Featured

How to build a good dividend portfolio that can outperform the market

Read on to learn about how to build good dividend stock portfolios.

I have been searching for a formula on how to build a good dividend portfolio of large-cap dividend stocks that can outperform the market by a significant margin on the long run. After many trials, I have found out that a portfolio of twenty S&P 500 companies yielding more than two percent a year and having the highest Research and Development Expense to Revenue ratio is giving excellent results.

I used Portfolio123’s screener to perform the search and to run back-tests according to these conditions. After running this screen on 19 August 2017, I discovered the following twenty stocks, which are shown in tables below.

It is worth noting that pharmaceuticals and biotechnology companies account for forty percent of the companies in the above list, and semiconductors & semiconductor equipment companies account for twenty-five percent of the companies. As I see it, that is not surprising since these industries are very sophisticated and require massive research and development expenses.

The table below presents the research and development expense for the last twelve months (TTM), the revenue TTM and the research and development to revenue ratio, for the leading twenty companies.

Back-testing

In order to find out how such a screening formula would have performed during the last two years, last ten years and last nineteen years, I ran the back-tests, which are available by the Portfolio123’s screener.

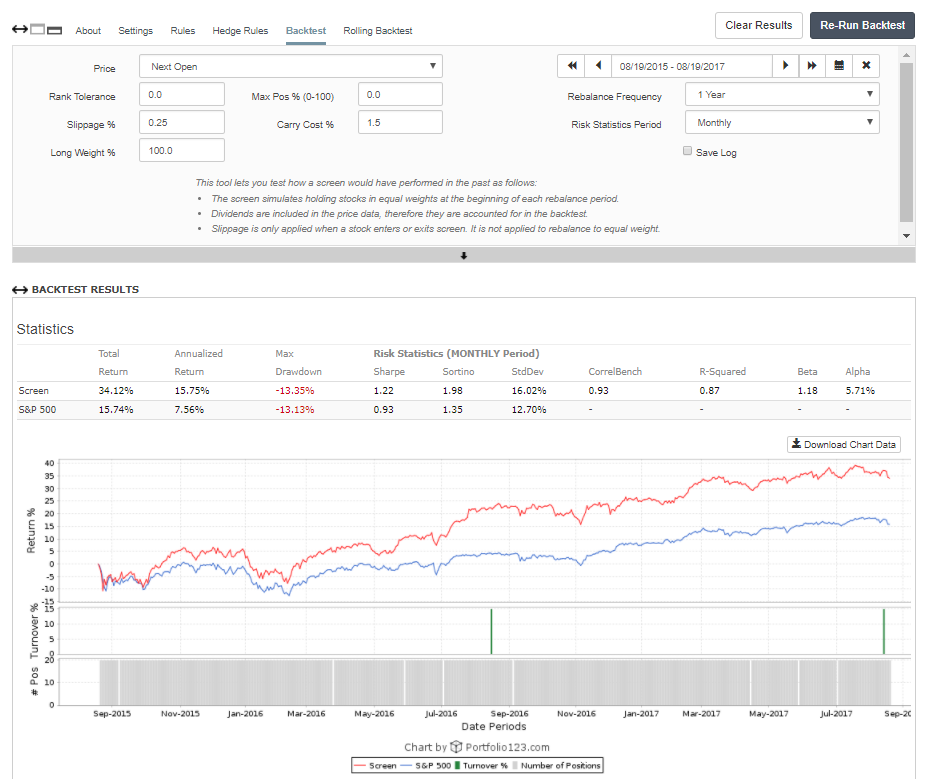

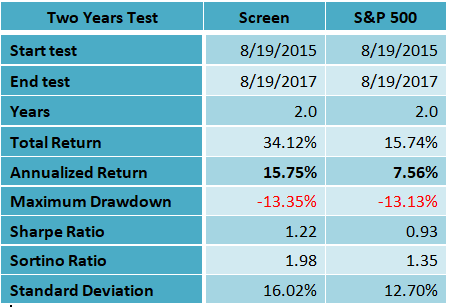

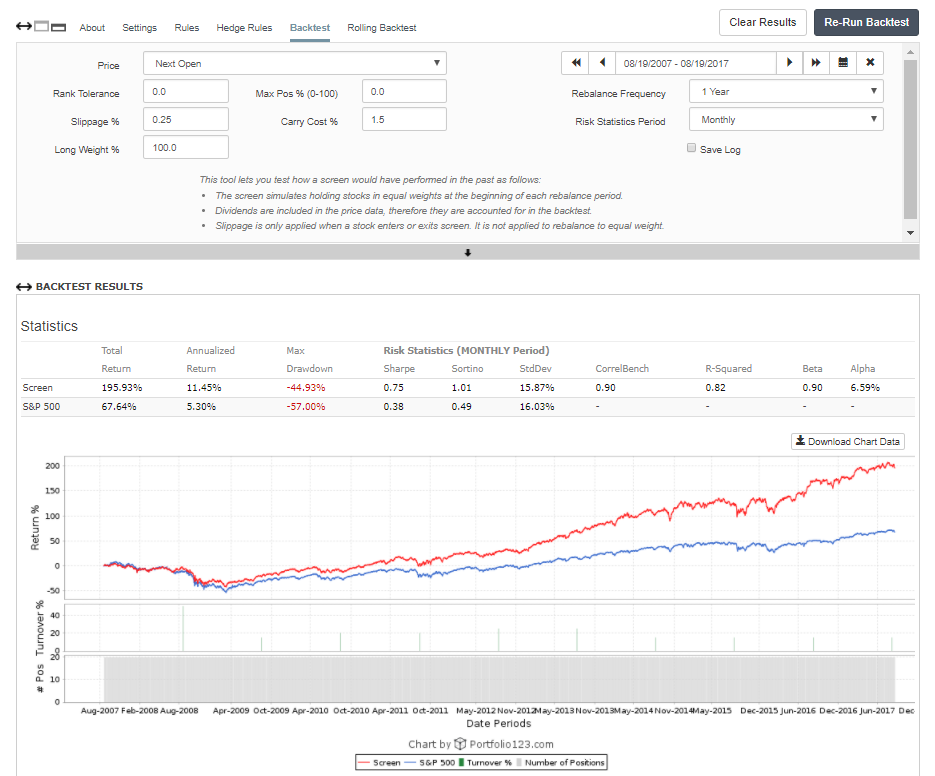

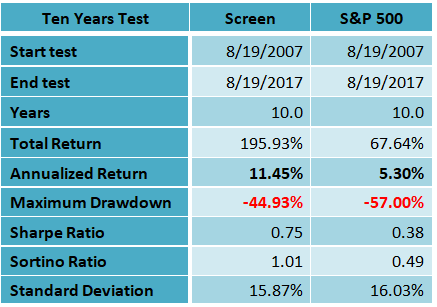

The back-test takes into account running the screen once a year and replacing the stocks that no longer comply with the screening requirement with other stocks that comply with the requirement. The theoretical return is calculated in comparison to the benchmark (S&P 500), considering 0.25% slippage for each trade and 1.5% annual carry cost (broker cost). The back-tests results are shown in the charts and the tables below.

Two years back-test

Ten years back-test

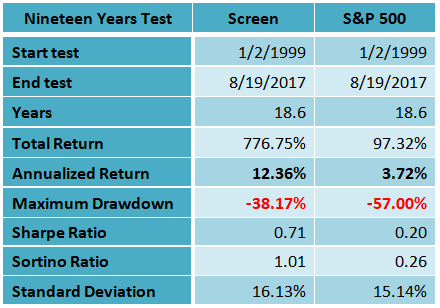

Nineteen years back-test

Summary

The dividend stocks portfolio based on the highest research and development expense to revenue ratio among all S&P 500 companies has given much better returns during the last two years, the past ten years and the last nineteen years than the S&P 500 benchmark. The Sharpe ratio, which measures the ratio of reward to risk, was also much better in all the three tests.

The two years average annual return of the dividend stocks portfolio was at 15.75%, while the average annual return of the S&P 500 index during the same period was at 7.56%. The difference between the dividend stocks portfolio based on the highest research and development expense to revenue ratio to the benchmark was even more noticeable in the nineteen years back-test. The nineteen years average annual return of the dividend stocks portfolio was at 12.36%, while the average annual return of the S&P 500 index during the same period was only 3.72%. What is most important, the maximum drawdown of the dividend stocks portfolio during that time was only at 38.17%, while that of the S&P 500 was at 57%.

Although this dividend stocks portfolio based on the highest research and development expense to revenue ratio has given superior results, I recommend readers use this list of stocks as a basis for further studies.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech2 weeks ago

Fintech2 weeks agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Impact Investing5 days ago

Impact Investing5 days agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds

-

Biotech2 weeks ago

Biotech2 weeks agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

You must be logged in to post a comment Login