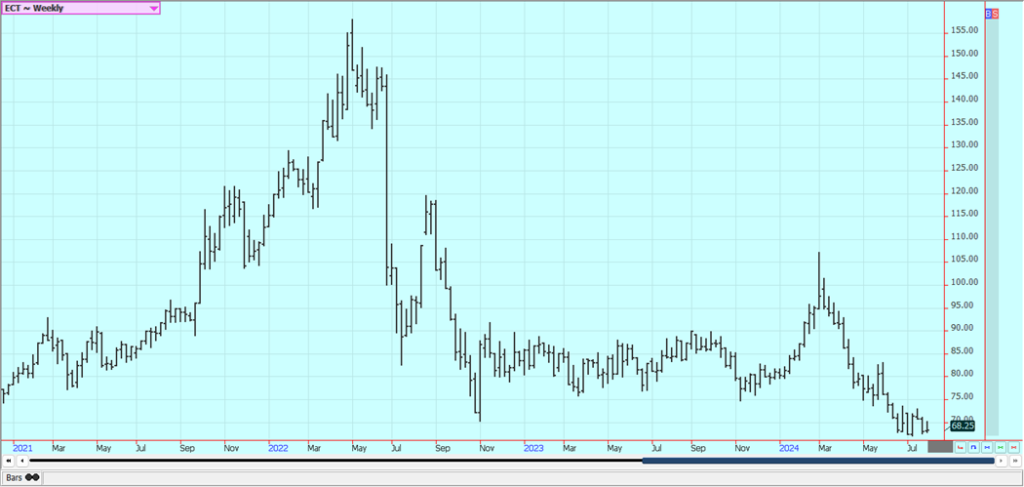

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week as the hurricane watch continued but nothing appeared threatening in the forecasts. Traders also continued to react to the USDA production reports released on Friday that showed slight increases in production in Florida and California.

A very active year is forecast and there have been some reports of flooding in the state even with no huge storms. The market remains well supported in the longer term based on forecasts for tight supplies and very hot weather in Florida. The reduced production also appears to be at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now.

Weekly FCOJ Futures

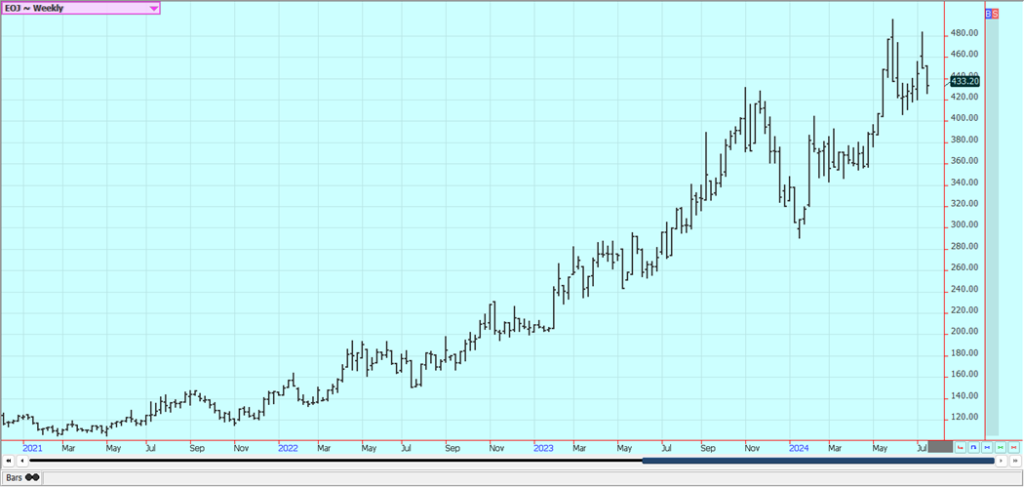

Coffee: New York closed a little higher and London closed a little lower last week as offers of Conillon from Brazil increased with the harvest there of the robusta starting to wind down. Reports of better rains in Vietnam and Brazil recently were important. There are still reports of short supplies that could be made worse by ideas of reduced offers of Robusta are still in the market.

Offers from Vietnam are reported to be down significantly and the current crop in Brazil along with the next crop in Vietnam s reported to be smaller. The weather forecasters now say that conditions are good in Vietnam, but damage was done to crops earlier in the growing season. A little rain has been reported in Vietnam and in Brazil recently to help crops in both countries. There were also reports of poor Robusta yields in Brazil during the harvest due to small bean sizes. Arabica yields in Brazil and Colombia are reported to be less this year due to extreme weather in both countries.

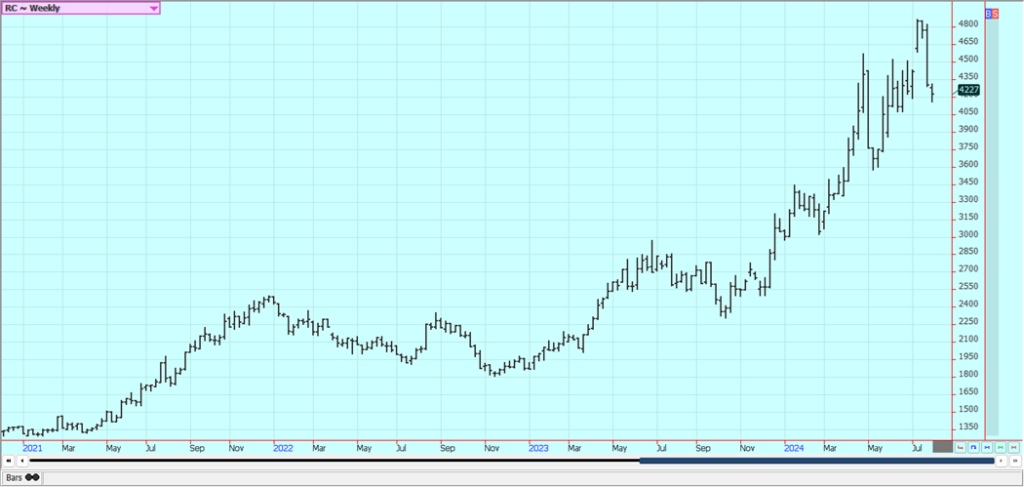

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

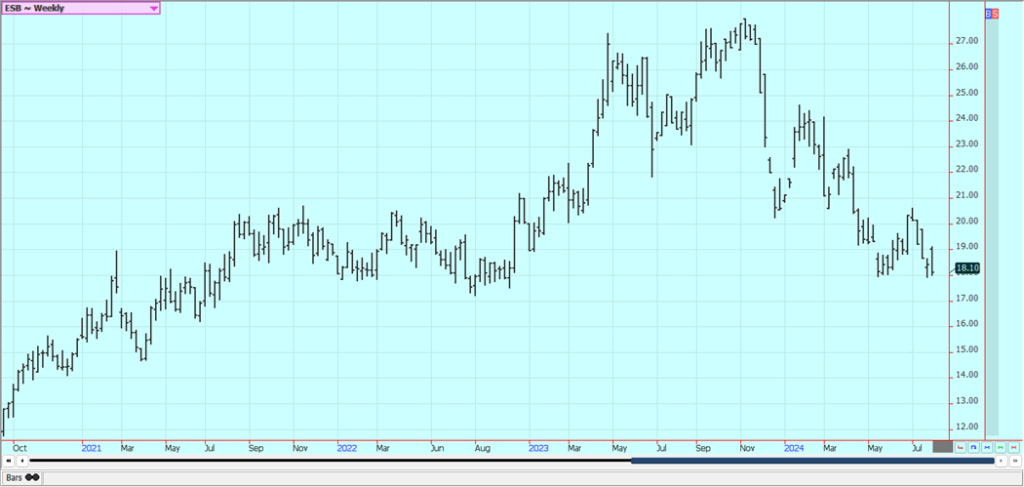

Sugar: New York and London closed lower last week as harvest progress in Brazil and improved growing conditions in India were the important fundamentals and as growing conditions improved in Brazil. Indin monsoon rains have been very beneficial and mills there are expecting a strong crop of cane.

They are pushing the government to allow exports but so far the government has not agreed. Produc-tion estimates were raised in the northern hemisphere. Harvest yields of Sugarcane in Brazil are im-proving. There are still ideas that the Brazil harvest can be strong for the next few weeks amid dry har-vest weather. Harvest weather is called good in center-south Brazil.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

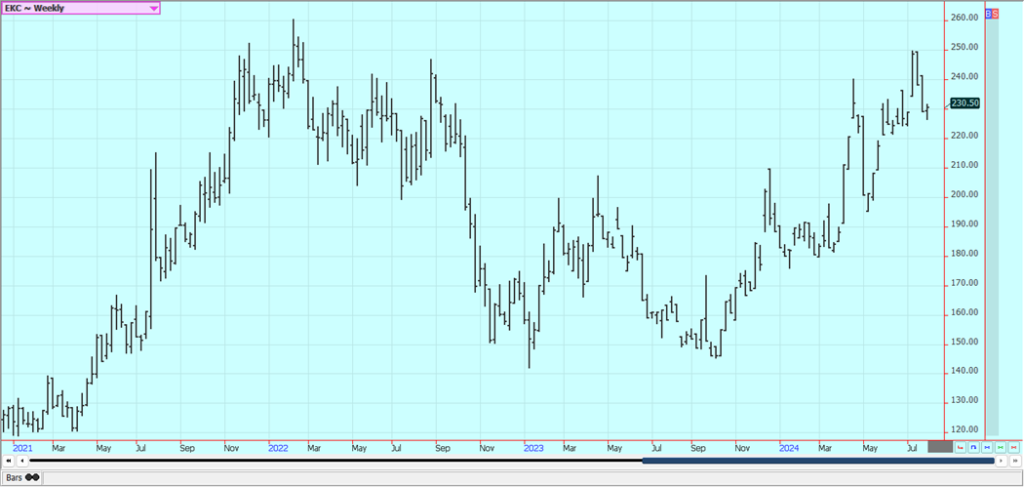

Cocoa: New York was higher and London closed lower last week as tight supply conditions and reports of good demand are still around. The weather for the next crop is still improved as weather reports in-dicate it is raining in Ivory Coast and Ghana right now. The current rains can help production of the next crop but have also created disease concerns about the pods. Production concerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting futures, but this support is running its course and the market is searching for a new bullish fundamental.

The North American and European grinds were stronger in data released last week, but the Asian grind was down a little. Production in West Africa could be reduced this year due to the extreme weather which included Harmattan conditions. The availability of Cocoa from West Africa remains very restricted. Cocoa arri-vals at Ivory Coast are now 27.2% less than a year ago. Demand has been strong for Cocoa and Choco-late.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Nika Benedictova via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Biotech2 weeks ago

Biotech2 weeks agoWhy Bioceres Shares Slide Into Penny Stock Territory

-

Crowdfunding14 hours ago

Crowdfunding14 hours agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Africa1 week ago

Africa1 week agoAgadir Allocates Budget Surplus to Urban Development and Municipal Projects

-

Cannabis2 weeks ago

Cannabis2 weeks agoKONOPEX Expo 2026: Celebrating Europe’s New Era of Legal Cannabis