Markets

Cotton Rallies but Faces Pressure from Tariffs and Demand Concerns

Cotton rose last week ahead of the USDA’s planting report but may consolidate after recent gains. Selling pressure followed Trump’s new tariffs on China, prompting Chinese retaliation on U.S. agriculture. Weak demand from other buyers and expectations of lower U.S. production next year add to market uncertainty.

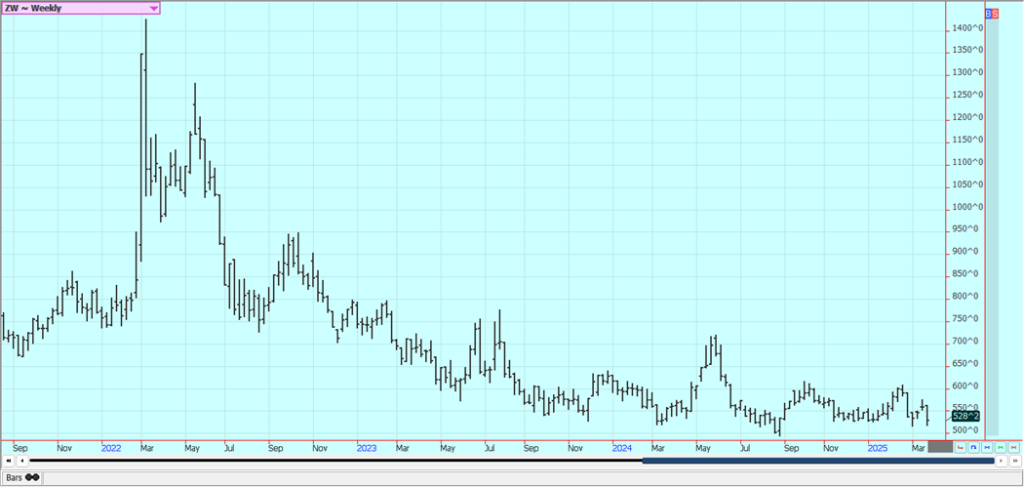

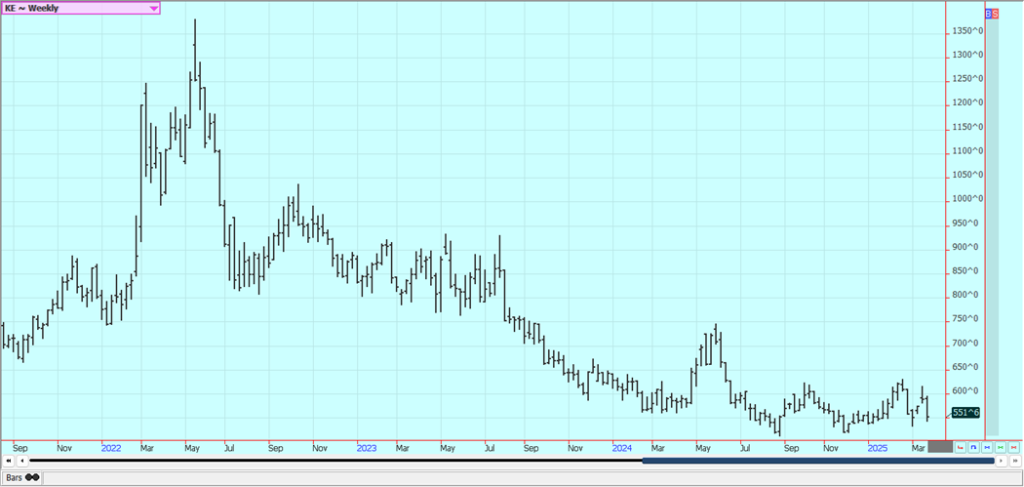

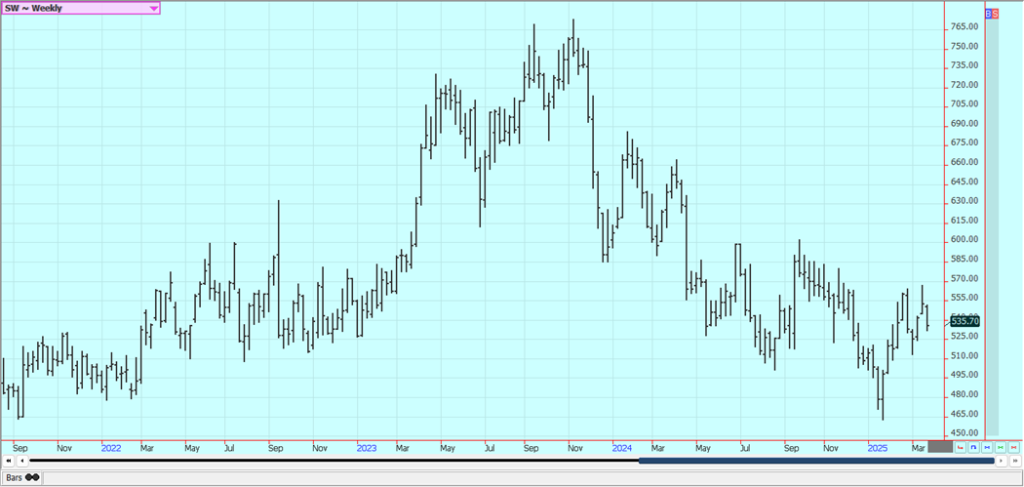

Wheat: All three markets closed lower last week and saw selling pressure every day, with dry outlooks for the Great Plains and Black Sea regions still the main feature but with rains in the forecast for the Great Plains from Nebraska to the north this weekend according zto one model. The other model has more general rains for all parts of the Great Plains. The coverage of the new system does not look very impressive. It is very dry in both areas although Kansas got a minimal amount of rain last week.

Growing conditions are dry around the world and in the US Great Plains and Winter Wheat crops are emerging from dormancy. Overall demand has been weak so the lack of rain hurting production potential is about to be important. The trade is also worried about the potential for tariffs to be imposed in early April and the counter tariffs that would come back to US agriculture. In addition, there are the stocks of grin in all positions report and the planting intentions report coming Monday to help keep trading subdued. Wheat stocks are estimated at about 1.2 billion bushels. Planted area is estimated by the trade at 46.5 million acres for All Wheat.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

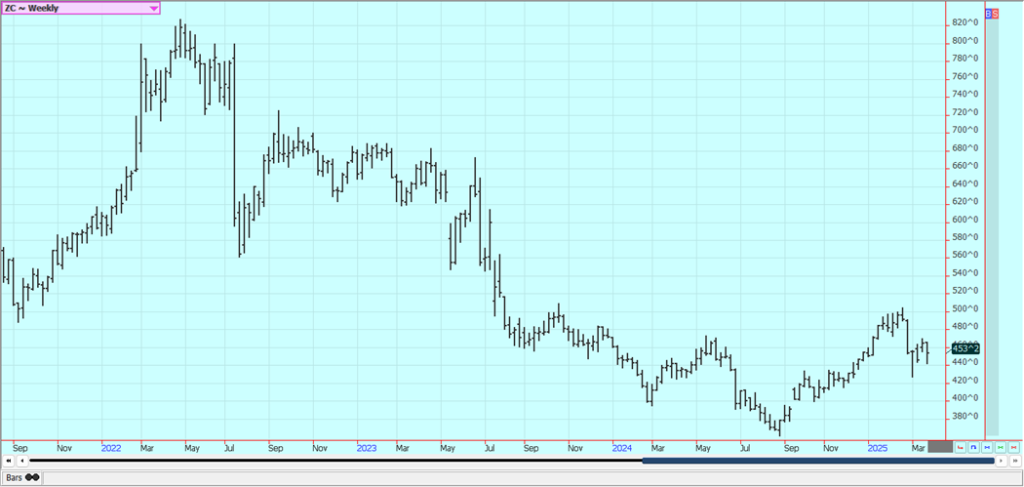

Corn: Corn closed lower last week as traders prepared for the coming USDA stocks in all positions report and planting intentions report. There was renewed talk that tariffs could damage agricultural exports starting in early April when the reciprocal tariffs will be announced. President Trump has announced that new tariffs are being imposed for all countries on a reciprocal basis starting in April.

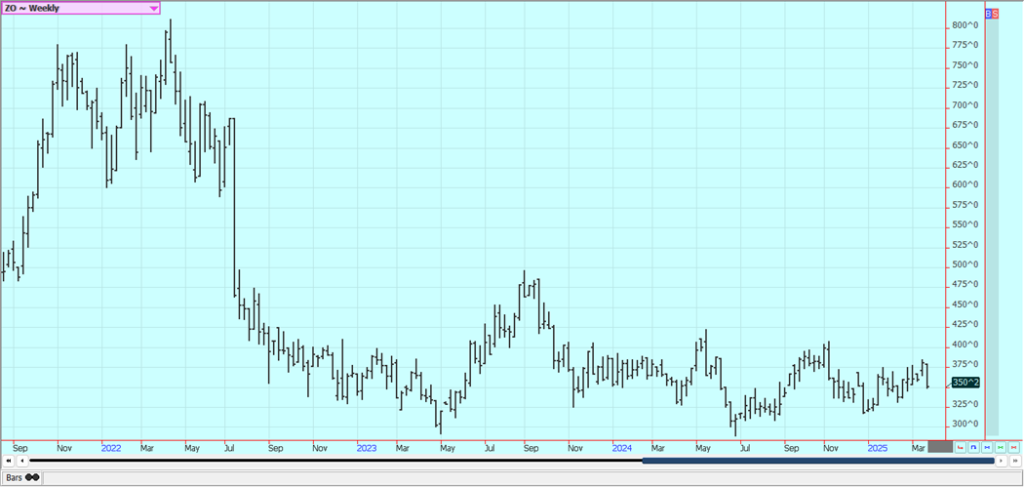

The tariffs have become an off again on again feature of the government and no one knows what to do at this time. It is dry in growing areas in western US, but most of the Midwest has had light precipitation lately. Scattered showers are likely this week. Traders expect USDA to estimate planting intentions at near or above 94 million acres this season. Stocks could be near 8.1 billion bushels. Oats were lower.

Weekly Corn Futures

Weekly Oats Futures

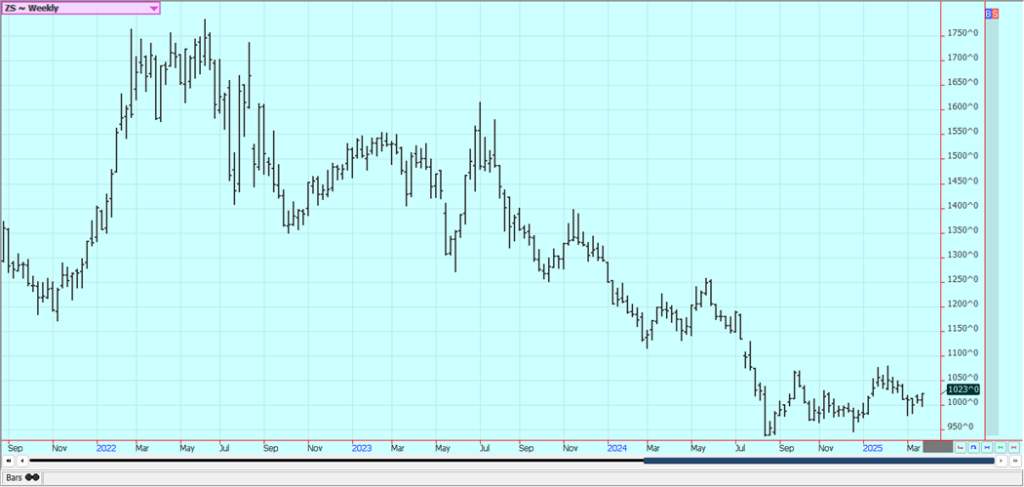

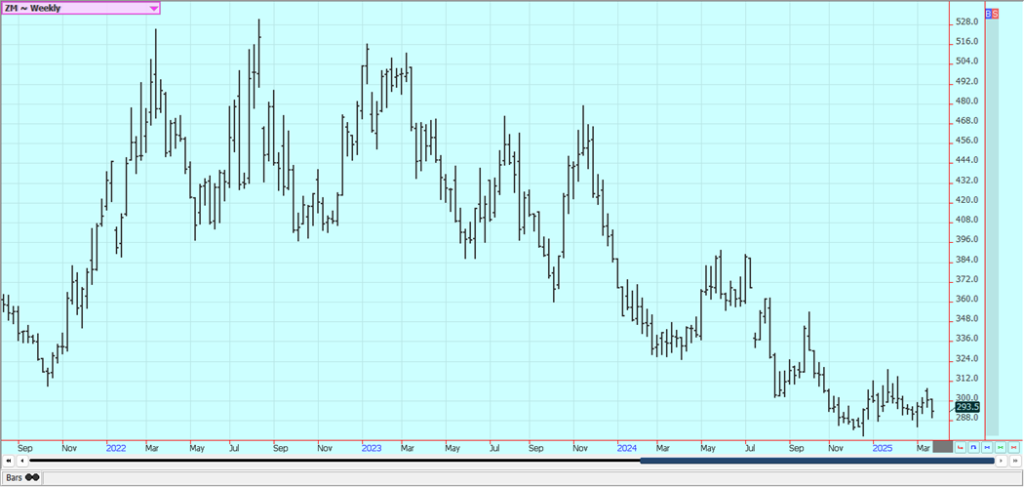

Soybeans and Soybean Meal: Soybeans closed a little higher last week, with Soybean Oil the strongest part of the complex and Soybean Meal closing lower. There was talk that the administration could approve the use of more bio diesel in blends this year. Traders were getting ready for the USDA stocks in all positions report and the planting intentions report, with both due to be released on Monday. There was also increasing talk of new tariffs coming in early April and the damage they could do to US agriculture.

South American production looks strong although slightly less than previous estimates, with Brazil expected to produce 170 million tons and Argentina producing 49 million tons or a little less. Consumer confidence is down and there are increasing worries that the US could be headed into a recession that could hurt domestic demand. The fundamentals remain mixed as cash markets are stronger in South America. The Soybeans harvest there is estimated to be more than 75% done. Soybeans planted area is estimated by the trade at 83.8 million acres and stocks in all positions are estimated at about 1.9 billion bushels.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

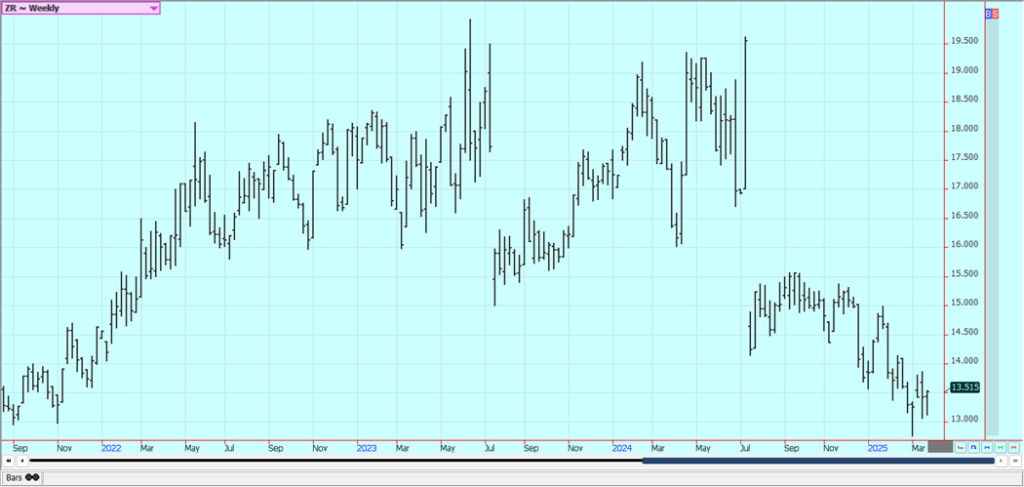

Rice: Rice closed a little higher last week as early week selling met new buying interest and some short covering before the USDA stocks in all positions report and the prospective plantings report coming on Monday. There was more concern about the tariffs scheduled to be imposed in early April.

Prices remain cheap, but could develop into a trading range, and could threaten the planted area as it will cost more to produce Rice than it is getting in the market right now. Export sales have not been strong, and domestic demand is there but is not strong enough right now to bid prices any higher. Milling quality of the Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters.

Weekly Chicago Rice Futures

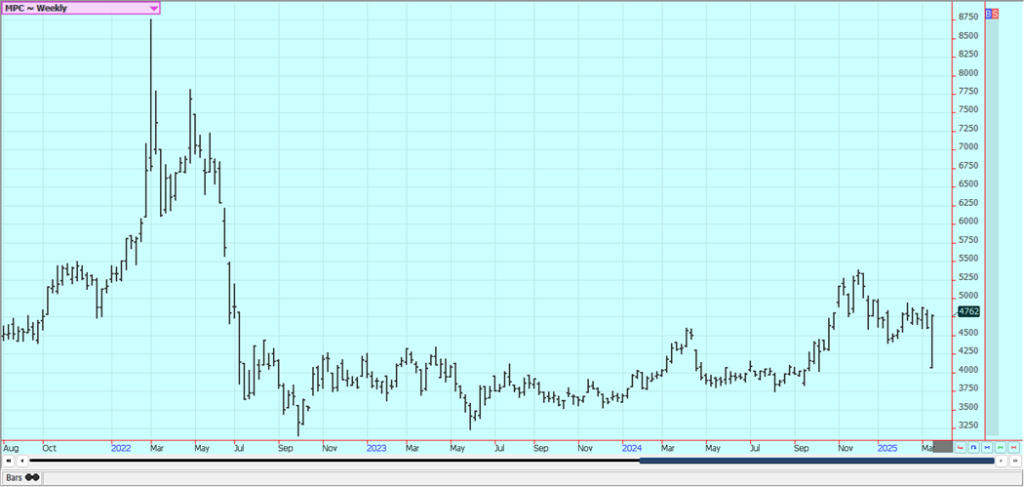

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week after moving sharply lower early as the market reversed on ideas that prices are a little too cheap. There is talk of reduced supplies in the market due to extreme weather that caused fields to flood among other things. Demand has not been good so far this month and was weaker than expected for February.

Chart trends are mixed. Canola was higher all week and closed near the highs of the week and continued to move away from the extreme lows set when China imposed tariffs on Canola and products a couple of weeks ago. The demand outlook is uncertain with the threat of US tariffs being imposed in early April.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was higher last week before the USDA reports on Monday highlighting cotton planting intentions for the coming crops. Ideas are that the cotton market has rallied well from the lows made a couple of weeks ago and could consolidate the gains for now.

Cotton selling has come from news that Trump has imposed some big tariffs on China earlier this week, and China announced tariffs on US ag production in retaliation. There are still reports of weaker cotton demand potential from other buyers against an outlook for less US cotton production in the coming year.

Weekly US Cotton Futures

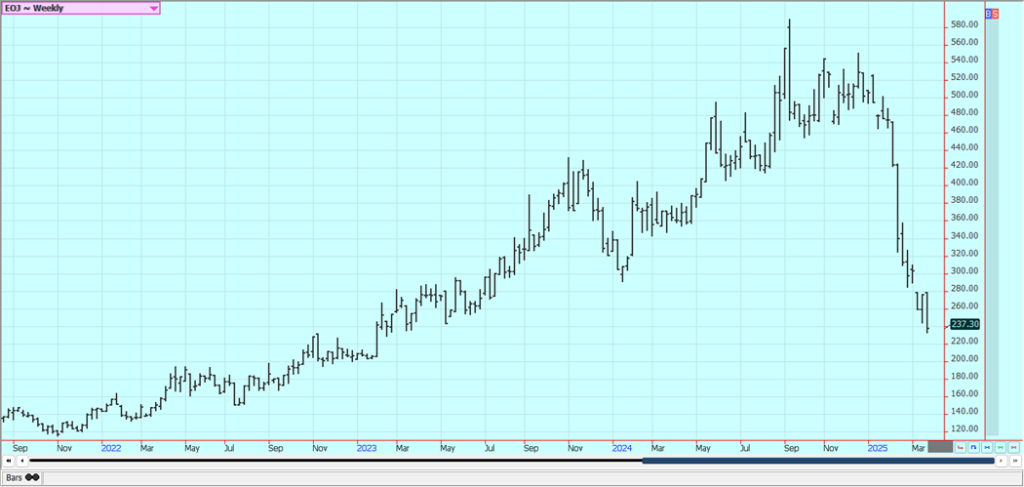

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week and kept the down trends in prices intact. Chart trends are down again on the daily charts. The short term supply scenario remains tight but is now a little loose.

The reduced Florida production appears to be mostly at the expense of the greening disease and some extreme weather seen in the last couple of years. There are no weather concerns to speak of for Brazil or Florida right now although Brazil could turn hot and dry.

Weekly FCOJ Futures

Coffee: Both markets closed lower last week as doubts about the production in Brazil continue. Bullish traders were unable to force a move to close above 400.00 May during a couple of attempts earlier in the week. Trends are turning down.

The lack of offers from Brazil along with reduced production and offers from Vietnam continue. The Vietnam harvest is over, but producers are holding back on some beans and are hoping for higher prices.. Hot and dry weather is in the forecast for Brazil longer term. The flow of coffee from Brazil should slow this year as it is an off year in the country’s biennial crop cycle.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

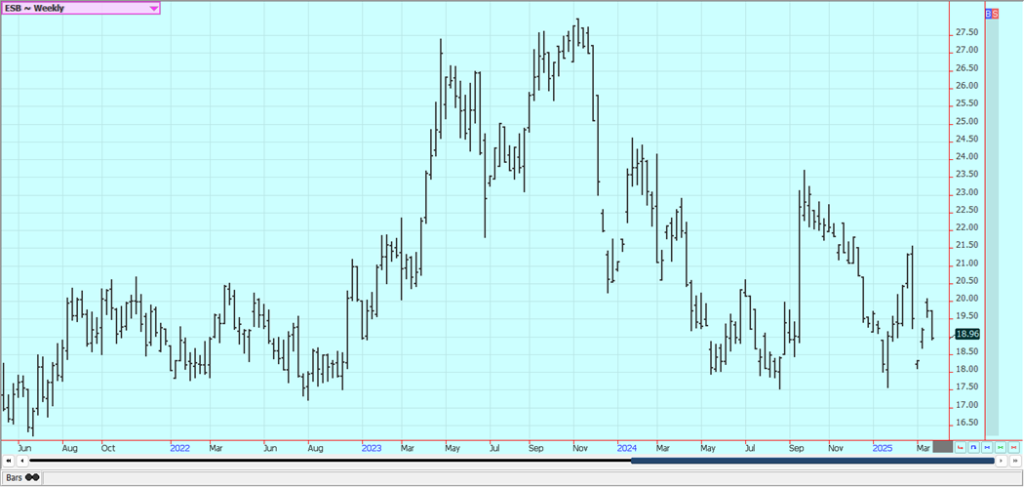

Sugar: New York and London were lower last week in part due to the Brazil weather and in part on relaxed vies on Asian Sugar availability. There were reports of some scattered showers in center south Brazil and forecasts for more showers in the next couple of weeks and reports that India will have comfortable beginning stocks to help cushion the blow from reduced production for the coming year.

Indian production is expected to be a disappointment this year. Ideas of decreasing Brazil and Asian production are still around. Center-south Brazil, India, and Thailand all have reduced production potential due to weather. Trends are turning down in both markets on the daily charts and on the weekly charts.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed higher last week but held the recent trading range. Ideas are that a strong crop is expected and the ICCO recently raised its forecast of production for the coming year. Ivory Coast port arrivals and Ghana arrivals are expected to fade but have held strong so far. There is talk that production will be short of demand for the fourth year in a row, and Ivory coast has already said that offers into the world market will be less this year.

Chart trends are mixed to down in both markets on the daily charts. Producers in Ghana and in Ivory Coast have been fighting against too little rain that has reduced yields.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Sze Yin Chan via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Africa2 days ago

Africa2 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

-

Impact Investing1 week ago

Impact Investing1 week agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing6 days ago

Impact Investing6 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development