Business

Why we think this mining company could be the next Newmont Goldcorp

Gold is considered one of the safest investment options, particularly during economic chaos, but what if there was a way to leverage rising gold prices? Companies like GoldCorp have traditionally represented a potential option but we’ve found a unique offering that could significantly outperform the general precious metals market. Read on to find out how.

Precious metals companies like Kinross Gold (TSX:K,NYSE:KGC), Newmont Goldcorp (TSX:NGT,NYSE:NEM), Kinross Gold (TSX:K,NYSE:KGC) and the Emgold Mining Corporation (TSXV: EMR.V OTC: EGMCF/ EMLM WKN: A2DW2K / ISIN: CA2909284077) represent a unique opportunity for precious metal investors.

Gold prices of over $1,500 per Troy Ounce have caused a big profit bounce for gold mines. The Arca Gold Bugs sector index has now risen to over 230 points and analysts are talking about a “gold mine rally”. Over the past 10 years the index has risen by 1,600% making gold companies the most successful stock sector in the US.

The price of gold is expected to continue to rise in the face of wider market instability. Analysts at Bank of America and Merrill Lynch predict that the price of gold will rise above $2,000 per troy ounce in the next two years.

You could simply bank on making money from holding gold but there is a bigger opportunity on offer.

Introducing the Emgold mining corporation

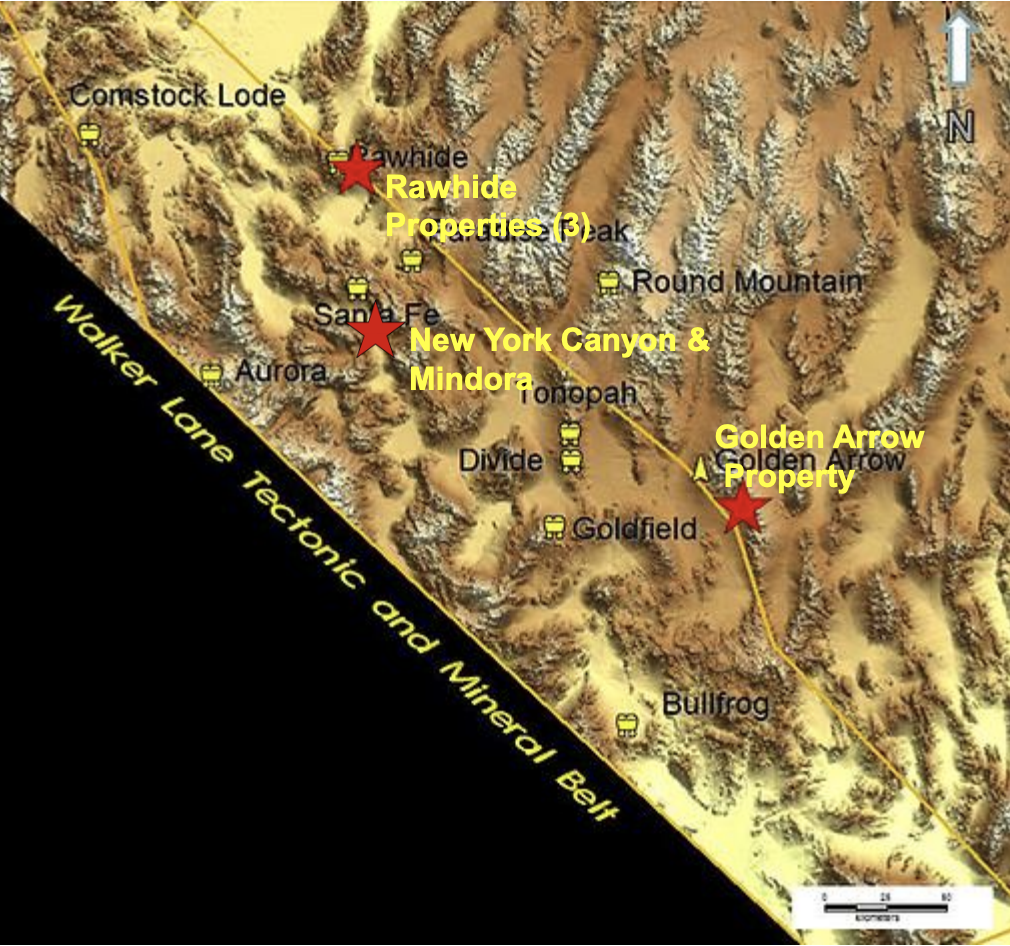

E Emgold Mining Corporation (TSXV: EMR.V OTC: EGMCF/ EMLM WKN: A2DW2K / ISIN: CA2909284077) is a gold, silver, and base metal exploration company focused on exploiting promising land in Nevada and Quebec. Unlike many competitors the company leverages cutting edge geophysics, data analytics, and modelling technologies to identify the most lucrative mines, providing a growth opportunity that goes beyond gold.

The company’s unique model identifies undervalued assets, adds value through exploitation, and them quickly monetizes those assets through divestiture. This approach minimizes risk by developing multiple assets simultaneously, whilst also providing the company an opportunity to take advantage of multiple opportunities and bring real value to their shareholders.

2020 is set to be a watershed moment for gold investors

While anybody holding gold will certainly do well there is a bigger value proposition on offer here. Individual mines will certainly prosper but Emgold Mining Corporation (TSXV: EMR.V OTC: EGMCF/ EMLM WKN: A2DW2K / ISIN: CA2909284077) is in a unique position to maximize this incredible opportunity.

The company is already building out a number of key assets and will be in a strong position to divest those assets when the market hits its peak. In 2019 the company closed 5 key agreements:

- An option to acquire 100% interest in the New York Canyon Property NV

- Options to acquire a 100% interest in the Mindora Property NV

- Acquisition of a 100% interest in the Casa South Property, QC

- Options to acquire up to a 55% interest in the East-West Property, QC.

- The company completed a drill program in its Casa South Property, QC.

The company’s existing opportunities are promising. Take the Buckskin Rawhide East Navada project. This single project could be worth $600 – $750 thousand a year to Emgold and its investors, and that’s without factoring in the predicted rise in the price of gold.

This is just a single project. Emgold currently has 9 projects, each brimming with potential.

The company spent 2019 focusing on acquisition of assets in order to build a solid base of growth. In 2020 it will focus on building out and monetizing those assets. The company will also look to create divestiture opportunities as a way to generate capital to build out their own assets.

The Emgold Mining Corporation represents one of the most unique opportunities on the market today. With a single stock, investors are able to take advantage of the potential of multiple valuable mining projects. It also provides an opportunity to not only benefit from the rising price of gold but maximize the opportunity on offer. For investors who are attracted by the stability of gold, but want to make the most of their money, it is hard to think of a better choice than Emgold.

In short, Emgold marries the security of gold with the growth potential of multiple mining companies combined and 2020 is set to be the company’s break out year.

__

(Featured image by Stevebidmead via Pixabay)

Disclaimer

This featured post was written by a third party contributor and does not reflect the opinions of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This feature may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto6 days ago

Crypto6 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis2 weeks ago

Cannabis2 weeks agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Biotech18 hours ago

Biotech18 hours agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding1 week ago

Crowdfunding1 week agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights