Featured

Palm Oil Supply and Production Will Be Strong. How Will the Demand Be?

Palm Oil closed lower on weakness in competing for vegetable oils markets and especially in Soybean Oil. Hopes for improved demand from China were reported but export demand overall has improved lately. Ideas are that supply and production will be strong, but demand ideas are now weakening and the market will continue to look to the private data for clues on demand and the direction of the futures market.

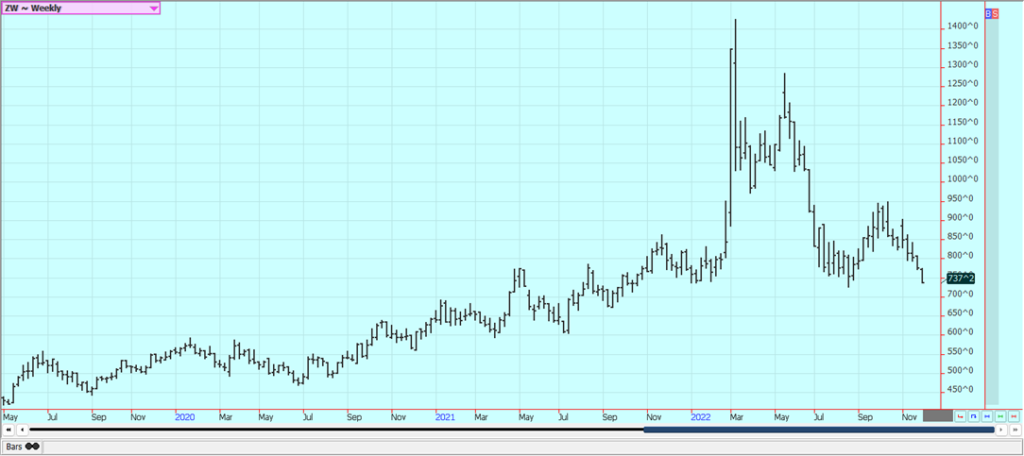

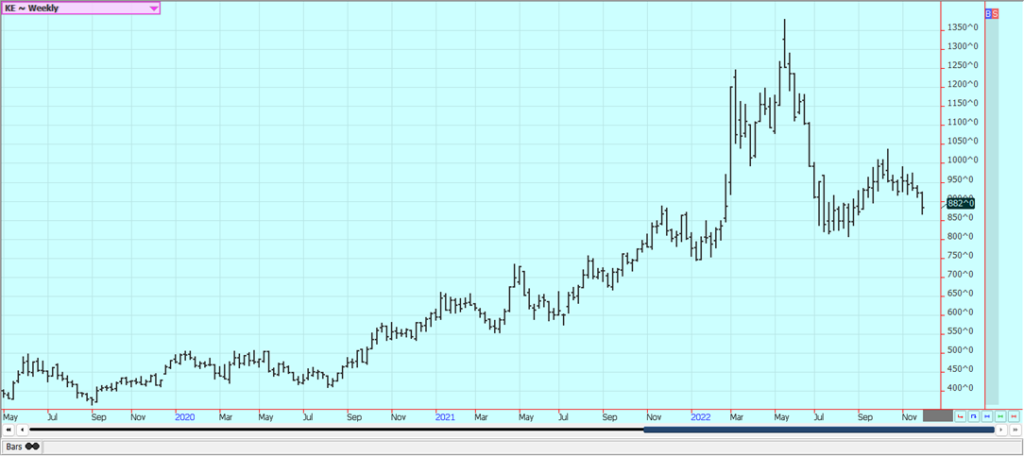

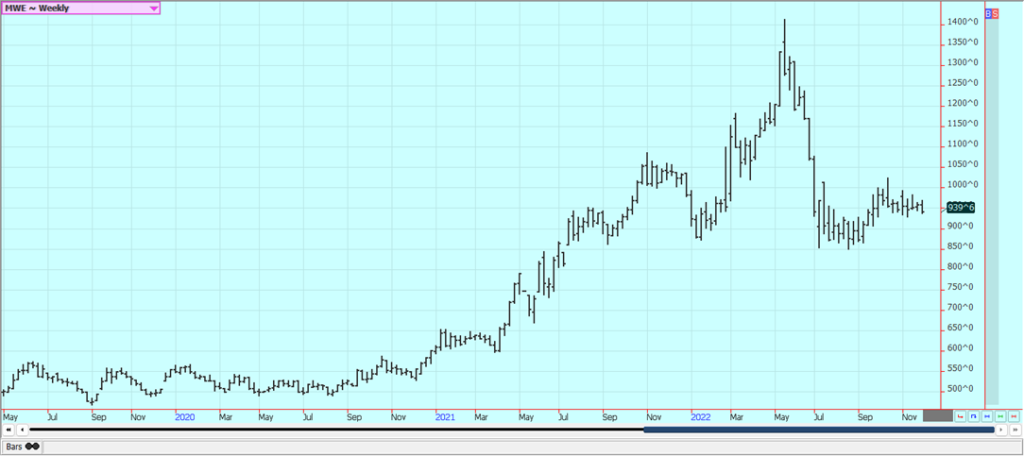

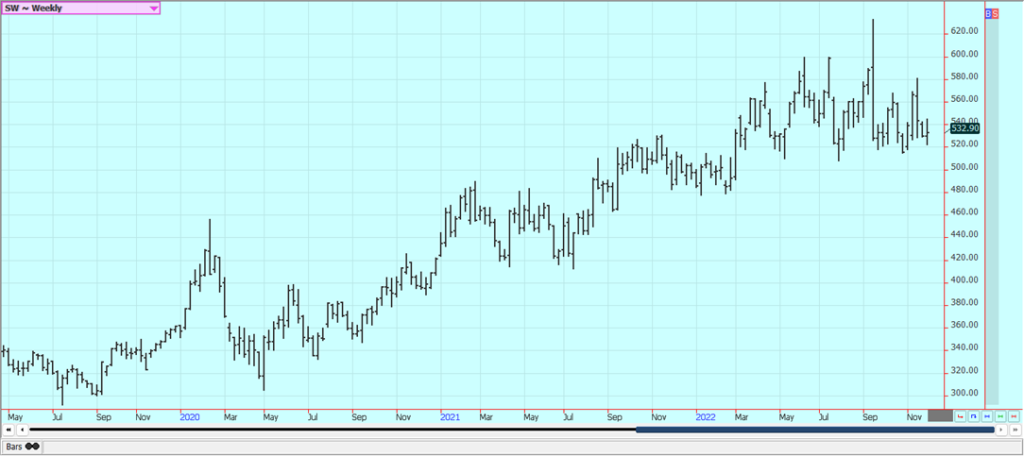

Wheat: Wheat markets were lower in all three markets last week after another week of low export sales and despite a lower US Dollar. The USDA crop progress and condition report showed improved condition but the overall condition remains mostly bad as the crops enter dormancy. Ukraine is also looking for new business for its crops and that news hurt the Chicago Winter Wheat markets. The news kept Russian and other world Wheat values on the weaker trend. The daily charts for the Chicago markets show down trends and demand fundamentals remain bearish. Minneapolis trends are sideways for now. The demand for US Wheat still needs to show up and there is still no demand news to help support futures.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

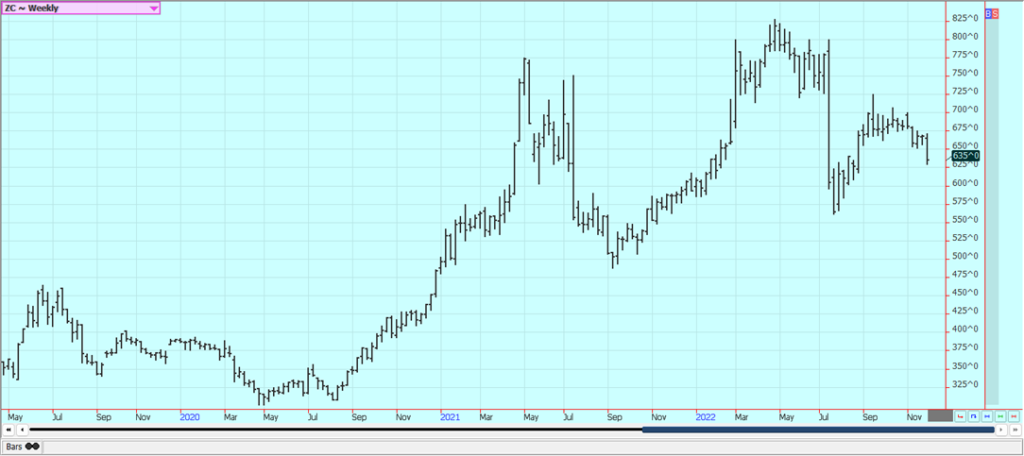

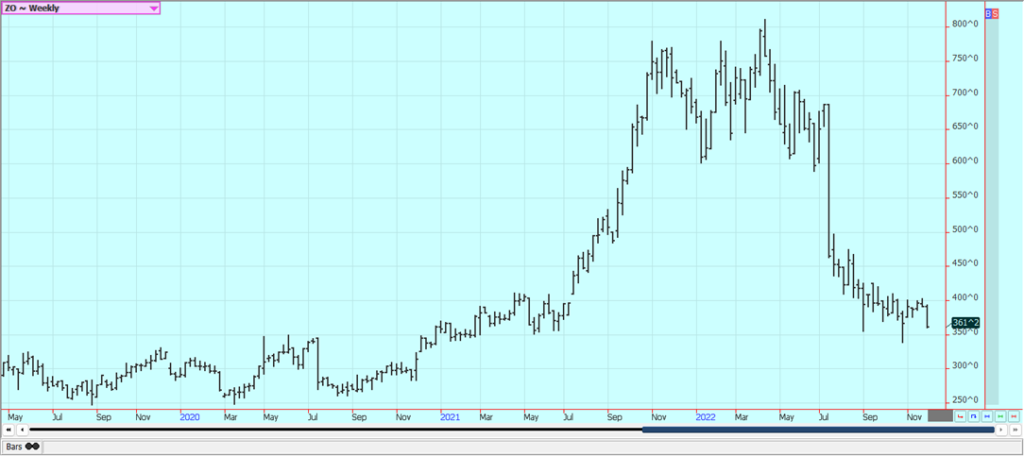

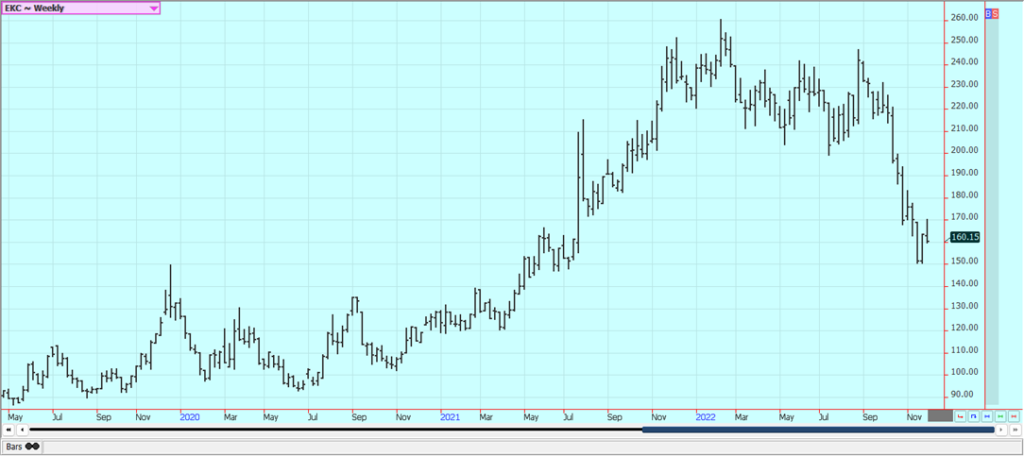

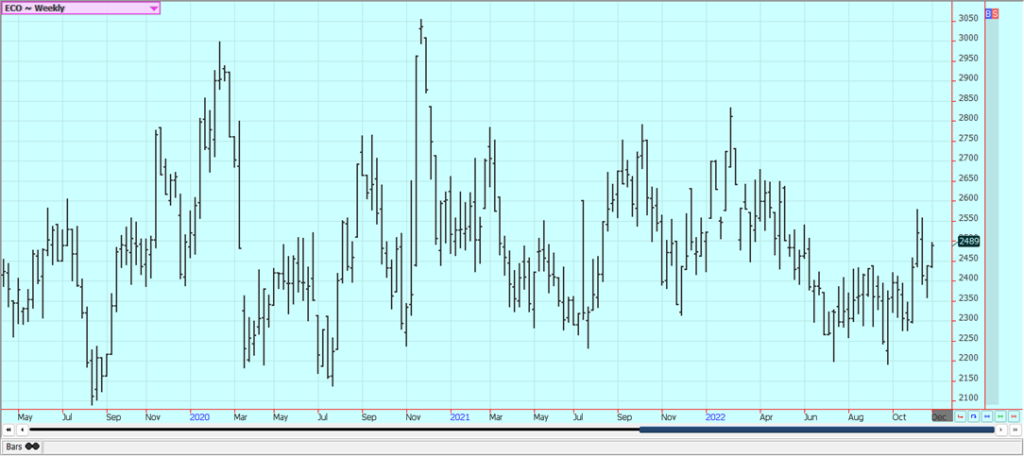

Corn: Corn and Oats closed lower last week, with Corn hurt by a weak export sales report and lower-than-expected biofuels mandates offered by EPA. Corn futures showed almost no reaction to the news that the Chinese government will ease lockdown restrictions on the populace in response to large protests seen in the country over the last week. Corn is still finding some support on a lack of farmer selling but the lack of export demand has hurt any upside moves. Weak demand overall for US Corn remains a big problem for the market. The Mississippi river remains low due to the dry conditions seen in most of the central parts of the US. Barge traffic has been reduced. Some water has been falling in the basin now in the form of rain and snow so conditions should be improving. The cash market has been strong at the Gulf but weak in the Midwest river areas due to the low river levels. Other interior basis levels have been strong due to a lack of farm selling. There are increasing concerns about demand with the Chinese economic problems caused by the lockdowns creating the possibility of less demand as South America has much better crops this year to compete with the US for sales. South American prices are currently cheaper than those in the US. Export demand in general has been slow so far this year.

Weekly Corn Futures

Weekly Oats Futures

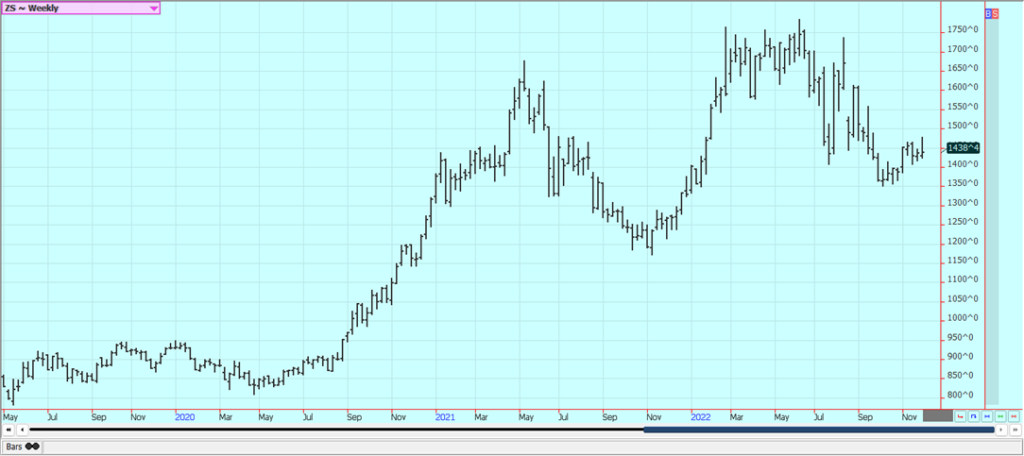

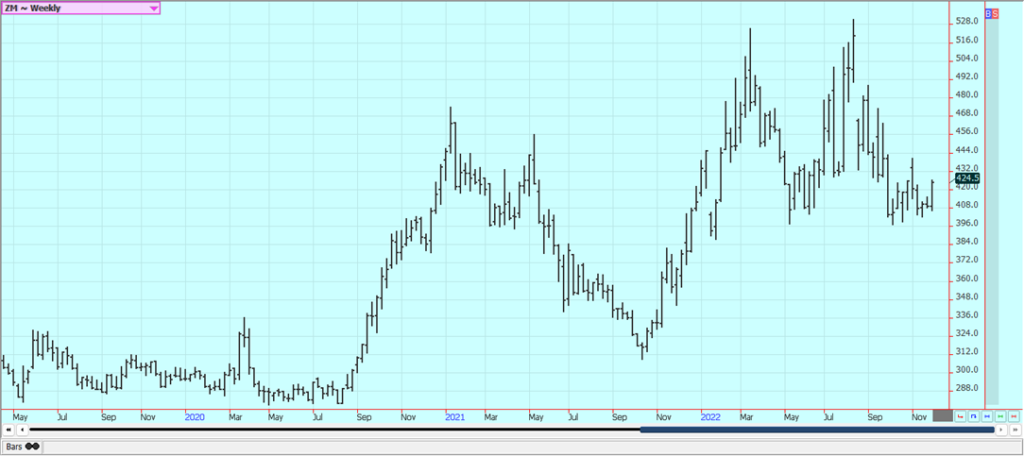

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed higher last week and Soybean Oil closed sharply lower, with Soybean Oil reacting to the less-than-expected EPA mandates released on Thursday. Trends remain up for Soybean Meal but remain mixed for Soybeans and have turned down for Soybean Oil. The biofuels mandates proposed by EPA increase the production of the fuels, but not by as much as the trade had expected. Conditions in Brazil are called very good in central and northern areas but are also dry in the south. There was news that China will start to ease Covid restrictions after some demonstrations by the Chinese people. Demonstrations were reported in China over the weekend due to the Covid lockdowns as some people were killed in an apartment fire. The protesters said the doors were locked due to a lockdown order but the government has denied this. Ideas that Chinese demand will stay weak overall and that Brazil growing conditions are good and getting better. However, it remains dry in Argentina and the crops and the planting pace are suffering. Export demand for the US is improved with the strong sales from last week. Domestic demand should be strong for Soybeans as the crush spreads are strong and provided crushers with a big profit margin for their crushing. The Mississippi river is low due to the dry conditions seen in most of the central parts of the US but some rain fell in the basin last week and river levels should work a little higher. Barge traffic has been reduced but could increase with the improved river flows.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was a little lower again last week in mostly quiet trading. There is not much going on in this market right now. Trends are turning down on the daily charts. Some new Rice producer selling might be found soon as futures and basis are now getting close to being profitable for producers to sell. Most Rice farmers were not paying much attention to the market as they are involved in other pursuits such as hunting. Demand in general has been slow to moderate for Rice for both exports and domestic uses.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil closed lower on weakness in competing for vegetable oils markets and especially in Soybean Oil. Hopes for improved demand from China were reported but export demand overall has improved lately. China has tried to relax some Covid restrictions so that quarantines now need to be eight days instead of at least two weeks. However, new outbreaks of the virus are being reported so the cities are still imposing lockdowns. Ideas are that supply and production will be strong, but demand ideas are now weakening and the market will continue to look to the private data for clues on demand and the direction of the futures market. Demand reports for the current month were stronger yesterday. Canola was higher on ideas of reduced offers into the market and on ideas the break yesterday was overdone. Production estimates released Friday were less than trade expectations to promote the rally. News of less-than-expected biofuels mandates from EPA and on n ideas that Chinese demand can remain weak due to increased outbreaks of Covid there were negative. Demand for export has been less. Farmers are holding tight to harvested supplies. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during the Summer.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was higher last week on weakness in the US Dollar and strength in Crude Oil and also on some ideas that demand could soon increase. Demand has not been really strong so far this year and the weekly export sales report was bad again yesterday. Demand has not improved with the reduction in prices and a lower US Dollar to date. China had been making some initial moves to open its economy and country again but many cities remain in lockdown due to an increase in Covid infections. China saw anti-government protests over the weekend due to its policies and the economic turmoil they have created. The protests were sparked by the deaths of several apartment dwellers in a city that protesters said was locked and on lockdown status. There are reports that China will end its zero-tolerance Covid policies and allow for greater freedom for citizens. Production in the US is very short. The trade is still worried about demand moving forward due to recession fears and Chinese lockdowns but is also worried about total US production potential. It is possible that the continued Chinese lockdowns will continue to hurt demand for imported Cotton for that country and that a weaker economy will hurt demand from the rest of the world.

Weekly US Cotton Futures

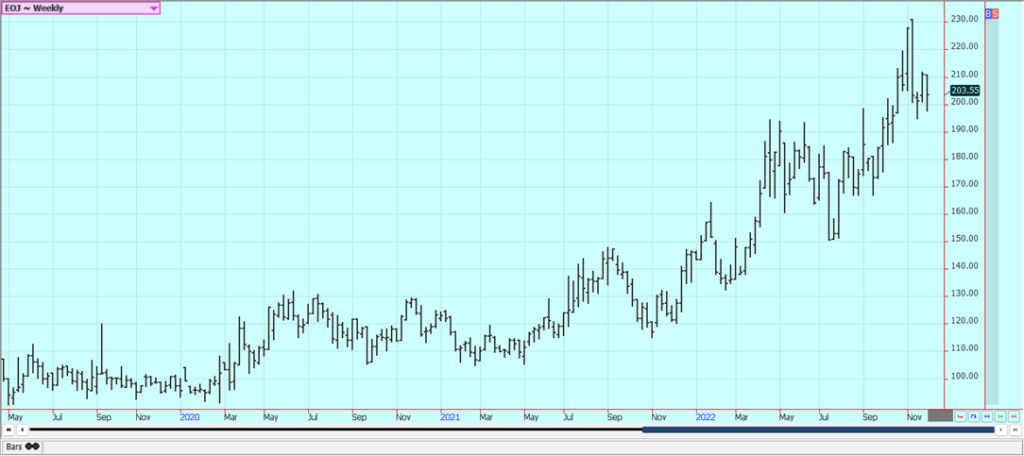

Frozen Concentrated Orange Juice and Citrus: FCOJ was lower last week on what appeared to be speculative selling. Historically low estimates of production due in part to the hurricanes and in part to the greening disease have hurt production remain in place but are apparently part of the price structure now. The weather remains generally good for production around the world for the next crop but not for production areas in Florida that have been impacted in a big way by the two storms. Brazil has some rain and the conditions are rated good. Mostly dry conditions are in the forecast for the coming days. Florida Citrus said that FCOJ inventories are now 40.3% below last year.

Weekly FCOJ Futures

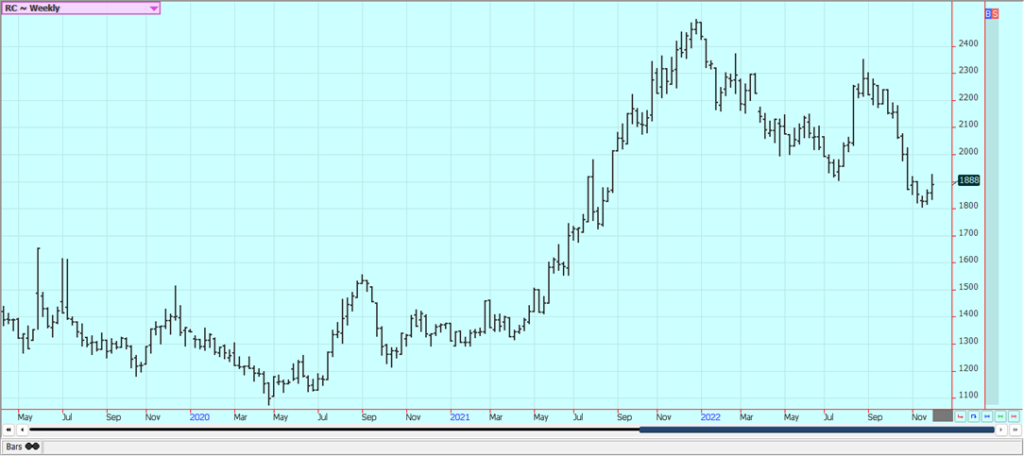

Coffee: New York and London closed lower Friday on ideas that current growing conditions in Brazil are very good. There are also ideas that the production potential for Brazil had been overrated and reports of too much rain in Vietnam affecting the harvest progress. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Weather conditions are good in Brazil and the rest of Latin America and supplies available to the market should keep increasing the market is looking forward to the increased supplies. Ideas are that the market will have more than enough Coffee when the next harvest comes in a few months. Ideas of a significant recovery in world production next year remain the main cause for any selling. More showers and rains are in the forecast in Brazil’s Coffee areas for this week. The rest of South America and Central America are reported to be in good condition. Vietnam has scattered showers in Coffee areas. Indonesia Sumatra Coffee exports were 32,290 tons in October, up 15.7% from last month but down almost 40% from September.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

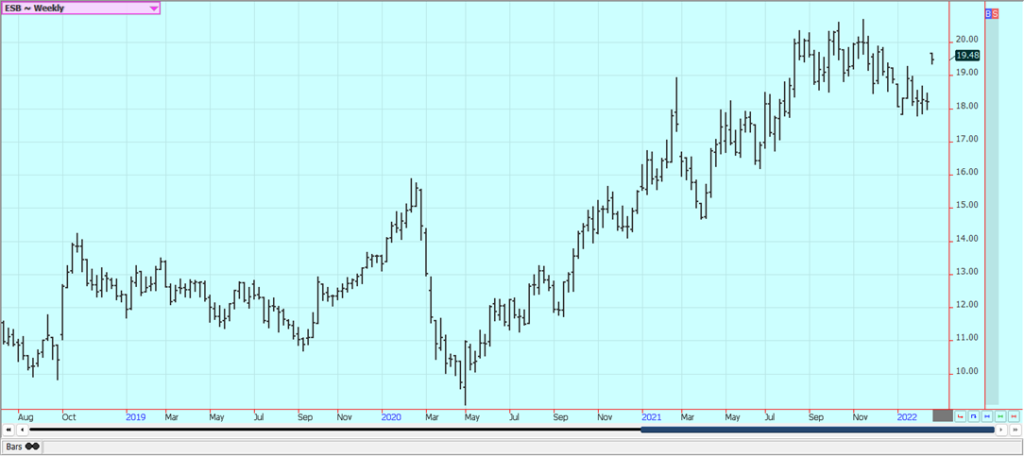

Sugar: New York and London closed higher last week as the market seemed to ingest more Sugar after the recent rally but grew more concerned about ongoing rains in Brazil production areas. Traders were disappointed with the EPA decision on biofuels mandates that will increase the production of biofuels but not as much as traders had expected. The weather in Brazil remains good for the next crop but bad for harvest and loading at ports as it is still raining in production areas. Some flooding rains have been reported in some areas and some roads to the ports have been blocked by landslides caused by the rains. More ideas that supplies of White Sugar are increasing for the market has weighed on prices for the London market but could be part of the price structure now. The world Sugar market is expected to be in a big surplus production next year. The supply is starting to increase. Brazil’s Sugar offers are increasing on ideas of unprofitable Ethanol prices coming to the country and reports of increased use of Corn for Ethanol production Indian exporters continue selling into the world market.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

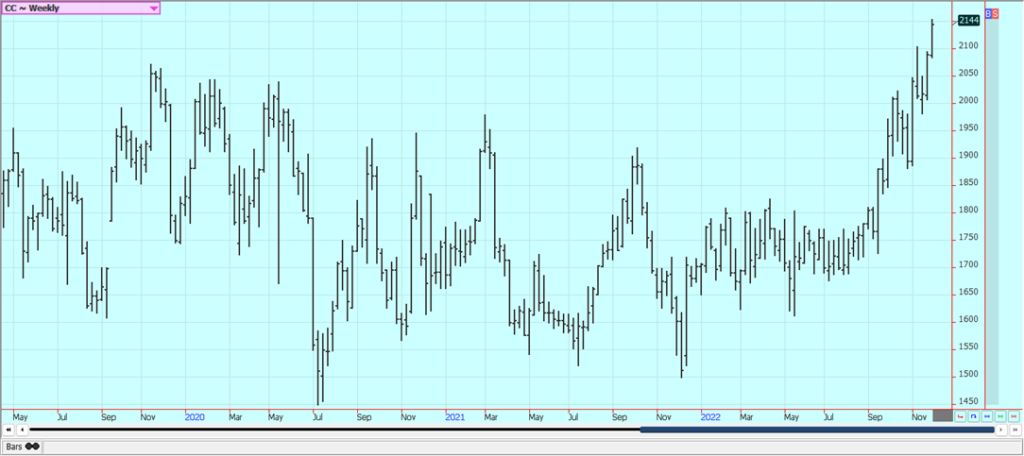

Cocoa: New York and London were higher last week. Trends are up in New York and mixed to down in London on the daily charts, but both show the chance to work higher in the next few weeks. Ivory Coast arrivals appear to have improved lately with the recent rally in futures prices. Ivory coast arrivals are now 718,000 tons, up 1.1% from last year. Ivory Coast exported 24,759 tons of Cocoa in October, down 67% from last year. It exported 46,729 tons of products, up 10.5% from last year. Good production is reported and traders are worried about the world economy moving forward and how that could affect demand. Supplies of Cocoa are as large as they will be now for the rest of the marketing year. Reports of scattered showers along with very good soil moisture from showers keep big production ideas alive in Ivory Coast. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by feelphotoz via Pixabay)

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing6 days ago

Impact Investing6 days agoGlobal Energy Shift: Record $2.2 Trillion Invested in Green Transition in 2024

-

Fintech2 weeks ago

Fintech2 weeks agoPayrails Secures $32M to Streamline Global Payments

-

Crowdfunding2 days ago

Crowdfunding2 days agoDolci Palmisano Issues Its First Minibond of the F&P “Rolling Short term” Program

-

Markets1 week ago

Markets1 week agoShockwaves of War: U.S. Strikes Iran, Markets Teeter, Global Risks Rise