Business

Quantum, RWA, AI — 2025 Predictions + My #1 Stock Pick for Gains That Go Boom

These opinions might be controversial, but 2025 will prove me right: quantum will go bust, AI will go sideways, and RWA tokenization will take off in a major way. Here, I cut through the hype and look at the fundamentals behind each of these 2025 investment themes. And, to wrap up, I’ll drop my #1 stock pick for major gains in 2025, and tell you exactly why I’m so bullish on it.

Call me old-fashioned, but I like to think of myself as a meat-and-potatoes kinda guy.

You know the sort.

Gimme a Ford F-150 over a Tesla [NASDAQ: TSLA] any day. Texas Roadhouse [NASDAQ: TXRH] over Michelin-starred finery. Fist bumps over air kisses… you get the point.

And, when it comes to stocks, give me fundamentals over hype any day. After all, there’s only so long the market can ignore fundamentals before things go boom or bust.

But hype — that feels like betting on my ex-wife’s mood swings. And trust me, that’s not a place you want to go if you value keeping a roof over your head.

Now, at this point, you might be wondering, “Why’s this Michael guy telling me all this stuff?”

Let me tell you why: I’m about to tell you where I’m betting my money this year. And I’m going to tell you why. So I want you to understand where I’m coming from with all of this.

That is, I’m coming from a place of fundamentals.

So with that out of the way, here’s what’s ahead:

- The fundamentals behind the top 3 investing trends to look out for in 2025 (AI, Quantum Computing, and RWA tokenization).

- Which of these trends will make you very rich.

- Which of these trends could just go sideways.

- Which of these trends has the potential to go bust.

- My #1 stock pick for 2025 (Spoiler: It’s Oxbridge Re [NASDAQ: OXBR]).

Let’s begin.

Quantum Computing — Boom or Bust?

Just two weeks ago, I told you it was probably already time to dump your quantum stocks.

And late yesterday, Nvidia’s [NASDAQ: NVDA] Jensen Huang just stated the same.

jensen just ended quantum computing – not happening in 30 years lmao @IonQ_Inc $IONS $RGTI $QBTS

— Martin Shkreli (@MartinShkreli) January 7, 2025

Now, if you’re skeptical about Huang’s statement, you’re not alone.

I wonder what his intention is for saying that. https://t.co/lj2FrqjxBu

— Shawn Kwon (@ShawnKwon11) January 7, 2025

You’d also be right to be pretty skeptical. After all, if quantum takes off and it’s half as useful as people say it is, then Nvidia basically dies.

So, is there any substance to what he’s saying?

Let’s step back a bit and survey the landscape.

For starters, it’s no big secret that quantum stocks are hot property right now. In the last month, pretty much anything quantum-adjacent has made major gains.

And I really do mean anything quantum-adjacent. I mean, just take a look at this randomly selected list of 10 quantum stocks I made:

- Quantum eMotion [TSXV: QNC]

- Arqit Quantum [NASDAQ: ARQQ]

- Quantum Corporation [NASDAQ: QMCO]

- Spectral Capital [OTC: FCCN]

- IonQ, Inc. [NYSE: IONQ]

- D-Wave Quantum Inc. [NYSE: QBTS]

- Rigetti Computing, Inc. [NASDAQ: RGTI]

- Quantum Computing Inc. [NASDAQ: QUBT]

- BTQ Technologies [CBOE: BTQ]

- Archer Materials [ASX: AXE]

I just checked the prices of all of those. And all of them have made gains. In some cases, very big gains.

So it’s natural that Huang’s feeling pretty threatened.

But here’s the thing. I don’t believe this quantum computing thing’s got the legs to survive 2025 either.

Why?

Simple. When I did my research into quantum computing — that is, when I went and listened to actual nerds working in the field — I basically got the gist that something wasn’t right here.

The hype doesn’t even come close to matching the fundamentals.

In a nutshell, we’re not even close to achieving anything practical with quantum computing. And, when I say not even close, I mean we’re probably at least a decade away.

That’s pretty much the consensus.

If you’ve got 8 minutes to spare (the last two minutes are an ad), this video is by an actual physicist and does a pretty good job of summing it up in plain language.

For those who skipped the video, here’s a very quick tl;dr.

- Everyone, from startups pitching investors to the press, is misinterpreting (or outright misrepresenting) scientific research in the field.

- The technology gap between where we are now and a practical, useful quantum computer is huge, and we’re not as far advanced along the timeline as some would have us believe.

- Further, not everything quantum will be faster than conventional computers. Most of the time, it’s not, and applications where quantum computers will provide a speed-up are rather limited.

Now, this might sound antithetical given the moment we’re in right now.

After all, haven’t half a dozen companies already built quantum computers?

And aren’t two dozen more already deploying “quantum algorithms”?

And isn’t half the NASDAQ already thinking about “quantum readiness?”

Well, yeah, that’s one way of thinking about it. But, currently, these quantum claims are the equivalent of typing out an email, taking a photo of it, and USPS “First-Classing” that photo to the email’s intended recipient.

Sure, technically you can kinda claim you sent an email.

But was that really the best use of your time?

Probably not, unless you’re a 1940s computer scientist playing out a thought experiment.

So, does this mean quantum computing will go bust in 2025 like Huang is claiming?

Well, here’s where I’m less sure.

Right now, everyone’s hungry for the next big thing. And now the metaverse is dead and the AI ship’s stuck in the doldrums, quantum computing feels like the perfect antidote.

So maybe people will simply brush off Huang’s claims as little more than the angry rantings of a hater who’s about to get his stock wrecked.

But, he’s also right. So here’s my advice. If you like making risky bets on how far hype can take something, then go ahead — play with the quantum computing fire.

But just know that right now, the fundamentals, according to nerds and science, simply don’t add up to anything substantial.

And that’s why, personally, I’m sitting back waiting for the first signs the quantum hype’s running out.

Maybe the market will listen to Huang and that will happen today.

Or maybe it’ll be later this year.

Only one thing’s for sure — when that moment comes, I’ll be piling on the put options like you wouldn’t believe.

AI — Scaling the Wall

Alright, here’s the point where I start to get a little more positive. But only a little.

So let’s start with an observation. AI felt like it was stuck moving sideways for quite a bit last year. That was, until Uncle Altman claimed there was no wall.

there is no wall

— Sam Altman (@sama) November 14, 2024

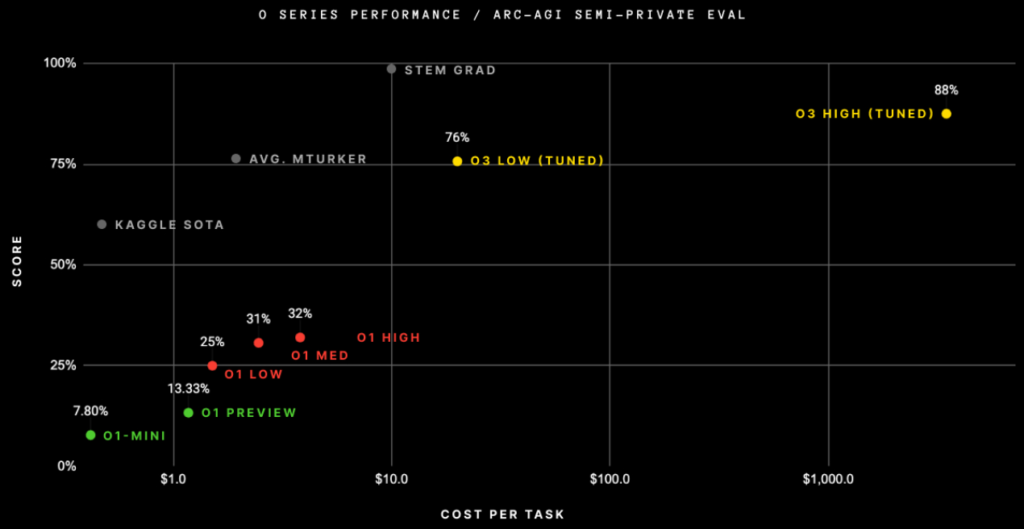

And then followed that up with this monster of a benchmark for OpenAI’s latest o3 model.

But there’s something here you need to pay attention to — the cost per task. It’s scaling exponentially. Just like training costs were when OpenAI used to disclose how much they were spending to train their models.

So yeah, in a way, there is no wall. Clearly, scaling still works. It’s just, that scaling will eventually meet a very hard, practical wall.

Think of it like this.

Imagine you’d invented the electric tea kettle. And now imagine you wanted to boil the world’s oceans with your invention.

So you decide to scale up your kettles. First a thousand. Then a million. Then a billion.

And then you start to notice something — each time you increase the number of kettles, some strange law of physics makes each kettle exponentially less effective. For every 10x in the number of kettles, you only get a 10% increase in the amount of ocean you can boil.

Now, this isn’t to say those kettles are useless.

Some of them might even be very nice kettles with built-in timers, temperature controls, and wifi connectivity.

And, if you get creative, you might even be able to use those kettles to boil your hot dogs and sterilize your surgical instruments.

But just don’t expect the day when we can boil the ocean with those kettles to come anytime soon.

And yes by kettles and boiling the oceans, I’m absolutely talking about the sort of revolutionary, humanity-changing AI Altman and co. have been promising.

Now, how does this apply to investing in AI in 2025?

Well, this is a tricky one.

There’s clearly a lot more substance to this than quantum computing. After all, we’re already using AI for real-world stuff and seeing real-world benefits.

And that’s a good thing. That means there’s fundamentally something more than an empty hype bubble.

But here’s where it also gets tricky.

On one hand, we have the thing. But on the other, there are people telling us the thing is something that it’s not.

And, for a fundamentals guy like me, that’s a problem. I simply don’t have a good way to price hype into a stock price. And that means I’m mostly sitting this one out. Maybe I’ll make a few small bets on things that look interesting.

RWA Tokenization — The Big One

I promised you one big trend to make you rich in 2025. So here it is.

Real World Asset tokenization, or RWA for short, is in for a wild ride this year. All the fundamentals point that way:

- The technology to deliver RWA tokenization is already here.

- The real-world applications are seriously huge.

- The benefits of RWA tokenization are not just tangible, but also highly desirable.

And here’s the best part — there’s almost zero hype in the space (for now).

In fact, it’s almost the opposite — outside of a few small circles, no one’s even aware of what’s going on in RWA tokenization (or even knows what it is). And that means valuations are at bargain basement prices right now.

Bet let’s get back to fundamentals for the moment, starting with the technology.

Unlike quantum computing which is still highly speculative, RWA tokenization is already here. In a nutshell, RWA tokenization basically takes the best bits of crypto and blockchain from the last few years, mashes those bits together with already-existing real-world assets, and the rest, as they say, is history.

The applications are real, too. So real, in fact, that Blackrock made a $10 trillion RWA tokenization commitment earlier this year.

And that’s not just empty talk, either. Blackrock has already launched its first RWA fund earlier this year (BUIDL) and started building out its RWA assets under management. Most recently, they dropped a bunch of cash on the world’s first tokenized municipal bonds.

There are a bunch of other big names racing to get into the space as well. Goldman Sachs, JP Morgan, HSBC, etc., etc.

All told, we’re potentially looking at a $30 trillion space within 5 years.

🚨Breaking: Coinbase says 2025 will be pivotal for #RWA growth! With pro-crypto policies, the sector could hit $30T in 5 years.

— Real World Asset Watchlist (@RWAwatchlist_) December 30, 2024

Keep loading—trillions are coming! 🚀 pic.twitter.com/33nfw5SyvF

So, why are all these massive institutions suddenly getting the urge to pour trillions of dollars into something most people have never heard of?

Well, this is where we get to the real-world benefits of RWA tokenization.

They’re already here, and they’re huge.

And not just in a handwavy, “crypto’s gonna democratize everything” kinda way. I mean, come on, would Goldman Sachs and Co. really care about RWA tokenization if the only thing going for it was democratization?

No. They wouldn’t.

But here’s what would get them majorly interested — liquidity.

Now, I know this doesn’t sound anywhere near as sexy as the stuff all the AGI and quantum computing hucksters are selling. But trust me on this one, liquidity is way more sexy than you might realize.

Wanna know why?

Because the more liquid an asset is, the more valuable it is. Or, to be more precise, the less its price is marked down due to the infamous “liquidity discount”.

And that’s why there are literal trillions flowing into RWA tokenization.

Major asset holders want to be able to sell those assets for more than they’ll currently fetch (or just mark up their value on their books). And one way to make that dream come true is to make those assets more liquid with RWA tokenization.

It’s as simple as that.

Big money wants it. And so big money will get it — it’s amazing what willpower backed by trillions of dollars can achieve.

🌍 2025: The Year of Real-World Assets (RWA) 🌍

— Brickken (@Brickken) December 31, 2024

As we approach 2025, experts are calling it "the year of the RWAs". 📈

Our CEO, @EdwMata, emphasizes: "RWA is going to matter a lot to key players. Big players like BlackRock and JP Morgan are jumping in to provide just what we…

#1 Stock Pick for 2025 — Oxbridge Re

As promised, here’s the bit where I tip my hand and tell you where I’m placing my biggest pile of chips in 2025.

It’s a little company called Oxbridge Re [NASDAQ: OXBR]. And word on the street is that they’ve got something seriously big brewing.

But don’t just take my word for it. Here’s a quick 1.5 minutes from someone else who’s picked up on what’s happening here (if the video doesn’t automatically play from the 4:10 mark, fast forward to that to see it.)

Now, if you watched, you probably noticed something. Oxbridge is in the RWA space, which is exactly where I want to be making my largest bets this year.

But there’s something else about Oxbridge that was left out of the video.

That is, Oxbridge is a whole lot more than just another RWA tokenization play — it’s almost literally a money-printing machine that’s about to go majorly BRRR.

But let’s back up for a minute and get a few basics in place.

First, what makes Oxbridge Re an RWA tokenization play is its SurancePlus subsidiary. Not that it’s much of a “subsidiary” at this point. I mean, when a company’s wholly-owned subsidiary is worth more than its parent company’s market cap, is that really a subsidiary, or is that now the main show? (Read the article I linked to — it explains why SurancePlus is worth more than Oxbridge Re’s market cap.)

Now, as for what SurancePlus actually does, it issues tokenized reinsurance securities.

And, as boring as that sounds, that’s actually what makes it really, really interesting (like money-printing machine interesting).

Let me lay out exactly how this whole reinsurance/SurancePlus thing works.

- An insurance company wants to take out a reinsurance policy

- They contact a reinsurance issuer like Oxbridge Re.

- If Oxbridge Re’s balance sheet can’t support the additional risk, they’d have to turn down the business.

- It’s here that SurancePlus steps in — it issues a tokenized reinsurance contract that allows outside investors to stake up the required capital in return for a cut of the profits.

- Everyone wins. Investors get access to a highly liquid asset that delivers incredible returns. Oxbridge Re can continue to grow its business unrestrained by its balance sheet. And, as the middleman, SurancePlus takes a small cut of the investor’s profits.

Now, take a moment to digest the above a little bit more.

Do you see how this scheme turns into a money-printing machine?

If you didn’t spot it, the key lies in the fact that neither SurancePlus, nor Oxbridge are restrained by capital anymore. The only thing holding them back is their ability to find investors willing to buy newly issued reinsurance contracts.

And, when those contracts deliver 40-50% annualized returns (seriously), how much trouble do you think they’re going to have finding those investors?

I’ll give you a hint — SurancePlus has already sold millions of dollars worth of these contracts. And that’s in an age where RWA tokenization is barely even a blip on the radar.

Now think about what happens once Blackrock and Co. start to really push the RWA narrative this year and demand for tokenized real-world assets really starts to ramp up.

Why is ‘BlackRock’ interested in RWA?

— PlearnOfficial (@PlearnOfficial) January 6, 2025

Larry Fink, CEO of BlackRock—the world’s largest asset manager with $11.5 trillion in assets – calls tokenization “a technological transformation for financial assets.” He highlighted how it enables tailored investment strategies for clients.… pic.twitter.com/lY46g6dYvy

If you want my opinion, I think we’re going to watch Oxbridge Re [NASDAQ: OXBR] take off in 2025.

__

(Featured image by Geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets2 weeks ago

Markets2 weeks agoRising U.S. Debt and Growing Financial Risks

-

Biotech4 days ago

Biotech4 days agoAI and Real-World Data Boost Oncology Clinical Research

-

Africa2 weeks ago

Africa2 weeks agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Africa6 days ago

Africa6 days agoMorocco’s Industrial Activity Stalls in January 2026