Featured

The demand rebound in the commodities market is still not here

Palm Oil closed higher. Demand reports from the private surveyors are stronger this month. Production ideas are turning seasonally higher as trees enter a peak production period over the next few months, but year to year production estimates are down this year from last year. Most importers seem to have enough stocks on hand and the pandemic is keeping overall demand on the lighter side.

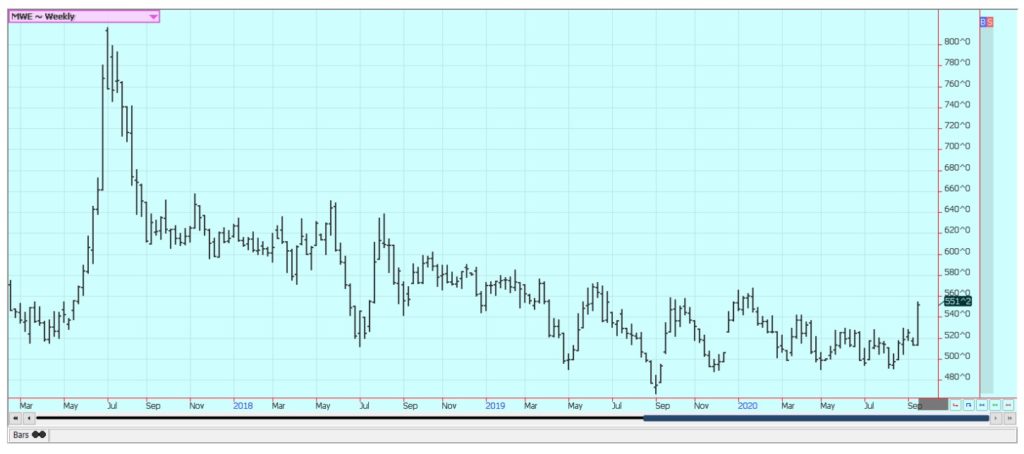

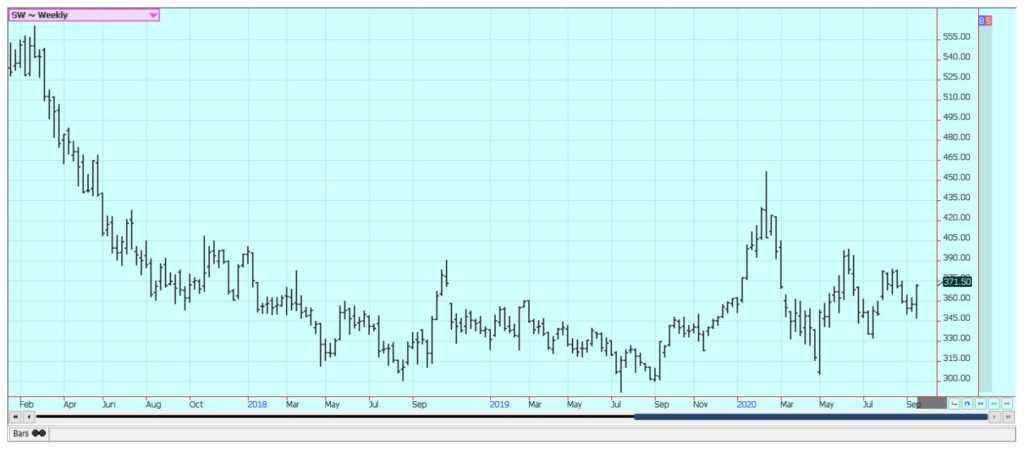

Wheat

Winter Wheat markets were higher last week as it remains dry in Europe and Russia. Western Europe is likely to get some rains in the short term, but eastern Europe and southern Russia could stay dry. These areas are trying to plant the next Winter Wheat crop but the dry weather and the dry soils are keeping farmers out of the fields. Less production is likely in Argentina due to drought. About half of Argentine growing areas are affected. The next crop is being planted now in the northern parts of the world. Conditions are improved in the US after some rains fell in the Great Plains but the southern Great Plains remains mostly hot and dry. The Midwest has had god rains although some areas in the southern Midwest have not gotten much rain recently.

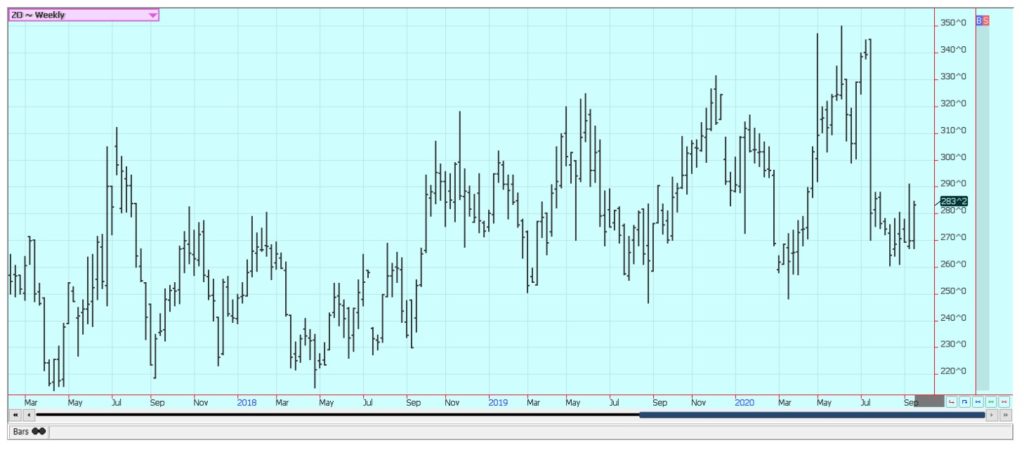

Corn

Corn was higher last week. Demand is holding strong for exports, but it is harvest time and initial yield reports have been strong. USDA has found less damage to crops in Iowa and northern Illinois due to the drought and derecho winds that hit both areas a month ago. That allowed for the higher yield, production, and ending stocks estimates. The harvest is concentrated in the southeast and Delta for now but will soon expand into the Midwest with very good harvest conditions. Demand has held together with China and other countries doing some buying. China seemed to be mostly quiet in the Corn market last week but did buy 210,000 tons on Friday. Other buyers around the world have been active as well. Corn is having trouble making any upside moves despite the demand due to the harvest and stronger than expected very early yield results.

Soybeans and Soybean Meal

Soybeans and the products closed higher for the week. Funds and other speculators were the best buyers on the week in futures and China was the best buyer in cash markets. Soybeans were the leader to the upside due to the strong Chinese demand. Much of the demand until now has been from China and some in the trade now think China will buy more than what USDA has indicated in its supply and demand tables. The trade generally expects China to shift its buying back to Brazil in the near future, but USDA suggests that China could continue to buy here a little longer than expected.

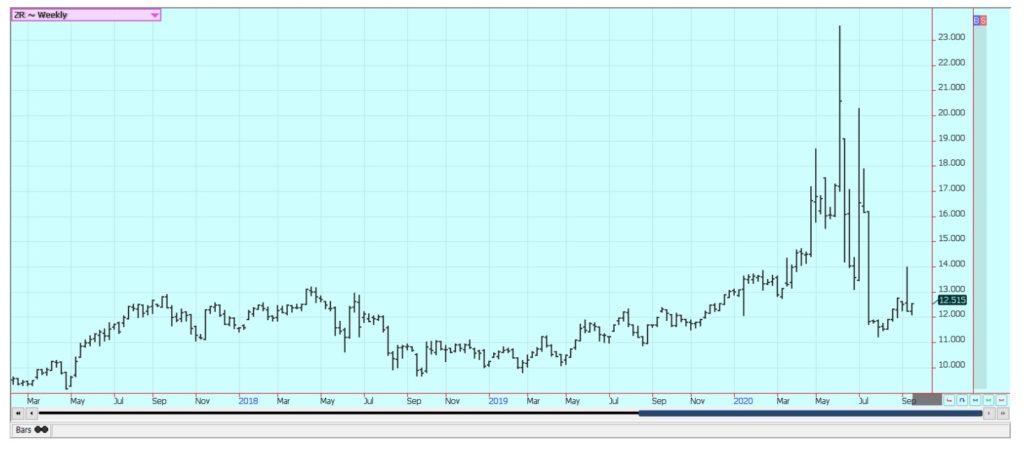

Rice

Rice was higher. Reports indicate that export and domestic demand has not been real strong to start out the new crop year. Exporters and domestic mills are thought to be holding back on purchases for as long as possible due to the current relatively high prices. That changed a little in the last week as the weekly export sales report was strong. Brazil was a buyer of 30,000 tons of Rough Rice and much of Central America was noted buying as well. The rebound in demand supported futures and pushed the market to new highs for the move late in the week. The harvest has been active in most states with good field yields reported. Quality is said to be very good, especially in Arkansas. Milling yields are higher and appearance is very good with minimal chalk or peck showing.

Palm Oil and Vegetable Oils

Palm Oil closed higher. Demand reports from the private surveyors are stronger this month. Production ideas are turning seasonally higher as trees enter a peak production period over the next few months, but year to year production estimates are down this year from last year. Most importers seem to have enough stocks on hand and the Coronavirus pandemic is keeping overall demand on the lighter side. Soybean Oil was a little higher and Canola was higher. Canola farmers have withdrawn from the market and speculators are buying. The rally in US Soybeans futures was also supportive to Canola futures as was weakness in the Canadian Dollar.

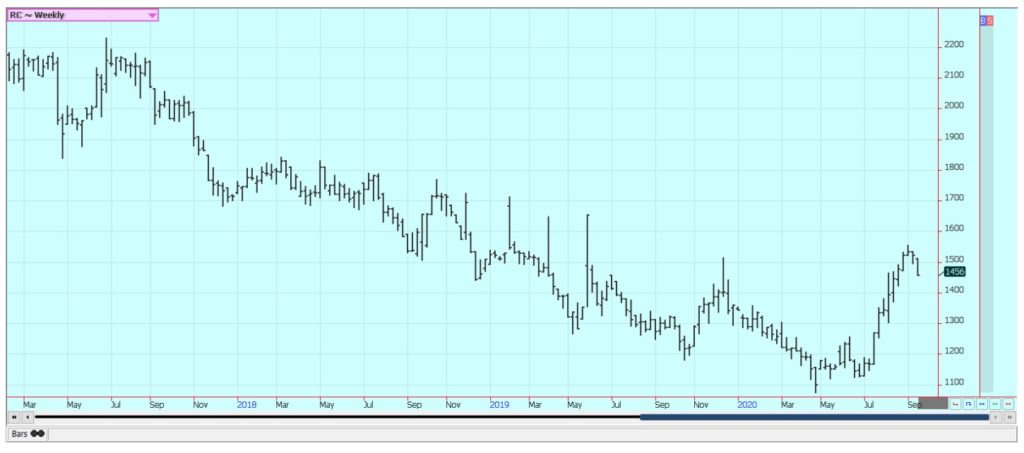

Cotton

Cotton closed a little lower for the week and trends are still sideways on the weekly charts. Demand has improved over the last couple of weeks and export demand was very strong last week. Demand should stay weak as long as the Coronavirus is around. Shopping is hard to do and many people are still unemployed. This is true in just about all countries. Hurricane Sally moved into the Southeast and brought some heavy rains. Ideas are that most of the Cotton crops in the region escaped any major damage that the storm could have brought. The supply losses are in the market now. However, the Harvest is still a ways down the road and the tropical season is active. There will be more chances to inflict more damage on the crops to help try to rally prices.

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower. No hurricanes have hit Florida yet. The systems have all gone south into the Gulf of Mexico or north into the Carolinas. It seems hard to believe that Florida has been spared as this year has been very active for tropical storms with a record amount of tropical storms hitting the US. The lack of damaging weather usually means lower prices for futures but prices are already relatively cheap. The Coronavirus is still promoting consumption of FCOJ at home. Restaurant and food service demand has been much less as no one is really dining out. Florida production prospects for the new crop were hurt by an extended flowering period, but the weather is good now with frequent showers to promote good tree health and fruit formation. Import demand to the US should be minimal as US prices remain below those of Europe. Brazil has been too dry and irrigation is being used. Some showers are in the region now to help in Sao Paulo.

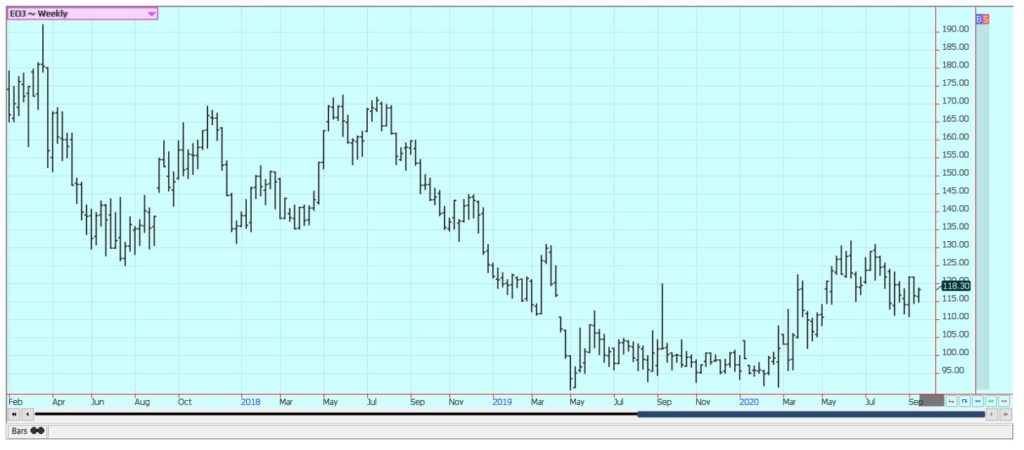

Coffee

Futures were lower last week in New York and in London. New York is close to support areas near 109.70 on the weekly charts. London has been better supported due to stronger demand ideas. The demand from coffee shops and other food service operations is still at very low levels. Consumers are still drinking Coffee at home. Reports indicate that consumers at home are consuming blends with more Robusta and less Arabica. Vietnam was dry during flowering time and is now getting rains. Production ideas are lower. The Brazil harvest is over. Ideas are that production is very strong this year as it is the one year for the trees. The strong production ideas are coming despite hot and dry weather seen in the country at flowering time.

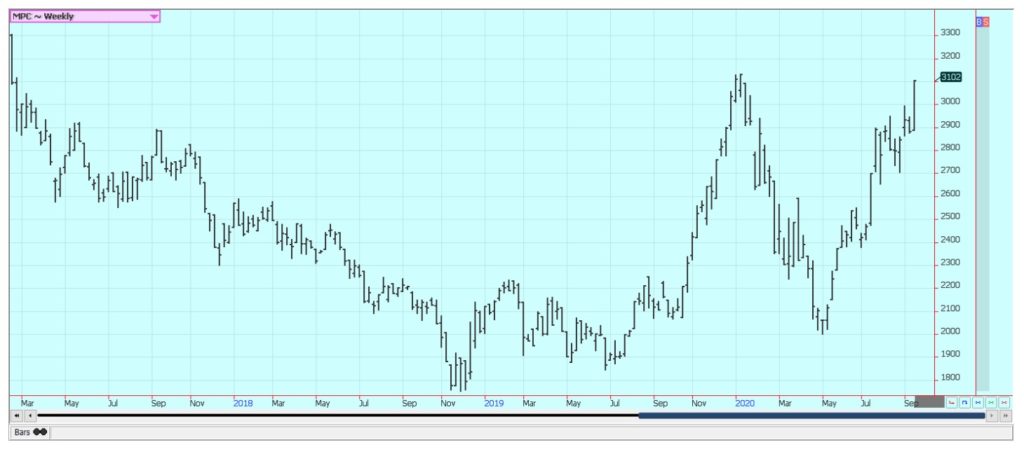

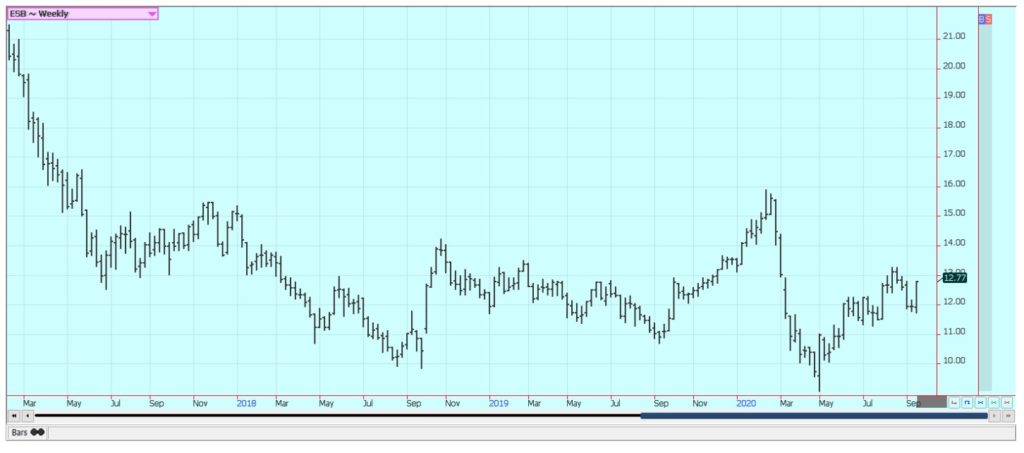

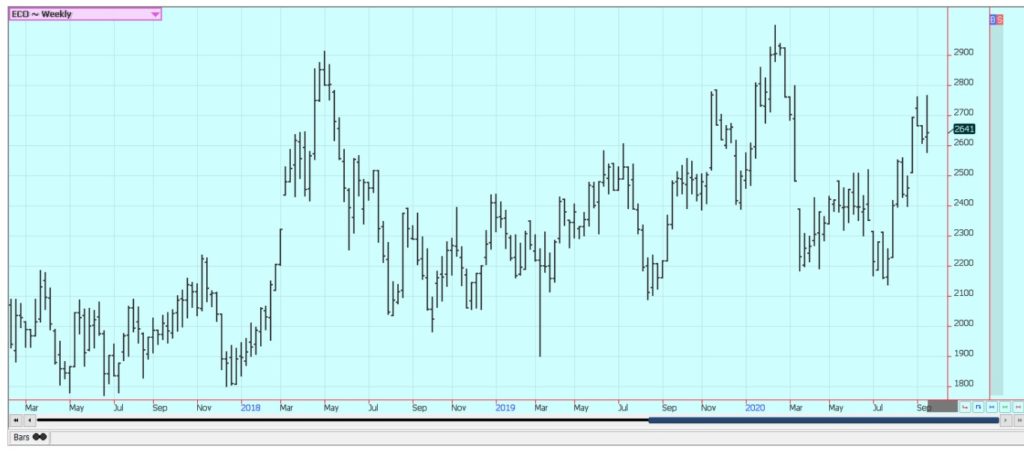

Sugar

New York and London were higher on speculative and fund related buying. Much of the buying came to New York, with London following. Brazil mills have been producing more Sugar and less Ethanol due to weak world and domestic petroleum prices, but that might be changing. Petroleum prices have rallied lately so mills could now be producing less Sugar and more Ethanol. Ideas are that there is plenty of Sugar for the world market. India is thought to have a very big crop of Sugarcane this year but getting it into Sugar and into export position has become extremely difficult due to Coronavirus lockdowns. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. There are reduced flows from rivers from China to hinder irrigation of the crops.

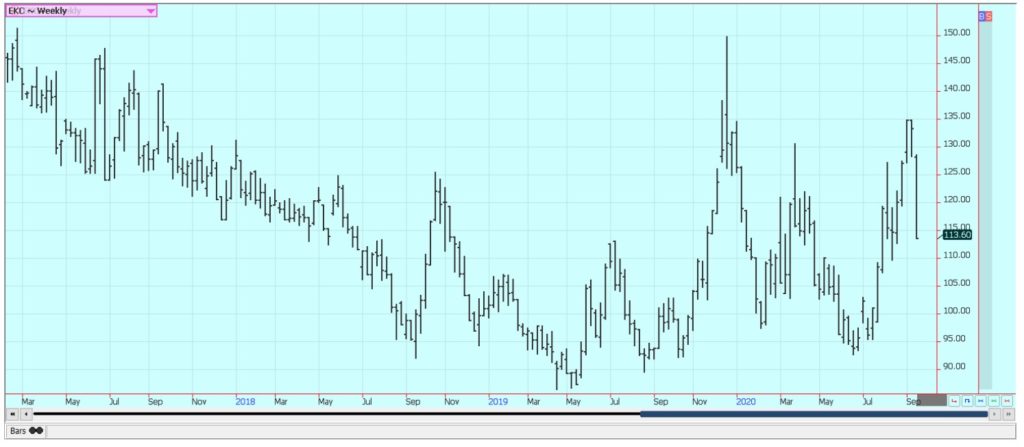

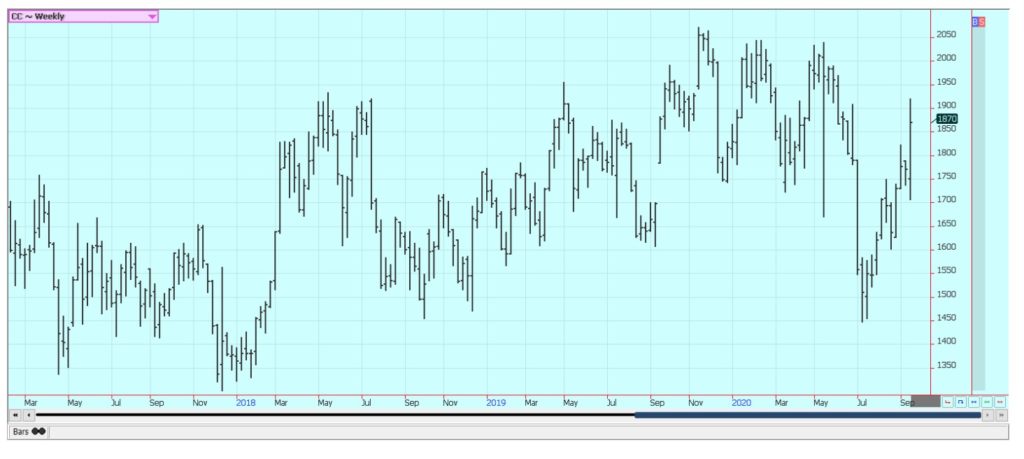

Cocoa

New York and London closed higher. London was the stronger market last week and trends turned up for the London market. New York held to sideways trends as futures were only able to match previous highs for the move. The current crop features strong production but there are worries about the next crop. The harvest for the next main crop just started in southeast Nigeria and will spread to the rest of West Africa in the coming weeks. There are a lot of demand worries as the Coronavirus is not going away and could be making a comeback in the US. Europe is still trying to open its markets again but the Coronavirus is still around and consumers are reluctant to buy. Ideas are that Southeast Asia also has good crops.

—

(Featured image by tristantan via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets2 weeks ago

Markets2 weeks agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Crypto2 days ago

Crypto2 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis1 week ago

Cannabis1 week agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Crowdfunding5 days ago

Crowdfunding5 days agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights