Featured

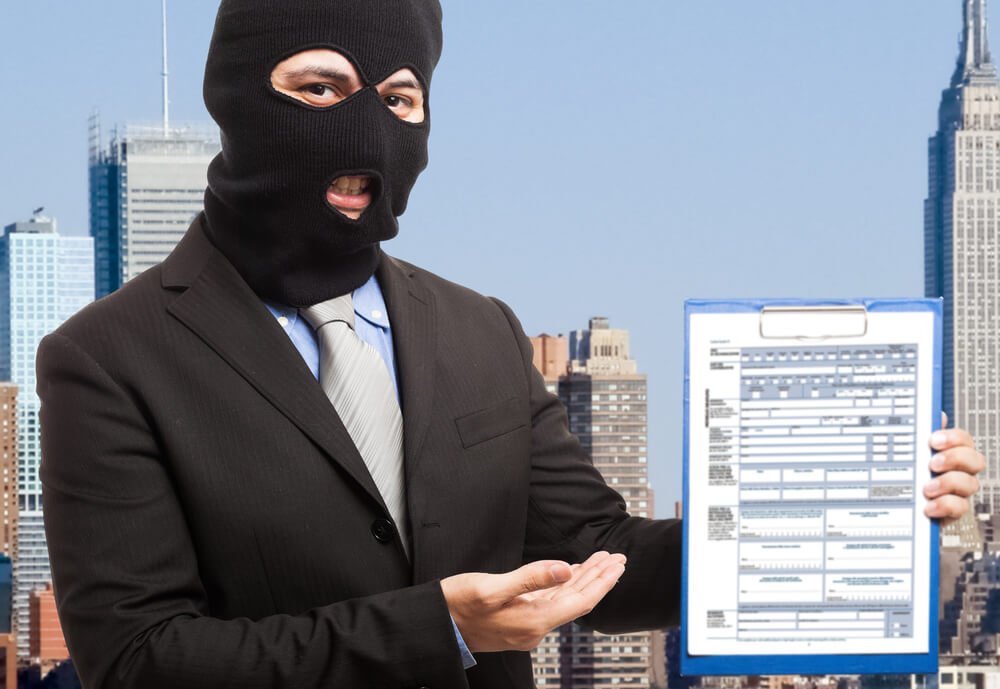

How to avoid tax scams

With tax filing now becoming electronic, tax scams have become one of the most prevalent scheming tactics in the industry today.

Don’t lower your guard now that the tax season is over. Tax scams are everywhere—and they’re out to getcha.

The latest rip-off involves criminals asking foreign workers to “authenticate” their information by filling out a phony tax form, according to the Internal Revenue Service. The fraudsters harvest your personal information, which can lead to ID theft and other crimes.

“Be alert to bogus letters and emails that appear to come from the IRS,” the agency warns.

Oh, I know what you’re thinking. The word “tax” and “scam” are synonymous. I admit I don’t like paying income taxes any more than the next guy. But these scams add insult to injury. First, the government takes, then the criminals take again. Don’t become a victim.

“Scams are everywhere today, and tax scams are no exception,” says Steven J. Weil, president of RMS Accounting, in Fort Lauderdale, Fla. “The dawn of electronic filing only made the problem worse. It can take two years to get your refund if a fraudulent return has been filed in your name. While this can hurt, especially if you very much need your refund, it’s not the worst of the fraud that revolves around the tax system.”

The fake tax return

This is a new one. To pull it off, ID thieves use phishing emails to tax preparers to gain information about the tax returns of their clients. The criminals then file income tax returns on behalf of those clients using much of the same information contained in previous tax returns, including information about dependents.

“They request the IRS to send the refund to the actual bank account of the victim, so everything appears quite normal,” says Steven J.J. Weisman, a lawyer and college professor. “After the refund has been received, the victim receives a telephone call from the scammer posing as a collector for the IRS who tells the targeted victim that there was an error in the refund and that it must be wired back to the collector.”

Gotcha!

You owe money!

Here’s another popular scam, likely to happen now that filing season is over. You get a call from the IRS that says you’re in a great deal of trouble as a result of a previously filed tax return and says you owe the IRS a substantial amount of money. The caller may even threaten you with arrest and tell you if you can’t immediately pay a certain sum through the use of a green dot card or other prepaid credit cards, then you’ll be subject to immediate arrest.

Be careful of tax scams made through phone calls. Prank callers may try to contact you asking for money for an “unpaid” tax. (Photo by DepositPhotos)

“Frequently the caller will tell the victim to go to Western Union and wire the money or ask for the prepaid credit card,” warns Paul T. Joseph, an accountant with Joseph & Joseph Tax and Payroll in Williamston, Mich.

We’ll steal your identity

The most ingenious scam artists pull off their nefarious deeds without you knowing it. “Identity theft can play a major role in tax scams,” says Bill Stack, author of the book “The 7.0% Solution.” He says scammers extract personal information year-round (see the IRS warning at the top of this story).

The bad guys do it in a variety of ways, from slick calls to phishing emails to letters. They’re playing a long game, which is to get as much information they need to perpetrate other forms of fraud—not necessarily related to your tax return. But when you receive a call with an ID that says “Internal Revenue Service,” even if it’s spoofed, such tactics can be highly effective.

How to spot and avoid the scams

I asked security expert Robert Siciliano how to spot a tax scam. He says the following could be signs:

– The initial communication about owed money is not through snail mail.

– If they request a credit card number over the phone or email.

– If they request a wire transfer or prepaid card over the phone or email.

Scammers are highly sophisticated, he adds.

“There’s background noise to make you think it’s a busy call center,” he says. “The caller identifies himself with a common name, like Michael Harris. He gives you his badge number to sound more official. And the phone call coincides with an email, to make things appear more official.”

The final litmus test: If you say, “I actually work for the IRS myself,” a scammer will hang up.

“Don’t argue with the caller,” he advises. “Simply hang up. If you really do owe taxes, call the real IRS and work with an authentic employee to pay what you owe.”

That’s good advice when dealing with anyone you suspect is a scammer. Hang up. Delete the email. Don’t walk away—run!

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis2 days ago

Cannabis2 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Cannabis1 week ago

Cannabis1 week agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

-

Africa5 days ago

Africa5 days agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

You must be logged in to post a comment Login