Crowdfunding

Need Steel Accelerates Digitization of Steel Sector with Equity Crowdfunding

Need Steel is raising €100,000–€400,000 via Mamacrowd to expand its B2B steel trading platform. Founded in 2020, it streamlines negotiations, enhances transparency, and integrates anti-fraud certification. With €600,000 projected revenue for 2024 and major industry partnerships, Need Steel aims to lead the sector’s digital transformation while aligning with European Green Deal regulations.

Need Steel, a startup that has launched an innovative B2B platform for managing tenders and direct trading of steel, has launched an equity crowdfunding campaign on Mamacrowd.

The aim is to raise between 100,000 and 400,000 euros to accelerate the expansion and adoption of the technology in the steel market, given the significant results in its reference sector that the company is already achieving.

Who is Need Steel?

Founded in 2020 by Dafne Russo and Giorgio Andrea Scarpa, two entrepreneurs with established experience in the digital and steel world, Need Steel has developed a platform capable of simplifying commercial negotiations between the main players in the steel market.

With a turnover of 600,000 euros expected for 2024 and an EBITDA margin of 26%, the company has already registered over 350 active users and has partnered with global leaders such as ZHENSHI and Meglobe, consolidating its position in the European steel market, which is worth around 500 billion euros annually.

“Need Steel is the future of steel trading. With our platform, we are bringing a new era of transparency, efficiency and sustainability to the sector, in line with the European Green Deal regulations,” said Giorgio Andrea Scarpa, Co-founder and President of Need Steel.

“The innovative approach and our anti-fraud technology for material certification – continues Scarpa – guarantee safe and traceable transactions, solving one of the most serious problems in the sector: the lack of transparency. We want to give steel companies the tools they need to face the challenges of the future, respecting environmental regulations and seizing the opportunities of digital transformation.”

Need Steel’s strengths

Need Steel offers several innovative solutions through its platform. Direct trading and digital tenders enable faster and more efficient commercial negotiations, increasing transparency and reducing response times.

The anti-fraud certification system, the AFP (Anti Fraud Protection), guarantees the authenticity and quality of the structural and green certificates of the materials traded, preventing fraud and manipulation.

Furthermore, the platform supports the transition of companies towards a more sustainable and efficient model, with solutions that facilitate the management of materials in accordance with the directives of the European Green Deal.

Commitments for the future

Need Steel has the ambition to become the main point of reference for the digitalization of the steel sector, with the aim of supporting companies in the transition towards greater sustainability and competitiveness.

The startup intends to further strengthen its market position by investing in technological innovation, expanding its network and affirming its leadership in certification and digitalization solutions for the steel trade.

__

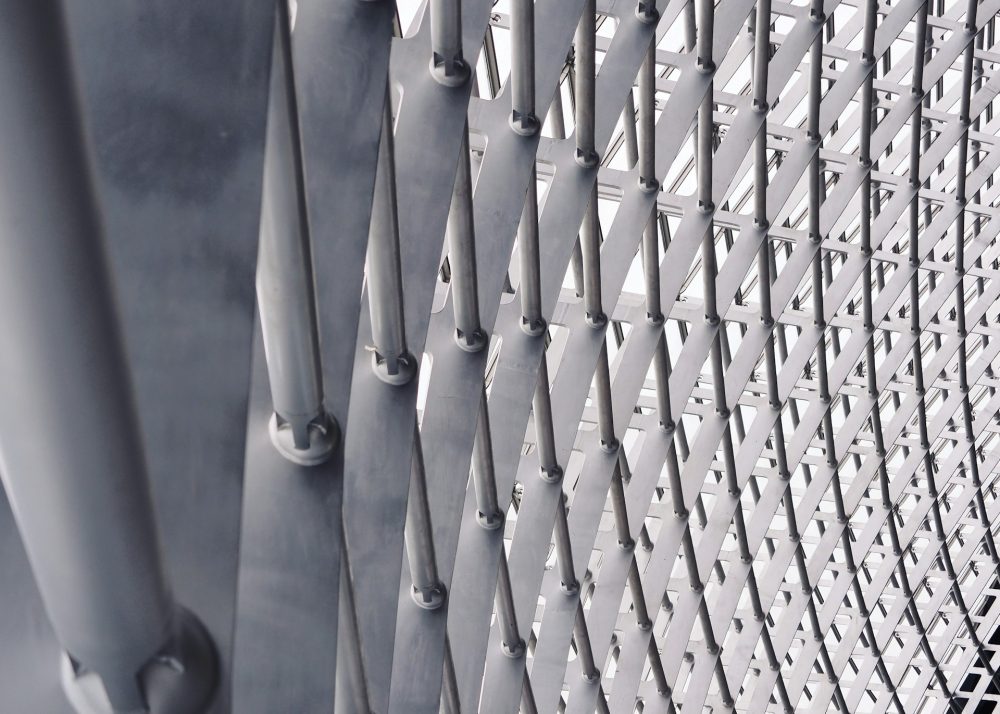

(Featured image by Flanker Lee via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Crowdfunding buzz. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Cannabis6 days ago

Cannabis6 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

-

Markets2 weeks ago

Markets2 weeks agoRice Market Slips as Global Price Pressure and Production Concerns Grow

-

Crowdfunding3 days ago

Crowdfunding3 days agoCrowdfunding for Mobility: Wheelchair User Seeks Accessible Car

-

Biotech1 week ago

Biotech1 week agoInterministerial Commission on Drug Prices Approves New Drugs and Expanded Treatment Funding