Markets

Market Trends, Gold Gains, and Surprising Canada-U.S. Trade Insights

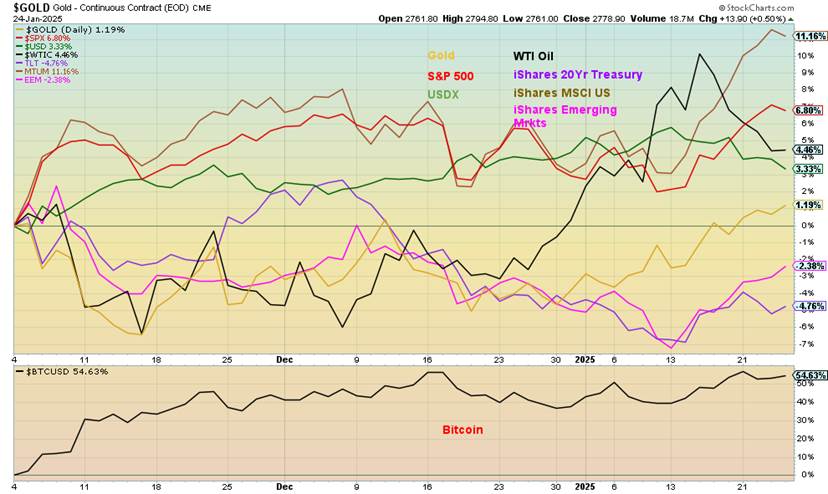

This week’s focus is on the economic and market impacts, including the US$ Index, WTI oil, Gold, Bitcoin, and interest rates, with weekly charts providing a broader perspective. The S&P 500 hit new highs but lacked support from other indices, while gold gained, and energy stocks fell. Canada-U.S. trade data offers surprising insights.

It doesn’t matter which publication (newspaper, magazine, journal, etc.) one opens up these days; Donald Trump continually appears at the top. A close second might be Elon Musk, the world’s richest man, even richer than many countries and Trump’s head of the Department of Government Efficiency (DOGE).

Trump’s executive orders on the first day left many heads spinning—from pardoning the January 6th, 2021 (Jan6) rioters to withdrawing from the World Health Organization (WHO) and the Paris Climate Agreement, to cracking down on immigrants, implementing a government hiring freeze, promising to “drill baby drill”, and threatening tariffs. There were many more. The age of destabilization appears to be upon us.

Our big question is, what does all this mean for markets and the economy going forward?

Politics can have a direct impact on markets and the economy. Political economy is a subject taught in universities as a part of the economics curriculum, and politics’ impact on the economy and markets cannot be ignored. And that can include the political players.

What one thinks of them is irrelevant; the market responds to what they do. So, regardless of how controversial he can be, what Trump decides to do can have considerable impact on the economy and markets. Like him or not, he has to be paid attention to. The attention is coming in spades, which explains why he is everywhere in the news.

So far, the winners have been the stock market—the S&P 500 (made new all-time highs this past week), Dow Jones Industrials (DJI), etc.—the US$ Index, and oil. Oh yes, and Bitcoin. Not doing as well were bonds, emerging markets, and gold, although gold is up as it approaches new all-time highs. However, silver and the gold stocks are still lagging. We didn’t show Bitcoin on our chart below because it would have condensed all the others into a blur. Since the election in November, Bitcoin is up over 54%.

The following performance chart shows that global US momentum stocks (MTUM) have led the way with a gain of 11.2% since November 5, 2024, while the S&P 500 is up 6.8%. Oil is up 4.5% despite the recent pullback. The US$ Index has gained 3.3% while Gold is treading water, up 1.2%. The losers have been bonds, as represented here by the iShares 20-year treasury bonds, down 4.8% and the MSCI Emerging Markets off 2.4%.

Stocks are up because the stock market expects Trump to extend the tax cuts that benefitted primarily corporations and the wealthy and, as well, he could add new tax cuts. The markets ignore the potential impact on the U.S. treasury that may have to borrow more, adding to the already astronomical U.S. debt, which is currently over $36 trillion. Spending cuts could be made by DOGE to offset that, but as we have noted, Social Security, Medicare/Medicaid, defense, plus interest on the debt make up over 70% of U.S. expenditures. Cutting those will be difficult at best to outright impossible.

The federal debt to GDP ratio currently stands at 123%. That puts the U.S. as having the 11th largest government debt to GDP in the world. Setting aside Japan, the highest of the G7, the U.S. is just behind Sudan, Argentina, Lebanon, Eritrea, Greece, Venezuela, Singapore, Bhutan, and Italy (also a G7 member). Is that sustainable? Many believe it is not.

Performance of Selected Indices since the Election November 5, 2024

Emerging markets have been weak, primarily because of the strength of the US$ Index. Many of these countries have debt denominated in U.S. dollars. As a result, a strengthening US$ Index implies that what they now have to pay back will rise as their revenues are in the local/home currency. Surprisingly, while tariffs could hurt the economy, they help strengthen the U.S. dollar. A stronger U.S. dollar makes U.S. exports more expensive but does it make U.S. imports cheaper? Will a rise in the US$ Index offset any tariffs placed on U.S. exports?

Which way will the U.S. dollar go? Trump has shaken many corporations with his recent speech at Davos, WEF. He’s also threatening the Fed to lower interest rates setting up a potential fight with the Fed that would shake markets. As a result, are we seeing the start of a sell-off of the US$ Index? That bottoming pattern suggested a potential move for the US$ Index to 114. The high at 110.01 implies the index achieved at least minimum targets so far. A firm break under 107 could send the US$ Index lower.

US$ Index 2019–2025 (weekly)

Trump has promised to “drill baby drill” in order to make the U.S. even less dependent on imports. The U.S. is already the world’s largest oil producer. They are the world’s fourth largest exporter behind Saudi Arabia, Russia (despite sanctions), and Canada. However, the U.S. is also the world’s second largest oil importer with a big chunk of that coming from Canada.

This anomaly occurs because the U.S. exports light crude and imports heavy crude as it can serve more products. Some depends on location and price as well. Pipelines carry Canadian heavy oil south to refineries in the U.S. In terms of reserves, Venezuela has the largest reserves of oil. The U.S. is eleventh, representing just over 10% of Venezuela’s reserves.

The U.S. is also the world’s largest producer of natural gas (NG), representing almost 25% of global production. They are also the world’s largest exporter of natural gas (LNG). Russia has the world’s largest reserves of NG. The U.S. has the fourth largest NG reserves, although it is only about 20% of Russia’s reserves.

Canada is the largest oil exporter to the U.S., accounting for 60% of its imports. The U.S. also gets oil from Mexico, Saudi Arabia, Iraq, and Colombia. The U.S.’s talk of 25% tariffs on Canada would be devastating to the U.S. consumer, making oil more expensive, if for whatever reason they included oil (and gas). Many believe that oil and some other commodities could be exempt from any U.S. tariffs.

Despite Trump’s promises to drive oil drilling, it’s difficult to say which way oil prices might go, given oil is the most politically sensitive commodity. After the plunge during the pandemic, oil prices rose steadily, peaking in 2022 when Russia invaded Ukraine. Since then, oil prices have fallen back and have traded largely in a range.

We don’t know which way prices might go. It appears to us on the weekly chart as a potential base to launch to higher prices. The outgoing Biden administration helped bump the price of oil recently by putting more sanctions on Russian oil. Whether that actually has any impact is still to be determined, as Russia has continually found a way to avoid sanctions.

This chart of oil shows the rise into the Russian invasion in 2022 followed by a decline that now appears to be making wide trading range. But is this a base from which to launch a new uptrend? Or is it a potential descending triangle that could result in a fall for oil prices? At this point, both scenarios remain in play. A break over $80 and especially over $85 would suggest up. But a break of $65 would bust the potential descending triangle and suggest a fall to at least $33.50. Trump is demanding lower oil prices from Saudi Arabia and OPEC but numerous exploration projects and production of heavier oils such as Canada’s oil sands require higher prices.

WTI Oil 2019–2025 (weekly)

Gold should benefit from all this chaos. It is a signal that trust in government is rocky at best. Inflation and interest rates also impact the price of gold. The U.S.’s rising debt and huge deficits also has a positive impact on gold. Gold has recently climbed over $2,750, suggesting new highs ahead over $2,800 with a possible move to over $3,000. So far, gold appears to be making a classic five-wave advance from that major low in 2015 at $1,045.

We may have completed an important 7–8-year cycle low in 2022 at $1,618. We also appear to be working on the fifth wave up from that low in 2015. The final fifth wave should also unfold in five waves. So far, we may have completed three of the five. New highs would suggest we have further to go. Could gold also be forming an ascending wedge triangle? We’d prefer that on pullback we hold above $2,600 because if it breaks, we could fall to near $2,000.

Our other main concern for gold as we have constantly noted is the failure of silver and gold stocks, represented by the Gold Bugs Index (HUI) and TSX Gold Index (TGD), to make new highs along with gold. It’s a concerning divergence. What gives us some hope is that commodities should perform well in this period. Our chart of the Commodity Research Bureau (CRB) Index shows an important top was made in 2008. We then descended in five clear waves to a low in 2020, coinciding with the pandemic.

We made a strong rise to the upside, peaking June 2022. Since then, we have gone through a prolonged period of a correction that appears to be forming a bottom. If that’s correct, then this is the A wave and B wave to the upside. We await the C wave that could take us to at least 550 once we firmly take out the June 2022 high of 330. We suspect the upcoming period should be dominated by gold and commodities, given the period of chaos and volatility that appears to be ahead of us.

Gold 2015–2025 (weekly)

Bitcoin and cryptocurrencies have garnered a lot of attention with Trump’s promise to make the U.S. the crypto capital of the world. Currently, about 28% of Americans own crypto, with Bitcoin being the leading crypto. When spread out into the world, only 6.8% of the world has crypto. Many more are planning on buying crypto, with Bitcoin, Ethereum, and Dogecoin being the most popular. Overall, though, only a few hold large amounts. Crypto is still subject to concerns as some 40% of U.S. holders are not confident that it is safe and secure. Some 20% have trouble accessing their accounts and hacks and scams still occur.

Bitcoin 2015–2025

This is a slightly different chart than what we showed previously. Our previous chart was a linear one, showing that Bitcoin was near the top of an important channel. This is a log chart (log charts show percentage changes, while linear charts show absolute changes). Here the picture is a little different and suggests that Bitcoin has considerable room to rise further in that bull channel, possibly up to $200,000. Nonetheless, a break under $87,500/$90,000 could signal a top, while a break under $75,000 could suggest further declines and under $60,000 a crash could occur.

A closer look at Bitcoin shows it is potentially making a distribution top; i.e. a series of ups and downs within a range that’s generally between $92,000 to $109,000 since mid-November. Firm new highs above $110,000 would end those thoughts, but a break under $90,000 could spell trouble. Meme coins such Fartcoin, Butthole coin, and the Trump and Melania coins have fallen hard recently. The Trump coin is down 65% from its high, Melania down 85%, Fartcoin down 50%, and Butthole coin off 76%. Bitcoin is off its high by only about 4%.

Bitcoin Daily 2024–2025

Our final note is on interest rates. The Fed started to lower interest rates on September 18, 2024. But a strange thing happened on the way to the Fed. Even as the Fed slashed, the official Fed rate by 100 basis points (bp), the U.S. bond market as represented here by the 10-year U.S. treasury note rose by roughly 100 bp. As our

chart of the 10-year shows, we haven’t as yet made new lows (price) and yields currently hover just below 5% near 4.65% (note: yields move inversely to price). It is possible that the 10-year is making a double bottom on the chart with the low seen in October 2023. We are also in the vicinity of a potential six-year cycle low from the last major cycle low seen in October 2018.

Now we learn that President Trump, in a speech to the World Economic Forum (WEF), said he will ask that interest rates be lowered immediately. He also said he was asking Saudi Arabia and OPEC to lower oil prices. No surprise that this potential demand could be controversial. The Fed’s independence is paramount. Any attempt to try to compromise the Fed’s independence could lead to unfavourable market gyrations.

Fed Chair Jerome Powell has made it clear he won’t leave until his term is up in 2026. Nor can he be fired. A president fighting with the Fed is not new. But trying to force interest rate policy on the Fed could be disastrous for the market. Nonetheless, this is coming week is the FOMC meeting on January 28–29. It’s expected that the Fed will do nothing.

We’d also be very surprised if Saudi Arabia and OPEC would accede to lower oil prices as they are independent countries. Their interest would be for continued high or higher prices in order to maintain their revenue streams. Lower oil prices, while positive, would have a negative impact on heavier oil that is difficult to extract (i.e. Canada’s oil sands) and make some oil fields not viable.

That said, some of the proposed policies are potentially quite inflationary. That includes tariffs, deportations, and tax cuts. Anything that might balloon the already huge federal debt is also potentially inflationary. That in turn could push bond rates higher. Already, U.S. interest payments on the debt exceed $1 trillion annually. It is now the third largest expenditure behind Social Security and Medicare/Medicaid.

The annual U.S. budget deficit is approaching 7% of GDP. Without major cuts that would slice into Social Security, Medicare/Medicaid, and even defense (the fourth largest expenditure), the U.S. debt is destined to grow. Or revenue needs to be increased with new taxes, something the U.S. (and others) have an aversion to even if they made sense.

We are entering a period of uncertainty that may be dominated by chaos, volatility and destabilization. We expect that during this period gold and commodities could do well. Stocks could be mixed, depending on how things shake out with tax cuts, etc. Our expectation is volatility, more so than a continuation of the bull market, which is now approaching 16 years. We note that the last major bull market in 1982–2000 lasted 18 years.

But the period had bear interruptions in 1983–1984, 1987, 1990, and 1998. The current bull market that got underway in 2009 has had bear interruptions in 2011, 2015–2016, 2020, and 2022. So, while this bull could continue, it is as we would say “getting long in the tooth” and valuations are for the most part overextended.

Welcome to the new paradigm.

U.S. 10-year Treasury Note 2005–2025 (weekly price)

Chart of the Week

Canada Exports to and Imports from the U.S. 1999–2023

Trade has been front and center with President Trump’s desire to impose tariffs on Canadian goods, potentially up to 25%. The threat is continually repeated, most recently at the Davos, WEF forum where Trump spoke. He reiterated the potential 25% on Canada (and Mexico) for February 1, 2025 and also his intention to make Canada the 51st state (ignoring that Canada is 10 provinces and three territories).

According to Statistics Canada (www.statcan.gc.ca), Canada sent $377.2 billion worth of goods to the U.S. in the first eleven months (to November) of 2024. Canada imported $322.2 billion worth of goods for a goods trade deficit of $55.0 billion. (Note: all figures are in U.S. dollars). In 2023, again according to Statistics Canada, the goods deficit was $64.3 billion. Canada is the largest export market for the U.S. but has one of the lowest trade deficits, thanks primarily to energy-related products. The auto sector is highly integrated, not only with the U.S. but also with Mexico. Supply chains are highly integrated. Tariff wars could cause supply disruptions.

Claims that the U.S. subsidizes the U.S. to the tune of $200 billion annually are questionable, mainly because we don’t know where that number comes from. Canada has substantially increased energy exports to the U.S. since Trump was last in office in 2017–2021. Exports to the U.S. of Canadian oil and gas constitute 60% of all imported oil and gas by the U.S. When the auto industry is taken into account, the U.S. runs a trade deficit with Canada.

Canada is also a supplier of many minerals to the U.S., including potash, uranium, gold, copper, aluminum, plus rare earths. These are minerals the U.S. considers important, particularly for the green economy. Not included in these numbers are services. Canada imports primarily management and financial services but its biggest export is probably Canadians visiting the U.S. The result is in 2023 (the last figures we could find) Canada has a services trade deficit with the U.S. of $13.8 billion. Overall, that would reduce the Canada’s total trade surplus with the U.S. to $50.5 billion in 2023 ($64.3 billion trade surplus in goods, $13.8 billion trade deficit in services).

A trade war would not be positive for either country, particularly if the U.S. put 25% tariffs on everything from Canada including energy.

Markets & Trends

| % Gains (Losses) Trends | ||||||||

| Close Dec 31/24 | Close Jan 24/25 | Week | YTD | Daily (Short Term) | Weekly (Intermediate) | Monthly (Long Term) | ||

| Stock Market Indices | ||||||||

| S&P 500 | 5,881.63 | 6,101.24 (new highs)* | 1.7% | 3.7% | up | up | up | |

| Dow Jones Industrials | 42,544.22 | 44,424.25 | 2.2% | 4.4% | up | up | up | |

| Dow Jones Transport | 16,030.66 | 16,605.95 | 1.1% | 4.5% | neutral | up | up | |

| NASDAQ | 19,310.79 | 19,954.30 | 1.7% | 3.3% | up | up | up | |

| S&P/TSX Composite | 24,796.40 | 25,468.49 | 1.6% | 3.0% | up | up | up | |

| S&P/TSX Venture (CDNX) | 597.87 | 621.25 | 0.8% | 3.9% | up | up | neutral | |

| S&P 600 (small) | 1,408.17 | 1,455.30 | 0.9% | 3.4% | neutral | up | up | |

| MSCI World | 2,304.50 | 2,380.01 | 2.5% | 3.3% | neutral | down | up | |

| Bitcoin | 93,467.13 | 104,904.73 (new highs)* | (0.2)% | 12.2% | up | up | up | |

| Gold Mining Stock Indices | ||||||||

| Gold Bugs Index (HUI) | 275.58 | 305.86 | 3.1% | 11.0% | up | up (weak) | up | |

| TSX Gold Index (TGD) | 336.87 | 376.61 | 2.8% | 11.8% | up | up | up | |

| % | ||||||||

| U.S. 10-Year Treasury Bond yield | 4.58% | 4.63% | flat | 1.1% | ||||

| Cdn. 10-Year Bond CGB yield | 3.25% | 3.30% | (0.6)% | 1.5% | ||||

| Recession Watch Spreads | ||||||||

| U.S. 2-year 10-year Treasury spread | 0.33% | 0.36% | 5.9% | 9.1% | ||||

| Cdn 2-year 10-year CGB spread | 0.30% | 0.37% | flat | 23.3% | ||||

| Currencies | ||||||||

| US$ Index | 108.44 | 107.47 | (1.8)% | (0.9)% | neutral | up | up | |

| Canadian $ | 69.49 | 69.74 | 1.0% | 0.4% | down (weak) | down | down | |

| Euro | 103.54 | 104.94 | 2.2% | 1.4% | down (weak) | down | down | |

| Swiss Franc | 110.16 | 110.36 | 1.0% | 0.2% | down | down | neutral | |

| British Pound | 125.11 | 124.83 | 2.6% | (0.2)% | down (weak) | down | down (weak) | |

| Japanese Yen | 63.57 | 64.13 | 0.2% | 0.9% | down (weak) | down | down | |

| Precious Metals | ||||||||

| Gold | 2,641.00 | 2,778.90 | 1.1% | 5.2% | up | up | up | |

| Silver | 29.24 | 31.18 | 0.1% | 6.6% | up (weak) | up (weak) | up | |

| Platinum | 910.50 | 972.10 | 0.7% | 6.8% | up | down (weak) | neutral | |

| Base Metals | ||||||||

| Palladium | 909.80 | 1,009.70 | 4.4% | 11.0% | up | neutral | down | |

| Copper | 4.03 | 4.32 | (1.1)% | 7.2% | up | neutral | up (weak) | |

| Energy | ||||||||

| WTI Oil | 71.72 | 74.66 | (3.5)% | 4.1% | up | up (weak) | down (weak) | |

| Nat Gas | 3.63 | 3.45 | (12.7)% | (5.0)% | neutral | up | neutral | |

They did it again. Yes, once again the S&P 500 (SPX) made new all-time highs. Okay, barely. But the SPX was the only major index making new all-time highs. So far, it’s only by about 0.4%. The others? The Dow Jones Industrials (DJI) remains down 1.5% from its all-time high, the NASDAQ is off 1.2%, and the Dow Jones Transportations (DJT) is down 7% from its most recent high and down 10.5% from its all-time high set in November 2021. The ongoing divergence between the DJI and the DJT confirms that the averages are not agreeing with each other. That is one of the key tenets of Dow Theory.

It was another up week for the stock markets. The bull just keeps on chugging. With another week to go in January, it will be difficult to have a 5% drop in the markets, which is what is needed at minimum to turn January negative. The result is the January barometer is giving the markets a thumbs up. The Santa Claus rally failed, but the first five days were positive and it looks like we’ll have a positive January. All that suggests that 2025 might not be a bad year after all, even if it might have a few bumps along the way. Since 2025 is a year ending in five, that is also favourable for the markets this year. The only fly in the ointment is that the first year of the presidential cycle is the weakest of the four years. Since 1833 there have been 23 up years and 24 down years in the first year of the presidential cycle. Since 1985 the record is eight up years and only two down years. So, which will it be?

If there is one thing we’ve noticed over the past month, it’s that, yes, the market is up but the best performing index has been the DJI along with the DJT. Flight quality to the blue chips?

The best performing sector in January to date has been the precious metals. Gold is up 5.2%, silver up 6.6%, platinum up 6.8%, palladium has a gain of 11%, and copper up 7.2%. The gold stock indices have also enjoyed a good month with the Gold Bugs Index (HUI) gaining 11.0% and the TSX Gold Index (TGD) up 11.8%. Unless a disaster hits this coming week, the sector looks like it could hold on to its gains. It remains our favoured sector for 2025.

On the week, the SPX rose 1.7% as noted to new all-time highs, the DJI was up 2.2%, the DJT gained 1.1%, and the NASDAQ was up 1.7%. The S&P 400 (Mid) was up 1.1% and the S&P 600 gained 0.9%. The S&P 500 Equal Weight Index gained 1.2% while the NY FANG Index was up 4.3%.

Despite a good gain by the NY FANG Index and fresh all-time highs from some of the MAG7, it was surprising that the NASDAQ didn’t do better. Meta, Amazon, Netflix, and Google all made new all-time highs this past week. The big winner with a whack of new subscribers in the fourth quarter was Netflix, up 13.9%. Tellingly, Tesla fell 4.7%, and not to be outdone Trump Media (DJT) fell 18.3%. Is the bloom off Musk and Trump? Bitcoin also made new all-time highs this past week but finished the week down 0.2%. A reversal but not a key one.

In Canada, the TSX Composite gained 1.6% while the TSX Venture Exchange (CDNX) was up 0.8%. Leading the way for the TSX was Consumer Discretionary TCD, up 3.2%, Information Technology TTK, up 3.7%, and Golds TGD, up 2.8%. The big loser was Energy TEN, down a paltry 0.4% and the only loser of the week. The CDNX continues to look positive, but it is so far down from its all-time highs that it needs a powerful telescope to see it. The CDNX remains unloved and undervalued.

In the EU, the London FTSE made all-time highs but closed the week down 0.2%. The EuroNext gained 0.3%, the Paris CAC 40 was up 2.8%, while the German DAX made all-time highs, up 2.4%. In Asia, China’s Shanghai Index (SSEC) was up 0.3%, the Tokyo Nikkei Dow (TKN) gained 3.9% and Hong Kong’s Hang Seng (HSI) gained 2.2%. Of the foreign indices, the best one this month has been the CAC with the DAX right behind, while the SSEC has been the weakest performer, losing 3%.

It’s been a good month for the stock market. Will it continue? February has a reputation of being the weakest month of the best six months (November to May). While the other major indices did not make new all-time highs this past week, a few others did, but once again like the SPX, barely. Making those highs were the Wilshire 5000, the S&P 100 (OEX), and the Russell 1000 and 3000.

For the record, interest rates were pretty steady this week in both the U.S. and Canada with the 10-year U.S. treasury note unchanged and Canada’s 10-year Government of Canada bond (CGB) down 0.6%. The 2–10 spreads were also largely unchanged. As we noted, the FOMC meets this week for its interest rate decision. The expectation is the Fed does nothing. The Bank of Canada (BofC) also meets this week for its interest rate decision. The expectation is for another 25 bp cut.

We’ll soon find out whether the new all-time highs will continue. The markets have to advance again this coming week and the indices that didn’t make all-time highs need to catch up to confirm. The SPX needs to hold above 6,000. A breakdown under 5,800 says it’s over.

As we have noted, the precious metals have been the best performers so far in 2025. Gold crossed above our $2,750 threshold this past week, telling us we should make new all-time highs above $2,801. Once above targets could be $3,050–$3,100. Our big concern is that silver and the gold stocks are nowhere near confirming gold’s run. Silver remains down roughly 37% from its all-time high set in 1980 and 2011 near $50, while the Gold Bugs Index (HUI) remains down 52% from its 2011 high and the TSX Gold Index (TGD) is off 17% from its 2011 high. As with the DJI and DJT, the averages are not confirming each other. It’s been an ongoing concern.

On the week, gold was up 1.1%, silver was weak but rebounded and closed up 0.1%, platinum had an okay week, up 0.7%, while palladium was a winner, up 4.4%. Copper fell 1.1% even as it remains up 7.2% in 2025. The HUI gained 3.1% while the TGD was up 2.8%. Now if only some of the positive vibes for the senior/intermediate/junior producing gold stocks would flow over to the junior exploration plays. We’re seeing some stirring but nothing substantial, with very small exceptions.

Helping gold this past week was a turnaround for the US$ Index, plus Trump calling for lower interest rates. Indeed, Trump’s remarks at Davos helped push the US$ Index lower. The USDX fell 1.8% this past week as the currencies benefitted. The euro was up 2.2%, the Swiss franc up 1.0%, the pound sterling up 2.6%, the Japanese yen gained 0.2%, while the Canadian dollar was up 1.0%. With Trump threatening everyone with tariffs, it weighed heavily on the USDX.

Dominant economic issues for 2025 the U.S. debt and budget deficits, tariffs and trade, income inequality, and immigrants. Already, kicking out immigrants (illegal or otherwise) has met with resistance and desertion. Fruit and vegatable fields are suddenly lying fallow as the pickers flee. A few factories have seen a chunk of their workforce either arrested or fleeing. And this is just the first week.

All this should weigh on the US$ Index and ultimately be good for gold. Oil doesn’t know what to do as tariffs could impact oil as well. Trump’s repeated promises for increased drilling been met with resistance by some companies because the conditions or the prices aren’t there. WTI oil fell this past week, off 3.5%, while Brent crude dropped 4.1%. Natural gas (NG) bounces around with the weather as NG at the Henry Hub fell 12.7% while the EU Dutch Hub saw NG rise 4.9%. The energy stocks were negative with the ARCA Oil & Gas Index (XOI) off 2.6% and the TSX Energy Index (TEN) down 0.4%. WTI oil still appears to us to be forming a huge base for a launch. But if we break under $63/$65 all bets are off.

Gold’s seasonals are usually postive during this period, often topping out in March around the time of the Prospectors and Developers Association of Canada’s Conference (PDAC) on March 2–5. We need to see more positive response from silver and the gold stocks. Silver needs to get over $32 and especially over $34 to think of new highs above $35. The TGD needs to clear 400 to suggest new highs there as well.

We remain positive on this sector as we proceed into 2025 as it’s a haven when things become volatile and uncerrtain. Since January 20, the uncertainty is sure to rise.

__

(Featured image by Colin Watts via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Copyright David Chapman 2025

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information.

However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter.

David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

-

Crypto3 days ago

Crypto3 days agoBitcoin Surges Past $69K as Ethereum Staking Hits Record Levels

-

Impact Investing1 week ago

Impact Investing1 week agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Impact Investing3 days ago

Impact Investing3 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring