Biotech

The Health Sector Reinvested 12.9% of Its Income in Innovation in 2022

Within the health sector, 20% of investment in R&D came from the ten largest companies by investment, which allocated €53.9 billion, €10 billion more than the previous year. This list was led by Merck, which invested €11 billion. They were followed in this classification by AstraZeneca and Sanofi, with €8.9 billion and €6.7 billion, respectively.

Health is the sector that reinvests most of its income in Research and Development (R&D). In 2022, companies in the health sector allocated 12.9% of their income to develop their research and development areas, according to the twentieth edition of the EU Industrial Research & Development Investment Scoreboard published by the European Commission, which analyzes the 2,500 companies with the greatest investment in innovation worldwide.

Specifically, health invested €261 billion in R&D in 2022, becoming the second sector that allocated the most capital to R&D, only behind the €285 billion invested by information technology companies and communication (ICT).

The sector has been increasing its investment in R&D for years. If between 2012 and 2019 investment in R&D by healthcare companies grew by 6.7% on average annually, this figure rose to 9.2% and 17.1% in 2021 and 2022 , respectively. However, although in 2022 the value was reduced to 7.3%, it was still higher than pre-pandemic records.

If you want to find more about the investments in R&D, download for free our companion app. The Born2Invest mobile app keeps its readers up to date with the most important financial news of the day.

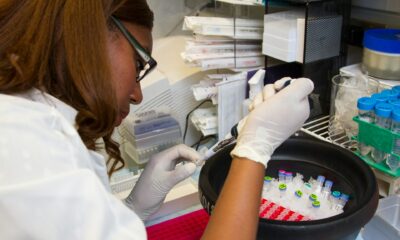

Within the different companies in the health sector, the report has highlighted the growth of biotechnology companies

Within the sector, 20% of investment in R&D came from the ten largest companies by investment, which allocated €53.9 billion, €10 billion more than the previous year. This list was led by Merck, which invested €11 billion. They were followed in this classification by AstraZeneca and Sanofi, with €8.9 billion and €6.7 billion, respectively.

Within the different companies in the health sector, the report has highlighted the growth of biotechnology companies, which have more than doubled since 2012, going from occupying 125 positions on the list to 271 companies. Investment by biotechnology companies totaled €66.5 billion in 2022, and their resources allocated to R&D grew by an annual average of 14.5% over the last decade.

Regarding pharmaceutical companies, their investment in 2022 rose to over €167 billion, which resulted in an average increase of 5.3% annually over the last ten years. As for the other companies in the health sector, together they totaled 27 billion euros of investment in R&D in 2022. In their case, the average annual growth of the last decade registered an increase of 6.5 %.

The United States has been the country that has led efforts in R&D within health, gathering 52.4% of the total figure

Since 2012, the United States has been the country that has led R&D efforts within health, gathering 52.4% of the total figure. Within the North American market, the report has highlighted the role of biotechnology companies, which in 2022 totaled €66.5 billion of investment in R&D.

The European Union has occupied third place, very close to the rest of the world group (which includes countries such as Switzerland and the United Kingdom), occupying second position, concentrating 16.8% of the total R&D figure. However, in both the European Union and Japan (contrary to the trend noted in China), the number of companies in the health sector has decreased compared to 2012 figures; For example, in the EU, the number of companies has fallen from 81 to 69 companies over the last ten years.

This report from the European Commission analyzes the main trends in innovation of the thousand most relevant investing companies in the European Union and contrasts them with global competitors to understand the structural trends in R&D over the last ten years, placing special emphasis on the activity deployed during the global financial crisis and the Covid-19 pandemic.

__

(Featured image by geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business21 hours ago

Business21 hours agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Cannabis3 days ago

Cannabis3 days agoColombia Moves to Finalize Medicinal Cannabis Regulations by March