Business

How high debt affects bond rates

You would think that rising government debt levels would lead to higher bond interest rates. Here’s what tends to happen instead. Higher government debt tends to lead to “diminishing returns,” or falling ratios of GDP created per dollar of debt. So, like any drug, it takes more and more to create less effect. Higher debt becomes a greater burden through rising interest and servicing costs.

The only Phd economist I allow to speak each year at the Irrational Economic Summit is Dr. Lacy Hunt. (You can watch his presentation from this year’s conference here.) Lacy can take that complex science and still see the forest for the trees. He can still find reality from all of that great theory to real-life outcomes.

It also helps that he advises a $4 billion bond fund at Housington Management and has to get the reality of bond interest rates right or face the consequences – which he has for this entire boom!

High Debt Doesn’t Equal Higher Rates

At IES, Lacy started off breaking one natural assumption of investors in his first slide. You would think that rising government debt levels would lead to higher bond interest rates. Higher debt means higher growth. Higher growth tends to cause higher inflation, and that in turn causes higher short and longer-term rates to compensate. Oh, and to sell more debt you have to raise the rates to attract investors to absorb it all.

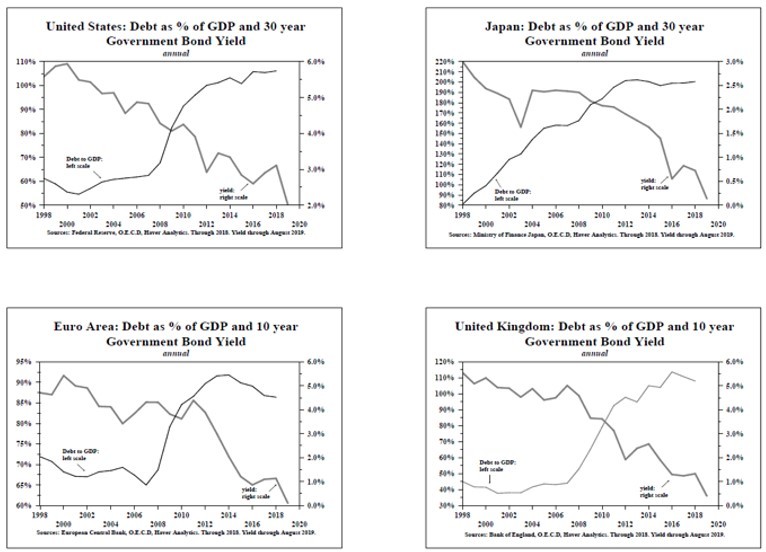

This chart pretty much proves these natural assumptions are false!

Rising Gov’t debt leads to lower Gov’t bond yields

Here’s What Happens Instead

The U.S. accelerated debt as a percent of GDP from 2007 through 2014, and T-bond yields fell from 5% down to 2.5% into 2016 on a two-year lag. Similar for the Eurozone with bond rates falling from 4.5% to 1.0%. Japan has been goosing debt the most from 1998 into 2013 and its bond rates fell from 3.0% to o.7% by 2016 on a 3-year lag. The U.K. was the most extreme in rising debt from 2007 into 2016 with falling rates from 5% down to 0.5% currently.

Here’s what tends to happen instead. Higher government debt tends to lead to “diminishing returns,” or falling ratios of GDP created per dollar of debt, which Lacy later shows has clearly been the case. So, like any drug, it takes more and more to create less effect. Higher debt becomes a greater burden through rising interest and servicing costs – and that slows economic growth.

It also encourages businesses and consumers to over-invest and that excess capacity lowers prices and inflation.

Voila: Another simple insight in a seemingly complex economy. And why I love Lacy!

—

(Featured image by Pixabay from Pexels)

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Africa3 days ago

Africa3 days agoSurging Expenditures Widen Morocco’s Budget Deficit Despite Revenue Growth

-

Markets2 weeks ago

Markets2 weeks agoSoybean Market Reacts to Trade Hopes, High Stocks, and Global Price Pressure

-

Cannabis12 hours ago

Cannabis12 hours agoGermany Moves to Curb Medical Cannabis Abuse, Sparking Access Concerns

-

Cannabis1 week ago

Cannabis1 week agoSwitzerland Advances Cannabis Legalization with Public Health Focus