Biotech

Qubiotech Raises €500,000 and Looks to Europe and America by 2024

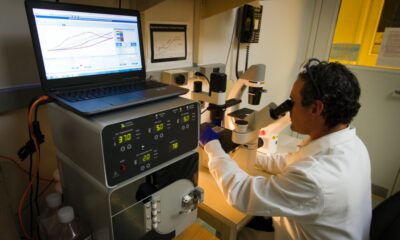

Qubiotech uses Artificial Intelligence-based image processing to develop diagnostics for brain diseases, which it has called Neurocloud. The software hosts three medical image quantification algorithms (PET, Spect, and MRI) and integrates them into clinical routine thanks to analysis automation. This is the second round of investment that the Galician biotechnology company closes

Qubiotech looks to enter the markets abroad. The Galician biotechnological company, dedicated to the development and commercialization of software to anticipate the diagnosis of neurodegenerative diseases, has raised €500,000 in an investment round, with the aim of expanding throughout Latin America and Europe, according to Daniel Fernández Mosquera, general director Qubiotech.

Specifically, the company plans to land in Italy, France, and Germany, in Europe; and in Brazil, Mexico, and the United States, among other markets, in America. To do this, Qubiotech is contacting early adopters in these markets to transfer their technology to the countries. The funds Semola Tech Ventures and Nowture have entered the last round that the company has closed.

“The idea is this year to close the first contacts, gain knowledge in the regions, and next year starts a more orderly expansion in Europe and America,” explained Mosquera, who assures that the company is collaborating with various American medical centers, testing their software, pending FDA approval.

Read more about Qubiotech and find the most important business headlines of the day with our companion app Born2Invest.

Qubiotech is collaborating with various US centers, pending FDA approval

Qubiotech uses Artificial Intelligence-based image processing to develop diagnostics for brain diseases, which it has called Neurocloud. The software hosts three medical image quantification algorithms (PET, Spect, and MRI) and integrates them into clinical routine thanks to analysis automation.

This is the second round of investment that the Galician biotechnology company closes. In 2019, the company already raised €300,000 to start its clinical trials. Looking ahead to 2024, Qubiotech plans to seek capital again, although the total investment has not yet been defined.

Qubiotech has entered €120,000 in 2022 and plans to triple the figure this year, reaching a turnover of close to €360,000. Headquartered in A Coruña, it has eight people on its staff and is currently developing its projects in Spain and Portugal.

The company plans to reopen a new investment round in 2024

In addition to its device for neurodegenerative diseases, Qubiotech is developing its activity in other fields of oncology, including a prototype for glioma segmentation, algorithms for prostate cancer detection, and cross-sectional multi-organ tissue segmentation techniques.

Qubiotech Health Intelligence was born in December 2014 with the transfer of a positron emission tomography (PET) image quantification algorithm developed by the Molecular Imaging Research Group of the Santiago de Compostela Health Research Institute Foundation (Fidis).

__

(Featured image by geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crowdfunding6 days ago

Crowdfunding6 days agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Africa2 weeks ago

Africa2 weeks agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Cannabis3 days ago

Cannabis3 days agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto1 week ago

Crypto1 week agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments