Biotech

Gilead Partners with Tentarix to Create New Cancer Therapies

Gilead said that it expects the agreement with Tentarix to reduce its earnings per share (EPS) from 3 to 4 cents in 2023. In addition, the US biotech company aims to generate at least a third of its revenue by 2030, through this alliance. Gilead Sciences had $6.4 billion in revenue in the first quarter of 2023, a 4% year-over-year decrease from the same period a year earlier.

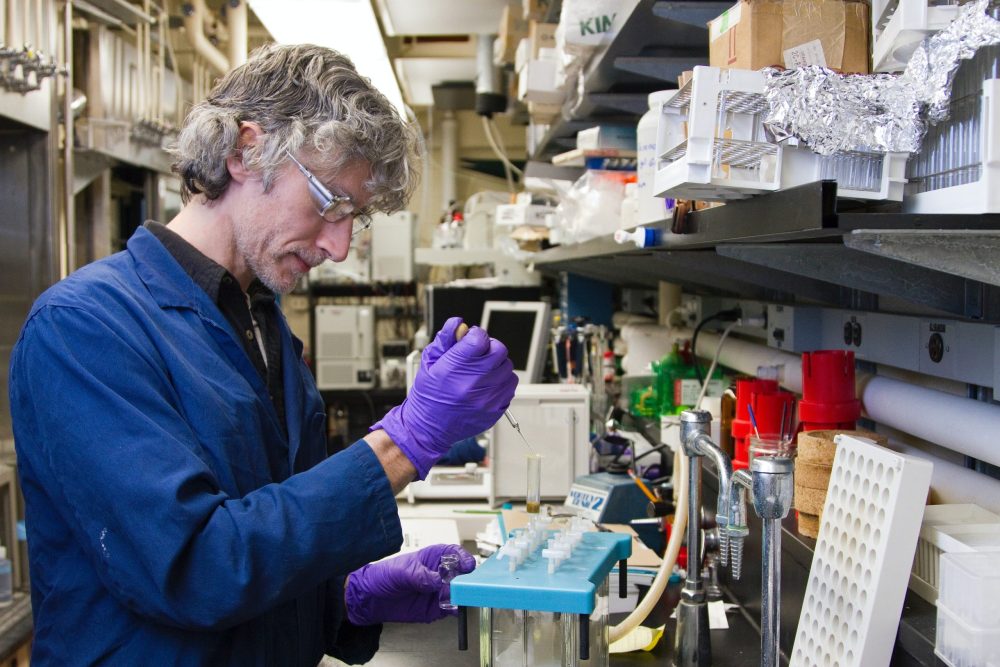

Gilead partners with Tentarix to create new therapies for cancer and inflammatory diseases. The US biotech company will enter into three multi-year collaboration agreements centered on the Tenacles platform, from Tentarix, to discover and develop therapies for oncology and inflammatory diseases.

“This early-stage collaboration with Tentarix will be highly synergistic to our current efforts, build on our growing strength in protein therapy, and may provide access to multi-species biologics from Gilead Sciences,” said Flavius Martin, Executive Vice President of Research at Gilead Sciences. Next Generation.

Tentarix will receive advance payments and an equity investment from Gilead of $66 million. In addition, the US biotech company has the option to acquire a total of, at most, three selected Tentarix subsidiaries containing the programs developed under the collaborations for $80 million.

If you want to read more details about Gilead and Tentarix agreement and to find out the most important business news of the day, download for free our companion app Born2Invest, available for free for both Android and iOS devices.

Gilead will make advance payments and equity investment to Tentarix for $66 million

Paul Grayson, President and CEO of Tentarix Therapeutics, explains that “collaboration with Gilead to build and expand the development of multifunctional antibody-based therapeutics, providing an excellent mechanism to validate our science with the ultimate goal of bringing these potential drugs to the patients faster.

Tentarix was created in 2021, following a $50 million funding round to support its Tenacles drug platform. This platform is based on protein therapies that target multiple specific proteins on the surface of cells, but are only active when all are present.

Gilead said that it expects the agreement with Tentarix to reduce its earnings per share (EPS) from 3 to 4 cents in 2023. In addition, the US biotech company aims to generate at least a third of its revenue by 2030, through this alliance.

Gilead Sciences had $6.4 billion in revenue in the first quarter of 2023, a 4% year-over-year decrease from the same period a year earlier. The company attributed the decline to declining sales of remdesivir, marketed under the name Veklury, which is a solution for the treatment of Covid-19.

Founded in 1987, Gilead is an American company specializing in the research and commercialization of pharmaceuticals. Its headquarters are located in Foster City, California, and it operates throughout North America, Europe, and Australia.

__

(Featured image by National Cancer Institute via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crypto7 days ago

Crypto7 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business2 weeks ago

Business2 weeks agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Cannabis4 days ago

Cannabis4 days agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

-

Fintech2 weeks ago

Fintech2 weeks agoFirst Regulated Blockchain Stock Trade Launches in the United States