Crypto

Ledger Hardware Manufacturer Must Cut Jobs Due to Bear Market

Ledger says it has more than 700 employees, so about 80 employees are likely to have to go. Gauthier promises to comply with strict French labor laws in the job cuts. Ledger has its headquarters in Paris and has already sold more than 6.5 million of its hardware wallets such as the Ledger Nano S and Nano X. In a March funding round, Ledger was valued at $1.4 billion

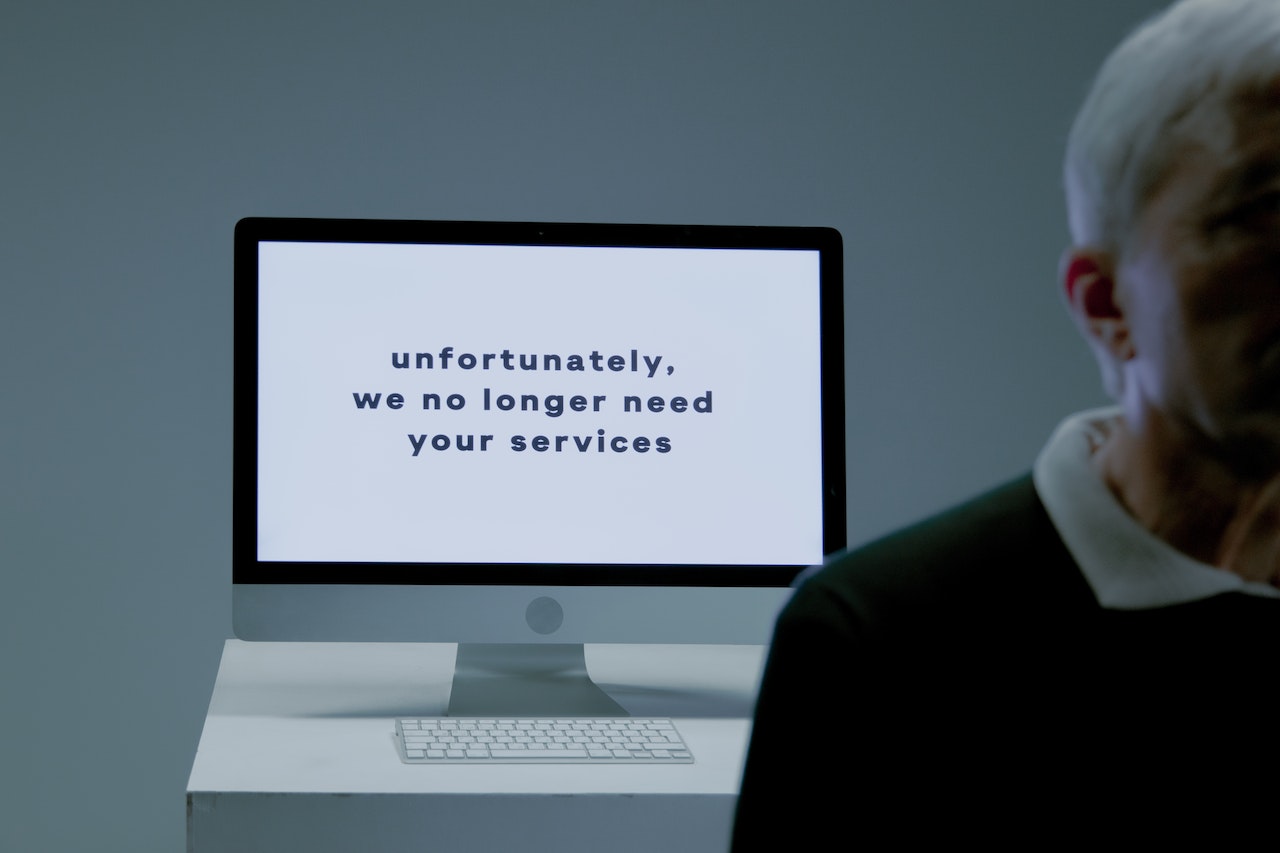

Leading hardware wallet manufacturer Ledger is laying off 12 percent of its workforce. The reason given is a “bear market” and “macroeconomic headwinds.” Other numbers from Ledger are compelling.

The crypto markets have basically been treading water since the spring, with the reserve currency Bitcoin (BTC) also mostly stuck in a narrow price corridor between $26,000 and $30,000 over the past six months.

At hardware wallet manufacturer Ledger, this situation now has consequences. “Unfortunately” they have to cut 12 percent of their jobs, Ledger CEO Pascal Gauthier announced via blog post. He speaks of a “bear market” and gives the affected employees hope for reemployment in better times.

Read more about Ledger and find why the company has to cut jobs and find the most important business news of the day with the Born2Invest mobile app.

Ledger says it has more than 700 employees, so about 80 employees are likely to have to go

Gauthier promises to comply with strict French labor laws in the job cuts. Ledger has its headquarters in Paris and has already sold more than 6.5 million of its hardware wallets such as the Ledger Nano S and Nano X. In a March funding round, Ledger was valued at $1.4 billion. Gauthier says this won’t change with the wave of layoffs.

His open letter makes exciting reading. For Gauthier reveals that at the beginning of 2023, he and his management team believed Ledger was prepared for the “bear market” that was emerging at the time.

Events such as the FTX insolvency at the end of 2022 had made it clearer than ever to investors that assets in Bitcoin and the like are only really safe if they are stored on private hardware wallets. A good 20 percent of all global holdings in cryptocurrencies are securely stored on Ledger hardware wallets, according to Gauthier, and more than 100 customers from the financial industry use the Nano X, for example.

Basically, Ledger has also attracted positive attention in 2023 with constant further developments of hardware and services. The new Ledger Stax model and the Earn program, which allows users to earn interest on crypto assets, are just two examples.

Conclusion: Ledger must cut back – but hardware wallets are still a must

Mass layoffs are not a desired task even for CEOs like Pascal Gauthier, and one is willing to accept his disappointment about this apparently necessary step. However, the business figures he presented show great potential, because many investors continue to be negligent without a hardware wallet.

Always order hardware wallets ldirectly from the manufacturer, because resellers repeatedly put manipulated devices into circulation.

__

(Featured image by Ron Lach via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in BLOCK-BUILDERS.DE. A third-party contributor translated and adapted the articles from the originals. In case of discrepancy, the originals will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Business7 days ago

Business7 days agoLegal Process for Dividing Real Estate Inheritance

-

Markets2 weeks ago

Markets2 weeks agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Fintech4 days ago

Fintech4 days agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa2 weeks ago

Africa2 weeks agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI