Impact Investing

PureLabs Collects Capex Line Financing from Banco BPM for Acquisition Financing of 12.4 Million

PureLabs spa, founded by Nino Lo Iacono, secured a €12.4 million loan from Banco BPM to acquire diagnostic centers across Italy. The first acquisition is Centro Sa.Na. in Aprilia, doubling PureLabs’ revenues to €20 million. With Banco BPM’s support, PureLabs aims to expand its network of diagnostic hubs, enhancing access to advanced diagnostic services.

PureLabs spa, a hub for diagnostic laboratories founded by Nino Lo Iacono, has received a loan of 12.4 million euros from Banco BPM with which to carry forward its strategic plan, aimed at the acquisition of diagnostic centers throughout the country.

The operation, of a capex line type for acquisition financing, has already seen a first significant use of resources for the acquisition of the majority of Centro Sa.Na. of Aprilia, a multi-specialist structure active for over 30 years in Lazio.

This center, known for its health and diagnostic services, is controlled by the Napoli family and closed the 2023 budget with 8.9 million euros in net revenues , an ebitda of 900 thousand euros and a net financial debt of approximately 600 thousand euros. The acquisition will allow the PureLabs group to double its consolidated revenues and reach the 20 million euro threshold.

Returning to the financing of Banco BPM, PureLabs availed itself of the law firm Bonelli Erede in the operation, while the bank was assisted by the law firm DWF

PureLabs follows the mission of making advanced diagnostic services accessible in a sustainable and widespread manner, offering patients a digital experience and personalized paths aimed at prevention , well-being and longevity.

Over the course of the last year PureLabs has completed several fundamental operations to consolidate its presence in Liguria, including last summer’s acquisition of 70% of VivoLab , the brand by which the company Istituto Radiologico Diagnostic srl , based in Sestri, is known. Levante (Genoa) and owner of 12 diagnostic centers. At the end of 2023 the company had also acquired 80% of the Medical Analysis Laboratory (LAM) of Sarzana (La Spezia).

Beatrice Barghini, head of the Chiavari-La Spezia area of Banco BPM, commented: “We are really satisfied to be able to once again support PureLabs in the expansion program of its network of clinical diagnostic hubs . Banco BPM has recognized the value of this entrepreneurial project by supporting it right from the start, which occurred with the acquisition of the first centers in Chiavari and the Ligurian East.”

Nino Lo Iacono , CEO of PureLabs, added: “The road to becoming the diagnostics center of excellence that we have in mind can only pass through strategic partnerships such as the one with Banco BPM, with whom we are honored to work. The capex line stipulated with Banco BPM will allow us to carry out ourinvestment and growth plan in a rapid and prudent manner, and is also confirmation of the concreteness of our project.”

In January this year, PureLabs closed the 15 million euro capital increase at the end of last January, in which RedFish LongTerm Capital spa had participated from the beginning, with an investment of 4 million euros and which was fully subscribed in January, following the entry of the entrepreneur Bruno De Guio , with RFLTC which was therefore diluted from 32% to 26%.

Furthermore, in December 2022, Boutique Italia, the club deal investment platform led by Enrico Carnevali, which includes among its shareholders entrepreneurial families and Italian and foreign institutional investors such as Banca Patrimoni Sella and Method Investments.

Other holding companies and family offices had also joined the club deal organized by Boutique Italia, including Marcap, Mazal Capital, Yellow Holding and Kayak Family Office, the latter held 49.8% by RedFish Kapital spa, indirectly referable to the founding members by RFLTC, Paolo Pescetto and Andrea Rossotti. Subsequently, Kayak Family Office then sold, at nominal value, its share of approximately 12% held in the share capital of PureLabs to Maior srl for 650 thousand euros.

As for Banco BPM, the bank has been quite active in these first months of 2024 on the financing front, for example supporting, together with BPER Banca , in recent days Castello sgr , 80% owned since the end of February 2023 by Anima Holding and participated to 20% by Oaktree Global Management, for the acquisition of a portfolio of seven photovoltaic plants located in Puglia and Emilia-Romagna with a total power of 12 MW.

Also in June, Banco BPM together with Crèdit Agricole Italia (agent and coordinator bank) and BPER provided a loan of 25 million euros in favor of Parmacotto , a historic Parma company that produces a complete line of cooked, cured, poultry and sausages, with which the group will boost its 2024 – 2027 industrial plan.

Previously, Banco BPM had allocated a loan of 10 million euros (assisted by SACE ‘s Green Guarantee ) for Pastificio Liguori , a historic dry pasta production company founded in Gragnano (Naples), with which the group will build a 10-meter photovoltaic system. MGW for the production of energy from renewable sources.

__

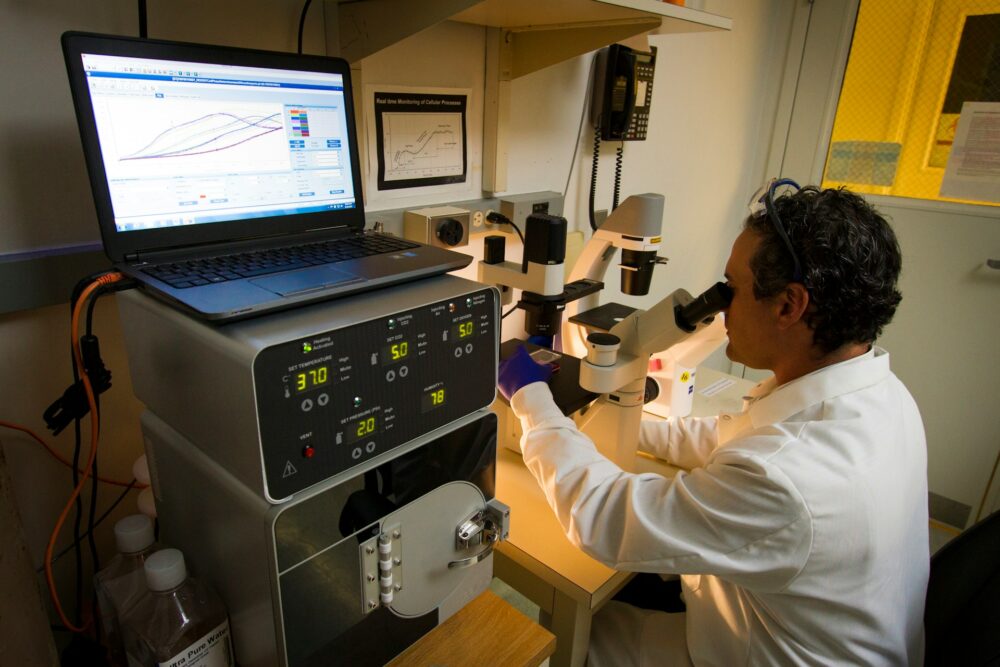

(Featured image by National Cancer Institute via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Be Beez. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Crypto13 hours ago

Crypto13 hours agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business1 week ago

Business1 week agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Fintech5 days ago

Fintech5 days agoFirst Regulated Blockchain Stock Trade Launches in the United States