Impact Investing

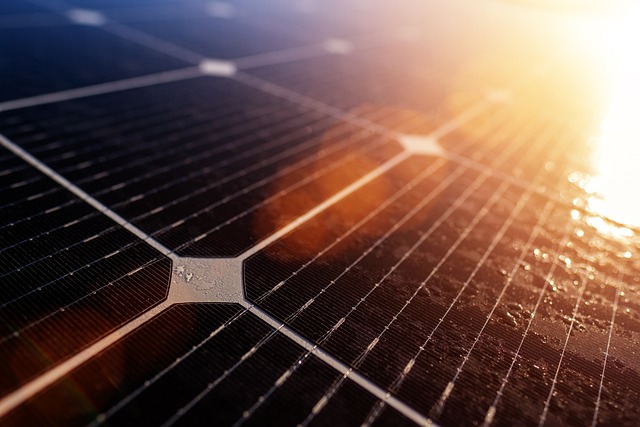

EF Solare Italia Builds 126 MW Photovoltaic Plant in Spain

EF Solare closed its 2022 financial statements with €112.8 million in net revenues, Ebitda of €44.7 million, and net financial debt of €1.88 billion, against equity of €642.4 million. The debt includes the €160 million loan guaranteed by SACE, which the group secured in March 2021 and was provided by Crédit Agricole Cib, ING and Intesa Sanpaolo.

EF Solare Italia spa, a leading photovoltaic operator in Italy and Europe 70% controlled by F2i sgr funds and 30% owned by Crédit Agricole Assurances, has built a new photovoltaic plant in Spain in Bolarque, Guadalajara region, which will have an installed capacity of 126 MW.

Construction of the plant was started last August by Spanish subsidiary Renovalia. It is EF Solare’s largest project in Spain, following the commissioning of the 79 MW El Bonal plant.

The new photovoltaic plant will come to cover the consumption of 63 thousand Spanish households and will avoid the emission of nearly 30 thousand tons of CO2 equivalent per year, for the absorption of which 10 million olive trees would be needed. The work is scheduled for completion in August 2024.

Read more about EF Solare Italia and its news project in Spain and find the latest financial news of the day with the Born2Invest mobile app.

The new plant project in Bolarque, is part of a broader development plan of EF Solare Italia in Spain where, through Renovalia, it aims to exceed 1 GW of new installations

EF Solare’s presence in Spain dates back to April 2020 when the group finalized the acquisition of 100 percent of Spanish solar operator Renovalia Energy Group, which was sold by Cerberus Capital Management

Andrea Ghiselli, managing director of EF Solare Italia, commented, “Spain represents a key territory in EF Solare’s development plans since here we have the opportunity to confront and grow in a market characterized by a more favorable regulatory framework than in Italy. Aware of this, we are therefore constantly working in synergy with Italian institutions and territories to contribute to the definition of clear and consistent regulations at the national level that can also allow Italy to seize the competitive advantage of photovoltaics.”

With more than 300 plants and an installed capacity of more than one gigawatt between Italy and Spain, EF Solare Italia is among the leading photovoltaic operators in Europe. With more than 10 years of experience, the Group is also actively operating in the agri-voltaic sector, thanks to its 32 MW of photovoltaic greenhouses and the development of an innovative open-field agri-voltaic model with zero land consumption.

EF Solare Italia began as a joint venture with Enel, but in December 2018 it came entirely under the control of F2i sgr’s Third Fund, which took over the remaining 50 percent stake from Enel Green Power spa. All PV assets held at that time by the fund were contributed to EF Solare Italia, including RTR Rete Rinnovabile, a company taken over in late 2008.

Last January, Predica Energies Durables, an investment vehicle dedicated to renewable energy controlled by the Crédit Agricole Assurance group, then took over 30 percent of EF Solare together with CA Vita (an Italian life insurance subsidiary).

EF Solare at the end of 2016 had bought Etrion spa, a company headed by Etrion Corporation’s Italian operations totaling 53.4 MW of installed capacity. Then in January 2019 EF Solare bought 31 PV plants in Italy with a total capacity of 34.4 MWp from Integrated Energy Holdings, the special purpose vehicle of IAM Capital and Ecoenergy. And in 2020, in addition as mentioned to Renovalia, bought, in December, the renewable energy producer won Terna’s call for tenders for the Fast Reserve project, winning 10 MW for the operation of an electrochemical storage system that will be installed on its own 13.4 MW PV plant located in the municipality of Troia, in the province of Foggia.

EF Solare closed its 2022 financial statements with €112.8 million in net revenues, ebitda of €44.7 million, and net financial debt of €1.88 billion, against equity of €642.4 million. The debt includes the €160 million loan guaranteed by SACE, which the group secured in March 2021 and was provided by Crédit Agricole Cib, ING and Intesa Sanpaolo.

Earlier, in October 2019, the group had refinanced a 118 MW portfolio of photovoltaic plants through a new €320 million package of lines. The loan was granted by Banca Imi (Intesa Sanpaolo), Banco BPM, BNO Paribas, CDP, Crédit Agricole and Société Générale.

__

(Featured image by 12019 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Be Beez, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Biotech2 weeks ago

Biotech2 weeks agoWhat Financial Impact Can the Health Sector Expect from the Metaverse Integration

-

Biotech4 days ago

Biotech4 days agoGrifols Announces Positive Results from Fanhdi Phase IV Study

-

Biotech1 week ago

Biotech1 week agoAI Will Revolutionize Mental Health, Generating 2.5 Billion in Spain

-

Cannabis1 day ago

Cannabis1 day agoCannabis Clubs: Germany Introduces Strict Regulations