Featured

Due to Demand Concerns, the Rice Prices were Lower Last Week

Rice prices were lower for the week in good volume trading on demand concerns. It looked like speculators were the best sellers. WASDE decreased ending stocks and increased demand in its monthly updates yesterday. All of the changes were noted for long grain. No changes were made for new crop estimates except for the decreased carry in and therefore decreased ending stocks.

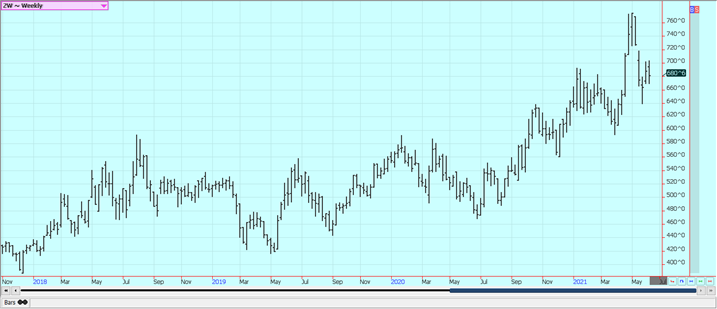

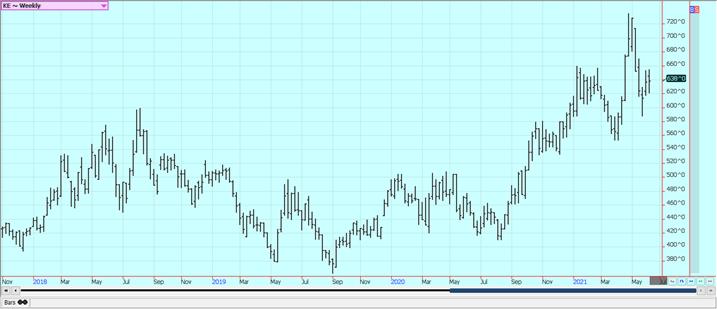

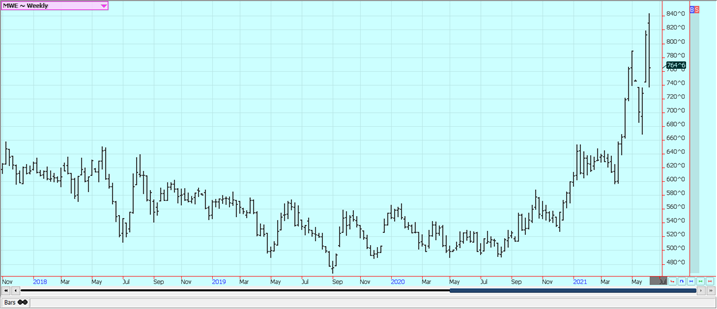

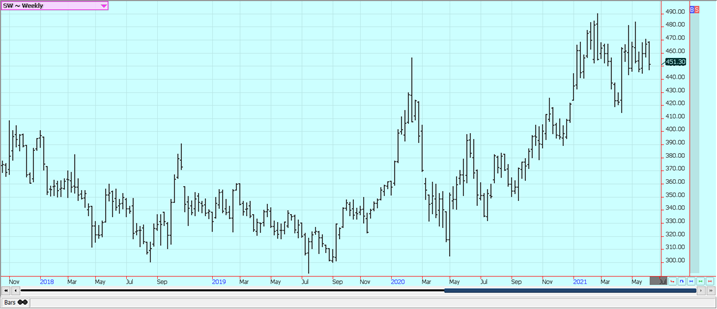

Wheat: Wheat markets were mixed, with winter wheat markets narrowly mixed and Minneapolis Spring futures down sharply as rain showed up in Canada and the northern Great Plains. Spring Wheat areas of the US and Canada got some showers and storms, but mostly in Canada. The storms appeared in the US on Friday. North Dakota is looking mostly dry and model runs from yesterday have taken some of the precipitation for the next week out of the state. Showers and rains were seen in parts of Western Texas and in Oklahoma. More showers are in the forecast in western Texas. Some rains would be very beneficial for planting and initial growth of the Spring Wheat while the drier but still wet weather would help Winter Wheat crops. USDA slightly increased Winter Wheat production in its reports released yesterday, but demand was increased as well, especially on the export side. USDA forecast slightly lower ending stocks because of the changes.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

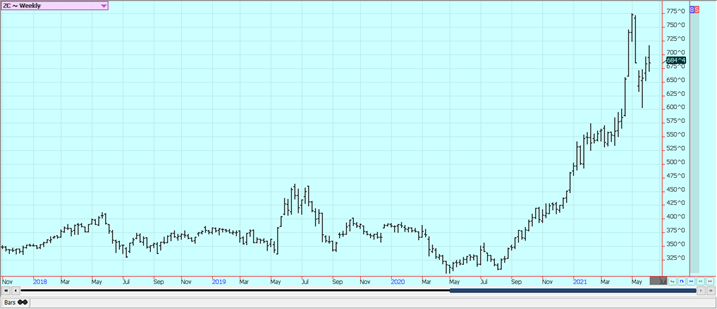

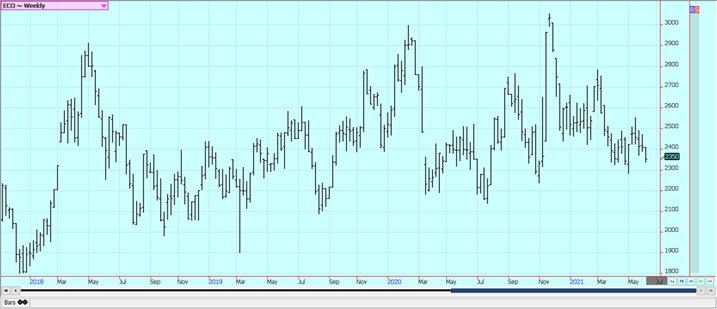

Corn: Corn and Oats closed higher as forecasts for the Midwest changed for the second time last week. Hot and dry weather is forecast for the Great Plains and Midwest this week and hot and dry conditions continue in central and northern Brazil. Some showers are now in the forecast for the Midwest in the second week. Longer range forecasts released by NWS call for warmer and drier weather for many important US growing areas this Summer. There are problems with the production potential for the Safrinha crop in Brazil as growing areas have been warm and dry and look to stay that way longer term. Reports indicate that crops are being stressed due to the lack of rain. It is drier in central and parts of northern Brazil, but southern Safrinha areas got some timely and somewhat beneficial precipitation last week.

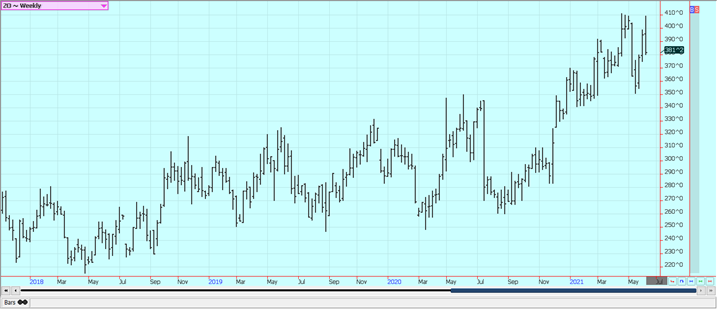

Weekly Corn Futures:

Weekly Oats Futures

Soybeans and Soybean Meal: Nearby Soybeans and both products were sharply lower as weather and demand concerns returned to the forefront. USDA released its monthly WASDE updates and showed less domestic demand and higher ending stocks. Export demand was left unchanged and all data for the next year except ending stocks levels were also left unchanged. President Biden is apparently considering adding some waivers back to the renewable fuels program to help industry and is under some pressure to do this. There are no waivers allowed now, but new waivers would hurt Soybean Oil demand. It rained on Friday in the Great Plains from Nebraska to North Dakota and on into Canada. Forecasts call for warm and dry weather this week in the northern Midwest and northern Great Plains but showers are in the forecast for much of this week in central and southern areas. China should start with new US Soybeans purchases soon for Fall delivery and reports indicate they are now asking for offers. The longer range forecasts from NWS call for warmer and drier than normal conditions for most Soybeans areas of the US. There is still crush demand and a little export demand even though the demand is less now than before.

Weekly Chicago Soybeans Futures:

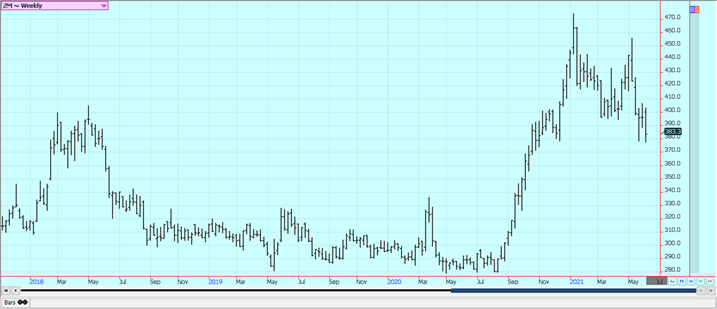

Weekly Chicago Soybean Meal Futures

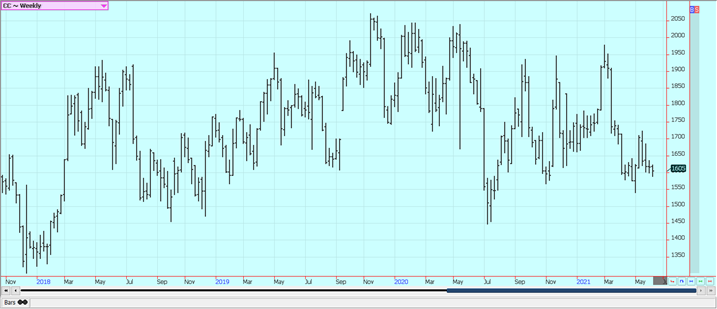

Rice: Rice prices were lower for the week in good volume trading on demand concerns. It looked like speculators were the best sellers. WASDE decreased ending stocks and increased demand in its monthly updates yesterday. All of the changes were noted for long grain. No changes were made for new crop estimates except for the decreased carry in and therefore decreased ending stocks. Moderate precipitation and warmer temperatures are forecast for southern US growing areas. Rice areas have generally been wet and northern areas have been cool. Louisiana and parts of Texas are saturated but crops are rated in good condition overall. Warm temperatures are reported in Arkansas and Missouri and the crop progress is improving. However, it is still very wet in Arkansas and farmer progress has been limited for the last couple of weeks. Texas and Louisiana are almost out of Rice, but there is Rice available in the other states, especially Arkansas. Milling interest in Rice is said to be slow.

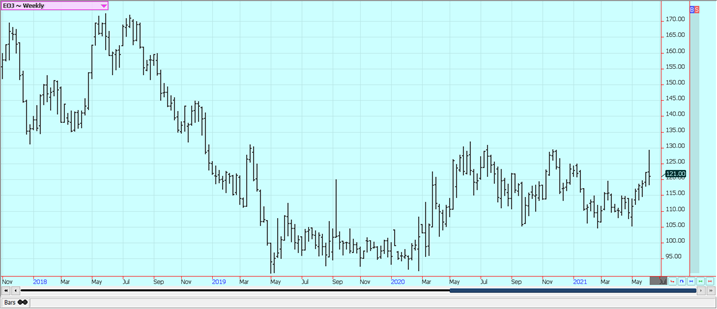

Weekly Chicago Rice Futures

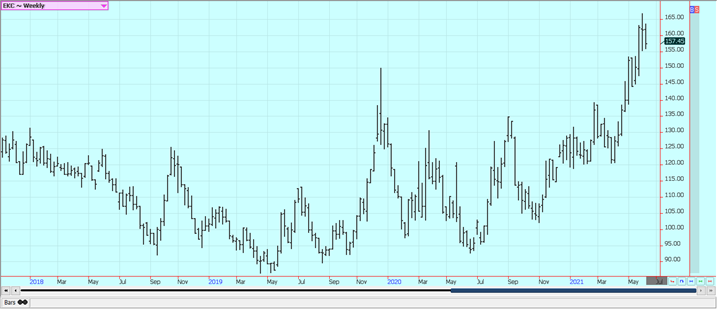

Palm Oil and Vegetable Oils: Palm Oil was sharply lower last week on reports from MPOB of increasing production and stocks levels. The private surveyors showed less demand so far this month. There were reports that Indonesia was about to cut its Palm Oil export duty. Demand has been less so far this month and the market fears the loss of Indian demand due to the big Coronavirus outbreak in India that could cut demand. However, prices are very high in India and imports are needed. Canola closed lower on demand and weather concerns. Weakening demand ideas were negative for prices as were ideas that the Canadian Dollar is ready to move much higher. Demand is thought to be OK with crush margins favoring a lot of production of vegetable oils to feed the demand but less exports. The demand for bio fuels is about to increase and is one reason to see much stronger Soybean Oil and Canola prices. The weather is improving in the Prairies with rains and more in the forecast into next week. Soybean Oil was sharply lower on Friday and lower for the week as President Biden started to consider changes in blending requirements for biofuels. There are currently no waivers allowed but the administration is apparently considering making at least some waivers available to industry.

Weekly Malaysian Palm Oil Futures:

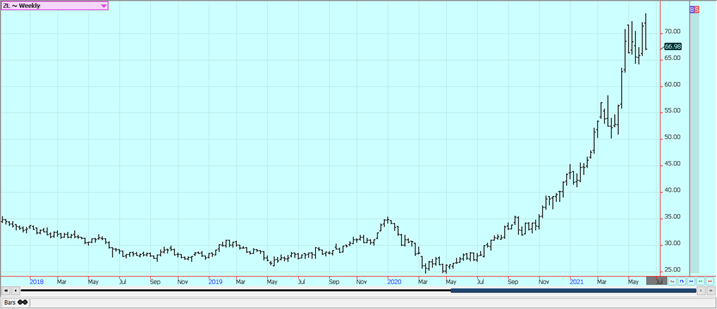

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

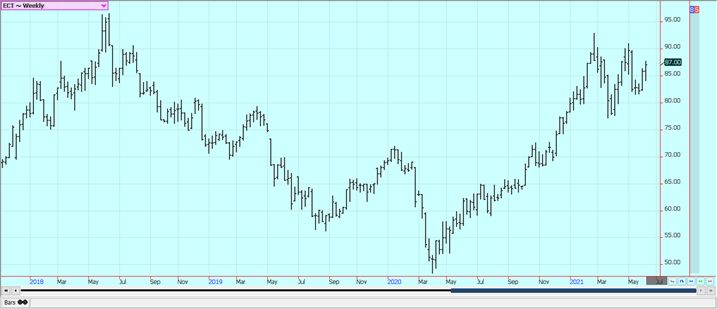

Cotton: Futures were higher last week on weather concerns. Trends are still mostly up on the daily charts. USDA released its monthly WASDE updates and the market found the reports a little bearish for a while as prices fell mid day. However, the potential for reduced production this year kept the market moving higher by the close as did USDA expectations for increased demand for exports. The reports highlight a potentially tight ending stocks scenario for the current and the next crop year. Cotton growing conditions have improved with rains reported in West Texas and the Delta. West Texas is now too wet. It is dry in the southeast. Production ideas are being impacted in just about all areas due to the weather extremes. Delta crop conditions are called good. Cotton demand remains solid although weaker this week.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed sharply lower on Friday and a little lower for the week after making new highs for the move on the weekly charts. Chart trends are mixed. The move came partly on forecasts from USDA for increased oranges production in Florida. The weather in Florida is good with isolated showers. The hurricane season is coming and a big storm could threaten trees and fruit. An active season is anticipated but that does not mean a big and damaging storm is coming. It does mean that the market will be on alert if one does show up. It is dry in Brazil and trees and fruit are stressed. Stress to trees could return if the dry weather continues as is in the forecast. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. It is dry in northern and western Mexican growing areas. Florida Mutual said that inventories are 15% less than last year.

Weekly FCOJ Futures

Coffee: Both markets traded to new highs for the move early in the week, then spent the majority of the week trading sideways at lower prices. The return of dry and hot weather to some of the Brazil growing area was the reason for some buying, but reports of beneficial rains in much of Minas Gerais caused selling. Drier conditions are in the forecast for these areas this week. The daily and weekly charts show mixed trends now in both markets but both markets have cleared some important resistance areas on the weekly charts and remain above these areas. Good conditions are reported in northern South America and improved conditions reported in Central America. Colombia is having trouble exporting Coffee right now due to protests inside the country. Conditions are reported to be generally good in Asia and Africa. Vietnam exported 130.285 tons in May, down 1.4% from April.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

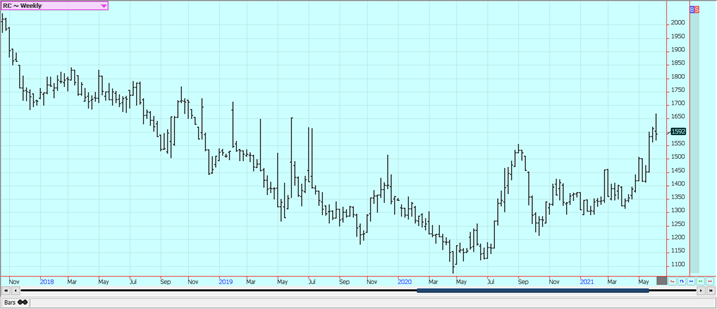

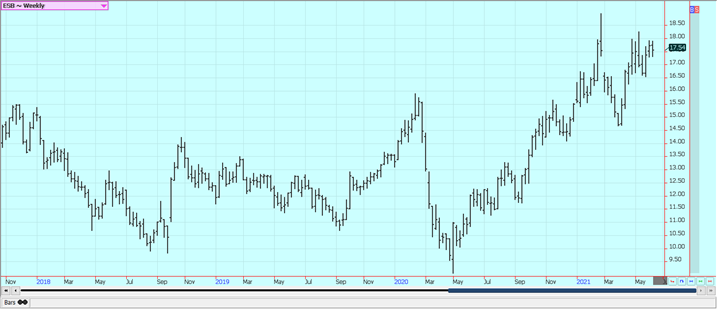

Sugar: New York and London spent most of the week in a trading range on forecasts for better rains in southern Brazil production areas and a stronger US Dollar against overall dry conditions in Brazil and ideas of increasing demand for Sugarcane. London moved out of its trading range to lower as White Sugar is available to the market. Demand for ethanol should be increasing and could divert the cane processing to production of the ethanol and away from Sugar. There is plenty of White Sugar available in India for the market. Southern growing areas of Brazil are getting some beneficial rains, with Parana and parts of Sao Paulo getting the best rains. Production has been hurt due to dry weather earlier in the year. India is exporting Sugar and is reported to have a big cane crop this year. Thailand is expecting improved production after drought induced yield losses last year. Ethanol demand is returning to the market as more world economies open up after the pandemic.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: Both markets were a little lower for the week. The daily charts show sideways or down trends in both markets. The harvests are over in West Africa and ports there have been filled with Cocoa. The weather has been a little too dry for best production prospects for the next crop. European demand has been slow as the quarterly grind data showed a 3% decrease from a year ago in grindings. This has been caused by less demand created by the pandemic. Asian demand improved. North American data showed improved demand. The supplies are there for any increased demand.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

—

(Featured image by Sandy Ravaloniaina via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

A majority of the source material for this article was obtained via BBC. In the case of any discrepancies, inaccuracies, or misrepresentations, the source material will prevail.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

-

Fintech1 week ago

Fintech1 week agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Impact Investing4 days ago

Impact Investing4 days agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Cannabis2 weeks ago

Cannabis2 weeks agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty