Featured

How do you find solid dividend growth stocks?

Creating a second stream of income based on dividend stocks is possible. To do so, you need to invest in high-quality stocks and avoid misleading metrics.

Investing in dividend stocks is not a fashion, but a main concept of investors for as long as capitalism exists. To create an additional stream of growing income based on some of the most successful companies in the world is not just a dream. It becomes a reality if you are willing to patiently invest in solid dividend growth stocks. Nevertheless, one question arises: How do you find them?

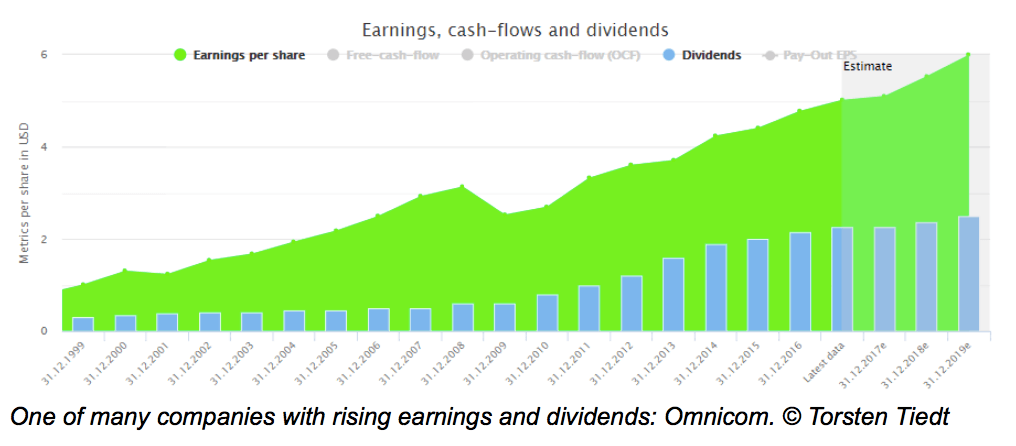

To get the answer, let us understand what you are really looking for. The quest for safe and rising dividends means that you are looking for dividend-paying companies with stable or, even better, rising profits. No profits, no dividends! At least not in the long run.

For a long-term investor, high-quality stocks differ from low-quality stocks by their earnings growth. A solid company increases earnings in the long run at a constant rate. A company with increased earnings for decades will most likely increase its earnings in the next year, too. At least, the probability to do so is much higher compared to a low-quality company whose earnings are volatile.

Years of increasing profits are no coincidence. They are the financial manifest of a well-performing business model including many pre-conditions, like functioning business processes, capable management, strong brands combined with market power and more. These characteristics of a company do not disappear from one financial year to the next. Most probably, such a company will continue to increase its profits. In doing so, it will increase its stock price as well as dividends. A successful investor is looking for these companies.

How to measure rising profits

Unfortunately, it is not easy for a private investor to find high-quality stocks. Even worse. The reason why many shareholders prefer low-quality stocks is that classic metrics such as PE ratio (price-earnings) or current dividend yield are misleading. They are misleading because they are only snapshots. It is like measuring an athlete’s time for only 100 meters when running a marathon. Even a crippled stock may have an attractive looking PE ratio after the share price dropped. In addition, after a dividend cut, the payout ratio of a stock could look fine.

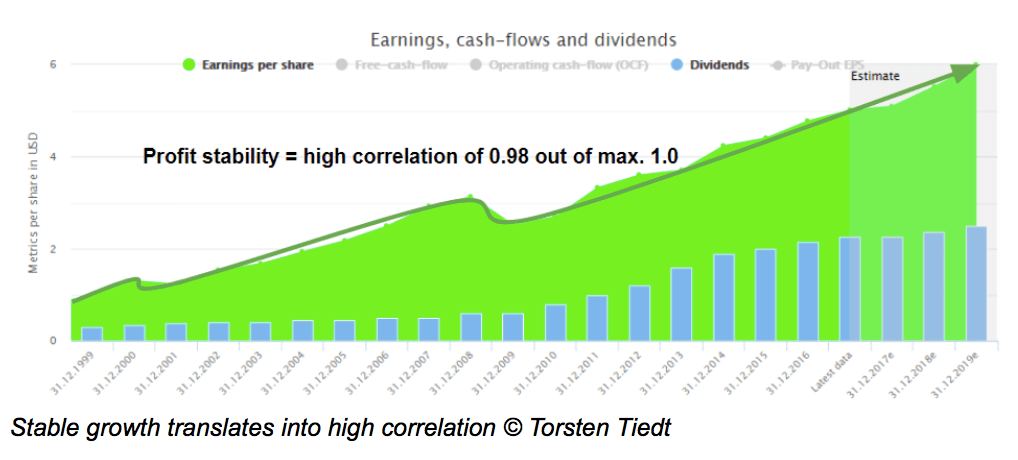

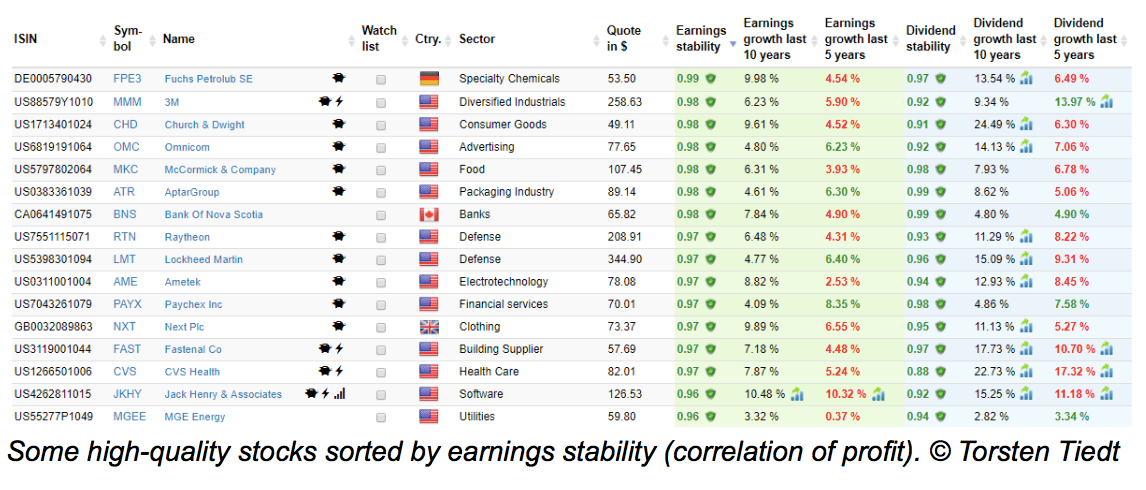

A better way to measure rising profits it by quantifying them using correlations. In our case, correlation measures the relationship between profit and time. The result goes from +1.0 to -1.0. A result of 1.0 means a perfect correlation between profit and time. Imagine a straight line drawn with a ruler. If the line slopes upwards (our preference), the 1.0 is positive. If it slopes downwards, we have -1.0. A zero means there is no correlation between profit and time.

Combining correlations with growth rates – known as compound annual growth rates – gives you a very good impression of the quality of a stock for long-term investing. Dividend growth investors can apply correlations and growth rates not only to profits but also to dividends.

Doing so allows you to quickly identify the most promising stocks to make your dreams of an additional ever-growing stream of income become reality.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds

-

Biotech2 weeks ago

Biotech2 weeks agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Cannabis3 days ago

Cannabis3 days agoCannabis Use and Brain Aging: What a Major Study Reveals

-

Africa2 weeks ago

Africa2 weeks agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

You must be logged in to post a comment Login