Crowdfunding

Faace Launches Equity Crowdfunding Campaign: Set to Hyperscale in 2023

Faace is a trailblazing UK-based skincare brand that’s seen rapid growth over its short two-and-a-half years of existence. Now, as it looks to enter its next growth stage, it’s launching its first crowdfunding campaign via the Seedrs platform. The opportunity gives cause-based investors an opportunity to invest in a high-growth, female-founded company that has strong ethics at its core.

In 2020, new mum Jasmine Wicks-Stephens found herself searching for effective, fuss-free skincare products adapted to her sudden, time-crunched lifestyle shift. Unsatisfied with what she found already on the market, she set out to create her own line and disrupt the £13 billion UK beauty industry.

The result was the launch of Faace and its first line of ethically sourced, 100% vegan-friendly skincare products that were quick and easy to use, and highly effective.

Fast forward to today, and the brand has since shot to prominence as one of the shining stars of the UK beauty industry. Its rapid growth has seen it expand into 23 countries in which it has been picked up by a total of 59 retailers to date, including Harrods and LookFantastic. And, along the way, it’s managed to bag a bunch of awards from the likes of Elle and Marie Claire.

Now, as Jasmine looks to transition Faace into its next growth stage, it is launching its first equity crowdfunding campaign via the Seedrs platform.

Faace Launches Crowdfunding Campaign as it Looks to Next Stage of Growth

To date, Faace has achieved most of its success as a scrappy, predominantly-bootstrapped startup. We say predominantly bootstrapped as it has received a small handful of cash injections from angel investors and a £150k investment awarded from the SFC Capital x The Red Tree beauty accelerator, which was part of a year-long partnership to help accelerate growth.

However, as the company now looks to enter its next growth stage with an additional £150k raise, it’s looking to open up the opportunity to a broader audience of investors. This has seen it turn to equity crowdfunding and the launch of its first publicly-available equity offer via the Seedr platform.

“We’re really excited to offer shares in our business and build a larger team of cheerleaders who can support our growth and potentially benefit from it in the future,” says Jasmine.

New Markets, Retail Partners, and Products on the Horizon in 2023

As for where Faace plans to head as it enters its next chapter, it’s more or less an expansion of what’s made it so successful so far. Specifically, it plans to continue its expansion into new countries, ink deals with new retail partners, and grow its product line through the addition of four new skincare products that are currently in the pipeline.

On the retail expansion front, it’s currently chasing after placement in prominent retailers like European online retail giant Zalando and the UK department store powerhouse Selfridges. It will also be seeking new opportunities with strategic partners as it expands into new countries and looks to establish a larger footprint in existing markets.

Cause-Based Investing With Big Growth Potential

For all the trailblazing success it’s had over the last two-and-a-half years, Faace remains a strong cause-based business at its core. As a female-focused brand, Jasmine is committed to dedicating some of Faace’s resources to addressing female health issues and opening up the conversation around the impacts these have on the daily lives of millions of women.

These issues include heavily stigmatized topics such as menopause and period poverty. The company’s work here also involves supporting community organizations dedicated to addressing these issues, such as Hey Girls and The Menopause Charity.

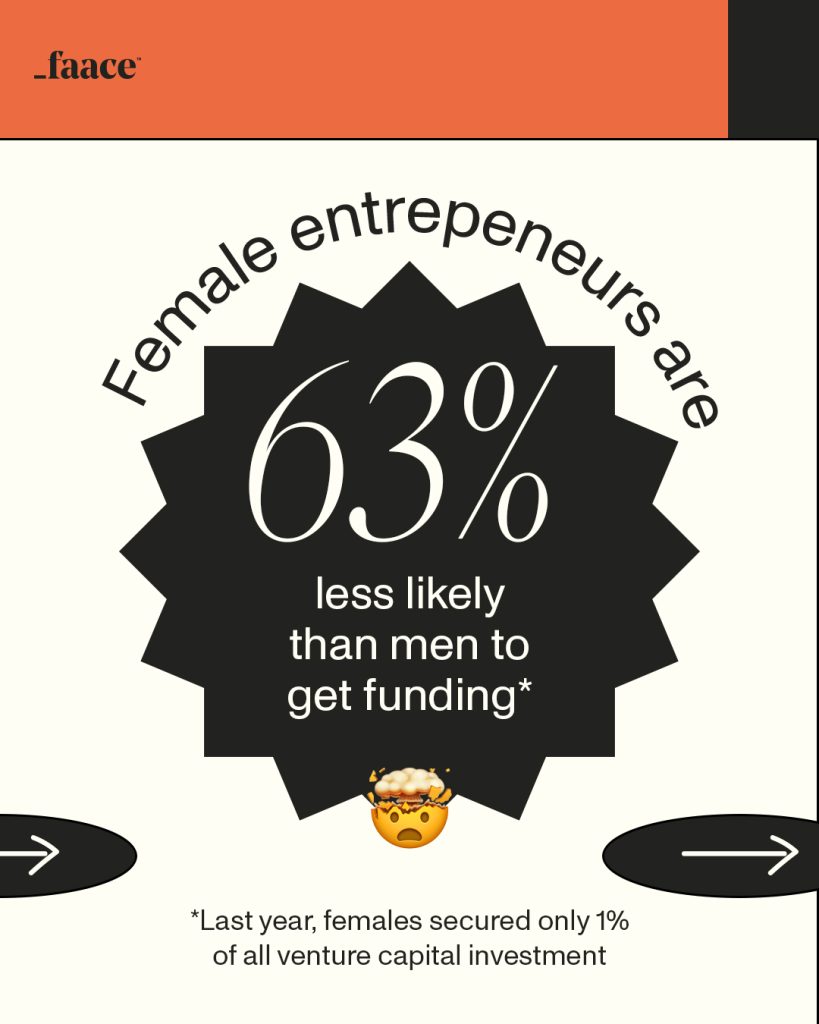

As a female founder, Jasmine also holds issues surrounding the disparity between male and female founder access to venture funding close to her heart. She highlights the fact that, even though female-founded startups only received 1% of venture capital investment last year, women-led businesses generated more gross sales, delivered twice the return on investment, and failed less often than male-led businesses.

Crowd Investing for Good Causes and Profit

While equity crowdfunding investments are fundamentally about returning a solid return on investment, they also offer so much more to both founders and investors. On this, Jasmine notes, “Crowdfunding doesn’t just help address investing inequity; it also helps even the odds for female founders. Female entrepreneurs are typically less likely than men to get investment for their ventures, however female-led campaigns on crowdfunding platforms were found to be 32% more successful at reaching their funding target than male-led campaigns.”

She goes on to note that Faace is particularly “inspired by fellow female-led brands in the ethical beauty and fem-care spaces like DAME and Upcircle, who have experienced great success with overfunded crowdfunding campaigns and so we are excited to now invite everyone to share in our future successes as well, with investments starting from just £11”.

Get Priority Access to the Faace Equity Crowdfunding Campaing

For investors looking to join in the story of a high-growth, female-founded brand with a great story and strong ethics at its heart, priority pre-launch access is now available.

For more information or to subscribe for priority access, head to the Faace pre-registration page on Seedrs

—

(Featured image courtesy of Faace)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing4 days ago

Impact Investing4 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business2 days ago

Business2 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich