Business

Emerging financial technologies that will help you grow your business

The fintech sector needs to start from scratch in the pandemic era. Financial institutions need to find solutions to the core problems in the system. Cryptocurrency-based transactions and digital payment solutions are some of the new avenues for fintech companies. AI is one of the most popular emerging technologies. It has strengthened its position across various industry sectors in a short time.

The advancing technology has taken the fintech industry by storm. A recent PwC report has revealed that as many as 56% of financial institutions have embraced disruption in their strategy. The FOMO (Fear of Missing Out) is prevalent in the fintech sector these days, and therefore, many such institutions tend to collaborate with smaller companies. The latest trends and growing competition are responsible for such disruption in the sector.

Here we are going to discuss the recent technology trends and tips for financial institutions to grow their business while overcoming the fear of missing out.

Latest trends in fintech market and emerging technologies

Rise of startups

Emerging technologies like AI and blockchain have made online transactions more secure and open the doors of new opportunities for startups. Many startups initiate their business by providing cryptocurrency-based transaction services or eWallet services. The finance app development has made it possible. The financial institutions can either purchase these startups or prefer to work in sync with them. It is fair to mention that the eWallet app development can contribute to begin a new era for startups.

New avenues

The fintech sector needs to start from scratch in this pandemic era. Financial institutions need to find solutions to the core problems in the system. Cryptocurrency-based transactions and digital payment solutions are some of the new avenues for fintech companies. It is necessary for financial companies to come up with a blend of traditional processes and technological advancements. For example, blockchain technology can manage online and cryptocurrency-based transactions in a secure way.

Focus on mobility

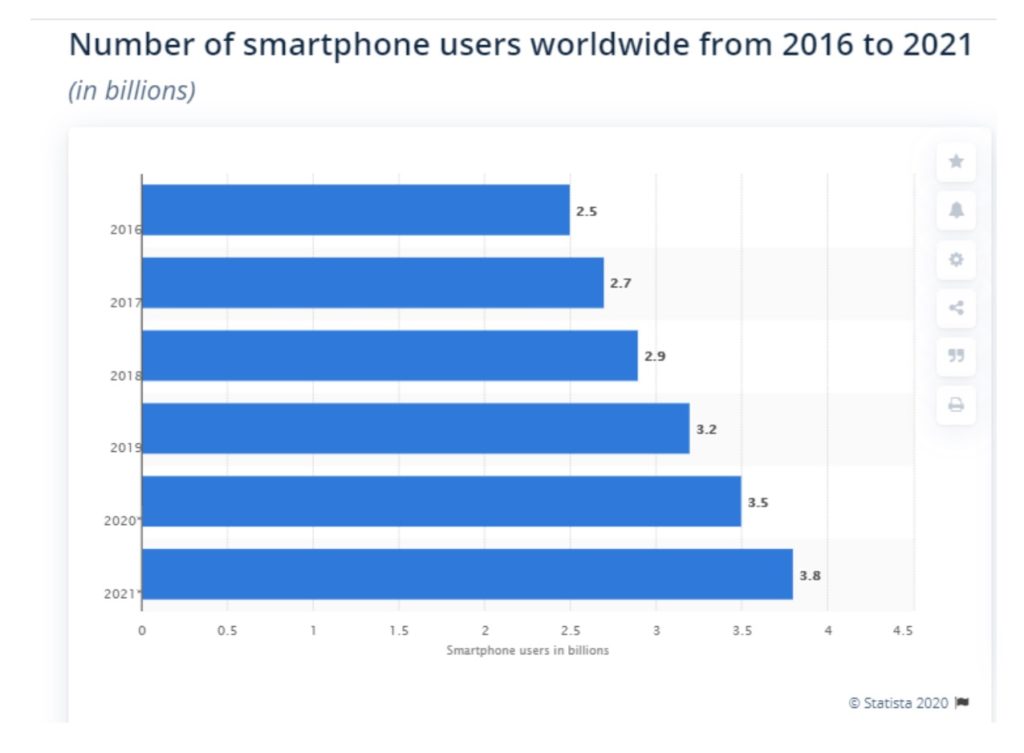

As per Statista, the number of smartphone users is expected to cross over 3.8 billion in the year 2021 globally.

This prediction suggests that over the period, more people will use their smartphones for making online transactions. Financial companies, therefore, have to focus more on eWallets, P2P payment apps, or mobile wallet apps. Talking about startups, they can attract a huge audience by bringing seamlessly-performing and user-friendly mobile wallet solutions. Some experts have already predicted that disruptive models with the combination of mobility and new tech trends will have more chances to find success in the coming time.

Dominance of AI

Artificial Intelligence (AI) is one of the most popular emerging technologies. It has strengthened its position across various industry sectors in a short time. Talking about the fintech sector, AI technology with concepts like ML (Machine Learning) and predictive analytics works wonders. It is easy to analyze big data and provide a personalized experience to customers using AI. Also, AI-based chatbots can provide support to the customers on a 24/7 basis. Be it communication, suggestion, or any other small requirements- AI bots are capable of accomplishing all such tasks efficiently.

It is expected that as the AI will get mainstreamed in various sectors, industries will integrate this futuristic technology in their ecosystem to deliver a seamless user experience. Considering the fintech industry, financial institutions can establish partnerships with established banks. Interactive interface, advanced features like Robo-advice, and improved customer experience are major characteristics of AI technology.

Biometric technology for enhanced security

All of us know about biometric technology. It is known for enhancing security at the workplace, smartphones, and even in mobile apps. These days, millions of billions of transactions are done online across the world and there is an increasing demand for security of confidential data including passwords and bank details of the users.

The financial institutions and fintech companies can offer high security to users using biometric technology. When the security standards will evolve to alpha-numeric to multi-step security, the importance of fingerprint recognition, iris recognition, and face recognition will be increased significantly. In such a scenario, biometric security will gain ground swiftly in the sector.

Wallets are here to stay

In the recent pandemic time, the importance of eWallets has increased like never before. People prefer contactless and smartphone-based payment methods to ensure swift, secure, and seamless payment. It is expected that contactless transactions including NFC (Near Field Communication) will double their current figure by the year 2021. Globally, fintech companies and even banks have come up with wallets with advanced features and user-friendly functionality.

There is a wider scope for wallet apps because they can easily enhance the customer or user’s experience. These apps provide a single-click payment service to satisfy users and improve the reputation of your company. Altogether, mobile wallets help finance companies build a better identity among users.

Another important trend is cloud technology. Though cloud computing is around us for some time, to date, some entrepreneurs sit on the fence for integrating this technology into their system. However, this technology is gaining ground swiftly across the corporate world, and in the coming years, cloud-based software will be extensively used in the fintech sector also.

Concluding Lines

Emerging financial technologies are capable of growing the business of the fintech companies by enabling them to provide excellent customer experience. Whether it is a startup or an established financial institution, advancements in technologies like AI, ML, and Blockchain can take financial services to a new level. However, startups can get more benefit from such emerging technologies as they have more flexibility and adaptability for disruptive changes in the sector.

—

(Featured image by Jack Sparrow via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto5 days ago

Crypto5 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis2 weeks ago

Cannabis2 weeks agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Biotech7 hours ago

Biotech7 hours agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding1 week ago

Crowdfunding1 week agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights