Business

The TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [Goldco Affiliate Program]

While all that glitters is not gold, it’s true that gold always glitters. At least, it does if you’re an affiliate in the Goldco Affiliate Program, but more on that soon. Until then, let me tell a little about what else is coming up, like how you can profit from DraftKings’ latest blunder in a handful of US states. And the best part, this isn’t an opportunity that’s going to die any time soon.

Quick Disclosure: We’re about to tell you how the Goldco Affiliate Program is pretty great. And we really mean it. Just know that if you click on a Goldco Affiliate Program link, we may earn a small commission. Your choice.

This week, the Olympics wrapped up.

And if you thought this was the last you’d be hearing about gold, then think again.

In case you didn’t know, the gold bugs are also having their day.

Yep, just as the games were closing out, gold hit new all-time highs.

So let’s go make some money.

Topranked.io Affiliate Program of the Week — Goldco Affiliate Program

We all know that the worst time to buy something is when something hits an all-time high.

But plenty of other people don’t.

That means, there’s never been a better time to sell gold than now.

The only question is, with what affiliate program?

Let me introduce you to the Goldco Affiliate Program.

Goldco Affiliate Program — The Product

Now, you might think you already know what the Goldco Affiliate Product is.

I mean, it was right there in the introduction. And it’s still right there in the name — Goldco Affiliate Program.

But just as there’s more than one way to skin a cat, there’s also more than one way to sell gold.

In the case of the Goldco Affiliate Program, what you’ll actually be selling is a little more interesting than straight up bullion.

Instead, with the Goldco Affiliate Program, you’ll be selling a full-suite of gold and precious metal products, including things like precious metal IRAs.

Now, I’ll save the whole discussion about what these various products are good for for an accountant or someone more qualified than I.

What I will say, however, is that having options like this in the Goldco Affiliate Program gives you a bunch of ways to target and sell to gold investors.

And that makes your life as a Goldco Affiliate Program member a little easier.

Goldco Affiliate Program — The Comissions

While the Goldco Affiliate Program product offering is strong (PS: did we mention it’s got an A+ rating from the Better Business Bureau?), the commissions in the Goldco Affiliate Program are better.

Let’s start out with what the Goldco Affiliate Program pays for a qualified lead.

Any guesses?

$10?

Nope, the Goldco Affiliate Program is a little more generous than that.

$50?

Getting warmer, but still cold.

$100?

Nope, still wrong. Try doubling that.

Yep. That’s right. The Goldco Affiliate Program will pay you a massive $200 just for referring qualified leads its way.

And then there’s the rev share side of the Goldco Affiliate Program.

Now, on face value, the Goldco Affiliate Program commissions here might look pretty small.

That is, if you’re used to seeing double-digit offers from some of our other programs.

But just because the Goldco Affiliate Program “only” pays 6%, that doesn’t mean you’re not gonna earn BIG.

In fact, if there’s one affiliate program where you’re gonna earn really big, it’s the Goldco Affiliate Program.

To see what I mean, remember this — the average person you’re targeting in the Goldco Affiliate Program isn’t some Gen Z college dropout who’s looking to dump their weekly paycheck on some sportsbook.

Instead, the average person you’re targetting with the Goldco Affiliate Program is someone a little older, and a little wealthier, who’s looking to dump their life savings into something useful.

So let’s do the Goldco Affiliate Program commission math.

If someone dumps a paltry $50k into the program, @ 6%, you’re gonna get a $3k payout.

If the then dump another $100k into it, the Goldco Affiliate Program will then pay you another $6k.

Suddenly, those Goldco Affiliate Program commissions aren’t sounding so paltry after all, are they?

Goldco Affiliate Program — Next Steps

If you’re still not convinced about the Goldco Affiliate Program commissions, go take a look at some of our other top investing affiliate programs and come back.

Yep, there’s some good ones in the mix. Some you should probably even join.

But let’s be honest, you’re gonna find it hard to top the Goldco Affiliate Program in terms of pure, gross earning potential.

So if you know what’s good for you, go sign up for the Goldco Affiliate Program here.

Affiliate News Takeaways

Nintendo Profits and Cassette Comebacks

This week, this feature-length article about Nintendo popped up on my radar.

The story is about Nintendo and its decision to sit out “the video game graphics wars”.

Those graphic wars, for the non-gamer, were the battles between game and hardware makers alike to constantly outdo each other in pixels, textures, shading, and whatever else might contribute to super-ultra-24k-HD-ultra-realistic graphics.

The net results is that, after a decade of sticking to its lo-fi guns, Nintendo is consistently the most profitable big-name in gaming. And that’s not just net profit as a percentage — we’re talking net profit as a gross dollar value, too.

Yep, even if PlayStation might outgun Nintendo in sheer pixels by a factor of a billion to one, Nintendo outguns Sony where it really matters — pure profits.

To illustrate, I’ll just quote the article: “Sony’s gaming division generated $29.1 billion of revenue and an operating profit of nearly $2 billion. Nintendo posted $11.4 billion of revenue and an operating profit of $3.6 billion.”

Or, if that’s too many words for you, here it is in a picture.

Now, I could go on about the various hypotheses for why Nintendo is so goddamn successful. But it has nothing to do with the takeaway I want to get to, so if you’re actually curious, go read the article.

Otherwise, here’s the takeaway.

Actually… I’m gonna delay the takeaway.

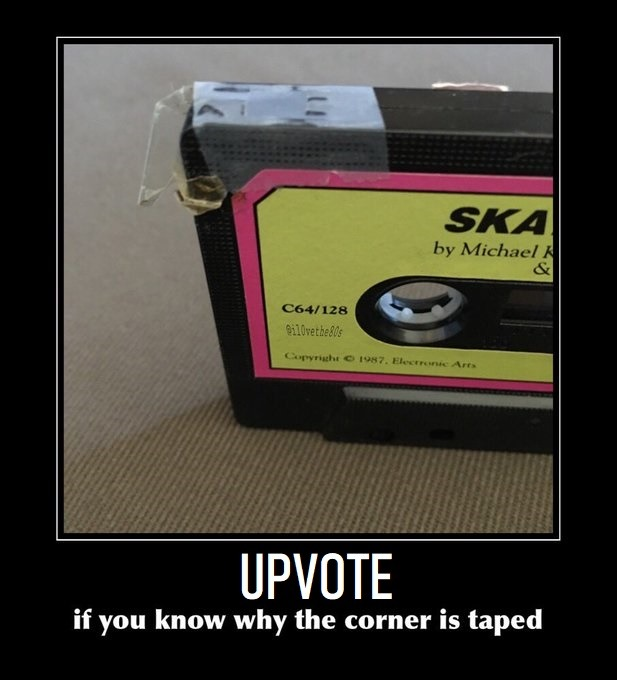

Here’s another article that just crossed my radar. The title, “Gen Z Loves Cassettes.”

Now, the story isn’t really all that new. We first mentioned it back in our Empire Flippers review edition.

But hey, it ties into the upcoming takeaway, and the article I linked to only just came out this week. So here’s a quick summary.

This one’s all about how cassette tape sales are on the up. To the tune of 500% of what they were a decade ago.

The best part, if you listen to one industry insider, is that cassettes are an absolute “cash cow”. To quote, “It’s another format to get you up the charts and milk money from people.”

Takeaway

The takeaway here is a pretty simple one.

Today, it’s all too easy to get distracted by the new, shiny thing. Retina-display this, AI-powered that, etc., etc.

But sometimes, if what you really like is “milking money from people”, sometimes something a little more old-school is precisely what you need.

Now, if you’re thinking it’s pretty hard to find products like this as an affiliate here, I’ve got three words for you. Coldco Affiliate Program.

Google: Consumers vs Investors

This week in Google news, the latest Pixel phone got launched.

And boy was it a tone-deaf launch.

At least, it’s tone-deaf if the phone is actually meant to appeal to consumers.

And no, I’m not talking about that little gaffe it made when it stupidly blurted out that the new Pixel 9 was “twice as durable as Pixel 8.”

Firstly, do people really care about a “more durable” phone?

Secondly, and more importantly, does that sound like something that’s gonna garner loyalty from existing Pixel customers?

Not sure about that one.

Anyway, what I’m more interested in is talking about how much this phone is all about AI.

There’s AI shoved into every corner imaginable.

And, honestly, some of it is just so stupidly and utterly useless you can’t help but wonder what Galaxy-brained MBA thought it was a good idea in the first place, much less pushed it through and then promoted it as some sort of headline-worthy feature.

Take the new Pixel Weather app. Google says it “uses AI to supplement traditional weather reporting so you get even more accurate forecasts.”

Sounds good right?

But since when does a self-confident generative bullshit model produce more accurate weather forecasts?

And besides, what was wrong with the good old picture and a number?

I mean, sure, if you’re a pilot or a ship captain, maybe you need to know a little more than if you should pack an umbrella today.

But, for most of us, what was wrong with pictures of clouds and sunshine? It literally took a split second to parse that and the corresponding temperature number. And it told us everything we needed to know.

But don’t take my word for it. Take the word of actual consumers.

Consumers who are increasingly being turned off by products that use AI.

There’s been a bunch of research crop up lately about this, like this study here. I’ll simply quote its conclusion: “The findings of the study indicated that the inclusion of the “Artificial Intelligence” term in descriptions of products and services decreases purchase intention.”

Apparently, mentioning AI lowers consumer trust in your product.

So why would Google go so far off the AI deep end that it’s about the only new thing in the latest Pixel?

The generous explanation would be that the phone is targeted more at early adopters. People who might be more willing to trust AI. Heck, they might even be excited about all of these “more accurate weather reports” and other fluff.

But the other explanation could also be that Google’s launch has little to do with pleasing consumers.

Instead, it’s more concerned with pleasing investors who’re still drawing a positive correlation between company valuations and the number of times a company stuffs the word AI into its publications and statements.

That’s what happened when Apple announced it was cramming AI into the iPhone.

And that’s probably what Google was hoping for, too.

Takeaway

The takeaway here is simple. If you rely on looking at what large companies do as any sort of indicator of what you should do, don’t.

At least, not when that company’s only out to please investors.

The thing is, when investors love one thing, it’s only natural that a company will do more of that thing. Even if that thing also happens to be something that’s being shown to actively hurt sales.

But here’s the nice thing about investors.

You can 100% rely on them to jump on something the moment something hits its peak.

They all did it when ChatGPT hit 100 million users.

And they’re all about to do it now that gold’s been hitting new all-time highs.

So here’s what I say.

Do as Google does.

Don’t sell to consumers. Go where the real money is and sell to investors.

The Goldco Affiliate Program is probably a good place to start.

DraftKings… More Like DaftKings

Yeah, I just misspelled DraftKings wrong.

I did that because they just did something daft.

They announced they were going to add a surcharge on winning bets in a bunch of states while their competitors didn’t.

Now, a little under two weeks later, they’re backpedaling hard, claiming they were “always committed to delivering the best value in the industry to our loyal customers.”

Lol.

Not sure how charging bettors a surcharge while your competitors don’t fulfils that mission.

But anyway, that’s just my take.

Time for the takeaway.

Takeaway

This sort of story isn’t as unusual as you’d think. Company’s piss off their customers all the time.

Don’t believe me?

Here’s another example.

This is good news if you’re an affiliate.

If you can catch consumers at their moment of greatest dissatisfaction, there’s a pretty good chance you convert them to an alternative.

Now, you could just take the story at face value and go and promote the best sports betting affiliate programs to former DraftKings clients.

But, you’re already too late.

Instead, maybe you could do your own research. Go find a gold company that’s ripping off its consumers.

Then, reach out to these consumers. Make them mad. And offer them an alternative.

I hear the Goldco Affiliate Program will pay you pretty well if you can do this.

Closing Thought

Let’s talk about free speech and free markets.

Let’s start with free speech.

Once upon a time, the left was the most earnest defender of what we also like to call our “right to offend.”

But today, it’s unquestionably the right.

All it took for this to change was a slight shift in the flavor of our “moral panic” du jour.

Here’s how it played out.

Once upon a time, that moral panic was clowns…

Err… I mean, blasphemous men in makeup like Marilyn Manson.

The left loved defending the rights of these clowns to make fun of hokey old creationists and other weird Christian folk with outdated beliefs.

“Free speech, free speech”, they would chant.

But then, the moral panic du jour changed.

Today, the moral panic is so-called “hate speech”. Aka, misgendering someone or some other mildly offensive behavior.

Thus the left, who once defended the right to offend, now thinks you have no right to offend.

That’s what we call a complete 180.

Now, in theory, this shift alone should be enough to show that we cannot take the claims of any free-speech absolutionists at face value.

At least, not if they’re on the left.

Instead, what we really need to do — that is, if we are to read them properly — is instead look at what they’re really defending.

In this case, the leftist, as a “free speech defender”, was never about free speech.

Instead, the left was more about upholding Xyr’s right to poke fun at creationists.

But that changed when other people started poking fun at the “rainbow-gendered” snowflake who thought Xyr’s preferences for dressing up like a clown somehow translated to a tangible, corporal gender identity.

Oh, the folly of the left.

But don’t think the right is somehow exempt from such contradictions.

Sure, the leftist’s limits have become blatantly self-evident in today’s culture wars… “Cancel this, cancel that, rah rah rah.”

But, if you look a little closer at either side, you soon see both sides have limits.

To give one example, GOP-dominated West Virginia introduced this bill, and this bill within months of one another.

The first of these bills is a good-ol’ rootin’ tootin’ free-speech-defending masterpiece.

It protects teachers’ rights to educate children on creationism.

And hey, why not?

I mean, if teachers should be allowed to ignore the science about the non-existence of “rainbow-gender”, then why can’t they also ignore the science about the existence of dinosaurs?

Am I right?

But then we get to the second bill.

The second bill leans on the auspices of “prurient interests” — that is, the “does it give me a boner” test… a classic test for the limits of free speech under traditional constitutional jurisprudence — to limit the ability of educators to expose children to performances by clowns…

…err, I mean, “transvestite and/or transgender” people…

…but hey, you tell me what the difference is.

Anyway, let’s get one thing straight.

Yes, Coulrophilia (clown fetish) is real. So yes, maybe you could make the case that clowns do, indeed, attend to the salacious wants of our baser desires.

But let’s also get another thing straight.

Coulrophilia is also extremely rare. So rare, in fact, that the “average person” to which the Supreme Court defers for the “boner test” wouldn’t find “exposure to clowns” to arouse a great deal of prurient curiosity.

And yet, that’s exactly what the other West Virginia bill attempts — to extend the definition of “prurient interests” such that it applies to clowns… err… I mean, “transvestite and/or transgender” people appearing in performances.

Now you tell me who’s the real defender of our First Amendment rights?

The right-leaning defenders of creationists’ free speech rights?

Or the left-leaning defenders of clowns…

If you see a difference between the two camps, then maybe you should get yourself checked out — you might have a case of Coulrophilia.

Otherwise, hopefully, we’re all on the same page about free speech.

So now let’s talk about free markets.

When it comes to free markets, it’d be remiss not to defer to the late, great Adam Smith — the so-called godfather of free markets.

If you don’t know who that is, then maybe you know the canonical free market quote.

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.”

That quote is Smith, and it’s everywhere. From quippy little motivational posters to Marc Andreessen’s sprawling defense of the techno-capital machine.

In that quote, Smith basically says that free markets compel otherwise self-interested people to serve the greater good by incentivizing — by way of profit — the pursuit of productive activities.

All good stuff.

That’s why today’s most ardent defenders of the modern-day UberCorp — the Googles, the Amazons… the Ubers — love quoting Smith. They’ll quote all manner of lines about the virtue of selfish butchers and other great Smithian one-liners like the “invisible hand”.

But they’ll also leave out the other bits — the bits where Smith reveals he, too, has his limits.

The bits where Smith talks about how “the constant view of such companies is always to raise the rate of their own profit as high as they can; to keep the market, both for the goods which they export, and for those which they import, as much understocked as they can: which can be done only by restraining the competition, or by discouraging new adventurers from entering into the trade.”

You see, much like free speech defenders have motivators that send them on their crusade and a limit at which they’ll do an unironic backflip, free market defenders also have theirs.

For Smith, his crusade was against, and I quote, “the wretched spirit of monopoly”. It was a reaction against the Mercantilism of his day — the government’s meddling in protectionist trade policies and sprawling, free-market-eating monopolies like the East India Company.

Thus, we can safely assume, that much like the leftist doing a free speech backflip once the right started making fun of clowns, Smith would also have done a backflip when confronted with, let’s say, today’s techno-capitalist wet dream about capturing “the light cone of all future value in the universe.”

It’s just that, back in his day, he might not have seen that “free markets” would allow such monopolies to happen.

Just as the leftists didn’t predict that their love of free speech would eventually lead to the right making fun of rainbow-gendered clowns.

Anyway, all of this was a long-winded way to say this: whether it’s free speech, free markets, or the goddamn tooth fairy, each one is only useful insofar as it serves the limits of our own self-interest.

When I was a kid, I pretended to believe in the tooth fairy for much longer than I really did. I knew that the longer I “believed”, the longer my mom would give me money for free.

True story.

But, again, I digress.

The real point of all of this is to say this — it’s okay to believe in something with reservations.

It’s okay to believe in free speech only up until the point where it offends you.

It’s a free country, for both the left and the right.

It’s also okay to believe in free markets only up until the point where that market is so dominant it can charge you a whopping 50% of your takings as a seller while only paying you a paltry 3% commission as an “associate”.

The “godfather of free markets” and Jeff Bezos are stranger bedfellow than you might think.

And it’s fine to decide you’re now against government interference at the moment you’re in a position to “pull up the bridge” on competitors, even if you did build your entire company on the back of billions worth of government subsidies.

That’s just the way the world works.

The only time it’s not fine is if you don’t do it out of self-interest.

The moment you start believing in something because, let’s say, you like the status a belief confers on you, that’s when you’re doomed. Until the moment you cross the bridge from the land of “temporarily embarrassed billionaires” to that of actual billionaires, chances are, your interests are not aligned.

So here’s my challenge to you.

Commit to a belief or make a decision today where your motivation is nothing but self interest. You might surprise yourself with what you find.

And, if you don’t know where to start, here’s a simple question — does a giant affiliate commission sound like the sort of stuff that’s in your own self-interest?

If it does, then joining a top affiliate program might be just the ticket.

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Cannabis6 days ago

Cannabis6 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

-

Markets2 weeks ago

Markets2 weeks agoRice Market Slips as Global Price Pressure and Production Concerns Grow

-

Crowdfunding3 days ago

Crowdfunding3 days agoCrowdfunding for Mobility: Wheelchair User Seeks Accessible Car

-

Biotech1 week ago

Biotech1 week agoInterministerial Commission on Drug Prices Approves New Drugs and Expanded Treatment Funding