Business

How the Dow Jones Closed the Past Week

Right now, the Dow Jones is making new all-time highs, which brings to my mind the nice rebound the Debt market has seen since its lows of Autumn. Dow Jones made a new all-time high on December 13th, and then quickly piled on four additional BEV Zeros before pulling back into scoring position, because that is what happens in bull market advances in the Bear’s Eye View format.

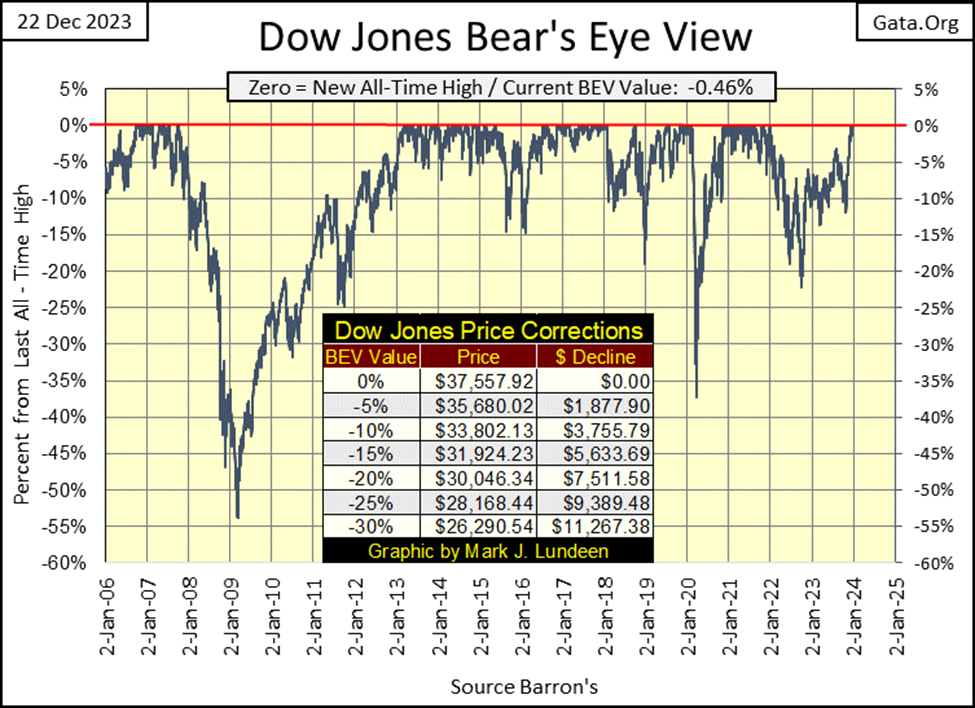

As always, I’m starting with a BEV View of the Dow Jones. The Dow Jones closed the week with a BEV of -0.46%, or only 0.46% away from its last all-time high.

But note, its last all-time high is no longer from two years ago, (04 January 2022), but from three days ago on December 19th. That makes a difference, or should if the Dow Jones can continue piling up new BEV Zeros (0.00% / New all-time highs). But will it, and if it does, how much higher is the Dow Jones likely to advance?

I’m beyond such considerations, as I don’t care how much more the Dow Jones advances. This is a market top; where the potential for profit is rapidly approaching zero, while the hazards for massive losses only grow larger as the Dow Jones rises ever higher.

Well, that is what you say Mark. Look at the Dow Jones from its lows of late October in its daily bar chart below.

Ya, I see it. Still looks like a market top to me. So, I’m passing on the stock market for the time being, leaving all the potential capital gains to you bulls out there. That isn’t going to change until I see another volatility spike in the Dow Jones daily volatility’s 200D M/A, to something well above 1.00%. Currently, this volatility metric closed the week at 0.54%; such low market volatility is another sign of a market top. Also, I want to see the Dow Jones’ dividend once again yielding something well over 6%.

A 6% yield for the Dow Jones is something not seen since September 1982, forty-one years ago. More proof to my way of thinking that for decades now, valuations in the financial system has been inflated into a massive bubble by the idiots at the FOMC. When this inflationary boom finally does go bust – watch out below!

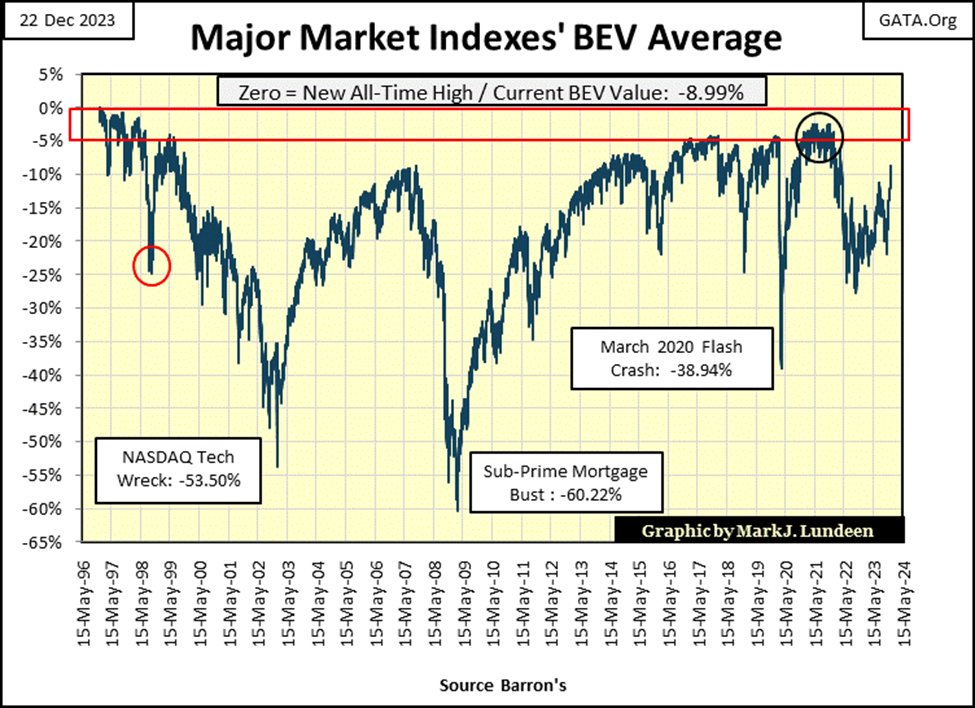

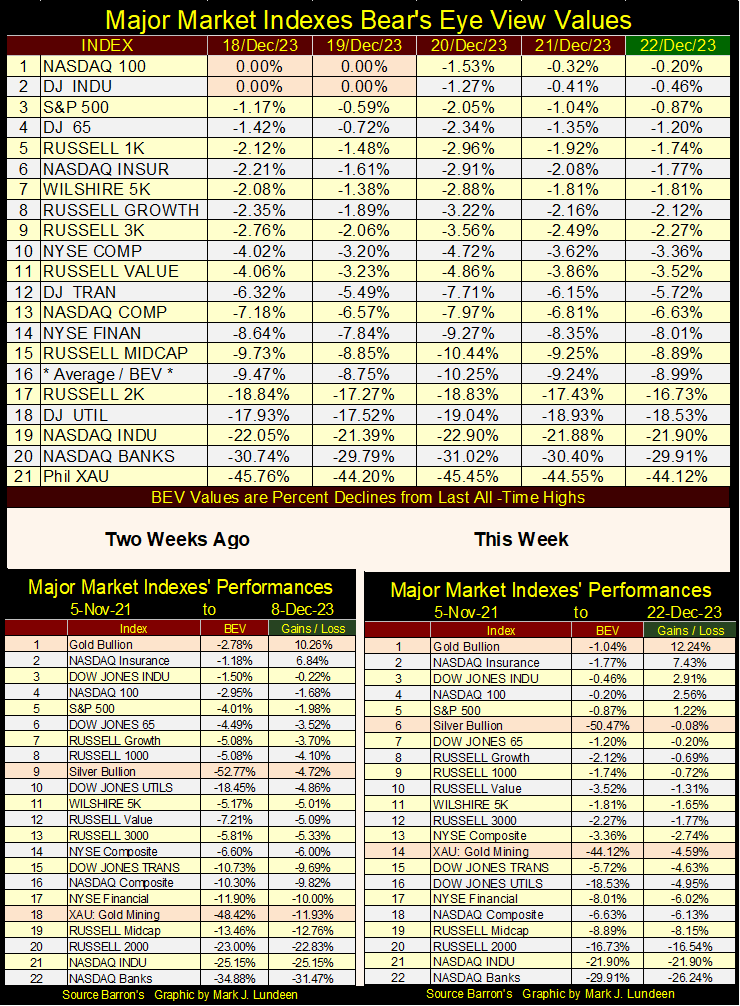

Here are the BEV values for the major market indexes I follow in the table below (two graphics down). The NASDAQ 100 (#1) & Dow Jones (#2) made new all-time highs (0.00% / BEV Zeros) on Monday and Tuesday this week. They, as well as other indexes, may make additional BEV Zeros in the weeks and months to come.

What is of interest to me is seeing how the Average BEV of these indexes (#16) is now in single digits, closing the week at -8.99%, something not seen since April 2022. Looks good! But then market tops always look good to dumb-money.

Looking critically at the chart below, the big money was always made by buying when everything in the market looked like it was going to hell. You know, when the BEV Average of these indexes declined near a BEV -40%, or even better, broke below a BEV of -50% as the financial media was singing to the pubic a song of “Oh Woe is Me” as a bear market was approaching a bottom. Seeing this average’s BEV value rise into single digits was a signal to sell, not buy. Why would it be different this time?

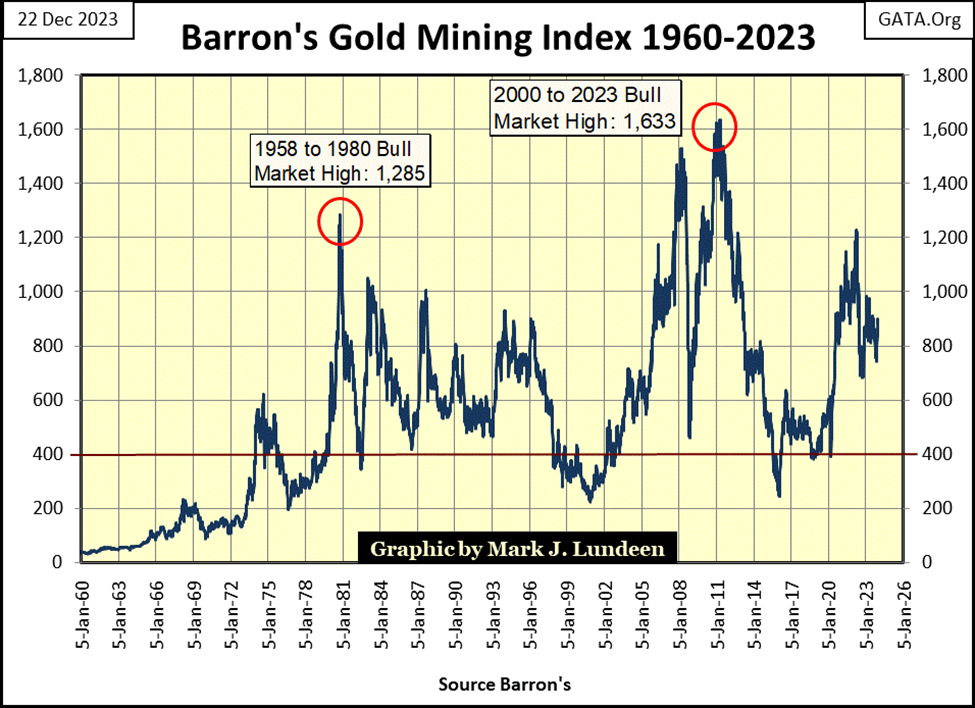

Going back to my BEV values for the major market indexes I follow in the table below, Geeze Louise, the gold miners in the XAU (#21) can’t get out of their way. For years now, they’ve languished below their BEV -40% line.

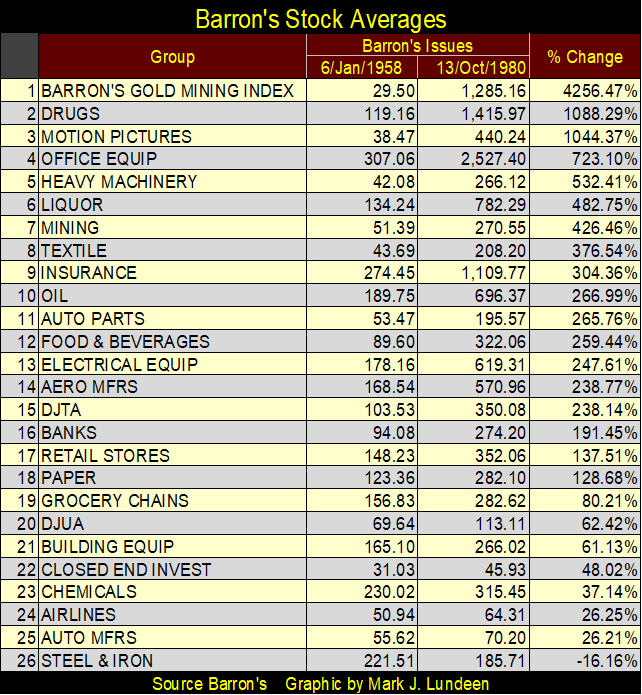

To get a better picture of the problems the gold miners have had, let’s look at the Barron’s Gold Mining Index (BGMI) in the chart below. Sure, prominent in the chart below are the valuation spikes seen in March 2008 and in April 2011; both spikes took the BGMI to new all-time highs. But in this weekly data series, most weekly closes for the past forty-three years are below, well below the BGMI highs of October 1980. As has been so since 2012, going on for the past eleven years.

What a difference from the late 1950s to 1980, where in October 1980 the Barron’s Gold Mining Index was the #1 stock group in the stock market, as covered by Barron’s Stock Averages. As reported in the dusty old pages of Barron’s from years gone by, nothing else came close to gold and silver mining.

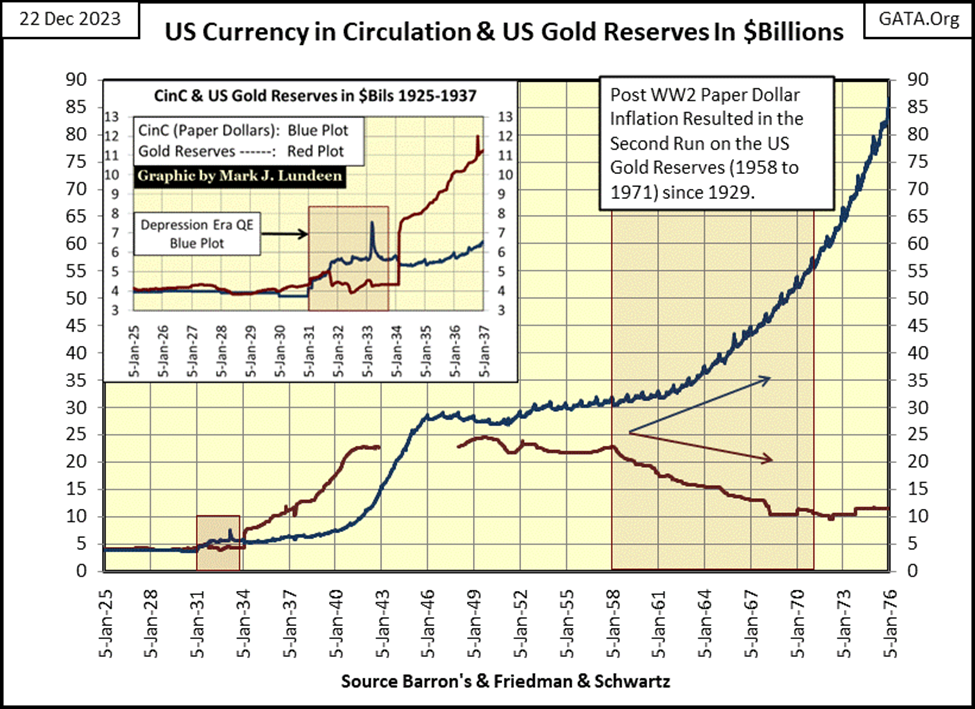

What drove the BGMI up as it did for these twenty years? The “policy markers” severed the dollar from its Bretton Woods $35 gold peg, by issuing more paper dollars (Blue Plot, chart below) than the US Treasury had gold reserves (Red Plot) to back them. First, a run on the US gold reserves began in 1958. That run on the US gold reserves only ended when the US Treasury refused to exchange its monetary gold for its paper dollars in August 1971.

Terminating the $35 gold peg didn’t solve the problem. It only encouraged the “policy makers” to print additional paper dollars at an even higher rate. That is why in October 1980, the BGMI was the best performing stock average in the Barron’s Stock Averages.

What happened after 1980? I’m going to sound like a conspiracy theorist, but at the dawn of 2024, anyone who still believes what the “market experts” on TV, or professors-of-economics tells them about how the market works, is clueless on how our world actually works.

Beginning in the first half of the 1980s, the “policy makers” finally figured out how to inflate the US money supply, without inflating the price of the old monetary metals (gold and silver) and the companies that used to mine money. Which was how gold and silver were once understood to be – MONEY mined from the Earth. The key in doing that, was to suppress the prices of gold, silver, and the precious metal mining shares, as seen above since 1980.

This week Eric King’s King World News (KWN), has Eric interviewing Alasdair Macleod that I found alarming for the stock and bond markets, as well as for the banks. But it’s an ill wind that blows no good, and the coming wind should be very positive for the old monetary metals, their miners and most especially for gold and silver exploration companies, or so Alasdair believes, and I agree.

I expect what Alasdair has to say about the market will all come to pass in 2024. But right now, the Dow Jones is making new all-time highs, which brings to my mind the nice rebound the Debt market has seen since its lows of Autumn.

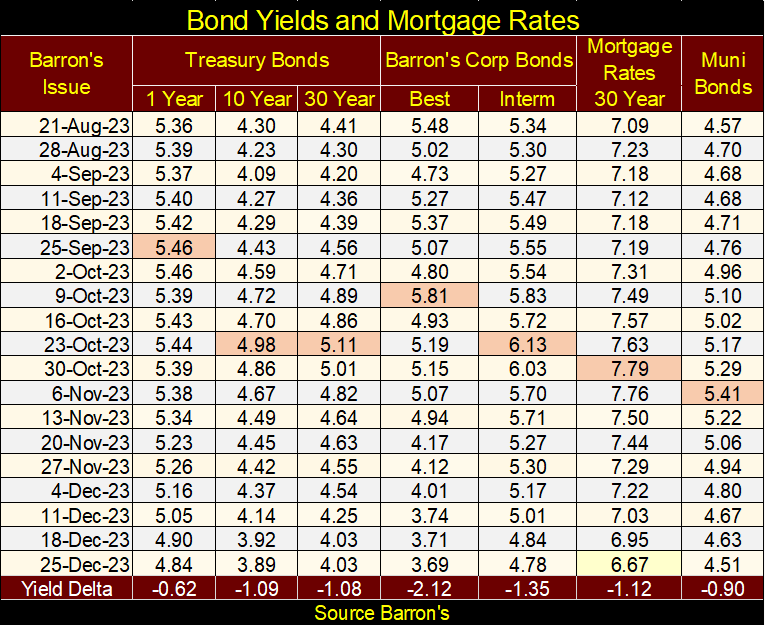

As seen highlighted in the table below, yields have fallen – a lot in the past two months. The bottom row in this table labeled “Yield Delta” lists the decline in percentage terms from their highs in the table of the noted bonds below. Barron’s Best-Grade Bonds (Corporate Bonds) yields have fallen over 2% since October. That is huge!

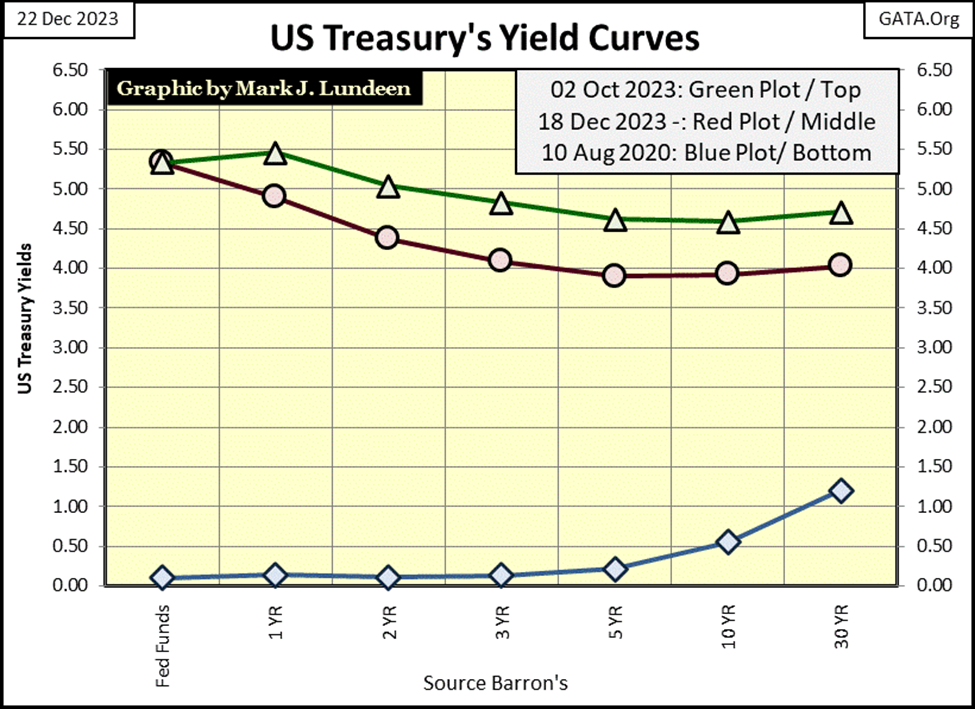

Next is a chart plotting three yield curves;

- August 2020; Blue Plot when T-bond yields bottomed,

- October 2023; Green Plot their recent peak in yields,

- December 2023; Red Plot where yields are now.

Bond yields have come down a bit from their highs of October, but not that much. With everyone from China to the FOMC itself selling T-bonds in the Treasury market, as the US Treasury with its deficit spending continues flooding the Treasury market with trillions of dollars of new T-bonds; who in the hell is buying them, and why?

I can’t say for a fact, but there appears to be a lot of damn-stupid buying of T-bonds in this market. Whenever I think of dumb money in the markets; I mean really stupid money, dollars spent by the trillions by morons, as is currently happening in the debt markets, eventually it always comes down to those idiots at the FOMC doing what they do best; buying financial assets at prices no one else would dare to, too “stabilize market valuations.”

But, the FOMC is still selling T-debt in a continuing QT, as they have since May 2022. I don’t believe that for a second. But you can if you want to.

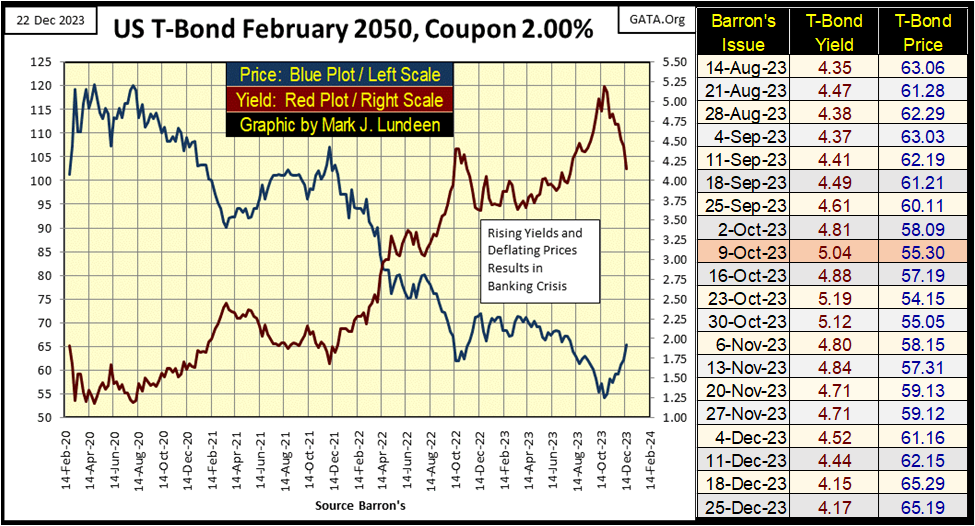

How these declines in yields have impacted bond valuations is displayed in the chart below of a 30Yr T-bond, issued in February 2020. This T-bond’s valuation (Blue Plot) has increased by 20% since Barron’s 09 October 2023 issue. The Dow Jones is up only 15.3% from its lows of Autumn (October 27th). That just seems so odd to me, and when it comes to markets; odd = bad in my mind.

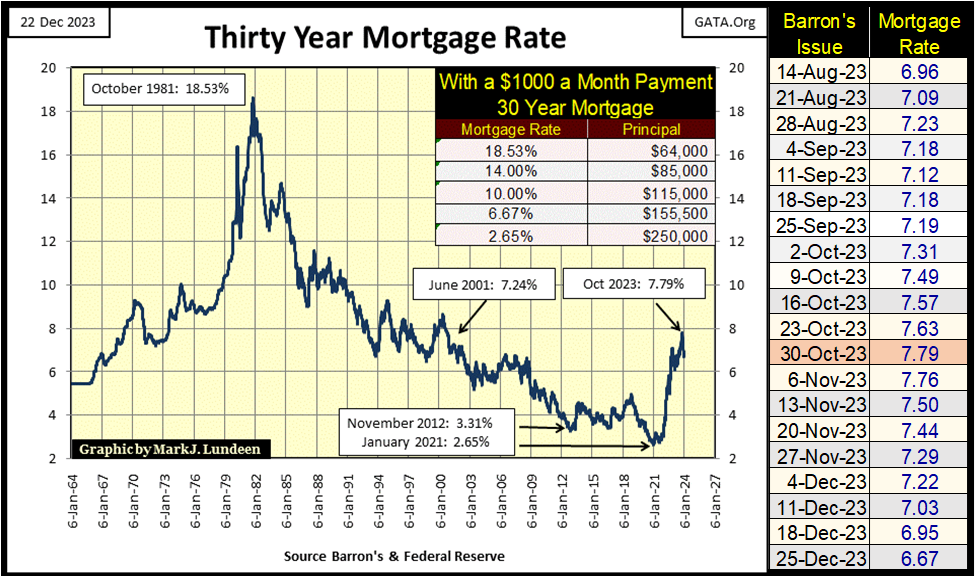

Mortgage rates have fallen over 1% since October, and guess what? I’ve seen a few homes with for sale signs in my neighborhood. Though seeing a home for sale isn’t the same thing as seeing a home actually being sold.

Let’s look at gold’s BEV chart. Since August 2020, anytime gold got close to its Red BEV Zero line, the COMEX Goons gave the gold bulls a damn good spanking by dragging the price of gold below its BEV -15% line, and they kept gold down there for a while.

But that changed in April 2023. By October the goons got gold below its BEV -10% line, but not for long, and then gold made a new all-time high on December 1st, its first since August 2020.

What does that tell us? Good question, and answering good questions like that is an excellent way for someone like me to look like I haven’t a clue of what is going on in just a few weeks or months to come.

But I will say this; looking at how gold has been trading in the red circle above, since last April, something has changed in the gold market. Being the optimistic type, I’m inclined to believe this something will prove to be for the better for the gold and silver bulls in 2024.

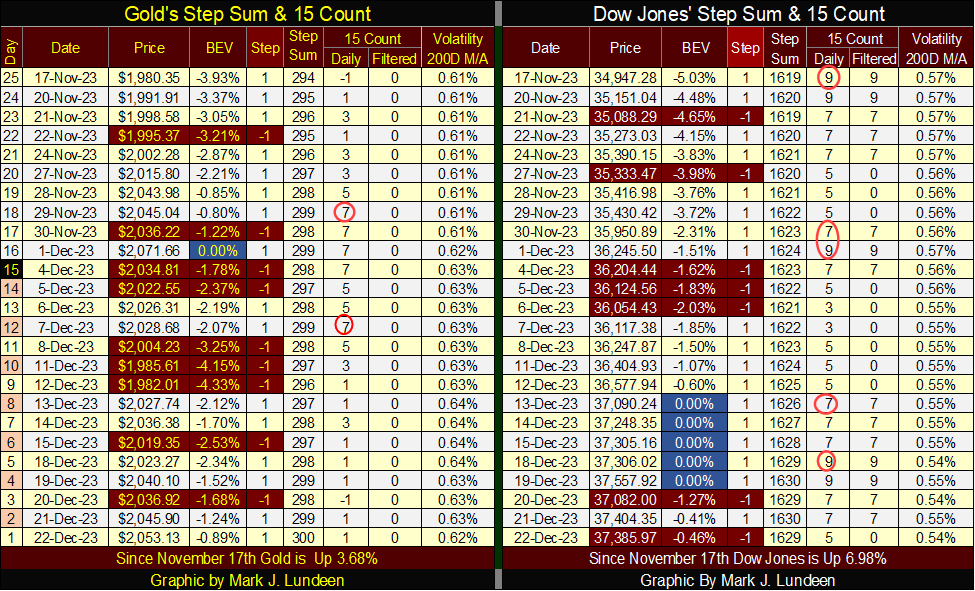

But as seen below on gold’s side of the step sum table, the COMEX goons are still a force to be reckoned with. Gold on December 1st made one new all-time high (0.00% / BEV Zero), with the following fifteen trading sessions closing in scoring position. If this was a real advance, I believe we should have seen a few more BEV Zero in the past three trading weeks.

For example, look at what the Dow Jones did on its step sum table. It made a new all-time high on December 13th, and then quickly piled on four additional BEV Zeros before pulling back into scoring position, because that is what happens in bull market advances in the Bear’s Eye View format.

That gold has yet to accomplish a similar technical feat; a string of BEV Zeros as seen above with the Dow Jones, makes me very wary about getting too bullish on gold just yet. It will happen. I’m just noting that it hasn’t happen just yet, and until it does, I’m hedging my bets on any explosive advance in the price of gold.

Christmas, December 25th 2023 was today, on Monday. Christmas once was a huge cultural event in Europe, and in the Americas in past decades. In World War Two, the Americans listened to German soldiers sing Silent Night during the Battle of the Bulge. That would not happen today!

Gone today are the universal greetings of “Merry Christmas,” once heard everywhere in the mass media not all that long ago, and prominently proclaimed in stores where people went shopping for their Christmas presents.

Christmas will continue to diminish as a cultural event. As the masters of this world; members of the World Economic Forum, professors at universities and colleges, Hollywood, and other key outposts of today’s corrupt establishment, worship other gods. These people have no love for Jesus, or of you and me.

What changed?

Less than one might think at first. Charles Darwin published his Origin of the Species before the American Civil War, in November 1859. This was a time when steam locomotives were cutting edge high-tech. 19th and 20th academics were quick to take on evolution as a rational explanation for how life began, as believing that God created life on this Earth was irrational to science, to those who demanded empirical evidence of how things in their world worked.

How has evolution withstood the march of science in the past 164 years? Not so good, though that would be news to biology teachers, and the college professors who teach biology teachers everywhere.

Below is a typical class room where evolution is taught.

The mechanism of evolutionary origins of life began to be understood as a chemical process, basic atoms in the Earth’s early seas combined into DNA, with abundant life on Earth that followed. It’s important to note chemists have never been able to reproduce what actually happens in a living cell – far from it on their best days.

As seen in the short video below, having DNA without the required machinery, yes * REQUIRED MACHINERY * to manipulate it in every living cell on Earth is pointless. If that wasn’t true, what kind of visions of horror would we see whenever we’d open a can of Spam?

It’s amazing stuff happening inside of all of us. Still, it’s up to each of us to understand why life began; either the inevitable consequence of the physical laws of nature, or the result of a loving God.

The following quote by Stephen Hawking nicely sums up academia’s attitudes on a God created universe.

I’ve always been fascinated with astronomy, and in years past waited anxiously for the launching of the James Web Space Telescope (JWST). I have to admit, one of my biggest joys with the JWST, is how many academic apple carts it has overturned. Many pre-JWST Ph.D. papers on astrophysics that were brought into doubt concerning this, and that, and everything else about the creation of the universe.

Like Darwin’s evolution, these scientific theories of cosmology of the past 100 years aren’t aging very well. But then why would they? It’s like the sailor prayer; protect me Lord, for your sea is so big and my boat so small. I’ve been through a few typhoons in the Pacific, whether on an aircraft carrier, or a LST (Tank Landing Ship), I know exactly what the prayer above means in an angry sea. For anyone to assume humanity knows anything about the universe with “scientific certainty,” with the limited facts we now have, or will have in the next few hundred years, is pure hubris.

The thing I note most; no matter what, academia, and the global elite’s refusal to acknowledge even the possibility of a God created universe. To be a member of the academy, and to do so, will result in one’s research to be defunded by those who hold the purse strings of science.

But that is not me! I disagree with professor Hawking. I believe God is personally involved with his creation – humanity. This may sound silly to “science,” but I believe God (Jesus) was born a little baby to the Virgin Mary in a stable, in Bethlehem, because that is what he wanted; to be borne in poverty, so best see what life was like for his creation – people like you and me.

The Lord experienced life, and death on Earth not as a king or a master on the field of battle, but as a humble human being, someone who was kicked around, a lot during his lifetime on Earth.

That is why Christmas was once celebrated with much joy not all that long ago. That this is now changing will not prove to be a positive development for society, as our cultural elite rejects the Bible’s Ten Commandments and its Golden Rule; of doing to others as you would have them do to you.

__

(Featured image by Dimitri Karastelev via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech4 days ago

Biotech4 days agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

-

Markets2 weeks ago

Markets2 weeks agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto18 hours ago

Crypto18 hours agoBitcoin Traders Bet on $140,000: Massive Bets until September

-

Crypto1 week ago

Crypto1 week agoCaution Prevails as Bitcoin Nears All-Time High