Business

The TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [+ Finministry Affiliates Review]

Ever wondered how cynicism could make you money? Then this week’s affiliate digest is for you. And, before you say, “But cynicism never pays”, stop being so cynical and just read on… there’s money to be made. We’re also going to cover a top affiliate program that’ll help you monetize cynicism (Finministry), and also throw in a few other updates on the latest happenings on Twitter and Google.

Quick Disclosure: We’re about to tell you how Finministry run a top-notch affiliate program. And we really mean it. Just know that if you click on a Finministry link, we may earn a small commission. Your choice.

Today, it seems there are more cynics than ever.

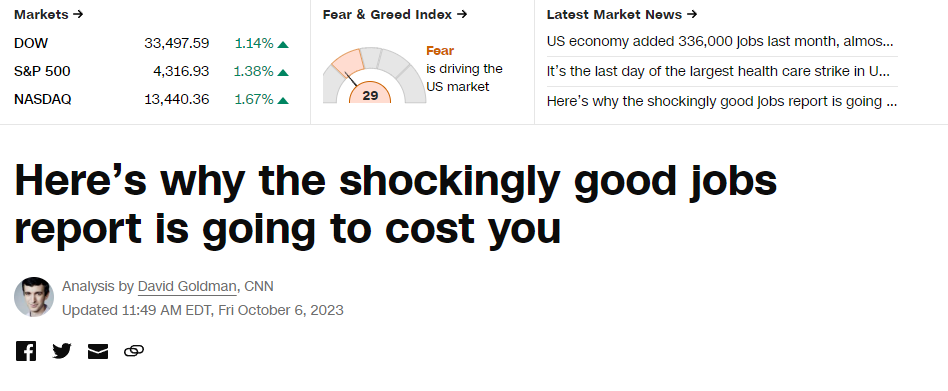

Case in point — the jobs report just dropped. And it was way better than expected.

Here’s a taste of the press coverage:

Now, usually, we’d say cynicism is a dirty word.

It’s kinda like an immovable object sitting in the middle of the road, holding you back from becoming an unstoppable money-making machine.

But just because you probably shouldn’t get too cynical about things yourself, whoever said you can’t monetize the cynicism of others?

We’ll show you how later.

But first, here’s a little partner program to help you monetize.

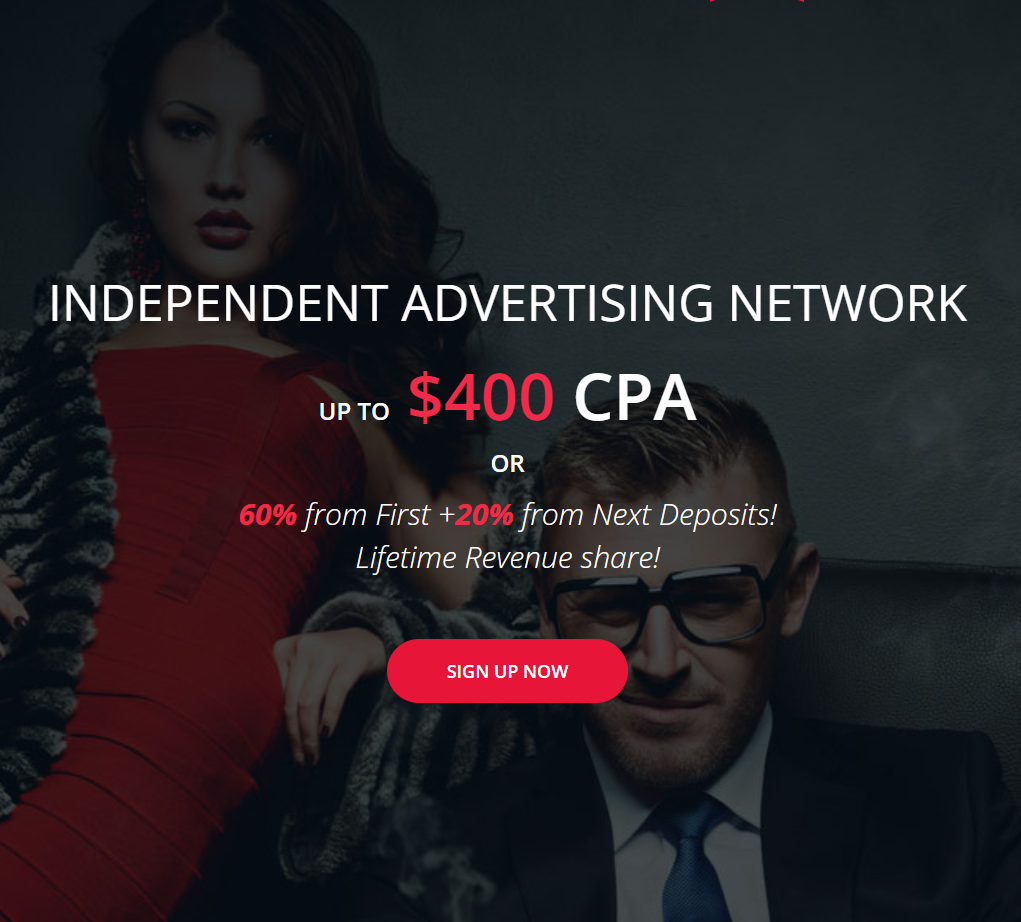

Topranked.io Affiliate Program of the Week — Finministry

Usually, when people think about trading, they think about “buying stocks.” But how do you sell a “buying stocks” platform in a market where people don’t have confidence in the market?

That’s right, you show them how to use other financial products to make money in a falling market.

And, if you want to get paid for introducing them to these products, then you’re not going to do much better than Finministry.

Here’s What Finministry Is All About

Finministry, as the “fin” might suggest, is all about finance. Think crypto, options, forex, CFDs, trading bots, etc.

That’s Finministry.

And while throwing all of that into a single brand might make for a confusing product offering, fear not.

That’s not Finministry.

Instead, Finministry is one of those programs where, with one simple signup, you get access to a bunch of brands. Here’s a taste of what you can promote with Finministry:

Got the picture about what Finministry is all about?

Good, let’s move on.

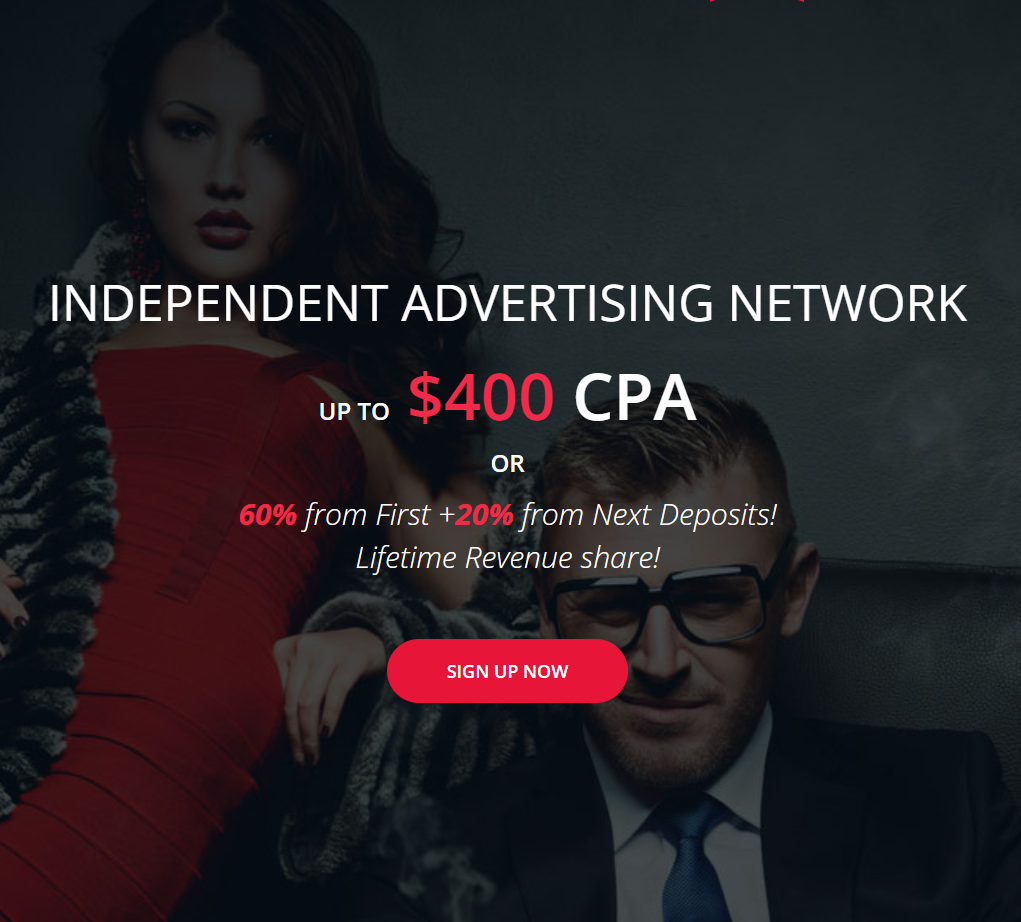

Finministry Affiliate Program Commissions

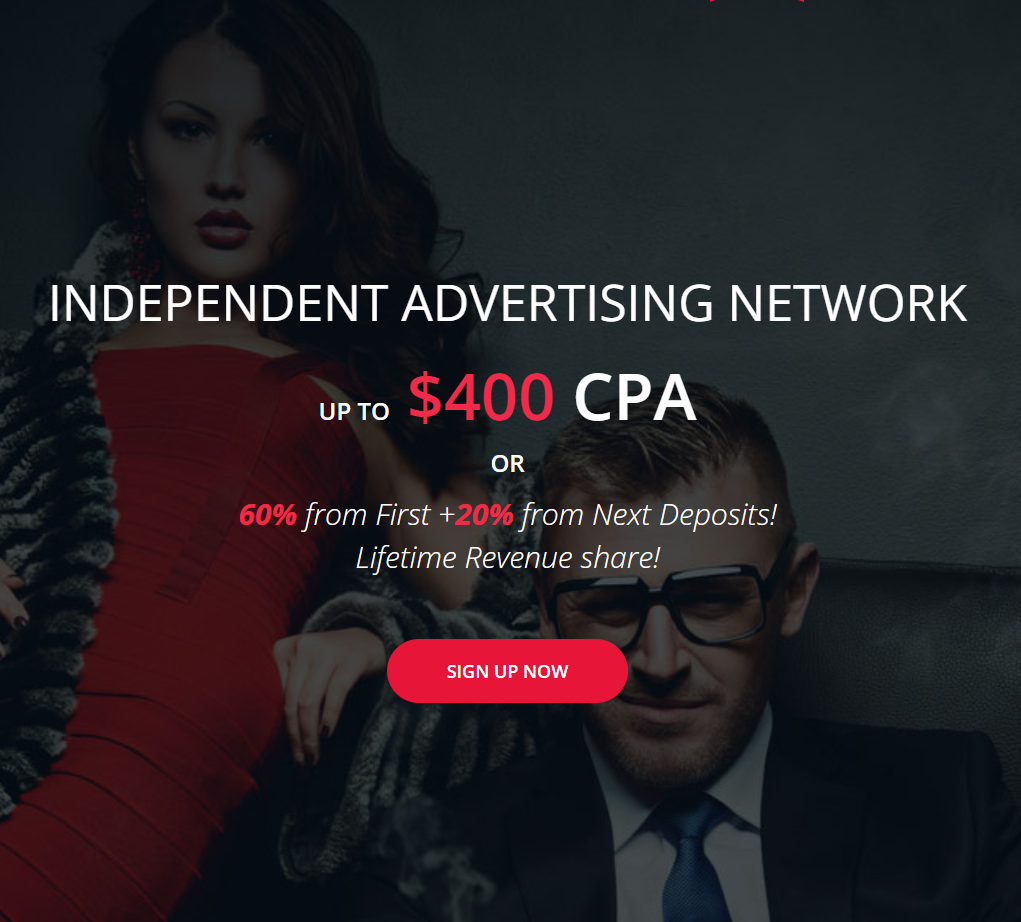

When it comes to commissions, Finministry has a few options.

The first option on the Finministry table is the classic CPA deal.

Now, like most finance programs, what Finministry pays you depends on where your traffic is coming from.

Here’s how that looks:

| Region | Tier 11-2 sales | Tier 22-4 sales | Tier 35+ sales |

| Western Europe | $250 | $350 | $400 |

| Middle East | $250 | $350 | $400 |

| Oceania | $250 | $300 | $350 |

| North America | $200 | $250 | $300 |

| Scandinavia | $200 | $250 | $300 |

| Eastern Europe | $150 | $200 | $250 |

| Russia | $150 | $200 | $250 |

| Central and South America | $150 | $200 | $250 |

| Asia | $150 | $200 | $250 |

| Africa | $100 | $150 | $200 |

Now, these CPA rates aren’t set in stone by Finministry. For affiliates looking to negotiate, they do offer the chance to set a custom minimum deposit amount to qualify for CPA. And, naturally, if you negotiate a custom minimum deposit with Finministry, you’ll also get to negotiate custom CPA rates.

Alternatively, Finministry also offers a relatively straightforward rev share options.

The way that works at Finministry is you get a flat 60% of your referral’s first deposit. And then you get 20% for life.

That’s pretty good if you ask me.

Finministry Payments, Support, Etc.

As for the rest of what you need to know about Finministry, here’s the basics.

- Payments: Finministry makes payouts on a weekly basis.

- Marketing Support: Finministry provides heaps of marketing support, from promo codes and other incentives to help you convert traffic, through to an advanced tracking and analytics platform.

- High Conversion Rates: Finministry publishes its aver conversion rates. “Average conversion ratio is 1:10 click to lead, and 1:50 click to deposit.”

Get Started Here

If you’re not sure whether promoting finance products is right for you, maybe take a read through to the end of the news section first.

Then, if you think you smell an opportunity, scroll back up here and reconsider.

For everyone else, here’s a link direct to Finministry.

Affiliate News Takeaways

Elon Just Killed Clickbait

About a month and a half ago, rumors started spreading that 𝕏 was going to change the way news article shares would display on the platform.

At the time, Musk confirmed them by taking responsibility.

But then, nothing much happened… until today.

Here’s how article shares now show up on 𝕏:

Basically, the only thing that’ll show up in the link preview now is the feature image.

No headlines. No text.

In other words, Musk just killed clickbait on 𝕏.

Takeaway

If content shares on 𝕏 don’t mean anything to you, then there’s nothing to take away here.

For everyone else, this change will require some adjusting.

Now, you could join the mainstream press core and just start complaining. Like The Guardian, who says 𝕏 is becoming hostile to news media.

Or the Verge, who say this change is “very annoying.”

Or, you could just get on with business.

Now, the bad news here is that text is out. So don’t bother optimizing your “twitter:title” and “twitter:description” meta tags — that’s now a lost cause.

But as for the old “twitter:image” tag — that’s still 100% usable.

So maybe put a little thought into the images you use for 𝕏. Maybe even consider combining the headline and the image, a little like this:

Now try and tell me you don’t want to click on that.

Google “Helpful Content” Update (And Why It’s Never Been a Better Time to Be an Affiliate)

A couple of weeks ago, Google rolled out another “Helpful Content” update.

Of course, Google didn’t really reveal much about what this update entailed. So all we had to go on was the usual, this update would “reward content where visitors feel they’ve had a satisfying experience, while content that doesn’t meet a visitor’s expectations won’t perform as well.”

But now that a few weeks have gone by and the impacts have been felt, we’re starting to see reliable reports about what this update means.

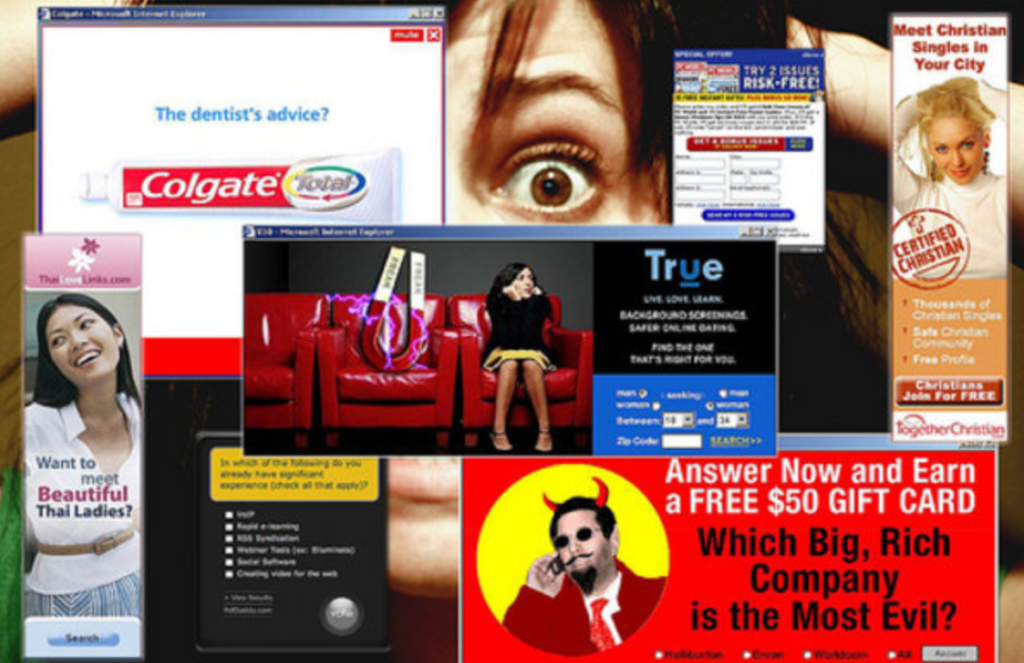

And the big takeaway this time is that sites with bad UX (User Experience) got hit hard.

As for what bad UX entails, the big focus this time around seems to be ads.

Or, more precisely, how are you displaying ads, and how many are you displaying?

Now, Big G hasn’t come out as anti-ad or anything like that. Plenty of sites that rely on ads are still ranking.

However, Big G does seem to be against sites where the ads severely detract from the UX.

To steal the words straight from GSQi, the sites that got whacked hardest were those where the “content may not be horrible… [but] users are being bombarded with ads all over the page, auto-playing video follows you as you scroll down the page, and then you might be hit with popups as well.”

Takeaway

It’s easy to think UX doesn’t matter if your bread and butter traffic is one-off visits from search engines. After all, if people aren’t going to stick around anyway, why bother trying to make their experience as pleasant as possible?

But now, if early results from this update say anything, Google seems to think that it does matter.

Now, of course, bad UX doesn’t begin and end with ads. So, if Google is going to keep pursuing this “good UX is helpful content” angle, then everything from the fonts you use to how many times per minute you hit someone with a “here’s a lead magnet” popup will matter.

But, for now, the big focus seems to be on ads.

And that means, there’s never been a better time to be an affiliate.

You see, with affiliate marketing, you can get a lot more creative with how you integrate ads into your site. In fact, do it well (as in, incorporate your affiliate links into the overall design/functionality), and your site will be a “delight” for visitors.

Here’s a great example:

Do you see that “Bet Now” button? That’s 100% “useful advertising” and 0% distracting visuals.

Now try and do that with display ads.

Of course, this isn’t the only way you can pull this off. But it does provide a useful template for the sorts of things you can do to improve your UX while also including more “ads” on your site.

To give you some idea of how this template could be applied to something else, let’s say you run a stock tips website.

And let’s say you were running an article about how overpriced Tesla was.

You could easily create a similar little box that included the “stock tip”. For example: “Tesla, Inc. ($TSLA) — Buy December put option with strike @ $230”.

And in that same box, you could include a “Buy Options Now” button.

Congratulations, You just created great UX, and stuffed one more ad onto your page.

Just don’t forget to monetize that buy button with a little Finministry magic.

Monetizing Cynicism

While I’m usually pretty resistant to clickbait, this week, Business Inider got me with this one: “BYD’s Founder Drank Battery Fluid to Impress Investors.”

The battery drinking story, as it turns out, is about BYD founder, Wang. (Great name, by the way.)

With that snickering out of the way, the story goes that his company apparently made the greenest batteries around. And, to prove it, he drank a glass of the company’s battery fluid and lived to tell the tale.

Anyway, one thing led to another, EVs became the new focus. And, according to a WSJ article the Business Insider article makes constant references to, BYD is now the biggest threat to Tesla.

Who would’ve known?

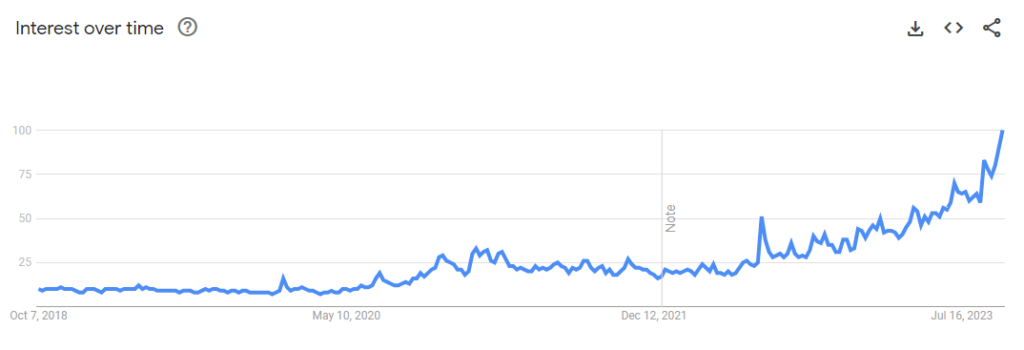

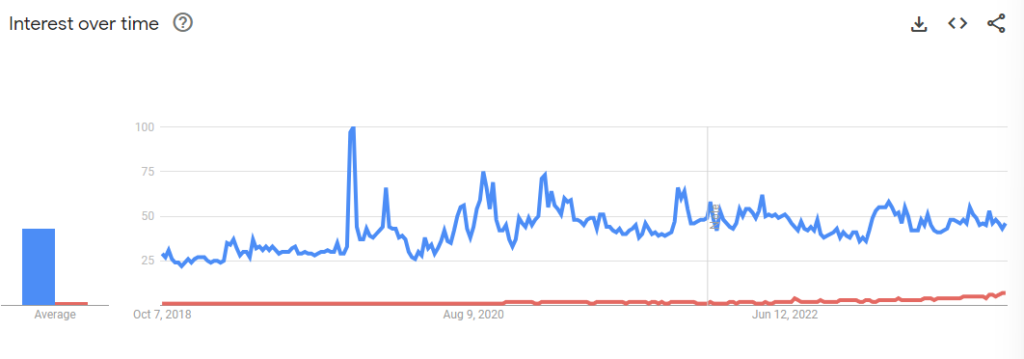

Now, personally, I don’t know much about car makers. But I do know how to use Google Trends. And, as it turns out, BYD looks like it’s starting to hit that “inflection point of exponential hockey stick growth” thing that people talk about.

Fortunately for Tesla, it still seems to hold the public mindshare in terms of gross interest. But, unlike BYD (which will now be the red line), interest in it has gone flat.

Now, interestingly, these sorts of articles/observations come at a bad time for anyone who’s long on Tesla.

Just today, Tesla cut prices for its cars in response to a sales slump. And this is coming at a time when “established carmakers like Ford Motor, General Motors, Hyundai and Volkswagen… [have] been chipping away at Tesla’s dominance.”

And let’s not forget how just a couple of months ago Musk pretty much confirmed that Tesla’s valuation was massively dependent on it developing autonomous self-driving… you know, the same autonomous self-driving that’s been “just one year away” every year since 2014?

Clearly, there’s a lot of good reason for people to be cynical.

So, I headed over to 𝕏, and did a little sentiment analysis on $TSLA.

Basically, there’s more than a small handful of people growing extremely skeptical.

But Who’s Monetizing?

Of course, I didn’t start digging on 𝕏 for pure curiosity. My thinking was, “if this gets people talking, then that means it’s got eyeballs, and eyeballs can be monetized.”

But, lo and behold, no one was really monetizing.

Or, at least, they were only monetizing in predictable, oversaturated ways.

You see, most of the “monetized” content you’ll find right now is from people whose main goal is to make you buy into their fund, or buy their trading course.

But there are only so many funds people can invest in, and so many trading courses they can take.

So where are the people saying “Here’s how to short Tesla stocks right now”? (And then monetizing it with Finministry, of course…)

There’s Maybe More to This Than Tesla

Now, of course, cynicism about any given stock/company isn’t anything new. Especially when it comes to Tesla, so this doesn’t come as a total surprise.

What is maybe more rare is just how primed the general public is for cynicism right now.

To illustrate, just think about what’s gone on over the last few years.

We’ve been dealt all manner of disappointment, between the Metaverse, NFTs, Web 3, AR/VR, and whatever else not living up to the hype.

And now we’ve got AI.

Now, sure, maybe Uncle Sam Altman’s plans for AGI will come true.

But these sorts of promises about AI do smell a lot like fully self-driving cars. You know, the cars that have been “just one year away” since 2014.

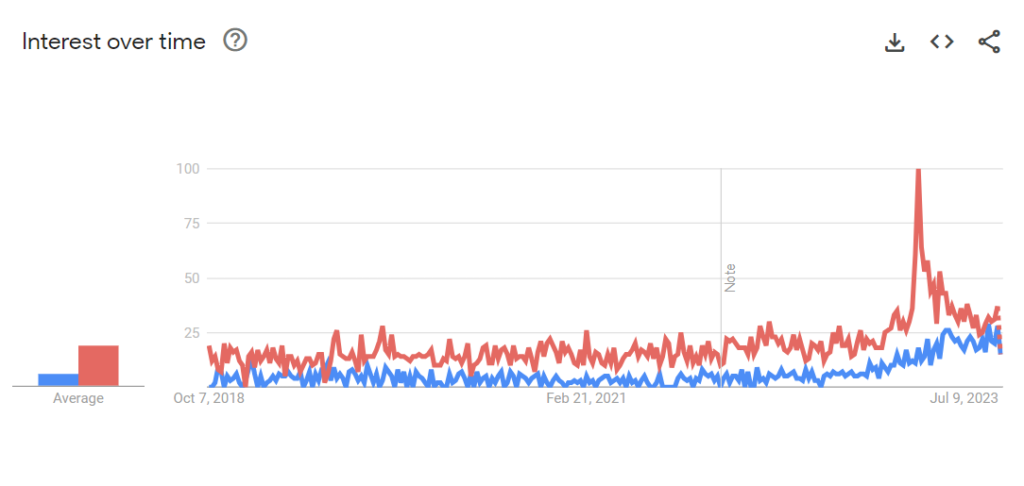

And, if I go back to Google Trends, it seems I’m not alone in this sentiment.

Just for fun, here’s a little comparison between “Artificial General Intelligence” (red) and “AI Hype” (blue).

If those trends are anything to go by, interest in AI hype is on track to eclipse interest in AGI very soon.

And, in case you were wondering, here’s the “People also ask” section for an “AI Hype” search.

But Again, Where Are the People Monetizing?

Unlike the Tesla skeptics, when it comes to monetizing AI skeptics, there really doesn’t seem to be anyone doing much right now.

In fact, most of the content a quick bit of digging turned up was basically just the usual “think tank/TED talk/thought leader” crowd.

And they didn’t really seem to be trying to do much more than convert eyeballs into clout.

Takeaway

There’s a lot of cynicism out there on the internet right now. And people have maybe never been more primed to buy into it than right now.

But curiously, everywhere I looked (and yes, monetizable skepticism goes beyond Tesla and AI), people just weren’t monetizing. And if they were, they were doing so in extremely saturated ways, like selling trading guru courses.

Across it all, what really seemed to be lacking was actionable “here’s a hypothesis, and here’s how to act on it” advice.

Of course, this might need a little work on your end. The average Joe probably doesn’t know how to, let’s say, use options to take a short position against a stock.

But, if your content can educate him on how, then there’s also a pretty good chance he’s going to be a bit more receptive when you also tell him the best platform for options trading is [insert your preferred Finministry brand here].

As for the more broad takeaway, that one’s simple. Sometimes, monetizable niches are best found by simply digging into a sentiment rather than a specific thing.

Closing Thought

All that talk about cynicism calls for a more positive ending, right?

Wrong.

Instead, I want to take a moment to tell you why it’s the greatest tool you can put in your marketing toolbox.

Now, I know what you’re thinking.

“It’s important to stay positive if you want to succeed.”

And I totally get you. Positivity is important.

But, here’s the thing. If you actually want to sell anything, sometimes a heavy dose of cynical thinking is just what you need.

Here’s an old post I dug up on Andy Elliot’s Instagram to explain why.

Now, of course, he says nothing about being cynical here.

But he does say a lot about overcoming objections.

And if you’re going to overcome objections in affiliate marketing, you’re going to have to anticipate objections.

The reason for this is simple. Unlike in regular sales, most affiliates never get to interact with their prospects.

That leaves almost zero room for an affiliate to “block and tackle” objections as they arise.

That means, the only way you’re going to be able to do it is to anticipate the objections.

And the best way to do that?

That’s right. Put that cynical thinking cap on, and start objecting to the product you’re promoting.

Now, once you’ve got your list of objections, you can start working counterpoints into your copy/images/etc.

For example, let’s say I want to promote a Finministry brand while playing into Tesla cynicism on 𝕏. Maybe you write some CTA about “Short Tesla by trading options with the best options trading platform.”

Good work.

Now what about the objections?

How about, “But options trading is too hard for me to understand.”

Okay, now let’s take another stab at that CTA: “Discover the simple way anyone can short Tesla right now with raceoption.com.”

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crowdfunding6 days ago

Crowdfunding6 days agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Africa2 weeks ago

Africa2 weeks agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Cannabis3 days ago

Cannabis3 days agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto1 week ago

Crypto1 week agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments