Business

Malaysia’s July palm oil production increased to almost 1.83M tons

From 1.51 million tons in June, Malaysia’s palm oil production in July increased to almost 1.83 million tons.

The Malaysian Palm Oil Board data indicated that the July palm oil production rose to about 1.83 million tons from the previous month’s 1.51 million tons.

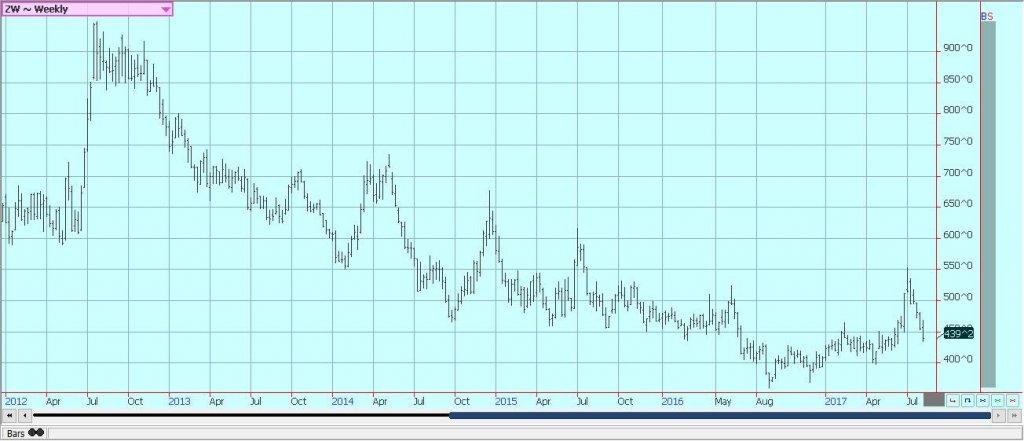

Wheat

US markets were generally lower again last week in reaction to the latest USDA reports. USDA showed higher than expected US production at 1.739 billion bushels. The big surprises were in Spring and White classes, where production was higher than what was expected by the trade. Hard Red Winter and Soft Red Winter were in line with trade estimate averages. USDA also showed higher than expected ending stocks estimates at 933 million bushels, mostly due to the increased production.

World production and ending stocks estimates also were higher than expected on a big jump in Russian production. World ending stocks were estimated at 264.7 million tons for the current crop year. US export demand is improving again as US prices are very competitive in the world market, and the recent trend to a weaker US Dollar has helped. The real hot weather in the US has left for the short term, but the heat is expected to return for one more visit in the next couple of weeks.

World growing conditions are problematic as well. Australia has been very hot and dry and production estimates there are now not more than 20 million tons after early hopes for production above 24 million tons this year. The weather there has improved, but the loss potential remains. Europe has also had problems due to wet and cold weather in northern areas. Both Germany and Poland have seen too much rain and production potential and quality have been downgraded. The weekly charts show that wheat markets are giving a strong test of support zones. These areas should hold as seasonal price strength becomes more of a market factor.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

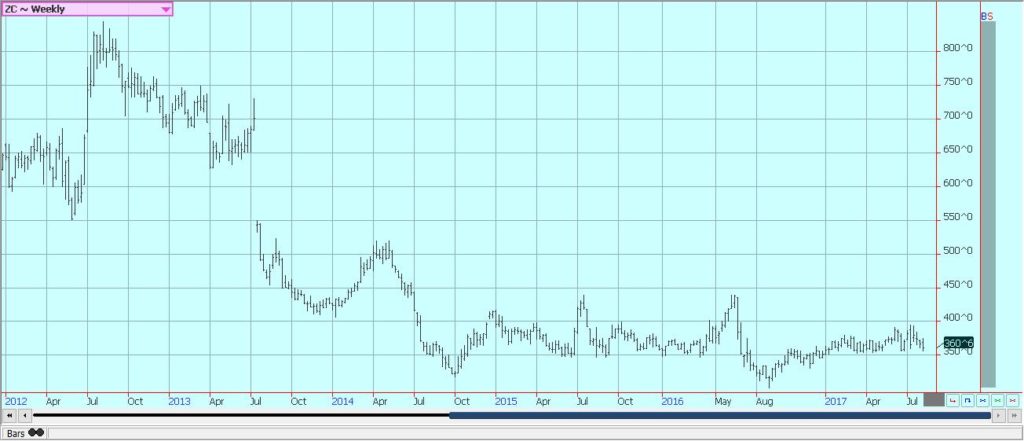

Corn

Corn and Oats were lower last week due to higher than expected production estimates from USDA and as some rain and cooler temperatures moved through the Midwest. USDA showed much higher than expected yield and production potential in its estimates that were released on Thursday morning. US production was estimated at 14.153 billion bushels on yields of 169.5 bushels per acre.

Both estimates were above any trade guess and the higher production pushed the US and world ending stocks estimates above all trade expectations for the coming year. USDA noted reduced ear populations in its survey but pushed ear weight to near record highs to compensate for the lost numbers. Many question the USDA assumptions on ear weight due to the variable weather seen until now in much of the Midwest.

Variable growing conditions continue as pollination comes to an end and kernel fill continues. The data will continue to affect the price for the next few weeks as private tour reports will start to be heard and as USDA will offer updated information next month with more data. However, the best data from USDA will not be seen until October. The weekly Corn charts showed an outside week down. This is bearish for near term price action even though futures have held important support areas until now. Near term price weakness is possible for the next couple of weeks.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

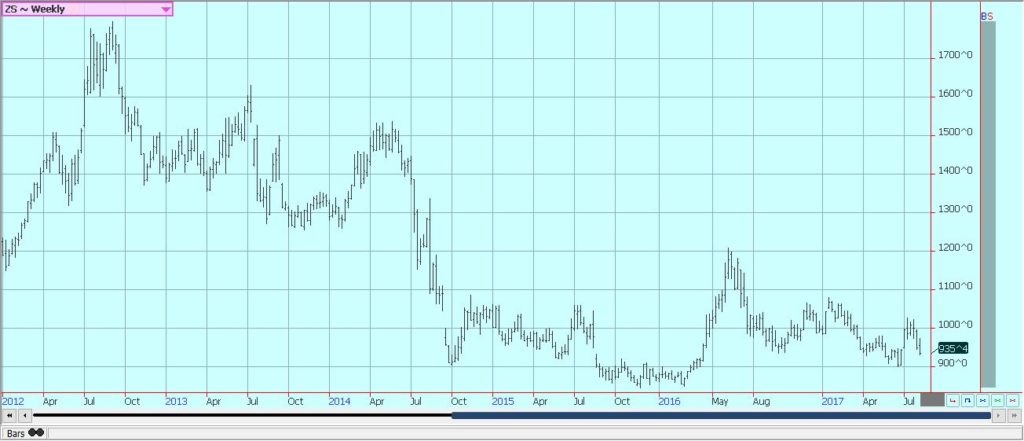

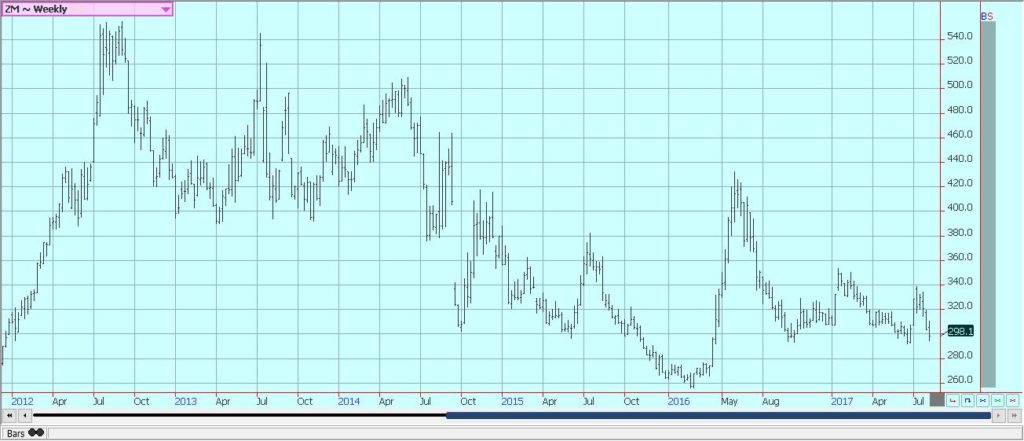

Soybeans and Soybean Meal

Soybeans and Soybean Meal were lower last week in response to the USDA reports and on ideas of somewhat better rains for the crops in the Midwest. USDA surprised the entire market by showing production potential of 4.381 billion bushels on yields of 49.4 bushels per acre. Both estimates were above any trade guesses and were considered bearish.

The estimates helped push ending stocks for the US and the world above trade estimates as well, and implied that there will be plenty of Soybeans for any world demand. Most had expected at least a small drop in yield estimates from the trend line yields of 48 bushels per acre used by USDA until now. However, USDA has very little useful information about the crop and will have much better information next month. The crop was planted late in many areas and is only starting to flower and set pods now.

The weather has been variable. Parts of Iowa and Missouri and central and southern Illinois have been dry and topsoil moisture levels are low. Crops in the east have been hurt where conditions have been too wet, and the plants are very small in Ohio and much of Indiana and into Michigan. Eastern Illinois showed some of the same features as other eastern states. The weekly charts imply that further price weakness is coming, with Soybeans possibly moving closer to 900 and Soybean Meal to about 28.00 in the next few weeks.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

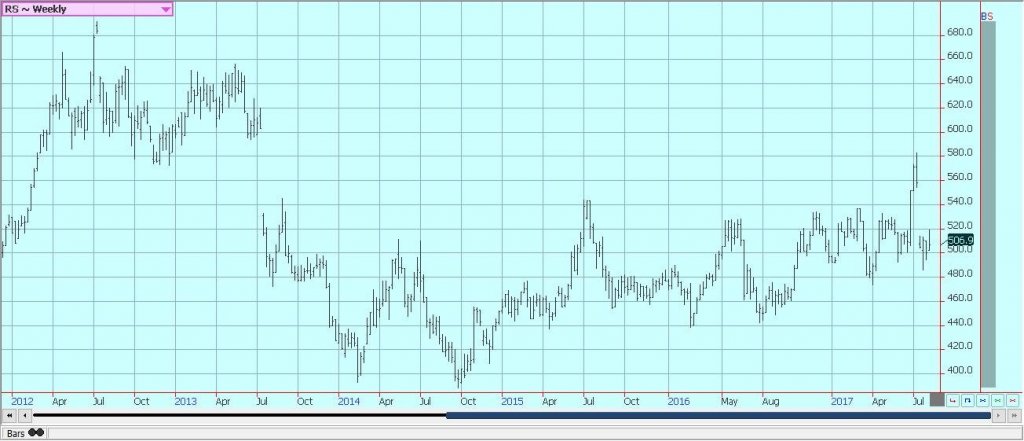

Rice

Rice closed higher and near recent highs last week in reaction to the USDA reports. US production was estimated at 186,467 million hundredweight, from 234.145 million last year. Yield estimates were higher at 7, 513 pounds per acre, from 7,237 pounds last year. Some will question these yield estimates due to the uncertain weather conditions seen all year. All states except Texas and Mississippi showed potential for increased yields.

Harvested area is less this year at 2.482 million acres, from 3.097 million last year. The FAS on Friday reported abandoned acres this year at 362,000 acres, from 91,000 acres last year. US ending stocks were cut to 30.1 million hundredweight, from 32.6 million last month and 45.9 million last year. World data from USDA showed unchanged ending stocks, with the US down a bit and the rest of the world a bit higher. Export and domestic demand were increased in the world data on increased carry in stocks and slightly less world production. There was really nothing bearish in the data from USDA last week for prices.

The US harvest is more active and as Asian prices remain soft. The Asian market has been weaker in the last few weeks. Texas is in good to very good condition and initial yield results from the harvest have been very good. California has good looking crops, but the crops were planted late so top yields are not likely. Parts of Southwest Louisiana are already harvesting, but frequent rains have caused delays.

Harvest yields have not been very good, but so far the quality appears to be satisfactory. Producers are hopeful for good crops in Arkansas and Missouri after a rough start to the growing season. Growing conditions are improved in India as the monsoon has been better, but coverage of rains has been spotty until now and there are still chances for weaker production than expected in India this year. The weekly charts show that the rally could continue to move higher over time.

Weekly Chicago Rice Futures © Jack Scoville

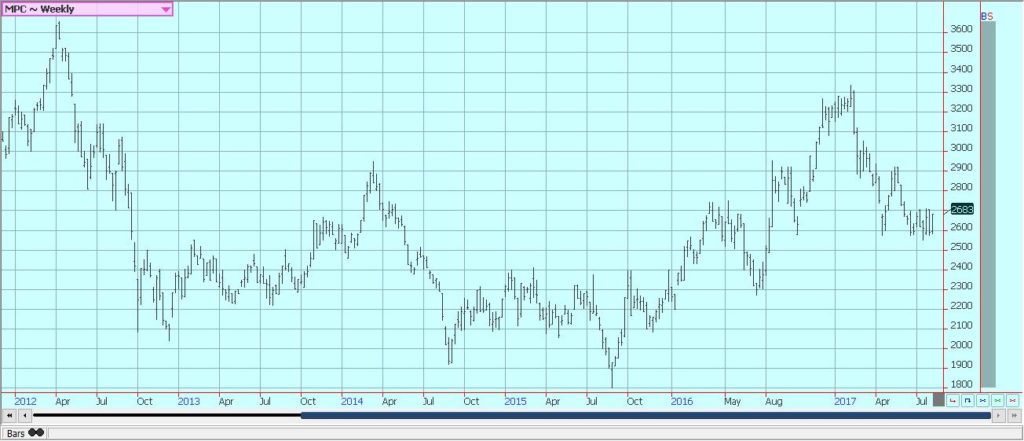

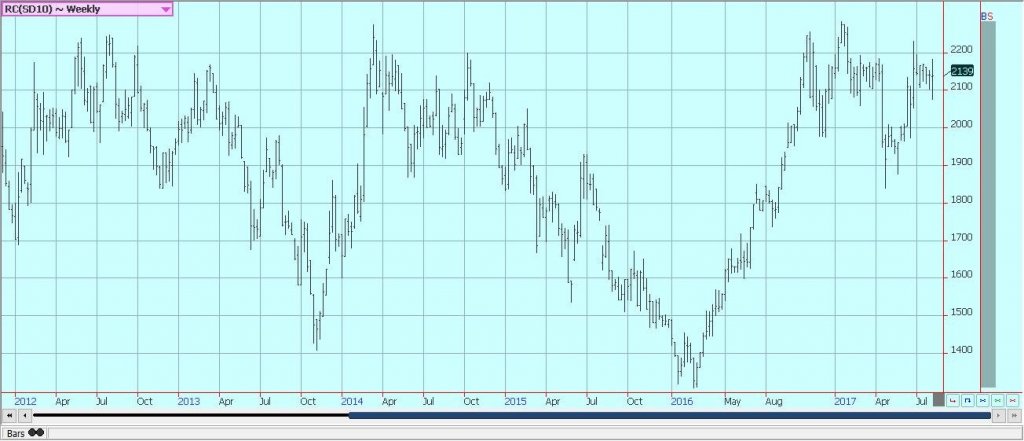

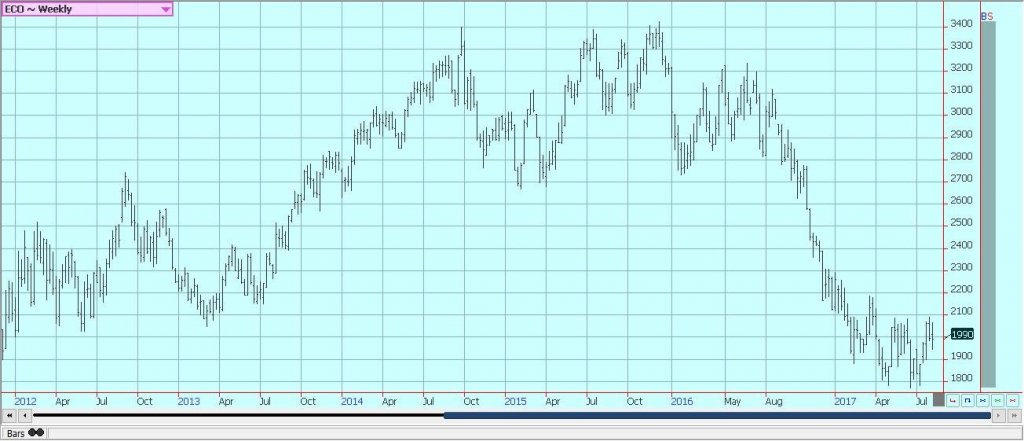

Palm Oil and Vegetable Oils

World vegetable oils markets were mixed last week. Palm Oil futures held well despite very bearish MPOB data. MPOB released its July data and showed production near 1.83 million tons for Malaysia, up from 1.51 million tons in the previous month. Ending stocks were estimated at 1/78 million tons. Ideas are that the production has now found its high point and will trend lower as a dry period has arrived. Export reports from the private sources so far this month are lower than last month, but this has been expected by the trade.

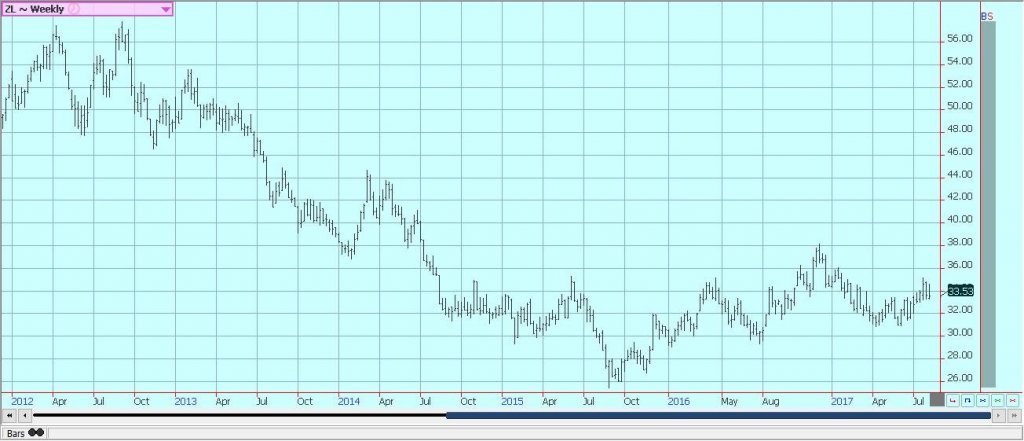

Soybean Oil was slightly lower but held above some big support areas on the weekly charts. This market also held well despite bearish production data from USDA last week. Canola remains relatively strong amid tight Canadian market conditions and adverse growing conditions. A primary negative for prices has been the strength of the Canadian Dollar against the US Dollar.

Western areas of the Prairies remain too dry and will be turning hot again late this week after some cooler temperatures for the last week and for much of this week. Eastern areas have seen good rains, but many eastern areas have seen too much rain and crop production potential is suffering. Demand from both the processor side and the export side has been strong enough to generally support the market.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was lower in reaction to the USDA production estimates. Traders had expected higher production due to increased planted area, but USDA showed production potential above all trade guesses at 30.545 million bales. The production estimate pushed ending stocks projections to about 5.8 million bales as demand was not forecast to keep up with the increased supply. World ending stocks estimates were increased due to the increases in the US as stocks outside the US were forecast to be slightly lower than a month ago.

December futures closed limit down on Thursday on the news, but prices were able to recover slightly on Friday in some consolidation trading before the weekend. The market remains concerned about the US and international growing weather. The growing weather in the eastern half of the US is generally good and crop conditions are reported to be good by producers and observers. These areas include parts of Texas, the Delta, and the Southeast. Warmer temperatures have arrived and there has been enough rain. Texas and the desert Southwest and into California has seen extreme heat and mostly dry weather, but the temperatures have moderated and rains have started to fall in the Texas Panhandle.

There is increased production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains.However, the monsoon has been uneven, with some areas in India flooding out and forcing some producers to replant if possible. Some areas have missed out on rains for the last few weeks and yields are hurting in these areas. Chinese growing conditions have improved, but crops appear to be uneven there. It has been very hot and dry in Turkey and there is talk of crop losses there.

Weekly US Cotton Futures © Jack Scoville

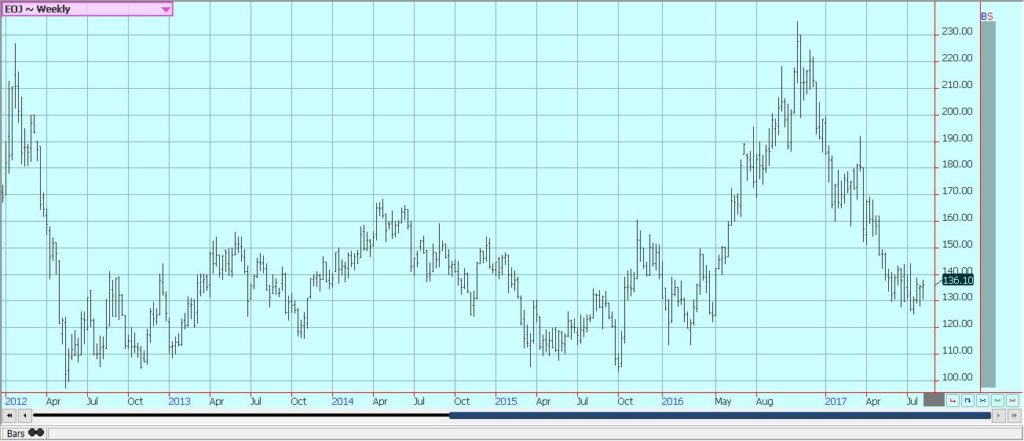

Frozen Concentrated Orange Juice and Citrus

FCOJ closed a little lower last week and remains in a trading range. All eyes remain on the hurricane season in the Atlantic as the pot4ential for storms increases dramatically for the next few weeks. Florida weather is very good as rains are reported each day and as no hurricanes have yet formed in the Atlantic. A couple of tropical storms have formed and one brought some big, but mostly beneficial, rains to the state.

There are no systems in the Atlantic to cause concern about tropical storm development that could be detrimental to trees and fruit. The demand side remains weak and there are plenty of supplies in the US. Brazil has been exporting FCOJ to the US to cover the short Florida crop. Domestic production remains very low due to the greening disease and drought. Trees now are showing fruits of varying sizes and overall conditions are called good. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were a little lower as the US Dollar started to move a little higher and pushed the Brazilian Real lower. Objectives for the up move are now 150.00 September over the longer term, but it could be that futures move a little lower in correction trading first. London has had more trouble holding the recent rally as there has not been much news to support buyers, but the market has been holding. The market is finding support from news that Broca Worm has infested Coffee areas. The Broca worm could really hurt yields that have suffered a bit anyway from the cool and wet weather.

Brazil is now at harvest, and traders and producers are reporting low quality and small beans. There is some concern about dry weather there, but it is the dry season and rains are expected to begin to promote good first flowering soon. Cash market conditions in Central America remain quiet as that part of the world is between harvests. There is coffee to sell, but little buying interest from major roasters. London had been stronger as supplies in the cash market are tight due to reduced Vietnamese selling and tight supplies in the country. Indonesia and Brazil have been very low on supplies as well, but Brazil is now harvesting its next Robusta crop.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures in London and New York were lower, and London turned trends back down last week. UNIXA released its second half July data and showed increased processing of cane again at 50.7 million tons. Mills have now processed 297.3 million tons of cane, down 4.7% from last year. The production mix still favors more sugar than last year 1t 17.6 million tons along with 11.6 billion liters of ethanol. The big harvest in Brazil continues. Some of the processing will probably switch now to ethanol due to tax changes.

Production potential in India and Thailand seems improved for now as monsoon rains have been better than last year. It is raining in much of India now as the monsoon is active, but rains have been uneven. Some northwest areas have been flooded due to big rains. Other areas are too dry and there could be some damage to crops if more rains do not show up fairly soon. Thailand is getting rains. The rest of Southeast Asia is seeing average to above average rains so far this year. Some problems are being reported in Europe and Russia for the beet sugar production.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

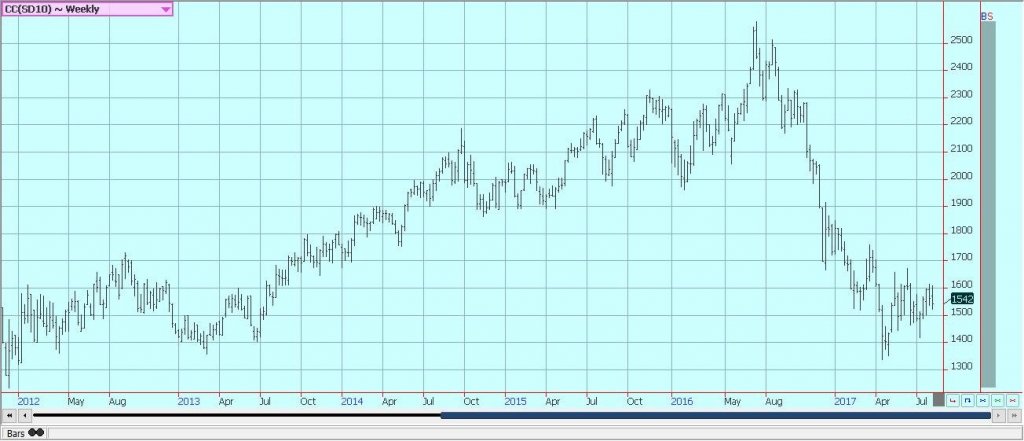

Cocoa

Futures markets were lower last week on follow through long liquidation after the market could not move above some strong resistance areas on the charts. Ideas of generally good weather and ample supplies available for any demand kept the market down. Harvest activities for the previous crop in West Africa are completed. The next harvest gets underway in the next month or so.

The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. The next production cycle still appears to be big since the growing conditions around the world are generally very good, but it might be smaller than last year due to lower prices. West Africa has seen much better rains this year and now getting some showers mixed with the hot and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

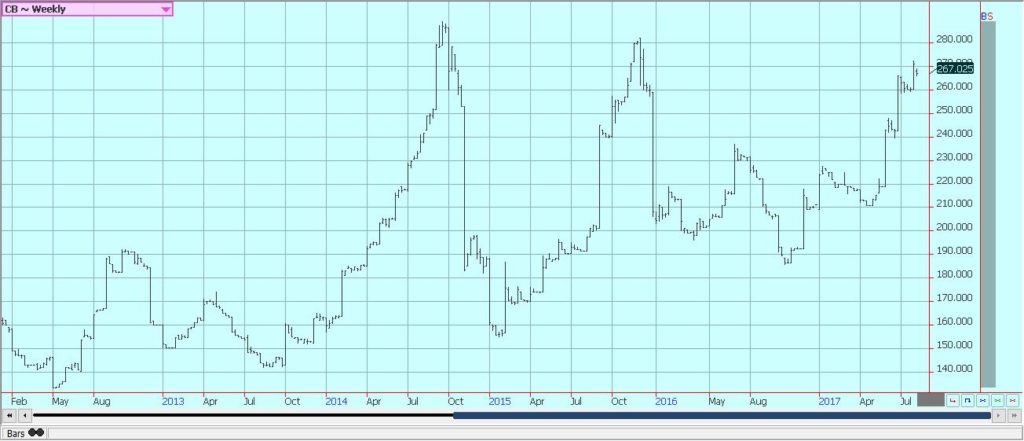

Dairy and Meat

Dairy markets were higher last week, and longer term trends remain up. Butter prices continue to be the strength of the market on reports of very good demand and adequate supplies. Cheese prices have been relatively weak, but are holding firm now. Demand is good for cream, but cream has generally been available to meet the demand. However, there are some shortages of cream in a few locations.

Cream demand for butter has been very good. Demand for ice cream has been mixed depending on the region. Cheese demand still appears to be weaker. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. The weaker US Dollar is helping on export ideas that might not mean much as US prices are higher, but the US Dollar weakness takes the edge off the higher internal prices.

US cattle and beef prices were lower and trends in cattle futures remain down. The beef market remains weaker in the last couple of weeks, and cattle prices have been under pressure since the release of the monthly cattle on feed report and the semiannual inventory report that showed bigger supplies are coming. Feedlots are filled with supplies and are concerned about extreme heat in feedlots that could hurt weight gain. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market. A seasonal demand increase is likely now, and October is very cheap to cash, so downside potential in futures might be limited.

Pork markets and lean hogs futures were firm and held on the weekly charts despite ideas a seasonal trend to lower demand. Ideas are that futures are too cheap to cash and that the spread between the two need to come together more than they are now. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech1 week ago

Fintech1 week agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Crypto3 days ago

Crypto3 days agoBitcoin Surges Past $69K as Ethereum Staking Hits Record Levels

-

Impact Investing1 week ago

Impact Investing1 week agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

You must be logged in to post a comment Login