Featured

The effect of currency fluctuations on foreign property prices

Currency and property prices share a mutual relationship. With currencies devaluating, investors put their properties on sale.

Foreign exchange fluctuations are affected by a number of factors, including monetary policy, inflation, consumer confidence, GDP dynamics and balance of payments. Usually, property prices increase and yields fall (and vice versa) when a currency strengthens.

Currency devaluation provides foreign property buyers with interesting opportunities

Such conditions may prompt extraordinary demand or even change the stage the market is at if foreign investor presence is strong. However, a weak currency where the property is located poses risks for international landlords as this reduces rental income. For instance, according to The Financial Times, in June 2016, the pound hit a 31-year low against the dollar following the announcement of the United Kingdom’s decision to leave the European Union (EU). This decline alone boosted the purchasing power of people with dollar-denominated incomes by 11 percent.

When a currency grows, it’s better for international investors to sell and not buy property

Property maintenance may become too expensive in this case. For example, in 2014–15, the ruble fell by 60 percent against the euro and 50 percent against the dollar. Before the crash, a US$500,000 property cost 17.5 million rubles, but after devaluation, the same property cost 35 million rubles. The fall of the ruble had a negative effect on the behavior of Russian investors. According to the Russian Central Bank, in 2015, Russians spent less than half of what they spent in 2014 on foreign money transfers for purchasing foreign properties.

The growth of the Euro and London’s falling property prices

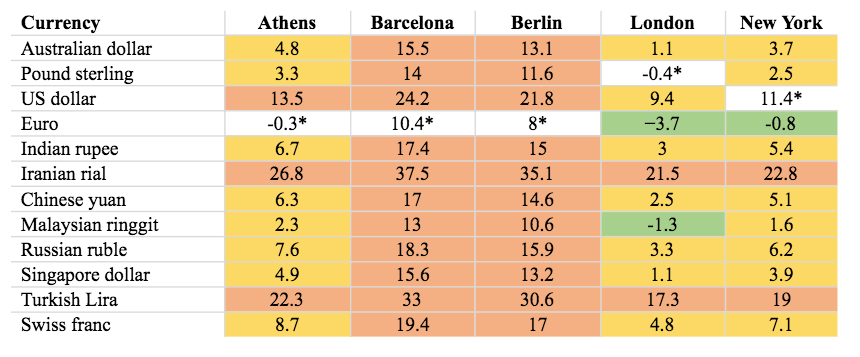

International real estate broker Tranio has analyzed the property market in Athens, Barcelona, Berlin, London and New York for buyers with incomes denominated in 12 currencies. Eurozone residents have the most favorable market entry conditions, adjusted for foreign exchange fluctuations and property price dynamics, in London and New York City. London is also the best market for Malaysian nationals to enter. Clients from these places are now able to buy property 1–4 percent cheaper.

2017 property price dynamics adjusted for foreign exchange fluctuations, percent

Note: Not adjusted for foreign exchange fluctuations (Sources: Bank of England, Bank of Greece, European Central Bank, United States Department of the Treasury, Central Bank of the Islamic Republic of Iran, Idealista, Nationwide, Wohnungsboerse, Zillow)

At the same time, Barcelona and Berlin property became significantly more expensive for all categories of buyers—not only did the euro strengthen against most currencies, but property prices in these cities also grew by about 10 percent. The price per square meter in New York City grew, but the weakened dollar cushioned price growth for most international investors.

The rial and lira fell the most among the currencies considered in 2017. Consequently, it became less advantageous for Iranian and Turkish nationals to buy foreign property as the price they had to pay grew by 20–30 percent.

What to expect in 2018

The trends observed in 2017 are expected to continue into 2018. For instance, it will still be advantageous for the Eurozone residents to buy property in the United Kingdom and the United States. Many financial companies, including Crédit Agricole and Deutsche Bank, anticipate the euro to continue strengthening against the pound and the dollar thanks to the overall economic improvement in the Eurozone.

Similarly, the strong yuan is helping the purchasing power of the Chinese. Central banks around the world are increasingly including the Chinese currency in their portfolios, and the high demand for the yuan can stimulate its growth.

As for British buyers, according to a survey conducted by the Reuters news agency in early 2018, most analysts are confident in the pound’s stability against the euro and the dollar in 2018, despite the situation largely depending on the course of Brexit. In their opinion, the dollar will continue falling against the euro and other major currencies.

For international buyers, currency fluctuations are an equally important factor for investment profitability as are the yield rate, price dynamics and the taxation load. Also, changes in exchange rates always present additional risks.

Those with a simple rental business on a 10 to 20-year horizon do not have a high risk. Exchange rate adjustments are critical for those engaged in Value Added projects. For example, if a US national invests in a redevelopment project in London and the pound falls against the dollar by 20 percent over the 18 months of the project’s delivery, this devaluation would “eat up” all the yields.

High risks also arise when mortgage loans are provided in a different currency from the borrower’s income. It is advisable to have one’s loan expenses and income denominated in the same currency.

As exchange rates are unpredictable, we recommend diversifying investments to protect them from exchange risks. Those who do not have the opportunity to simultaneously invest in real estate in several countries should invest in a country with the currency that constitutes the bulk of their expenses in the medium-term to long-term horizon. This will help reduce exchange risks.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Africa5 hours ago

Africa5 hours agoAfrican Bank Appoints Manyathi as Interim CEO After Bungane’s Departure

-

Biotech1 week ago

Biotech1 week agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Impact Investing4 days ago

Impact Investing4 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

You must be logged in to post a comment Login