Markets

A Look at the Vibrant Inflation and Slowing Economy in the US

Markets can be fascinating and chaotic. Inflation is alive and well. Against an inflationary backdrop, cash-strapped shoppers turn to discount stores such as Dollarama, which reported increased sales and higher income, pays a dividend, and is held in the Enriched Capital Conservative Growth Strategy. Hotter than everyone expected and it spooked the markets.

This may not come as a surprise but, as we suspected all along, the Fed won’t be cutting interest rates anytime soon.

It was a big week for inflation numbers

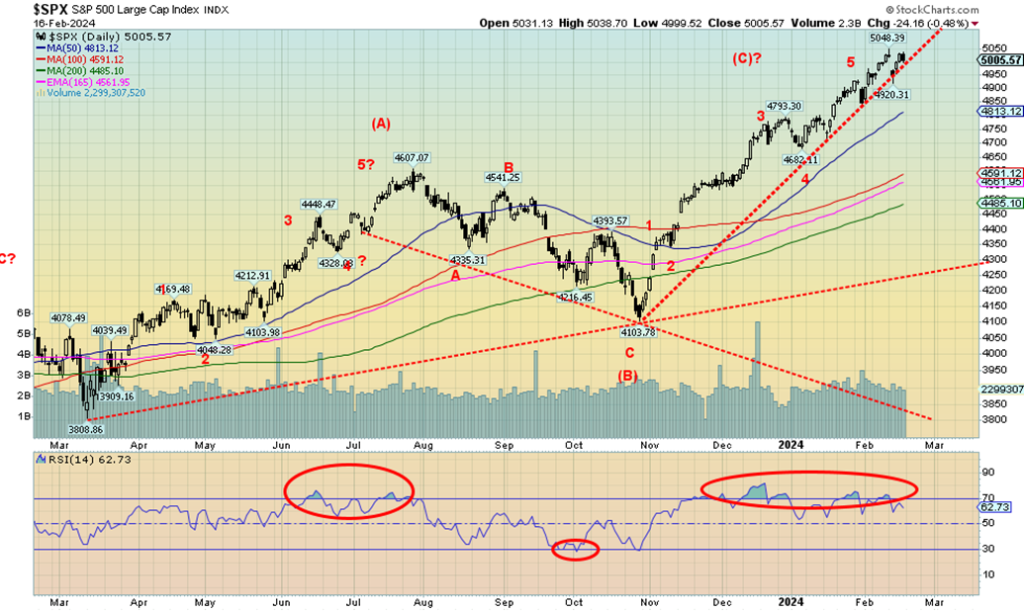

First CPI came in at 3.1%, largely as expected, but the core CPI was 3.9%, above the expected 3.7%. The previous month saw the CPI at 3.4% and the core at 3.9%. All good? Not so fast. Nobody seemed to like it as USDX soared, bond yields rose, and the stock markets and gold fell sharply. The S&P 500 (SPX) gapped down, leaving us wondering whether we have seen our top.

But no, SPX recovered and seemed headed back to the highs, even filling the gap. However, along came the PPI and it jumped 0.9% for January. Except they expected only 0.8% and December’s was 1%. The core PPI was 0.5% above the expected 0.1% and December’s negative 0.1%. The markets freaked again and dropped Friday. But gold bounced back and silver leaped. Not helping were retail sales, only 0.6% for January when they expected 5.8% and December’s number was 5.6%. Not good.

Odds of a rate cut in March are now about zip. Odds of a rate cut in May/June? Falling fast. And now, poor retail sales, poor industrial production as well—does stagflation loom? Manufacturing production year-over-year was negative 0.9%, well below the expected gain of 1.5%. But despite layoffs everywhere, it seems the most recent weekly claims were only 212,000 below the expected 220,000 and last week’s 220,000. Go figure.

The U.K. and Japan have now both entered an official recession (two consecutive quarters of negative growth), albeit a mild one. Mild, so far is the operative word. Japan has now slipped to the 4th largest economy. Japan and the U.K. now join Germany and a wobbling entire EU and eurozone. The U.S.? Not even close, it seems—hence, the strong USDX and gold struggling. Bond yields are rising again as the 10-year U.S. treasury note jumped this past week to 4.28%, up from 4.18%, and in Canada the 10-year Government of Canada bond (CGB) rose to 3.59% from 3.55%. The 2–10 spreads widened to 36 bp and 71 bp respectively, delaying the recession in both Canada and the U.S.

Despite the week for the stock market that saw the S&P 500 fall 0.4%, the Dow Jones Industrials (DJI) down 0.1%, the Dow Jones Transportations (DJT) down sharply 3.6% and continuing its negative divergence with the DJI, and, the NASDAQ off 1.3%, the bullish consensus still remains at extreme greed.

At the other end, the Gold Miners Bullish Percent Index (BPGDM) is at 17.86. Okay, not extreme—3.45 in October 2023 was closer to extreme. As well, we were a bit surprised to see that the Gold/Gold Bugs Index (HUI) ratio was at 9.73, down from a high just recently at 10.24. In 2015 at the bottom, it hit 10.90 and way back in 2000 which was a major bottom for gold stocks before we took off for a solid decade from 2000–2011 it was only at 7.46.

All this suggests to us that if gold stocks are not at a bottom, they are so close to it that the odds of further significant declines are about zip. Those already long can take some solace. We’re overdue.

Gold/HUI Ratio

As for the stock market, with so many making new all-time highs and the week closing mostly down, the odds are rising that we may have made a significant top. Joining the all-time highs’ lower close were the New York FANG Index and Microsoft. Other FAANGs made all-time highs but didn’t close lower, including Meta, Nvidia, and Snowflake.

In the EU, the Paris CAC 40, the German DAX, and the EuroNext made all-time highs but held their gains. In Canada, Industrials (TIN) and Information Technology (TKK) both made all time highs that along with Energy (TEN) and Materials (TMT) helped the TSX Composite move to new 52-week highs. The TSX 60 also made new 52-week highs. And, in a surprise move, the TSX Venture Exchange (CDNX) was up 1.9% on the week bucking negativity elsewhere.

The fact that most indices held their gains means the rally may not be over just yet and could still run up into March, just like the dot.com bubble did in 2000. SPX needs to break 4,900 and then 4,800 to give us some sell signals. The daily MACD indicator is rolling over and on the verge of a sell signal. One really needs to the weekly MACD to roll over and that’s not close.

This week could decide. If we recover and move higher again, March is looking like our top. But if just those points we noted above break, then a top could be in. A break of 4,650 would be a weekly breakdown and confirm a top. Buying up here is not recommended unless you are going after energy and golds.

Energy inparticular is being driven by growing dangerous geopolitical events, but WTI oil still needs to get over $80 to give us a confirmed buy signal. Warm weather is keeping natural gas (NG) in the dumpster as it hit a 52-week low closing at $1.61.

Gold managed to recover at week’s end and still closed lower on the week, thanks to a strong USDX and rising bond yields. While gold was down 0.7% on the week, silver starred, up 3.9%, and closed over 23. Platinum +4.0%, palladium +9.61%, and copper +4.4% all hinted for us that something could get going across the spectrum for the precious metals and the metals, even as the gold indices were still down on the week. The Gold Bugs Index (HUI) fell 1.4% while the TSX Gold Index (TGD) was down 0.2%, but both were down a lot more earlier, bouncing back nicely at week’s end. The TGD made lower lows below October 2023 and the HUI basically met the October low. Notably gold itself did not. As we noted, the Gold/HUI ratio and sentiment suggests we are at or very close to a low for the gold stock indices.

Gold needs to take out $2,050, $2,060, $2,080, and $2,100 to convince us we are moving higher. The commercial COTs for both gold and silver perked up this past week and look better. Silver still needs to take out $24, $25 and once above $26 we will have a confirmed low and will be most likely headed to $30.

The geopolitical situation is deteriorating particularly in the Mid-East. The entire region is a powder keg. Costs to companies are rising because of the situation in the Red Sea. That’s inflationary. The domestic political scene is also a concern as the U.S. marches towards a potentially very confrontational election in November.

We’ve seen a rise not just in attack ads but also false AI generated ads as the rhetoric rises. Risks remain in commercial real estate and the banking sector as many fund managers become concerned about a systemic event that could put the global financial system at risk. We live in increasingly dangerous times and ultimately that is good for gold. Got some?

Markets & Trends

| % Gains (Losses) Trends | ||||||||

| Close Dec 31/23 | Close Feb 16 , 2024 | Week | YTD | Daily (Short Term) | Weekly (Intermediate) | Monthly (Long Term) | ||

| Stock Market Indices | ||||||||

| S&P 500 | 4,769.83 | 5,005.57 (new highs)* | (0.4)% | 4.9% | up | up | up | |

| Dow Jones Industrials | 37,689.54 | 38,627.99 (new highs)* | (0.1%) | 2.5% | up | up | up | |

| Dow Jones Transport | 15,898.85 | 15,629.19 | (3.6%) | (1.7%) | up | up | up | |

| NASDAQ | 15,011.35 | 15,775.65 (new highs) | (1.3)% | 5.1% | up | up | up | |

| S&P/TSX Composite | 20,958.54 | 21,255.61 (new highs) | 1.2% | 1.4% | up | up | up | |

| S&P/TSX Venture (CDNX) | 552.90 | 556.76 | 1.9% | 0.7% | up | down (weak) | down | |

| S&P 600 (small) | 1,318.26 | 1,304.98 | 1.3% | (1.0)% | up | up | up (weak) | |

| MSCI World | 2,260.96 | 2,256.63 | 0.8% | (0.2)% | up | up | up (weak) | |

| Bitcoin | 41,987.29 | 51,565.94 (new highs) | 8.7% | 22.8% | up | up | up | |

| Gold Mining Stock Indices | ||||||||

| Gold Bugs Index (HUI) | 243.31 | 207.96 | (1.4)% | (14.5)% | down | down | down | |

| TSX Gold Index (TGD) | 284.56 | 251.57 | (0.2)% | (11.6)% | down | down | down | |

| % | ||||||||

| U.S. 10-Year Treasury Bond yield | 3.87% | 4.28% | 2.4% | 11.6% | ||||

| Cdn. 10-Year Bond CGB yield | 3.11% | 3.59% | 1.1% | 15.4% | ||||

| Recession Watch Spreads | ||||||||

| U.S. 2-year 10-year Treasury spread | (0.38)% | (0.36)% | (20.0)% | 5.3% | ||||

| Cdn 2-year 10-year CGB spread | (0.78)% | (0.71)% | (6.00)% | 9.0% | ||||

| Currencies | ||||||||

| US$ Index | 101.03 | 104.28 | 0.2% | 3.2% | up | up (weak) | up (weak) | |

| Canadian $ | 75.60 | 74.27 | flat | (1.8)% | down | neutral | down | |

| Euro | 110.36 | 107.75 | (0.1)% | (2.4)% | down | neutral | down (weak) | |

| Swiss Franc | 118.84 | 113.64 | (0.6)% | (4.4)% | down | up | up | |

| British Pound | 127.31 | 126.00 | (0.3)% | (1.0)% | down | neutral | neutral | |

| Japanese Yen | 70.91 | 66.57 | (0.6)% | (6.1)% | down | down | down | |

| Precious Metals | ||||||||

| Gold | 2,071.80 | 2,024.10 | (0.7)% | (2.3)% | down | up | up | |

| Silver | 24.09 | 23.48 | 3.9% | (2.5)% | neutral | down | neutral | |

| Platinum | 1,023.20 | 913.50 | 4.0% | (10.7)% | down | down | down | |

| Base Metals | ||||||||

| Palladium | 1,140.20 | 952.80 | 9.6% | (16,4)% | down | down | down | |

| Copper | 3.89 | 3.84 | 4.4% | (1.3)% | neutral | down (weak) | down | |

| Energy | ||||||||

| WTI Oil | 71.70 | 78.46 | 2.1% | 9.3% | up | neutral | neutral | |

| Nat Gas | 2.56 | 1.61 (new lows) | (13.0)% | (37.1)% | down | down | down | |

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs

__

(Featured image by engin akyurt via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Copyright David Chapman 2024

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

-

Impact Investing6 days ago

Impact Investing6 days agoGlobal Energy Shift: Record $2.2 Trillion Invested in Green Transition in 2024

-

Fintech2 weeks ago

Fintech2 weeks agoPayrails Secures $32M to Streamline Global Payments

-

Crowdfunding2 days ago

Crowdfunding2 days agoDolci Palmisano Issues Its First Minibond of the F&P “Rolling Short term” Program

-

Markets1 week ago

Markets1 week agoShockwaves of War: U.S. Strikes Iran, Markets Teeter, Global Risks Rise